Virtual Home Invasions: We're Not Safe From Government Peeping Toms

Authored by John & Nisha Whitehead via The Rutherford Institute,

“The privacy and dignity of our citizens is being whittled away by sometimes imperceptible steps. Taken individually, each step may be of little consequence. But when viewed as a whole, there begins to emerge a society quite unlike any we have seen—a society in which government may intrude into the secret regions of man’s life at will.”

- Justice William O. Douglas

The spirit of the Constitution, drafted by men who chafed against the heavy-handed tyranny of an imperial ruler, would suggest that one’s home is a fortress, safe from almost every kind of intrusion.

Unfortunately, a collective assault by the government’s cabal of legislators, litigators, judges and militarized police has all but succeeded in reducing that fortress—and the Fourth Amendment alongside it—to a crumbling pile of rubble.

We are no longer safe in our homes, not from the menace of a government and its army of Peeping Toms who are waging war on the last stronghold of privacy left to us as a free people.

The weapons of this particular war on the privacy and sanctity of our homes are being wielded by the government and its army of bureaucratized, corporatized, militarized mercenaries.

Government agents—with or without a warrant, with or without probable cause that criminal activity is afoot, and with or without the consent of the homeowner—are now justified in mounting virtual home invasions using surveillance technology—with or without the blessing of the courts—to invade one’s home with wiretaps, thermal imaging, surveillance cameras, aerial drones, and other monitoring devices.

Just recently, in fact, the Michigan Supreme Court gave the government the green light to use warrantless aerial drone surveillance to snoop on citizens at home and spy on their private property.

While the courts have given police significant leeway at times when it comes to physical intrusions into the privacy of one’s home (the toehold entry, the battering ram, the SWAT raid, the knock-and-talk conversation, etc.), the menace of such virtual intrusions on our Fourth Amendment rights has barely begun to be litigated, legislated and debated.

Consequently, we now find ourselves in the unenviable position of being monitored, managed, corralled and controlled by technologies that answer to government and corporate rulers.

Indeed, almost anything goes when it comes to all the ways in which the government can now invade your home and lay siege to your property.

Consider that on any given day, the average American going about his daily business will be monitored, surveilled, spied on and tracked in more than 20 different ways, by both government and corporate eyes and ears.

A byproduct of this surveillance age in which we live, whether you’re walking through a store, driving your car, checking email, or talking to friends and family on the phone, you can be sure that some government agency is listening in and tracking your behavior.

This doesn’t even begin to touch on the corporate trackers that monitor your purchases, web browsing, Facebook posts and other activities taking place in the cyber sphere.

Stingray devices mounted on police cars to warrantlessly track cell phones, Doppler radar devices that can detect human breathing and movement within in a home, license plate readers that can record up to 1800 license plates per minute, sidewalk and “public space” cameras coupled with facial recognition and behavior-sensing technology that lay the groundwork for police “pre-crime” programs, police body cameras that turn police officers into roving surveillance cameras, the internet of things: all of these technologies (and more) add up to a society in which there’s little room for indiscretions, imperfections, or acts of independence—especially not when the government can listen in on your phone calls, read your emails, monitor your driving habits, track your movements, scrutinize your purchases and peer through the walls of your home.

Without our realizing it, the American Police State passed the baton off to a fully-fledged Surveillance State that gives the illusion of freedom while functioning all the while like an electronic prison: controlled, watchful, inflexible, punitive, deadly and inescapable.

Nowhere to run and nowhere to hide: this is the mantra of the architects of the Surveillance State and their corporate collaborators.

Government eyes see your every move: what you read, how much you spend, where you go, with whom you interact, when you wake up in the morning, what you’re watching on television and reading on the internet.

Every move you make is being monitored, mined for data, crunched, and tabulated in order to amass a profile of who you are, what makes you tick, and how best to control you when and if it becomes necessary to bring you in line.

Cue the dawning of the Age of the Internet of Things (IoT), in which internet-connected “things” monitor your home, your health and your habits in order to keep your pantry stocked, your utilities regulated and your life under control and relatively worry-free.

The key word here, however, is control.

In the not-too-distant future, “just about every device you have—and even products like chairs, that you don’t normally expect to see technology in—will be connected and talking to each other.”

By the end of 2018, “there were an estimated 22 billion internet of things connected devices in use around the world… Forecasts suggest that by 2030 around 50 billion of these IoT devices will be in use around the world, creating a massive web of interconnected devices spanning everything from smartphones to kitchen appliances.”

As the technologies powering these devices have become increasingly sophisticated, they have also become increasingly widespread, encompassing everything from toothbrushes and lightbulbs to cars, smart meters and medical equipment.

It is estimated that 127 new IoT devices are connected to the web every second.

These Internet-connected techno gadgets include smart light bulbs that discourage burglars by making your house look occupied, smart thermostats that regulate the temperature of your home based on your activities, and smart doorbells that let you see who is at your front door without leaving the comfort of your couch.

Nest, Google’s suite of smart home products, has been at the forefront of the “connected” industry, with such technologically savvy conveniences as a smart lock that tells your thermostat who is home, what temperatures they like, and when your home is unoccupied; a home phone service system that interacts with your connected devices to “learn when you come and go” and alert you if your kids don’t come home; and a sleep system that will monitor when you fall asleep, when you wake up, and keep the house noises and temperature in a sleep-conducive state.

The aim of these internet-connected devices, as Nest proclaims, is to make “your house a more thoughtful and conscious home.” For example, your car can signal ahead that you’re on your way home, while Hue lights can flash on and off to get your attention if Nest Protect senses something’s wrong. Your coffeemaker, relying on data from fitness and sleep sensors, will brew a stronger pot of coffee for you if you’ve had a restless night.

