"Economics Works In Mysterious Ways": Is China's Wealth Effect Being Substituted?

By Teeuwe Mevissen, Senior Macro Strategist at Rabobank

Is the wealth effect being substituted?Summary

- China’s real estate market suffered heavy losses early this year while stock market investors continue to face huge uncertainty.

- This will add to the deterioration of household balances and as such could influence private domestic (consumer) demand.

- While the wealth effect predicts a deterioration of consumption, the substitution effect would predict the exact opposite.

- This paper concludes that the substitution effect is more likely in the case of real estate.

- This could be explained by the fact that housing is still expensive despite declining housing prices while at the same time wages are suppressed and youth unemployment is high.

- But more explanations (like prepayment risks) could be given for the positive correlation between housing prices and the savings ratio.

The new year in China kicked off with turmoil on China’s stock markets. Amongst others, the decision of the court in Hong Kong to liquidate real estate giant Evergrande further undermined investors’ confidence in China’s stock market. A market that already had been battered during the last three years due to ongoing worries about China’s economic prospects, regulatory crackdowns, a changing geopolitical landscape and a real estate sector in crisis. While China’s stock markets have pared some of the most recent losses due to (expectations of) increased government support, investor sentiment will likely remain fragile for some time to come. Moreover, many of the recently imposed government regulations, such as short selling curbs, are likely to be temporary assuming China is really serious about attracting more foreign investments. This follows from the fact that a full functioning market environment includes the possibility to sell stocks short and let market forces determine market outcomes.

Given that stock markets tend to be a leading indicator for the economy’s travails, this special zooms in on the question what the recent market turmoil could mean for China’s economic prospects in the coming year(s). The relation between the stock market’s performance and economic prospects is, amongst others, reflected by the expected future cash flows that companies are expected to make. But there may also be a wealth effect which predicts a positive relationship between stock market performance and consumption. Since the value of real estate also affects the willingness to consume, we also take a closer look at this particular topic in this research note. But before we do so, we will start with a general overview of China’s stock markets, its performance over the last 5 years and the measures that China’s government has implemented so far in order to prevent a further slump, which already evaporated a stunning amount of $7 tn during the recent lows in February. For more information regarding the real estate sector we refer to an earlier publication that covered this topic.

China’s stock markets experiencing a rout.After a sharp recovery of China’s stock markets in 2021 – which was part of a global relief rally that followed the panic sell-off in March 2020 – 2022 saw investor sentiment souring and China was no exception. However, whilst Western indices recovered sharply thereafter, China’s stock markets struggled to keep up during the first half of 2023 and showed a very poor performance in the second half of 2023. The start to this year can only be characterized as a true stock rout. As a result, the benchmark MSCI China stock index is down 60% from its peak in 2021. All in all the total decline in value of China’s stock markets is approximately 7 tn renminbi (close to $1 tn) since the peak in 2021. The majority of these losses are borne by domestic holders of Chinese equities and retail investors in particular.

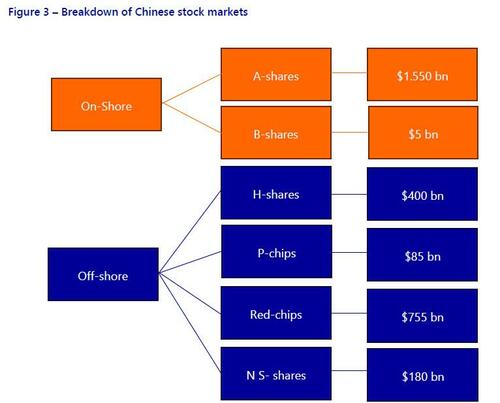

Some background on China’s stock markets

China’s restrictions related to foreign investments, geopolitical tensions and regulatory crack downs have soured foreign investors’ appetite for Chinese stocks and in October 2023 it was estimated that foreigners only hold $600 billion in Chinese stocks listed on mainland China or Hong Kong. This is indeed a small share of a total market capitalization that is estimated to be a little less than $9.7 tn in January 2024. While institutional investors’ share in Chinese stock holdings has significantly increased over the past two decades, China’s stock markets are still more influenced by retail investors than is the case in, for example, the United States. The box below explains some of the most common features of its stock market.

