The Steady Slide Towards Tyranny: How Freedom Dies From A To Z

Authored by John & Nisha Whitehead via The Rutherford Institute,

“As I look at America today, I am not afraid to say that I am afraid.”

- Former presidential advisor Bertram Gross

The American governmental scheme is sliding ever closer towards a pervasive authoritarianism.

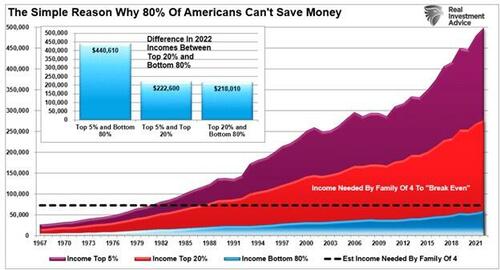

The American people, the permanent underclass in America, have allowed themselves to be so distracted and divided that they have failed to notice the building blocks of tyranny being laid down right under their noses by the architects of the Deep State.

This steady slide towards tyranny, meted out by militarized local and federal police and legalistic bureaucrats, has been carried forward by each successive president over the past fifty years regardless of their political affiliation.

Biden, Trump, Obama, Bush, Clinton: they have all been complicit in carrying out the Deep State’s agenda.

Frankly, it really doesn’t matter who occupies the White House, because it is a profit-driven, unelected bureaucracy—call it whatever you will: the Deep State, the Controllers, the masterminds, the shadow government, the corporate elite, the police state, the surveillance state, the military industrial complex—that is actually calling the shots.

In the interest of liberty and truth, here’s an A-to-Z primer that spells out the grim realities of life in the American Police State that no one seems to be talking about anymore.

A is for the AMERICAN POLICE STATE. A police state “is characterized by bureaucracy, secrecy, perpetual wars, a nation of suspects, militarization, surveillance, widespread police presence, and a citizenry with little recourse against police actions.”

B is for our battered BILL OF RIGHTS. In the militarized police culture that is America today, where you can be kicked, punched, tasered, shot, intimidated, harassed, stripped, searched, brutalized, terrorized, wrongfully arrested, and even killed by a police officer, and that officer is rarely held accountable for violating your rights, the Bill of Rights doesn’t amount to much.

C is for CIVIL ASSET FORFEITURE. This governmental scheme to deprive Americans of their liberties—namely, the right to property—is being carried out under the guise of civil asset forfeiture, a government practice wherein government agents (usually the police and now TSA agents) seize private property they “suspect” may be connected to criminal activity. Then, whether or not any crime is actually proven to have taken place, the government keeps the citizen’s property and it’s virtually impossible to get it back.

D is for DRONES. Nearly 1500 police departments across the U.S. include drones as part of their technological arsenal, and that number is growing. Although drones may be used for benevolent purposes, they have increasingly become extensions of the surveillance state, carrying out warrantless and constant mass aerial surveillance in violation of the Fourth Amendment. New autonomous police drones can “read a license plate from 800 feet away and follow a vehicle from a distance of 3 miles.”

E is for EMERGENCY STATE. From 9/11 to COVID-19 and beyond, we have been the subjected to an “emergency state” that justifies all manner of government tyranny and power grabs in the so-called name of national security. The government’s ongoing attempts to declare so-called national emergencies in order to circumvent the Constitution’s system of checks and balances constitutes yet another expansion of presidential power that exposes the nation to further constitutional peril.

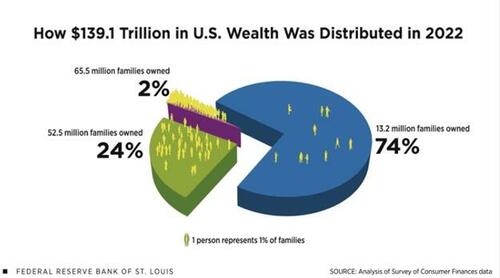

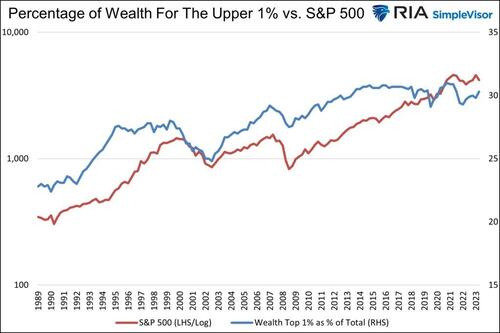

F is for FASCISM. A study conducted by Princeton and Northwestern University concluded that the U.S. government does not represent the majority of American citizens. Instead, the study found that the government is ruled by the rich and powerful, or the so-called “economic elite.” Moreover, the researchers concluded that policies enacted by this governmental elite nearly always favor special interests and lobbying groups. In other words, we are being ruled by an oligarchy disguised as a democracy, and arguably on our way towards fascism—a form of government where private corporate interests rule, money calls the shots, and the people are seen as mere economic units or databits.

