More quantitative easing is here. The Federal Reserve will increase purchases of mortgage-backed securities and agency debt by $340 billion by December 31st, 2012. From the FOMC statement:

More quantitative easing is here. The Federal Reserve will increase purchases of mortgage-backed securities and agency debt by $340 billion by December 31st, 2012. From the FOMC statement:

The Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month.

The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year

More astounding is the promise to continue to make MBS purchases until the employment rate is acceptable.

If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

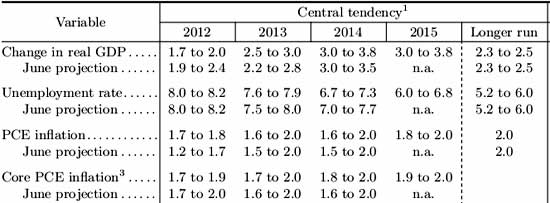

The FOMC did some odd things in their future economic projections. Below is their table for September 2012. They lowered GDP for 2012 yet raised it for 2013. While they lowered GDP for this year, they kept the unemployment rate the same.

They also are planning on keeping the key interest rate at an effective zero all the way until 2015.

The Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

Bernanke also gave a press conference where he literally promised even more quantitative easing than what has been announced until the economy really recovers. Many in the press questioned this and Bernanke implied they will continue even more quantitative easing until the unemployment rate declines. They want to see a general improvement in labor market conditions.

Bernanke seemed to acknowledge that quantitative easing is not the solution for jobs. Yet they seem to say we will continue to blast the economy with quantitative easing until you, Congress and you, employers, get your act together and start hiring some Americans.

While it appears Bernanke is acknowledging quantitative easing is not so effective at creating jobs, he also seems to be hoping confidence will be boosted so much, employers will finally start hiring Americans. Good luck with that, employers seem to want to hire anyone but an American.

Once again we will see more support for housing prices, which are still out of alignment with actual wages.

Bernanke once again warned on the Fiscal cliff and the CBO's projection that Congress, through inaction, will cause a recession. Bernanke warned if this happened the Fed simply doesn't have the tools to counter the economic shock.

Bernanke's attitude towards quantitative easing seemed to be some assistance vs. none, knowing it is Congress, this administration who really needs to act.

Most telling was a question from Fox News. The reporter seemed to accuse Bernanke of playing politics by enacting QE3 before the election. The reporter claimed this will help Obama and hurt Romney. This is an outrage and describes the real problem with our government. Instead of being concerned about the massive unemployment and what is in the national best interest, what will get people jobs, we have the primary concern being who will win the election. Isn't that just an outrage? Politicians care more about who obtains power than being responsible and enacting policy which will help the people who they were elected to govern. Think what you will about the Fed and their actions, but who can combat such political corruption and dereliction of duty?

Bernanke defends quantitative easing in his press conference opening remarks:

I’d like to briefly address three concerns that have been raised about the Federal Reserve’s accommodative monetary policy. The first is the notion that the Federal Reserve’s securities purchases are akin to fiscal spending. The second is that a policy of very low rates hurts savers. The third is that the Federal Reserve’s policies risk inflation down the road.

On the first concern, I want to emphasize that the Fed’s purchases of longer-term securities are not comparable to government spending. The Federal Reserve buys financial assets, not goods and services. Ultimately, the Federal Reserve will normalize its balance sheet by selling these financial assets back into the market or by allowing them to mature. In the interim, the Federal Reserve’s earnings from its holdings of securities are remitted to the Treasury. In fact, the odds are strong that the Fed’s asset purchase programs, both through their net interest earnings and by strengthening the overall economy, will help reduce rather than increase the federal deficit and debt.

On the second concern, my colleagues and I are very much aware that holders of interest-bearing assets, such as certificates of deposit, are receiving very low returns. But low interest rates also support the value of many other assets that Americans own, such as homes and businesses large and small. Indeed, in general, healthy investment returns cannot be sustained in a weak economy, and of course it is difficult to save for retirement or other goals without the income from a job. Thus, while low interest rates do impose some costs, Americans will ultimately benefit most from the healthy and growing economy that low interest rates help promote.