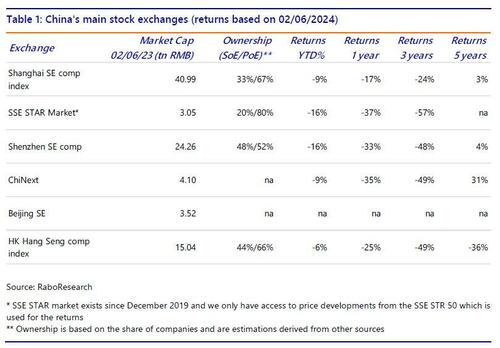

The structure of China’s stock market is important because it gives an idea of who has ownership and to what share classes. But for this it is clearly also relevant to have an idea about the total market capitalization of China’s main stock markets. This is why we show a table below that provides an overview of China’s stock exchanges ranked by market capitalization and which also includes the stock market returns YTD and for longer periods; It also provides an estimated breakdown between the share of private owned enterprises and state owned enterprises where available.

Connecting the stock market with consumption

While stock markets are less connected to the economic process and performance in China than is the case in most advanced economies (for instance, equity financing plays a relatively small role for China’s corporates who generally rely more on retained earnings and bank loans), the recent stock market rout adds to the wealth loss Chinese households already had suffered from China’s real estate crisis.

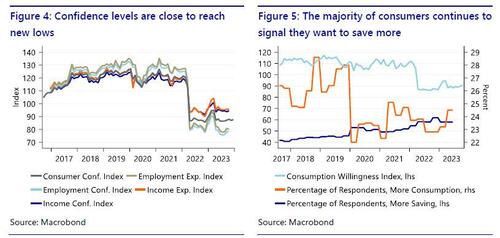

As can be seen from figure 4 below, surveyed consumers continue to signal weak confidence regarding developments related to employment and, related to it, income. Furthermore, consumer confidence is near record low levels. Moreover, close to 60% of respondents expect to increase savings in the next quarter while less than 25% of respondents indicate that they are expecting to consume more in the next quarter. We do note, though, that the most recent data is from Q2 2023.

Measures to support China’s stock markets

While most recently Beijing fired the head of the China Securities Regulatory Commission (CSRC) Yi Huiman and replaced him with Wu Qing, it is questionable whether this will result in the much needed restoration of investors’ confidence. However, as a previous head of the Shanghai Stock Exchange and in various roles within the CSRC, where he earned the nickname ‘the broker butcher’, it seems that a further crackdown on illicit trading practices is on the cards.

Several other measures have been announced, although the majority lacks details as is often the case when new policies and/or guidelines are announced. Below is a broad selection of measures that have been decided upon in recent months:

- More liquidity support for developers

- The CSRC announced it would look to support listed companies to find possibilities to merge and or restructure businesses in order to create value

- Sales of stocks were also restricted for some domestic institutional investors as well as some offshore units of those investors

- A lowering of 0.5% of the reserve ratio requirement for banks

- Monetary authorities provided 1 tn yuan extra liquidity into the markets in order to provide ample liquidity

- Promises to deal with margin call risks

- More active involvement of the CSRC in addressing concerns from listed companies

- Placing restrictions on security lending

More recently announced measures are:

- Cease displaying real-time data for flows into the world’s second-largest stock market through Hong Kong

- China’s ‘national team’ buying for $50 billion of stocks

- Clarification of new delisting rules which are aimed at zombie firms

- Tighten stock listing criteria

- Crack down on illegal share sales

- Strengthening the supervision of dividend payouts

While the PBOC has added additional stimulus since the end of last year, this stimulus still seems not to have fully fed into China’s economy and the real estate sector. Earlier this year, the PBOC offered 1 tn renminbi in loans to the banking sector and lowered the reserve requirement ratio by 0.5% bringing the average RRR for financial institutions to ‘about 7.0% after the cut’. A move that is expected to free up about 1 tn yuan according to the central bank chief who held a press conference in Beijing on Wednesday the 24th of January.

