In both the academic and political blogospheres, there are parallel but different discussions going on about the same point: this recession is far more severe in terms of unemployment than the 2.8% loss of GDP from peak would predict. At 9.5% and increasing the unemployment rate is approaching rates only seen once since the 1930s, as almost 8 million jobs have been lost in the last year and 7 months.

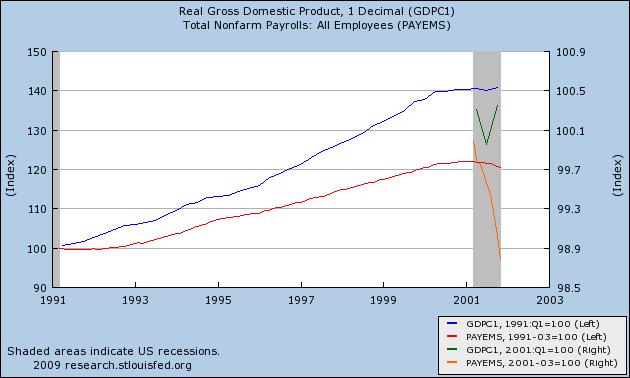

A graph illustrating the uniquely bad job losses during this recession has appeared frequently in the blogosphere, and is not a stranger to this blog:

The increase of unemployment during this recession to nearly 10% violates something academic economists call "Okun's law":

Here is the gist: if GDP (production and incomes, that is) rises or falls two percent due to the business cycle, the unemployment rate will rise or fall by one percent. The magnitude of swings in unemployment will always be half or nearly half the magnitude of swings in GDP

This rule of thumb says that in a recession the % of jobs lost will approximately equal 1/2the % of GDP loss. In December 2007 when this recession began, the unemployment rate was 4.9%. We have lost ~2.8% of GDP. Thus "Okun's law" says our unemployment rate should now be about 6.3! Instead our unemployment rate is already 9.5%. In other words, the unemployment rate during our recession is increasing nearly four times the predicted rate!

Professors Krugman, Delong, and others are perplexed. They can't seem to locate the source of the problem. For my part, I think the data is right in front of us, as I'll show below.