And finally, on inflation: Inflation has varied in recent years with swings in global food and fuel prices caused by a range of factors, such as drought and geopolitical tensions. However, overall inflation has averaged very close to the Committee’s goal of2 percent per year for quite a few years now, and a variety of measures show that longer-term inflation expectations are quite stable. The Federal Reserve is fully committed to both sides of its mandate—to price stability as well as to maximum employment—and it has both the tools and the will to act at the appropriate time to avoid any emerging threat to price stability.

Bernanke also said the missing piston from the economic engine is residential real estate and the Federal Reserve, with their tools, are not a panacea for all economic ills.

One of the most powerful actions Bernanke has done is to at least acknowledge the severity of the jobs crisis. Strange, but Bernanke is one of the few public figures who at least describes how bad it really is and what the employment crisis really means. More amazing, the press who attended the conference didn't even ask a question on the below remarks and how the United States is literally laying to waste her own skilled labor by refusing to employ those Americans.

The employment situation, however, remains a grave concern. While the economy appears to be on a path of moderate recovery, it isn’t growing fast enough to make significant progress reducing the unemployment rate. Fewer than half of the 8 million jobs lost in the recession have been restored. And, at 8.1 percent, the unemployment rate is nearly unchanged since the beginning of the year and is well above normal levels.

The weak job market should concern every American. High unemployment imposes hardship on millions of people, and it entails a tremendous waste of human skills and talents. Five million Americans have been unemployed for more than six months, and millions more have left the labor force—many of them doubtless because they have given up on finding suitable work. As the skills of the long-term unemployed atrophy and as their connections to the labor market wither, they may find it increasingly difficult to get good jobs, to their and their families’ cost, of course, but also to the detriment of our nation’s productive potential.

Comments

More Bubbles, No Jobs

QE3 is the blowing of a new bubble nothing more. It is designed to further fatten the larders of the 1%.

Here's the transmission mechanism:

FED buys MBS (mortgage backed securities), thus further lowering yields on these bonds.

Because yields on bonds are low, money flows into the stock market in a quest for yield. Stocks go up because more money flows into stock market.

Home prices go up because lower interest on home loans allows lower payments and more people can thus afford to buy. Prices can't rise unless there is turnover.

Thus we have the goosing of the stock market and a re-inflation of the housing market to stabilize prices in an artificially high region.

No reason the above should stimulate jobs beyond creating a new crop of real estate agents and stock hucksters. Yet another giveaway to the rentiers.

If you want a good laugh read the below article on Bloomberg concerning Qe3. It illustrates the insanity of our current policy makers.

http://www.bloomberg.com/news/2012-09-13/with-qe3-we-all-win-poor-and-ri...

Wall Street Crack != Jobs

We wrote up a detailed post on Bernanke's claim QE creates jobs.

It's ridiculous, but on the other side, the Fed cannot create a direct jobs program unless somehow they can do some funky finance to expand their own budget and hire 3 million people to cut the Federal Reserve building grass with scissors and then replant new grass with tweezers. Or maybe Ben needs a team of 500,000 make up artists for press conferences. He could hire 2 million hole diggers to dig and then fill up the holes, or maybe he could start a "let's dig to China and get our jobs back" project.

;)

Ok, today was an improvement in that he was more realistic in terms of trying to get corporations to hire Americans and claim it was a confidence thing.

I also took unlimited QE as almost a threat, as in "we're going to keep this up until you assholes start hiring some Americans".

The real problem is this administration and Congress and maybe the press as well. Everyday I see completely bogus claims, often from CEOs on financial news networks on what they want "to create jobs". It's pure bullshit. Corporations, MNCs are demanding even more policies to offshore outsource jobs, to not pay taxes, to not let anyone sue them and import more foreign guest workers to labor arbitrage, i.e. displace or NOT hire Americans.

This is just ridiculous and needs a direct confrontation that these agendas will COST more American jobs.

Then, on the other side, the fiscal cliff is real and we have corrupt Democrats, beyond brazen corrupt congressional leadership and an administration, also corrupt, who will not act in the national interest and simply pass policies, programs that are KNOWN to work, huge "bang for the buck" with the big multiplier not being GDP but Jobs.