G is for GLOBAL POLICE. The federal government has distributed more than $18 billion worth of battlefield-appropriate military weapons, vehicles and equipment such as drones, tanks, and grenade launchers to domestic police departments across the country. As a result, most small-town police forces now have enough firepower to render any citizen resistance futile. By the time you take those small-town police forces, train them to look and act like the military, and then enlist them to be part of the United Nations’ Strong Cities Network program, you not only have a standing army that operates beyond the reach of the Constitution but one that is part of a global police force.

H is for HOLLOW-POINT BULLETS. The government’s efforts to militarize and weaponize its agencies and employees is reaching epic proportions, with federal agencies as varied as the Department of Homeland Security and the Social Security Administration stockpiling millions of lethal hollow-point bullets, which violate international law. Ironically, while the government continues to push for stricter gun laws for the general populace, the U.S. military’s arsenal of weapons makes the average American’s handgun look like a Tinker Toy.

I is for the INTERNET OF THINGS, in which internet-connected “things” monitor your home, your health and your habits in order to keep your pantry stocked, your utilities regulated and your life under control and relatively worry-free. The key word here, however, is control. This “connected” industry propels us closer to a future where police agencies apprehend virtually anyone if the government “thinks” they may commit a crime, driverless cars populate the highways, and a person’s biometrics are constantly scanned and used to track their movements, target them for advertising, and keep them under perpetual surveillance.

J is for JAILING FOR PROFIT. Having outsourced their inmate population to private prisons run by private corporations, this profit-driven form of mass punishment has given rise to a $70 billion private prison industry that relies on the complicity of state governments to keep their privately run prisons full by jailing large numbers of Americans for petty crimes.

K is for KENTUCKY V. KING. In an 8-1 ruling, the Supreme Court ruled that police officers can break into homes, without a warrant, even if it’s the wrong home as long as they think they may have a reason to do so. Despite the fact that the police in question ended up pursuing the wrong suspect, invaded the wrong apartment and violated just about every tenet that stands between the citizenry and a police state, the Court sanctioned the warrantless raid, leaving Americans with little real protection in the face of all manner of abuses by law enforcement officials.

L is for LICENSE PLATE READERS, which enable law enforcement and private agencies to track the whereabouts of vehicles, and their occupants, all across the country. This data collected on tens of thousands of innocent people is also being shared between police agencies, as well as with government fusion centers and private companies. This puts Big Brother in the driver’s seat.

M is for MAIN CORE. Since the 1980s, the U.S. government has acquired and maintained, without warrant or court order, a database of names and information on Americans considered to be threats to the nation. As Salon reports, this database, reportedly dubbed “Main Core,” is to be used by the Army and FEMA in times of national emergency or under martial law to locate and round up Americans seen as threats to national security. There are at least 8 million Americans in the Main Core database.

N is for NO-KNOCK RAIDS. Owing to the militarization of the nation’s police forces, SWAT teams are now increasingly being deployed for routine police matters. In fact, more than 80,000 of these paramilitary raids are carried out every year. That translates to more than 200 SWAT team raids every day in which police crash through doors, damage private property, terrorize adults and children alike, kill family pets, assault or shoot anyone that is perceived as threatening—and all in the pursuit of someone merely suspected of a crime, usually possession of some small amount of drugs.

O is for OVERCRIMINALIZATION and OVERREGULATION. Thanks to an overabundance of 4500-plus federal crimes and 400,000 plus rules and regulations, it’s estimated that the average American actually commits three felonies a day without knowing it. As a result of this overcriminalization, we’re seeing an uptick in Americans being arrested and jailed for such absurd “violations” as letting their kids play at a park unsupervised, collecting rainwater and snow runoff on their own property, growing vegetables in their yard, and holding Bible studies in their living room.

P is for PATHOCRACY and PRECRIME. When our own government treats us as things to be manipulated, maneuvered, mined for data, manhandled by police and other government agents, mistreated, and then jailed in profit-driven private prisons if we dare step out of line, we are no longer operating under a constitutional republic. Instead, what we are experiencing is a pathocracy: tyranny at the hands of a psychopathic government, which “operates against the interests of its own people except for favoring certain groups.” Couple that with the government’s burgeoning precrime programs, which will use fusion centers, data collection agencies, behavioral scientists, corporations, social media, and community organizers and by relying on cutting-edge technology for surveillance, facial recognition, predictive policing, biometrics, and behavioral epigenetics in order to identify and deter so-called potential “extremists,” dissidents or rabble-rousers. Bear in mind that anyone seen as opposing the government—whether they’re Left, Right or somewhere in between—is now viewed as an extremist.

Q is for QUALIFIED IMMUNITY. Qualified immunity allows police officers to walk away without paying a dime for their wrongdoing. Conveniently, those deciding whether a cop should be immune from having to personally pay for misbehavior on the job all belong to the same system, all cronies with a vested interest in protecting the police and their infamous code of silence: city and county attorneys, police commissioners, city councils and judges.

R is for ROADSIDE STRIP SEARCHES and BLOOD DRAWS. The courts have increasingly erred on the side of giving government officials—especially the police—vast discretion in carrying out strip searches, blood draws and even anal and vaginal probes for a broad range of violations, no matter how minor the offense. In the past, strip searches were resorted to only in exceptional circumstances where police were confident that a serious crime was in progress. In recent years, however, strip searches have become routine operating procedures in which everyone is rendered a suspect and, as such, is subjected to treatment once reserved for only the most serious of criminals.