The last and perhaps most draconic measure announced this year is a ban on net stock selling during the first and last 30 minutes of a trading session. This measure came into effect on the 21st of February. This makes it harder for entities affected by this measure (mainly hedge funds and institutional investors) to apply certain trading strategies. At the same time it makes it easier for government-backed funds to influence the stock market during those crucial trading windows.

These measures clearly influence the extent to which stock valuations are determined by market mechanisms but they won’t increase the profitability of any company traded at any of China’s stock exchanges. It also remains to be seen how offshore investors will react on measures that increase the risk of not being able to sell your stocks anymore because of decreasing liquidity on the sellers’ market. Moreover, the restrictions on security lending are likely to have more effect on stocks listed on the Hong Kong exchanges than those listed in Shanghai. Mostly because stocks listed on the Shanghai stock exchange are held for more than 80% by individual investors vs 15% of stocks traded at the Hong Kong stock exchanges.

While Chinese stock markets initially showed a sharp recovery since their February lows, the stock rally seems to have stalled again since the midst of March. Taking all of the above into account, it remains to be seen whether the recent recovery of stock prices can be continued, especially when the current stock market trading curbs would be lifted again.

How the loss of wealth could lower consumptionWealth effect

We will now look at a few behavioral phenomena when it comes to the relationship between wealth and consumption. This so-called wealth effect is a behavioral economic theory which postulates that peoples’ willingness to spend increases when the wealth of their homes or asset portfolio increases because they feel more financially secure. Since (for now) we want to exclude the extreme swings of consumption and stock market prices arising from the Covid-19 pandemic (which is even more relevant given China’s strict lock down measures and its obvious effect on consumption), we first use the results of an academic paper from 2010 which studies the importance of the wealth effect on China’s consumer spending.

This paper estimates a long run consumption elasticity of total assets to be around 0.51 or roughly one half. This would imply that a 20% drop in share prices would result in a drop of about 10% in consumption. Compared to Western elasticities, which are often found to be closer to 0.05, this is extremely high. Based on such a positive relationship between wealth and consumption, one would expect a significant negative impact on consumption from the recent decline in house and equity prices. The elasticity on income is estimated at 0.76, which seems plausible in our view.

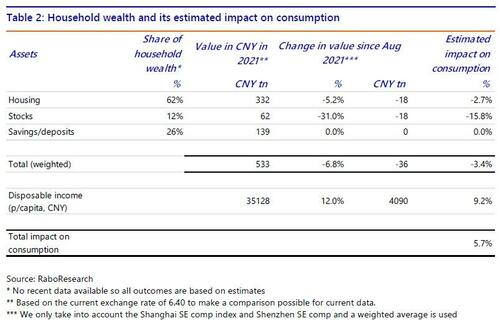

Based on the elasticity from the paper above and given the price developments of the separate asset classes we can make a rough estimate of the impact of declining asset prices on consumption. We take 2021 as the starting point because the real estate crisis started in the summer of 2021 and we want to omit the results during the pandemic because of reasons discussed above. These estimates are shown in table 2 below. We abstain from the impact of increased saving via (bank) deposits.

This is based on a total value of real estate in China of $55tn in 2021. So, if we assume the elasticities from this paper to be realistic, this suggests that the decline in asset values has depressed consumption by some 3.4% since August 2021. This would amount to a drop of consumption of more than $2 tn! Given a level of nationwide per capita consumption expenditure of 26.796, a total population of 1.425.000.000 people and the current USD/CNH exchange rate of around 7.25, this would boil down to a total amount of consumption of $5.3 tn. Our estimates above are generally inline with other research indicating that ‘a 5% decline in home prices will wipe out 19 trillion yuan ($2.7 trillion) in housing wealth’.

