Discharged US Marine Threatened To Target White People In Mass Shooting, Feds Say

Authored by Ryan Morgan via The Epoch Times (emphasis ours),

Federal prosecutors have charged a recently discharged U.S. Marine with making threats to attack white people in a mass shooting.

The Department of Justice building in Washington on Feb. 9, 2022. (Stefani Reynolds/AFP via Getty Images)

The Department of Justice building in Washington on Feb. 9, 2022. (Stefani Reynolds/AFP via Getty Images)

On Monday, the U.S. Attorney’s Office for the District of New Jersey announced the arrest of Joshua Cobb, 23, on a single-count indictment of transmitting an interstate threat over the internet. According to a complaint filed in the case, Mr. Cobb authored a social media post on Dec. 17, 2022, indicating his interest in inflicting mayhem “on the white community.”

The author of the Dec. 17, 2022, social media post states, “I want to cause mayhem on the white community. The reason i specifically want to target white people is because as a black male, they will NEVER understand my struggles.”

The post’s author goes on to state he has already begun planning the attack, which he intended to carry out somewhere in New Jersey at some point in 2023, though he had not chosen an exact time.

“I have not chosen a exact date but I am going to be sure it is close to an important holiday to their race. I have a location in mind already which I have frequented for the past year and I am certain nobody there is armed to be able to stop me from spraying them to the ground,” the suspect’s social media post continues. “I have already acquired 2 of the 4 firearms I plan to use for my attack, and I also know my entry and exit points already after the mayhem.”

The social media post was published under the handle “NearbyUserl0l.” Investigators determined that social media activity was associated with an internet protocol (IP) address matching the Trenton, New Jersey residence in which Mr. Cobb resided at the time.

Suspect Planned to ‘Continue Training’ For AttackFederal prosecutors allege Mr. Cobb made subsequent posts on a second social media platform in the Spring of 2023, expressing homicidal ideations. A May 2023 social media post states, “Imagine the rush you’d feel while shooting some [expletive] up. Probably could get literally high off the adrenaline alone. I’d probably OD on my own adrenaline after the 10th body goes down.” Another May 2023 post states, “I hope I do progress into a serial killer because I [expletive] hate life man... But one day everyone will suffer. I promise I will make everyone feel my [expletive] pain. My deep, sincere, raw, & sharp pain.” Prosecutors say Mr. Cobb’s posts also indicated a plan to “continue training and buying more ammunition” until the day he could carry out his attack.

Mr. Cobb joined the U.S. Marine Corps and entered basic training in June 2023. The Marine trainee completed his basic training in September and was given a period of post-basic leave. He arrived at another duty station, the Marine Corps Air-Ground Combat Center Twentynine Palms (Twentynine Palms), in California in February of this year.

Investigators eventually caught up with Mr. Cobb last month while he was still stationed at Twentynine Palms. They seized and searched his phone, finding additional notes he allegedly made in May 2023 expressing further homicidal ideations.

Suspect Discussed Attack Ideas in FBI InterviewThe federal complaint indicates that FBI agents interviewed Mr. Cobb at the Marine Corps in April after they had seized his phone. The complaint states that during his interview, Mr. Cobb described to FBI agents his ideas for carrying out mass shootings, including one idea he had to shoot up a gym called New Jersey Strong, believing he could carry out the attack at the gym’s peak hours and then easily escape. Mr. Cobb described a second idea of attacking a grocery store because those are “almost always crowded.”

Mr. Cobb allegedly told FBI agents he specifically thought of targeting an Aldi’s grocery store in Robbinsville, New Jersey, “cause it was like one of them grocery stores like where you just see all these [expletive] rich-[expletive] white people.”

Mr. Cobb allegedly told FBI agents a third idea he had was to simply “go into like a rich white area and just like start shooting.”

During the April interview, Mr. Cobb allegedly suggested an affinity for the suspects in the 2018 Parkland High School shooting in Florida and the 2022 shooting at a supermarket in Buffalo, New York. In the latter of those two shootings, federal prosecutors have alleged the shooter posted a manifesto expressing a desire to specifically target a black community. Despite their differing racial motives, Mr. Cobb said he “liked the element of surprise and style” of the 2022 Buffalo supermarket attack.

Mr. Cobb was discharged from the Marine Corps sometime after his April interview with the FBI.

NTD News reached out to a pair of public defenders assigned to Mr. Cobb’s case for comment, but they did not respond by press time.

Mr. Cobb faces a maximum penalty of five years in prison and a $250,000 fine if convicted.

From NTD News

Tyler Durden Thu, 05/16/2024 - 18:05

Poll workers sort out early and absentee ballots at the Kenosha Municipal building on Election Day on Nov. 3, 2020, in Kenosha, Wis. (AP Photo/Wong Maye-E)

Poll workers sort out early and absentee ballots at the Kenosha Municipal building on Election Day on Nov. 3, 2020, in Kenosha, Wis. (AP Photo/Wong Maye-E) Photo: justin lane/Shutterstock

Photo: justin lane/Shutterstock

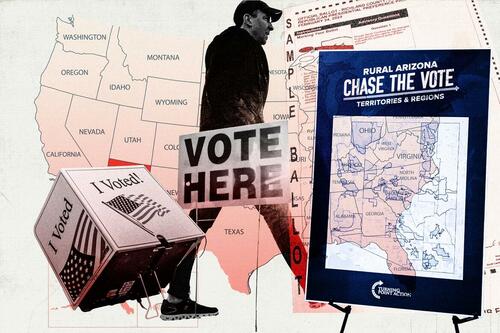

(Illustration by The Epoch Times, Nathan Worcester/The Epoch Times, Getty Images)

(Illustration by The Epoch Times, Nathan Worcester/The Epoch Times, Getty Images) A view of Turning Point Action's Chase the Vote maps for greater Milwaukee, Wisconsin on May 10, 2024, at the organization's headquarters in Phoenix, Arizona.

A view of Turning Point Action's Chase the Vote maps for greater Milwaukee, Wisconsin on May 10, 2024, at the organization's headquarters in Phoenix, Arizona. Election official Paula Volpiansky (L) signs voters' sealed absentee ballots as a witness at the Madison Central Public Library on the last day of early voting in Milwaukee, Wis., on Nov. 6, 2022. (Chip Somodevilla/Getty Images)

Election official Paula Volpiansky (L) signs voters' sealed absentee ballots as a witness at the Madison Central Public Library on the last day of early voting in Milwaukee, Wis., on Nov. 6, 2022. (Chip Somodevilla/Getty Images)

There has been high levels of homophobic, transphobic and gender violence in Peru Credit: Fotoholica Press

There has been high levels of homophobic, transphobic and gender violence in Peru Credit: Fotoholica Press

Image source: US Central Command (CENTCOM)

Image source: US Central Command (CENTCOM)

Recent comments