For better or worse everyone hates the Fed and also acts like the Fed somehow can 100% control the economy, when it's this administration and Congress that have control over labor policies.

I'm sick to death of the economic fiction and the agendas and could list maybe 20 policies that should be palatable to most people in the U.S. that would save and create jobs.

This site was literally founded over the disgust of economic fiction. That's when someone claims agenda x will have effect y, when in truth it is well proven it will have effect z and effect z means bad news for the U.S. economy, middle class and American jobs.

And the Fed serves us more inflation at the request of TBTF

And as requested, the Fed gives the TBTF banks exactly what they wanted - more free money printed out of thin air. And all that money, when not siphoned off for unearned bonuses and salaries over $20 million/year, will go chasing food and fuel, driving up food prices for everyone (not a real worry for those that dine in posh restaurants every day at taxpayer expense) and fuel prices. Toss in any Middle East oil supply shortage and we're screwed. All transportation costs will shoot up for everything carried anywhere for sale, plane tickets, heating oil, driving to or from a job (if those are anywhere to be found) or riding a bus or transportation of any kind, petroleum products will become more expensive (which basically covers a huge number of items, from chemicals to plastics and everything else in modern society), etc. In the previous two attempts, the Fed has done nothing to improve the unemployment situation. This money printing is only done at the behest of the big banks that don't care if we suffer inflation like the Weimar Republic or Robert Mugabe's Hades. People on fixed incomes are now doomed. Ironically, people collecting fixed incomes from unemployment are one of the major groups to be screwed, but Ben says he's looking for job growth? Great, suffer now for sure, and maybe in 1-10 years you might benefit somehow, but not likely at all.

But because nearly all of us are barely scraping by, the Fed's claim that it was concerned about the unemployed is a complete lie. Bernanke himself said in one interview he was purposely blowing up asset prices in the market because if people felt richer, they would feel better about spending money, creating demand, and that would cause companies to hire. Is that convoluted and tortured thinking or what?

First, no one has enough money in the stock market to feel better in 2012. Second, if stocks are going up, people are most likely to take that money out to feed and clothe themselves and pay off debt in 2012. Third, assuming people actually spend the money and companies hire, those companies have been proven time and time again to not hire Americans, but overseas, so the $ never winds up here as a paycheck. Fourth, isn't the building up of, and obsession over, "confidence" and feeling good the marks of a Ponzi and confidence game? So the Fed finally admits it. Finally, how about the Fed is honest, says these moves just give out money to TBTF, and this time, it realizes Americans outside corporate boardrooms and TBTF banks could actually use any money to pay bills and survive. I'd settle for 1/20 of Dimon's paycheck, I'll wait for it in the mail Ben, thanks.

And here comes the oil shortage as N. Africa and M. East explode

Here we go, within 24 hours of Fed flooding market with free cash for TBTF, we have violence and mayhem in North Africa and the Middle East spreading (Yemen, Sudan, and other places along with Libya and Egypt) which will directly affect oil supplies. All that money printed will now chase less oil and we can sit back, watch oil prices skyrocket, and feel the pinch in everything we buy or rent or use that depends on oil (which goes way beyond just filling up at the gas station). Thanks Fed and the TBTF that control the Fed at our expense.

oil and other commodities jumped yesterday

As expected. Oil broke $100/barrel today, first time in 4 months. Soybeans jumped, gold 6 month high and so on.

I still blame this administration and Congress. I fully expect a GOP wipe out this election but little good that will do us. When they had full control they did not implement what was needed, so I imagine if they get full control we'll see even more bad trade deals and of course Dems will try to pass "immigration reform" to flood the labor market more than it is.

Honestly, while I think QE is ineffective, crack cocaine for Wall Street and will raise commodities, prices, inflation, at least they are trying to do something, unlike our Congress and this administration who could care less about the economy.

Instead they are busy using the economy in attempts to gain political power.

There is a tool.

