DOJ Charges 30 More People For Minnesota Church Invasion

Via Headline USA,

Attorney General Pam Bondi announced charges Friday against 30 more people who are accused of civil rights violations in a January protest inside a Minnesota church where a pastor works for Immigration and Customs Enforcement.

Bondi said on social media that 25 people were in custody and more arrests would follow.

The new indictment comes a month after independent journalists Don Lemon and Georgia Fort and prominent local activist Nekima Levy Armstrong were charged for their alleged roles in the protest at Cities Church in St. Paul, Minnesota.

“YOU CANNOT ATTACK A HOUSE OF WORSHIP. If you do so, you cannot hide from us — we will find you, arrest you, and prosecute you,” Bondi wrote in the post.

“This Department of Justice STANDS for Christians and all Americans of faith.”

In total, 39 people now face charges of conspiracy against religious freedom and interfering with the right of religious freedom.

The new defendants will have an initial court appearance and a magistrate judge will set conditions for their likely release. Lemon and Fort said they were at the church as journalists covering news. Levy Armstrong was the subject of a doctored photo posted by the White House showing her crying during her arrest. The three have pleaded not guilty.

Protesters descended on Cities Church on Jan. 18 after learning that one of the church’s pastors also serves as an ICE official. The protest drew swift condemnation from Trump administration officials and conservative leaders for disrupting a Sunday service.

The indictment says the “agitators” entered the church in a “coordinated takeover-style attack” and engaged in acts of intimidation and obstruction.

“Young children were left to wonder, as one child put it, if their parents were going to die,” the indictment says.

A lawyer for the church praised the Justice Department for charging more people.

“The First Amendment does not give anyone — regardless of profession, prominence, or politics — license to storm a church and intimidate, threaten, and terrorize families and children worshipping inside,” Doug Wardlow said in a statement.

The revised indictment adds new allegations when compared to the original filed in January.

It says two people “conducted reconnaissance” outside the church a day before the protest and recorded their visit on video, with one saying, “My thoughts are to be able to close up this whole alleyway right here.”

The court filing quotes one protester as chanting in the church, “This ain’t God’s house. This is the house of the devil.”

Separately, a woman who was at the church service has filed a lawsuit against some people who were charged, alleging emotional trauma and an inability to exercise her religion that day.

The protest came at a tense time in Minnesota, where the Trump administration sent thousands of federal officers for Operation Metro Surge after a series of public fraud cases where the majority of defendants had Somali roots. Officers frequently deployed tear gas for crowd control in neighborhood clashes with residents, often detaining them along with immigrants.

On Jan. 7, a federal officer fatally shot Renee Good, 37, in Minneapolis. In another fatal shooting a week after the church protest, a federal officer killed 37-year-old nurse Alex Pretti.

Nationwide demonstrations erupted in response, followed by a change in Operation Metro Surge’s leadership and the eventual wind-down of the immigration enforcement operation. Roughly 400 ICE officers and Homeland Security agents were expected to remain in Minneapolis by early March, down from roughly 3,000 at the peak, according to a court filing.

Since then, the Twin Cities have grappled with the impact to communities and the local economy. The city of Minneapolis said it suffered an impact of $203.1 million due to the operation, with tens of thousands of residents in need of urgent relief assistance.

Tyler Durden Sun, 03/01/2026 - 16:20

Source:

Source:

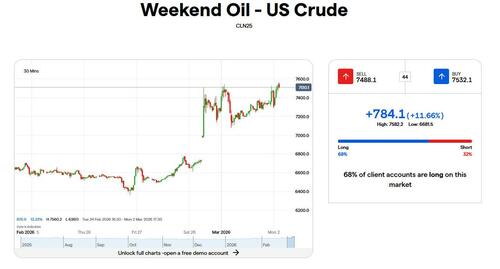

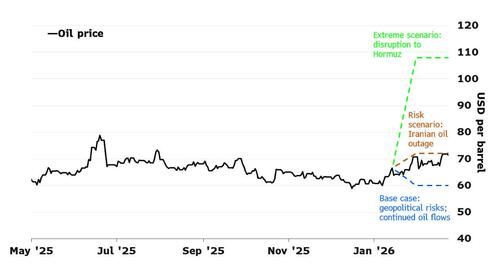

Source: Bloomberg

Source: Bloomberg

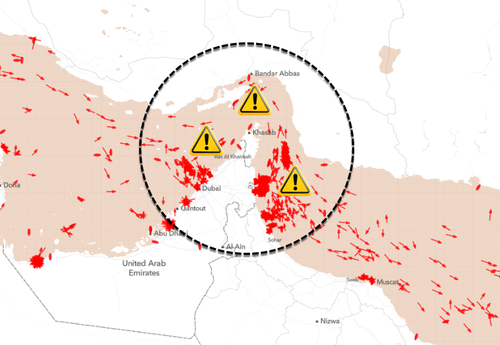

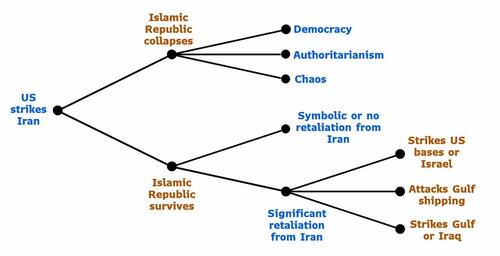

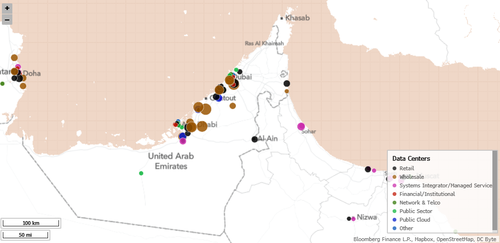

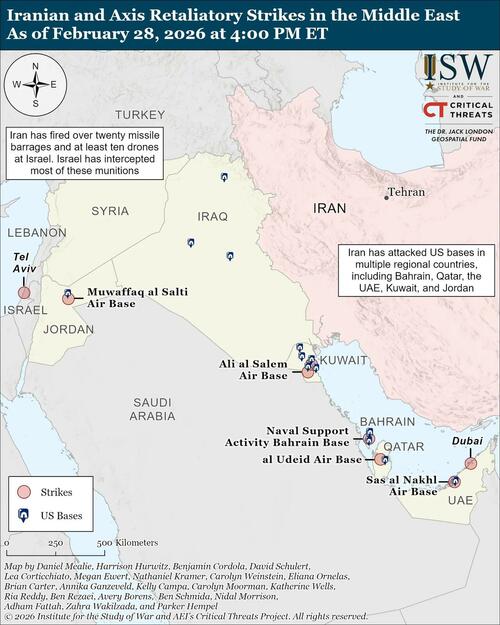

Explosions at Dubai International Airport following Iranian strike.

Explosions at Dubai International Airport following Iranian strike.

A U.S.-made F-16V fighter jet taxis on the runway at an airforce base during the annual Han Kuang military drills in Hualien, Taiwan, on July 23, 2024. Sam Yeh/AFP via Getty Images

A U.S.-made F-16V fighter jet taxis on the runway at an airforce base during the annual Han Kuang military drills in Hualien, Taiwan, on July 23, 2024. Sam Yeh/AFP via Getty Images An aerial view of vehicles awaiting their export at a port in Nanjing, eastern Jiangsu Province, China, on Dec. 9, 2025. AFP via Getty Images

An aerial view of vehicles awaiting their export at a port in Nanjing, eastern Jiangsu Province, China, on Dec. 9, 2025. AFP via Getty Images

Michelle Bowman, vice chair for supervision of the Federal Reserve Board, in Washington on July 22, 2025. Ken Cedeno/Reuters

Michelle Bowman, vice chair for supervision of the Federal Reserve Board, in Washington on July 22, 2025. Ken Cedeno/Reuters Homes for sale in Maryland on Nov. 12, 2023. Madalina Vasiliu/The Epoch Times

Homes for sale in Maryland on Nov. 12, 2023. Madalina Vasiliu/The Epoch Times

Recent comments