S is for the SURVEILLANCE STATE. On any given day, the average American going about his daily business will be monitored, surveilled, spied on and tracked in more than 20 different ways, by both government and corporate eyes and ears. A byproduct of the electronic concentration camp in which we live, whether you’re walking through a store, driving your car, checking email, or talking to friends and family on the phone, you can be sure that some government agency, whether the NSA or some other entity, is listening in and tracking your behavior. This doesn’t even begin to touch on the corporate trackers that monitor your purchases, web browsing, Facebook posts and other activities taking place in the cyber sphere.

T is for TASERS. Nonlethal weapons such as tasers, stun guns, rubber pellets and the like have been used by police as weapons of compliance more often and with less restraint—even against women and children—and in some instances, even causing death. These “nonlethal” weapons also enable police to aggress with the push of a button, making the potential for overblown confrontations over minor incidents that much more likely. A Taser Shockwave, for instance, can electrocute a crowd of people at the touch of a button.

U is for UNARMED CITIZENS SHOT BY POLICE. No longer is it unusual to hear about incidents in which police shoot unarmed individuals first and ask questions later, often attributed to a fear for their safety. Yet the fatality rate of on-duty patrol officers is reportedly far lower than many other professions, including construction, logging, fishing, truck driving, and even trash collection.

V is for OPERATION VIGILANT EAGLE. One of several government initiatives dating back to 2009 that call for heightened scrutiny of those who challenge the government’s authority, this particular program calls for surveillance of military veterans, characterizing them as extremists and potential domestic terrorist threats because they may be “disgruntled, disillusioned or suffering from the psychological effects of war.” Coupled with a report that defines extremists as individuals and groups “that are mainly antigovernment, rejecting federal authority in favor of state or local authority, or rejecting government authority entirely,” these tactics bode ill for anyone seen as opposing the government.

W is for WHOLE-BODY SCANNERS. Using either x-ray radiation or radio waves, scanning devices and government mobile units are being used not only to “see” through your clothes but to spy on you within the privacy of your home. While these mobile scanners are being sold to the American public as necessary security and safety measures, we can ill afford to forget that such systems are rife with the potential for abuse, not only by government bureaucrats but by the technicians employed to operate them.

X is for X-KEYSCORE, one of the many spying programs carried out by the National Security Agency that targets every person in the United States who uses a computer or phone. This top-secret program “allows analysts to search with no prior authorization through vast databases containing emails, online chats and the browsing histories of millions of individuals.”

Y is for YOU-NESS. Using your face, mannerisms, social media and “you-ness” against you, you are now be tracked based on what you buy, where you go, what you do in public, and how you do what you do. Facial recognition software promises to create a society in which every individual who steps out into public is tracked and recorded as they go about their daily business. The goal is for government agents to be able to scan a crowd of people and instantaneously identify all of the individuals present. Facial recognition programs are being rolled out in states all across the country.

Z is for ZERO TOLERANCE. We have moved into a new paradigm in which young people are increasingly viewed as suspects and treated as criminals by school officials and law enforcement alike, often for engaging in little more than childish behavior or for saying the “wrong” word. In some jurisdictions, students have also been penalized under school zero tolerance policies for such inane "crimes" as carrying cough drops, wearing black lipstick, bringing nail clippers to school, using Listerine or Scope, and carrying fold-out combs that resemble switchblades. The lesson being taught to our youngest—and most impressionable—citizens is this: in the American police state, you’re either a prisoner (shackled, controlled, monitored, ordered about, limited in what you can do and say, your life not your own) or a prison bureaucrat (politician, police officer, judge, jailer, spy, profiteer, etc.).

None of these dangers have dissipated in any way, and yet suddenly, no one seems to be talking about any of the egregious governmental abuses that are still wreaking havoc on our freedoms: police shootings of unarmed individuals, invasive surveillance, roadside blood draws, roadside strip searches, SWAT team raids gone awry, the military industrial complex’s costly wars, pork barrel spending, pre-crime laws, civil asset forfeiture, fusion centers, militarization, armed drones, smart policing carried out by AI robots, courts that march in lockstep with the police state, schools that function as indoctrination centers, bureaucrats that keep the Deep State in power.

As I make clear in my book Battlefield America: The War on the American People and in its fictional counterpart The Erik Blair Diaries, this is how freedom dies.

If there is any means left to us for thwarting the government in its relentless march towards outright dictatorship, it may rest with the Tenth Amendment, which affirms that “we the people” (in the form of juries and local governments) have the power to invalidate governmental laws, tactics and policies that are illegitimate, egregious or blatantly unconstitutional.

Nullify everything.

Nullify the court cases. Nullify the laws. Nullify everything the government does that flies in the face of the Constitution.

It’s time to rein in our runaway government, reclaim our freedoms, and restore justice in America.

Tyler Durden Wed, 05/01/2024 - 16:30

Recent comments