Well, of course the government DOES have a tool to restore jobs. It's spelled B-L-O-C-K-A-D-E. Nothing goes into China, nothing comes here from China. No stuff, no money, no jobs. Anyone who attempts to break the blockade dies.

That would restore jobs with amazing speed. Some corporate traitors (eg Apple) are so ferociously anti-American that they will die before they give a job to an American. But I'm sure a few would respond, however grudgingly, to the threat of a bullet.

China blockade

Actually if that happened, they have captured SO MUCH of our manufacturing, literally we could not make a host of electronics, computers, devices, if that happened. The U.S. literally offshore outsourced almost all of their advanced technology. Intel does have FABS here but all of those parts and pieces around the processor are ONLY available in China.

Sad. According to EPI a conservative estimate of job losses just to goods (manufacturing offshore outsourced) is 2.7 million (see the link).

So, we can't really blockade China, but we could certainly confront them on currency manipulation AND make a national program to bring back certain key manufacturing industries, products are are key to the national interest.

It's not just computers where we're stuck, the U.S. sold to China key technologies in all sorts of national security and strategically critical areas. Literally our boneheads of corruption offshore outsourced national security to China by doing this. (both parties, no need to pick a color on this one).

Bernanke's ploy worked for less than a day or two

Bernanke's/Fed's/TPTF's ploy for boosting a stock market bubble further so "people felt richer" lasted for less than 2 trading days. I guess reality is too powerful at this point, despite the best efforts of the Fed, US Government, and MSM/business networks to try to fool us. More free cash for TPTF is now seen for what is was the last two times QE was tried = complete crap that does nothing for the real economy and real jobs. So Bernanke will flood the market with inflation-causing cash with no recognizable returns whatsoever for 99.9% of the population.

Meanwhile, the Iran crisis is stepping up as the US seems intent on increasing military forces in the region, Middle East getting worse, and China vs. Japan continues to heat up over territorial disputes. So we have to borrow money from China to finance our military in the Middle East and sell our military technology to China while the government can't help 27+ million American citizens? That's not too logical and seems to only screw us over at every turn. In other news last week, Japan said it was aiming to completely eliminate dependence on nuclear energy in a few decades. Guess what that added demand on oil will do when Japan seeks oil supplies in waters in the region and also increases the global demand on oil that everyone else demands? Not good for prices or regional security. Add to that the ECB's and Fed's endless desire to flood us with worthless currencies and we'll see new words invented because hyperinflation and staglation and Great Depression Redux, or II, or III won't do the situation justice.

But that's why we leave such matters to our betters in the halls of power that have jobs that don't demand integrity or intelligence. Because logic and long-range thinking never affect simple themes like "blue vs. red," or "money is good, so trillions more off the presses is really, really good," etc. When life can be boiled down to simple themes by the Wizards of Oz and corrupt bastards behind the curtains or in the boardrooms, I'm sure we'll all be okay. Not like they would ever purposely screw us over for their own benefit or the benefit or their relatives or equally corrupt friends and cronies. The Ponzis and scams are becoming more and more readily apparent.

Anyway, on this anniversay of Occupy, where oh where are the masters of the universe like Jon Corzine? Should we check Leavenworth or the Hamptons? Also, remember, banksters were busted for laundering money for terrorists and so as radical Islamists kill our personnel overseas, what is our government doing specifically to bust and imprison the banksters that our aiding our enemies as we speak? Instead of jailing Occupy protestors, what is Mike Bloomberg as a bankster and bankster friend doing to fight bankster money launderers that help terrorists attack us? NYPD? FBI? How about the US Attorneys and DOJ? Eh? Fox News, any comment? MSNBC? CNN? Anyone JAILING THE BANKSTERS THAT AID THE TERRORISTS ATTACKING US THIS WEEK OVERSEAS? These banksters have admitted to aiding them and have only paid fines for doing so, so where's the rule of law and true justice for Americans? And that summarizes the whole ridiculous screwing over of us all for the benefit of criminals pretending to be anything but.

more foreign workers

You know what our Congress is doing? Not putting together a direct jobs program for U.S. citizens or even passing the label China a currency manipulator. Nope, they are busy making sure more foreigners take our jobs by increasing even more Visas. This time they want to give an automatic green card to foreigners going to our schools. This is while there are 2.1 million U.S. STEM workers who cannot get a job.