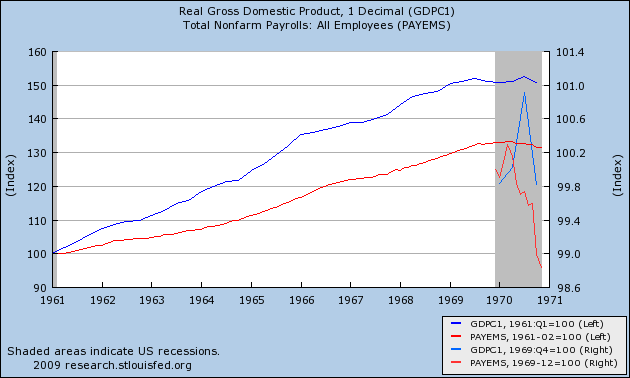

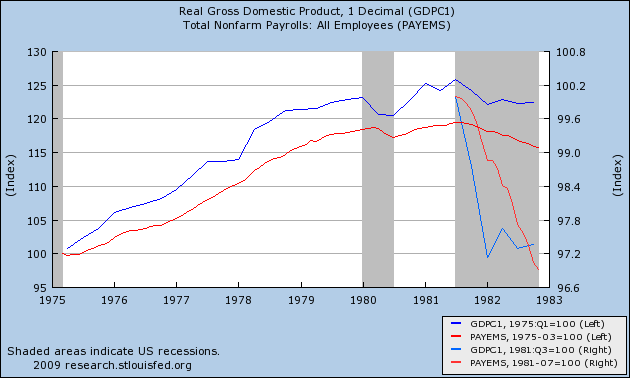

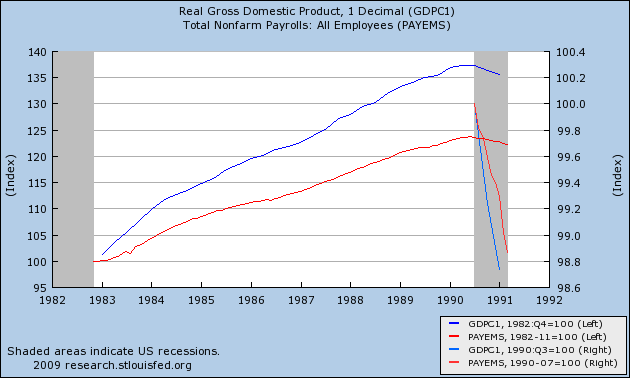

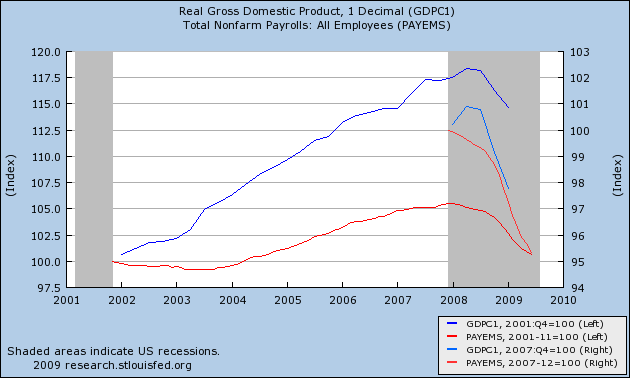

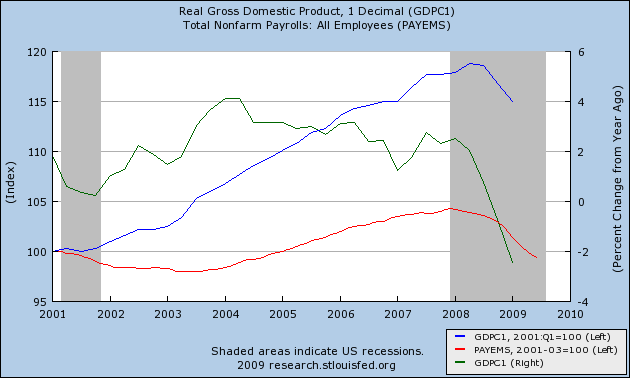

In order to show you how a structurally worse unemployment picture has been built into the economy, let me show you a series of graphs of unemployment growth vs. GDP growth covering all of the economic expansions and recessions for the last 50 years. (Note: In all of the graphs below, GDP is in blue, employment gains/losses in red. The longer lines measure the entire cycle from start of expansion to bottom of next recession. The lines at the right measure only the declines during the recession).

The 1960s were truly the halcyon era of American economic dominance. GDP grew on average about 4.75% a year for the entire decade, and employment by a terrific 3.5% a year. When the 1970 recession hit, it caused a mere 1% decline in GDP and a 1.5% decline in employment.

After the 1974 Oil shock, the economy still grew at a "subpar" 3% a year, with 2% annual employment gains. In the severe 1981-82 recession, GDP fell 2.8% in only 6 months before stabilizing, while employment dropped about the same percent, half of it during the initial 6 month burst.

In the 1980s, the economy again grew at a robust 4% a year, while employment grew by 2.75% a year. The mild 1990 recession knocked about 1.5% off GDP and a smaller percent off employment.

In the 1990s, the economy again grew at a robust 3.5% a year, while employment grew by 2%. Note that this rate, with employment growth only slightly over half of GDP growth, is the weakest so far. But then, things began to really change. The 2001 recession lopped off a paltry 0.4% of GDP, while employment lost 1.2%

In our own decade, it is clear that something has been different. While the economy as a whole grew by about 2.8% a year during the poor Bush "expansion", employment grew by a paltry 1% a year. When the recession hit, the trend of subpar employment as compared with GDP simply continued. GDP has shrunk some 2.3% from the top, while employment has plummeted by nearly 5%.

In other words, the steep job losses during this recession should not be looked at in isolation. They are the continuation and intensification of a trend that began in the 1990s, and really took off with the 2001 recession. The trend is that of subpar job growth during economic expansion, and intensified job losses during recessions. Here is a graph starting from January 2001 showing that there has been ZERO job growth in the face of 15% GDP growth even at this point in the "Great Recession". This graph also shows, in green, yearly GDP growth. Note that only in those periods of GDP growth over 2% a year in the last decade, have any jobs been added. It appears that something is happening, something that (in net terms) failed to generate a single American job unless there was at least 2% GDP growth.

So, what started happening during the 1990s expansion, that accelerated dramatically in the 2000s? Berkeley economics Prof. Brad Delong, cited above, writing about "jobless recoveries" believes:

Manufacturing firms used to think that their most important asset was skilled workers.... Now, by contrast, it looks as though firms think that their workers are much more disposable—that it's their brands or their machines or their procedures and organizations that are key assets. They still want to keep their workers happy in general, they just don't care as much about these particular workers.

.... Hence the start of the recovery is a business' last moment to slim down its labor force and become more efficient and profitable in the coming boom.