We should also add, though, that rising incomes have overshadowed its impact so that a positive gain in consumption (in nominal terms) results after all.

The (opposite) substitution effect

Having said this, there could also be reasons to assume an increase in consumption. So how would that work? Young people in China have been faced with a prolonged episode of rising housing prices while at the same time facing high levels of youth unemployment and an economy slowing down. As such, young people have increasingly felt discouraged. This has even led to the so-called lying flat movement, where young people deliberately choose to not join the tough rat race that recent graduates face when entering the labour market. Additionally, despite the gradual decline of house prices (both newly built and existing homes), suppressed wages have not made housing that more affordable especially in China’s tier-1 cities. This may have led many young people in China to delay or even give up on buying a house entirely.

Another reason why some young people are delaying or have given up on purchasing a house is the huge impact it has on the ‘quality of life’. Young people that have been able to purchase a house face relatively high monthly mortgage payments despite significant down payments. This has led a large amount of young Chinese citizens increasingly willing to spend their money on

consumption like traveling. This effect is called the substitution effect. Many economists have indeed claimed that the effect on consumption of declining stock and housing prices in China is different. Let’s say a wealth effect with Chinese characteristics, i.e. an inverse wealth effect.

For about two decades, consumption in China has been partially suppressed since households had to channel an unusual large share of their income to savings in order to make the necessary down-payment for purchasing a house. Back then, this often boiled down to about 30% of the value of the house. In other words, consumption was substituted for expenditures on housing. Indeed last year we saw signs of the substitution effect when the savings rate for households dropped while real estate prices dropped as well. This effect is in sharp contrast with the findings of the wealth effect discussed in the academic paper mentioned earlier.

Our data shows yet another pictureSince we lack data about the net savings rate for households in China we have derived the savings ratio by subtracting household expenditures from disposable income. We plot this estimated saving ratio against both real estate prices as well as the Shanghai Stock Exchange Composite Index. This results in the two graphs below:

While positive correlation between (inflation-adjusted) real estate prices and savings (i.e. a negative correlation with consumption) is evident from the first graph, stock prices don’t seem to have an impact on private domestic savings or consumption at all. Both results are at odds with the results from the academic paper discussed above whilst the first chart suggests that there is – if anything – a substitution rather than wealth effect.

However, we should be aware of the fact that in China, the major component of household wealth is invested in real estate and not the stock market. As such, declining stock prices could reduce consumption of the holders of these stocks; but if only a relatively small percentage of China’s citizens hold stocks or if many Chinese citizens only hold very small portions of their wealth in stocks, the impact on an aggregate level would still be negligible.

It is therefore important to take into account that approximately 70% of household wealth is in real estate while it was estimated in an article published by Atlantic press that household financial assets only accounted for about 13%. The rest is allocated towards other financial assets like saving accounts, deposits, gold etc. etc. The important conclusion we can draw from these figures is that much of the wealth of China’s households is either being held in illiquid assets, such as real estate or in low return deposits. From this angle it becomes easier to understand why in China the wealth effect arising from declining stock market prices is less likely to have a significant influence on consumption patterns.

Moreover, as we argue, the wealth effect arising from the developments in the real estate sector, may not apply in the case of China. We therefore conclude this special by discussing a number of explanations for the observed effect from real estate prices on consumption.

What about other factors? (prepayment risk)

Above we have shown conflicting findings on the existence of a wealth effect in China arising from price developments in both the real estate- and stock market. While older research seems to conclude that the wealth effect is indeed present, most recent data seems to indicate the absence of it. Indeed, in the case of real estate we actually observe an opposite effect, i.e. lower housing prices lead to lower saving rates. Does this mean that we observe a substitution effect in China? We would, albeit hesitantly, answer this question with a yes. But there could be more at play.

Aside from the substitution effect which has been outlined above, lower interest rates could also play a role. This is via the so called prepayment risk. It is well known that when interest rates and/or housing prices decline, house owners tend to increase their mortgage payments in order to reduce their outstanding amount of mortgage debt. Most mortgage prepayment models indeed predict increasing prepayments when the contract rate and the current market rate diverge, i.e. a situation where the contract rate is significantly higher than the current market rate.