Even worse, we're being bombarded with pure statistical lies claiming this creates jobs. It does NOT create jobs, it takes away jobs from U.S. workers. They will claim this bold faced lie and lobbyists helped them out with some complete statistical fiction provided.

That's what our Congress is doing in the midst of our jobs crisis.

Check out numerian's post on the purchase of MBSes, it's really frightening what is going to happen with all of these derivatives later down the road.

The Fed getting nervous - knows public tired of banksterism

A sane, normal man or woman in a Nation founded on democratic principles would ask hourly how is it an unelected group of individuals composed of former and/or future highly-paid banksters could approve printing trillions of dollars and inflating the dollar into oblivion. A citizen would also ask how such a group could make secret loans in the tens or hundreds of billions of dollars to US and foreign banks without any say-so by the American public. An American that cared about democracy would also ask why people implicated in receiving commingled and stolen funds (greetings Jamie "White Whale enabler among other winning strategies" Dimon) could still remain, one year later, on the NY Fed's Board of Directors. Jamie and Jon "MotherF'ing Global" Corzine, come on, you're so guilty of stealing and receiving billions of looted funds from farmers and so much more, just admit it, your buddies won't prosecute you, but we know you belong in Florence ADX for your crimes that destroyed millions of lives and national economies.

In a sane world, one might ask why the NY Fed Board of Directors actually thinks the CEO of Macy's, the President of Columbia University, and the President of the Metropolitan Museum of Art would actually "represent the public" as they were apparently elected by the Fed and banks to do according to the NY Fed's website. Really, the President of Columbia, Lee Bollinger, is struggling with student debts, or working a minimum wage job, or is injured and 70 and relying on Social Security payments to pay heating bills? How about the CEO of Macy's? And the President of the Metropolitan Museum of Art? Really? The wealthy have a lot in common with the long-term unemployed struggling to survive? Something tells me the CEO of a retail chain loves credit, free money, and printing more and more cash. But hey, what do the 99% know? I'm sure the Fed is looking out for us and people like Dimon (and other banksters), Fed official banksters like Bernanke, and university presidents and other six-figure head honchos really care about Americans suffering whenever they examine, discuss, and analyze how the Fed is helping TBTF and bankster allies at the expense of America.

But hey, it's only democracy, and if Ben and TBTF and the Fed tell us they are better than disclosing anything that directly affects us, despite the FOIA, and the very idea that democracy is built on being well-informed and no secrets, than who are we to argue? Ben, print away! Banksters, party on like it's 1929 X 10. Because what's going to happen soon globally because of your madness will make Zimbabwe look like a booming economy and the chaos over unemployment and unaffordable food globally would make Genghis Khan's approach look like a giant Macy's Thanksgiving Day Parade in comparison. Ah, Macy's, expertise on Fed matters and parades does come in handy, so now I do see the connection, impressive!

nice rant

The dollar hasn't devalued though, although I think they should count all of inflation, not just core, gee wiz, food and energy as just a tad important to regular people here.

That's only because BOJ and ECB are also engaged in lunacy

Everyone with a printing press is engaged in this madness, so if Japan can try failed central policies, then the ECB will continue to follow them, as well as the Fed. None of them have worked. Seriously, the Japanese worker can't get a break for years now and still pays outrageous sums to live in a tiny shoebox in Tokyo to hopefully find a job (or live like the students and people in their 30s that will never know the employment of the famed "salarymen"), and still the same failed policies go on and on. Same as the Fed. And the ECB continues to insist that the Euro can never be broken, never, despite how much the headlines replay every single day (e.g., Spanish unemployment 25%+, Greek unemployment not getting fixed, austerity, Troika comes up witn nth "deal" that last for a day or two, then a national leader comes out and says he won't go along with austerity as soon as he meets the angry faces in his own national capital). Those headlines have lasted how long now and keep getting replayed. It's endless. There simply can't be this much money being printed without completely devaluing currencies. And metals keep going up.