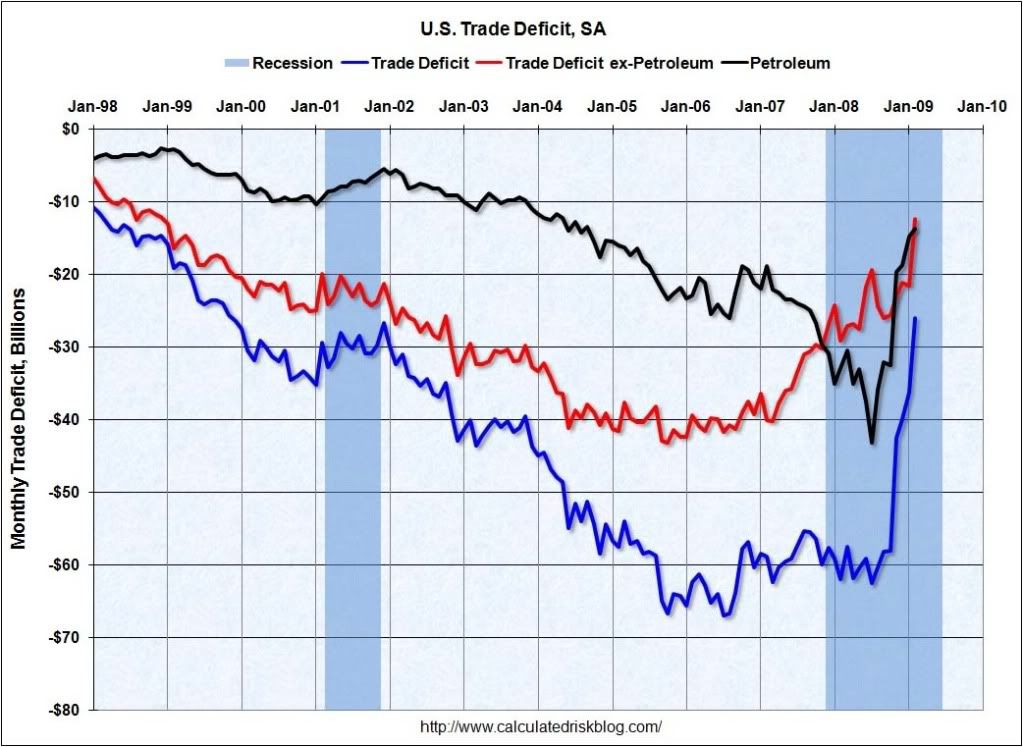

I think there is a much more straightforward answer, one which embraces the poor job performance of the entire last decade -- because there is a candidate the graph for which seems to be a near perfect match. This is a graph of the US trade deficit, current through February 2009 (h/t Calculated Risk):

Between 1969 and the mid 1990s, the US ran a consistent trade deficit, but in the mid 1990s, the trade deficit really took off, growing from -$10 billion a -year- month to -$65 billion a -year- month at its height. This is almost a perfect match for our GDP and employment data above. It appears that as corporations offshored more and more factory and back office work to China and the rest of Asia, consumer inflation was held in check, but consumers in the aggregate did not have the jobs to pay for the cheap goods which were supposed to be the payoff. Instead, as we all know, American consumers took advantage of easy credit to go deeper and deeper into debt. This cycle required the generation 2% of GDP growth a year before a single net American job was produced.

In short, the employment losses during this recession are not special. Rather, they are the continuation of a trend caused by the ongoing, chronic trade deficit, most particularly the offshoring of employment.

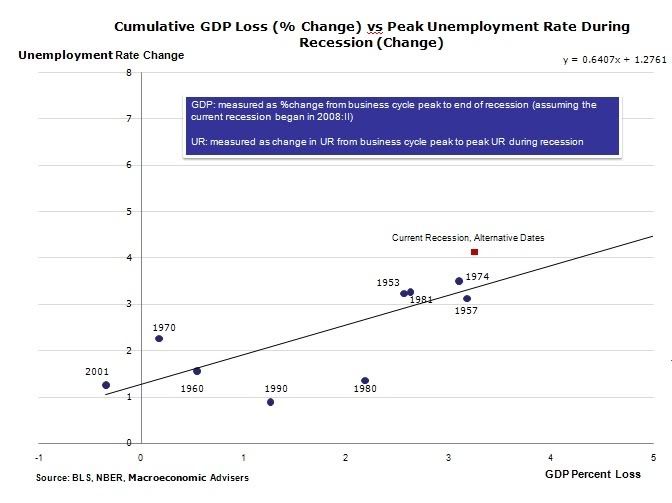

You may astutely notice, however, that since mid 2008, the trade deficit has plummeted, the most recent reading of -$26 billion being only about 40% of the deficit of several years ago. If I am right, that the culprit is offshoring, then we ought to be moving to a more normal relationship between employment and GDP growth and loss. And indeed, in his most recent installment discussing the issue academically, David Altig of the Atlanta Fed notes that if we start the data after the 2nd quarter of 2008, when GDP peaked - and coincidentally when the trade deficit began to plummet - the job losses during this recession, while still slightly high, much more closely fit the rule of thumb of "Okun's law":