One way to look at this phenomenon is the following: house owners have an incentive to refund themselves against lower rates and pay off the outstanding amount of mortgage debt if the terms and conditions of the mortgage allow for this. However, prepayment risks can also work in the opposite direction. When home owners expect rising interest rates the home owner also has an incentive to repay the mortgage more quickly to avoid higher interest rate payments in the future. Since interest rates have gradually and steadily declined in China, the former prepayment risk is more likely.

Additionally, the relationship between real estate prices and consumption is not necessarily static. Its effect could very well change over time. A prime analogy is the famous Phillips curve that tries to explain the inverse relationship between (wage) inflation on levels of unemployment. If other factors occasionally flip the relationship between wealth and consumption this would make it very hard to predict the impact of real estate prices on consumption at any point in time. Finally, developments in the labor market, such as adverse job conditions, could also impact the savings rate where higher unemployment levels lead to decreasing levels of savings and consumption, if households are forced to dip into their savings to maintain consumption levels.

Finally - as our analysis shows – the consumption effect arising from the rise in disposable income (which according to the paper has an elasticity of 0.76) has offset the wealth effect arising from the decline in assets. This could be another reason why the predicted decline in consumption cannot be observed.

ConclusionAltogether it is extremely hard - and with a lack of relevant data – impossible to draw strong conclusions about a permanent presence or absence of a wealth effect arising from price developments in the real estate sector in China. Unfortunately we cannot present a solid relationship between real estate price developments and consumption. At his point in time we can only conclude that we observe a negative relationship between consumption and house prices and offer some reasons that are likely to have influenced this relationship, with prepayment flows and possibly a weak labor market situation as relevant factors. The only firm conclusion we can draw is that economics continue to work in mysterious ways.

Tyler Durden Sun, 05/05/2024 - 19:50

Typhoon system, via US Army

Typhoon system, via US Army Image via Yahoo News

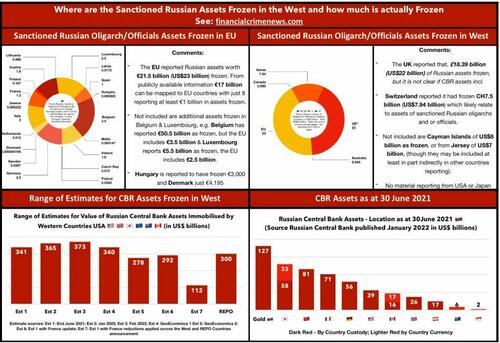

Image via Yahoo News Via Financial Crime News

Via Financial Crime News

AFP via Getty Images

AFP via Getty Images (Illustration by The Epoch Times, The Cass Review, Getty Images, Freepik)

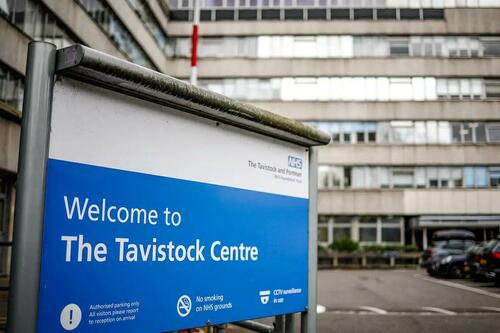

(Illustration by The Epoch Times, The Cass Review, Getty Images, Freepik) The NHS Tavistock Centre, England's first gender-identity development service for children, in London on April 10, 2024. (Henry Nicholls/AFP via Getty Images)

The NHS Tavistock Centre, England's first gender-identity development service for children, in London on April 10, 2024. (Henry Nicholls/AFP via Getty Images) A young girl at the annual NYC Pride March in New York City on June 25, 2023. (Samira Bouaou/The Epoch Times)

A young girl at the annual NYC Pride March in New York City on June 25, 2023. (Samira Bouaou/The Epoch Times)

Recent comments