Yet given the speed and trajectory at which these technologies are developing, it won’t be long before these devices become government informants, reporting independently on anything you might do that runs afoul of the Nanny State.

Moreover, it’s not just our homes and personal devices that are being reordered and reimagined in this connected age: it’s our workplaces, our health systems, our government, our bodies and our innermost thoughts that are being plugged into a matrix over which we have no real control.

It is expected that by 2030, we will all experience The Internet of Senses (IoS), enabled by Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, and automation. The Internet of Senses relies on connected technology interacting with our senses of sight, sound, taste, smell, and touch by way of the brain as the user interface. As journalist Susan Fourtane explains:

Many predict that by 2030, the lines between thinking and doing will blur. Fifty-nine percent of consumers believe that we will be able to see map routes on VR glasses by simply thinking of a destination… By 2030, technology is set to respond to our thoughts, and even share them with others… Using the brain as an interface could mean the end of keyboards, mice, game controllers, and ultimately user interfaces for any digital device. The user needs to only think about the commands, and they will just happen. Smartphones could even function without touch screens.

Once technology is able to access and act on your thoughts, not even your innermost thoughts will be safe from the Thought Police.

Thus far, the public response to concerns about government surveillance has amounted to a collective shrug. Yet when the government sees all and knows all and has an abundance of laws to render even the most seemingly upstanding citizen a criminal and lawbreaker, then the old adage that you’ve got nothing to worry about if you’ve got nothing to hide no longer applies.

To our detriment, we are fast approaching a world without the Fourth Amendment, where the lines between private and public property are so blurred that private property is reduced to little more than something the government can use to control, manipulate and harass you to suit its own purposes, and you the homeowner and citizen have been reduced to little more than a tenant or serf in bondage to an inflexible landlord.

When people talk about privacy, they mistakenly assume it protects only that which is hidden behind a wall or under one’s clothing. The courts have fostered this misunderstanding with their constantly shifting delineation of what constitutes an “expectation of privacy.” And technology has furthered muddied the waters.

However, privacy is so much more than what you do or say behind locked doors. It is a way of living one’s life firm in the belief that you are the master of your life, and barring any immediate danger to another person (which is far different from the carefully crafted threats to national security the government uses to justify its actions), it’s no one’s business what you read, what you say, where you go, whom you spend your time with, and how you spend your money.

As Glenn Greenwald notes:

“The way things are supposed to work is that we’re supposed to know virtually everything about what [government officials] do: that’s why they’re called public servants. They’re supposed to know virtually nothing about what we do: that’s why we’re called private individuals. This dynamic—the hallmark of a healthy and free society—has been radically reversed. Now, they know everything about what we do, and are constantly building systems to know more. Meanwhile, we know less and less about what they do, as they build walls of secrecy behind which they function. That’s the imbalance that needs to come to an end. No democracy can be healthy and functional if the most consequential acts of those who wield political power are completely unknown to those to whom they are supposed to be accountable.”

As I make clear in my book Battlefield America: The War on the American People and in its fictional counterpart The Erik Blair Diaries, none of this will change, no matter which party controls Congress or the White House, because despite all of the work being done to help us buy into the fantasy that things will change if we just elect the right candidate, we’ll still be prisoners of the electronic concentration camp.

Tyler Durden

Thu, 05/09/2024 - 21:00

Boxing promoter Don King attends the Presidential Debate at Hofstra University, in Hempstead, N.Y., on Sept. 26, 2016. (Drew Angerer/Getty Images)

Boxing promoter Don King attends the Presidential Debate at Hofstra University, in Hempstead, N.Y., on Sept. 26, 2016. (Drew Angerer/Getty Images)

The then-U.S. President-elect Donald Trump, along with boxing promoter Don King, answers questions from the media after a day of meetings at Mar-a-Lago in Palm Beach, Fla., on Dec. 28, 2016. (Don Emmert/AFP via Getty Images)

The then-U.S. President-elect Donald Trump, along with boxing promoter Don King, answers questions from the media after a day of meetings at Mar-a-Lago in Palm Beach, Fla., on Dec. 28, 2016. (Don Emmert/AFP via Getty Images)

Former President Donald Trump (R), alongside UFC CEO Dana White (L), attends the Ultimate Fighting Championship (UFC) 299 mixed martial arts event at the Kaseya Center in Miami, Fla., on March 9, 2024. (Giorgio Viera/AFP)

Former President Donald Trump (R), alongside UFC CEO Dana White (L), attends the Ultimate Fighting Championship (UFC) 299 mixed martial arts event at the Kaseya Center in Miami, Fla., on March 9, 2024. (Giorgio Viera/AFP)

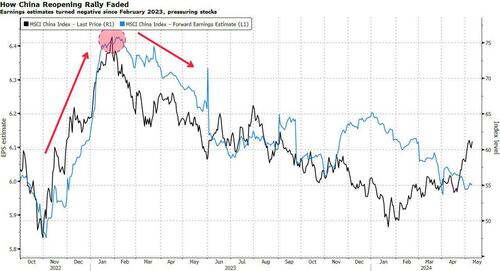

Source: Bloomberg

Source: Bloomberg

The U.S. Capitol building during a rainy day in Washington on April 2, 2024. (Madalina Vasiliu/The Epoch Times)

The U.S. Capitol building during a rainy day in Washington on April 2, 2024. (Madalina Vasiliu/The Epoch Times)

Recent comments