Should GDP turn positive in the next few months, a test of this hypothesis will be to watch how GDP growth translates into the trade deficit. Has there been an actual change in the structural nature of the trade deficit, so that there will be relatively more robust job growth? Or will the trade deficit increase again, and a "jobless recovery" once again be in store?

-----------------------

Addendum and Note to readers .... First the Addendum: This essay was originally published elsewhere and since then seems to have found its way into certain academics' in-box. Paul Krugman opines that the Friday changes to GDP for 2007 and 2008 mean that this recession's job losses are actually in accord with "Okun's law" although he uses declines from trend, not nominal declines. OTOH, he agrees that there has been a structural change in the economy which means that there must be 2% GDP growth before there is any net job growth -- which seems to contradict the notion that Okun's law hasn't been violated.

Brad Delong responds to Krugman, believing that this recession still is off-trend for Okun's law.

Now the Note to readers: A couple of months ago, my friend Hale Stewart a/k/a Bonddad invited me to co-blog with him at the bonddad blog. While I will continue to post pubic policy analysis and populist themed writings here, I have already shifted most of my economic and financial analysis to that blog, including a discussion of whether declines in initial jobless claims are a "false dawn" or not; and housing data during the Roaring Twenties and Great Depression; and for the time being, that will continue. This week I'll be following the data that will be released for 4 of the 10 leading economic indicators, so if you are interested in my take on the economic and financial news of the day, click over there

Comments

Income Inequality + Financialization + Globalization =

Destruction of the Middle Class. I started reading Dr. Thomas Palley's (h/t Robert) "America's Exhausted Paradigm".

I strongly agree with Dr. Palley, we need a new economic growth model that relies on the rising middle class incomes. What we are seeing is a "new normal" in economic growth - one that will lead to higher structural unemployment but this could change as Robert says "it doesn't have to be this way". It doesn't. I wish people would wake up and realize this and tell their elected officials that is time for a new economic model.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

A partial explanation

Believe it or not, this article is already dated. When the BEA came out with the recent GDP report, they also revised the entire recession.

It turns out the GDP loss so far was twice as bad as first reported.

that's true but....

Did you read Krugman's posts? I did and they still do not add up. He's missing a good 1% unemployment from what I saw, never mind the fact unemployment has changed so U3 is deflated.

I wrote up a post as well, GDP, Productivity, jobs & outsourcing, which also shows that roughly 0.5% GDP is phantom, or wrongly attributed GDP.

From the increase in outsourcing statistics, now tax revenues, imply the estimate is already low, out of date....

but that shows roughly 0.5% GDP is wrongly attributed to U.S. GDP when it should be attributed to foreign nations.

Then, we tore apart, as did many good diligent bloggers the Q2 GDP and then again, saw the exports, imports, were both in decline, yet because the difference implied U.S. exports were decreasing at a lesser rate than imports...it "puffed up" the GDP.

But, declining exports....means declining exports, i.e. layoffs, less jobs.

So, in my view, NDD is onto something here.

So, GDP, Q1, 2009 was revised to -6.4% from -5.5%.

It seems to get closer but still it appears Okun isn't holding to me.

I think this is a great post regardless of using the unrevised GDP numbers.

Looking at the pattern, the overall causes of jobless "recovery" & linking it up with the ballooning trade deficit....

This topic is very important to me, simply because the Stimulus was created using some "multiplier" or "throw money at it" type of theory, when we see from the various reports (we don't have an aggregate number yet) that jobs & money from the Stimulus is going offshore.

NDD, I think this is a great post, but I do believe you need to update it with the revised GDP numbers. I suspect the conclusion is going to be the same.

(oh yeah, you shouldn't go over to that Bonddad character, Bonddad should come over here. ;))

Not quite

The GDP revisions "added" 1.1% to the recession, turning it into a decline of -4.0% total. That should translate into a 2% increase in unemployment, not the actual 4.6%.

another criticisim of both Krugman & Delong

Both of them refuse, absolutely refuse to recognize contained within Productivity figures is labor arbitrage. Continually they will claim it's "technological advances" instead of outsourcing, global supply chain or the importing of foreign labor to undercut U.S. wages.

Looks like I have an exercise for the reader, but I have read multiple papers showing the increases in productivity can be attributed to outsourcing, the percentages vary but it is a factor.

I believe this is one of those "religious" themes....it's like they cannot utter the "O" word.

About "productivity"

It is amazing to me that Krugman accepted the thesis of this essay -- that structurally the US economy now requires 2% GDP growth to create jobs -- and then waved it off with the one word, "productivity."

OK, we all got computers in the 90s. But how many people got super duper extra caffeine productive computers in the last 5 years?

politics vs. theory and analysis

There really is something funky going on and didn't Krugman support "free trade" and economies of scale, trying to claim there would just be "regional adjustments" which might cause "short term pain" and "pockets of localities" might be "temporarily affected"

(and no one adding up all of those "localities" to be the United States of America?)

So, in other words, are some of these people sticking with their philosophy, just ignoring the data, stats and the possibility their "theoretical advancements" are skewed or missing something ...with some incredible assumptions?

(like let's say regional pain as a time window happens to be 50+ years?)

Seriously.

On Krugman

These "regional adjustments" smack of the "creative destruction" Dr. Geeenspan used to prattle about, before it hit the American economy right between the eyes.

The dislocations may be temporary, but that says nothing about the outcome, or how many of us will be around to see it.

Welcome to EP Frank T.

I notice you are adding a number of comments and this one above I personally appreciate...

(reminds me of a Monty Python film, Can we have your liver!)

May I suggest creating an account and logging in.

The CAPTCHA goes away, your comments no longer go into moderation and you get your own account to track your comments and see who has replied to more easily manage discussions on the site.

Welcome to EP again....

Thank you Robert

Really like this site which I just joined. I am not an economist but am bothered by the Fed-Administration cabal and their meta-theory that ignores the real issues in favor of their client interests.

Frank T.

Frank T.

welcome to the party!

Good deal, glad you're here and yeah, no formal education required on EP. There are many people, highly intelligent, coming from all sorts of backgrounds who can go onto the Internets and realize something is structurally askew without having made it through the dissertation/oral exam hazing ritual.

Thanks

I did go through the hazing ritual, though not in econ, but I'm not sure how much good that did me. When you see how many economists are just using math to please their employers and clients -- enough said on education. I learned more since grad school than I ever learned in it -- finally have time to read and think.

Frank T.

Frank T.

In fact, there's a widely held Open Source theory

That we passed the * usable productive increase* of computers for 90% of the population some time ago. You just don't need a 3 Ghz processor and 4GB of Ram to play solitaire and read e-mail.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Here is a new equality.

New normal for economic growth = More income inequality = More destruction of middle class.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

A simpler solution

could be that we are measuring GDP wrong. To look at it another way, with as severe as this recession has looked statistically (credit freezing etc.) the GDP numbers could be far worse. So maybe the what has happened is that the way in which we actually construct GDP is wrong and the decline is far worse than is being reported. I would look towards the import-export difference as one point of confusion (among many others).

And I am with Krugman on the productivity issue. Computers/PDA's/Robotics are continually improving and making more and more jobs obsolete. I work with manufacturers and have been through some new plants and all I can say is the only people working in them are the people who load the material in one end and take it out the other and those who maintain the robots. There are no "factory" workers in modern manufacturing plants.

so...

technology explains the mass exodus of manufacturing to China? I don't think so.

It explains why

job losses have been so steep this recession (they didn't go to China this quickly) and why it is so hard to create jobs here anymore. People can be easily replaced with tech and as the economy worsened businesses realized just how "efficient" the new techs were.

The other thing to remember that NDD doesn't discuss is the massive losses in construction and finance jobs this time that were almost entirely the result of bubbles popping (ie they should never have been there in the first place and are not coming back).

well, you've given me a post topic

because jobs have been leaving the U.S. for China in the last two years, in droves. Finance jobs too. Citigroup signed a $2 billion dollar outsourcing deal AFTER receiving TARP funds and used the meltdown as an excuse to offshore outsource even more tech. IBM, massive layoffs...all offshored. GM, 13k offshored. I haven't even gotten to R&D being offshored in droves. So, while one can claim "construction" the job losses are across the board, every occupational category.

Thanks for taking the time

Thanks for taking the time to discuss this, I feel strongly about it and love learning more on this topic. If possible, as you gain expertise, would you mind updating your blog with more information? It is extremely helpful and beneficial to your readers.

nice

excellent post, thank you for sharing i love reading your blog