Business Inventories, or Manufacturing and Trade Sales and Inventories, show a 1.2% increase in sales but only a 0.2% increase in inventories in comparison to October. Earlier, wholesale inventories, about a third of all inventories, also showed a deceleration in growth.

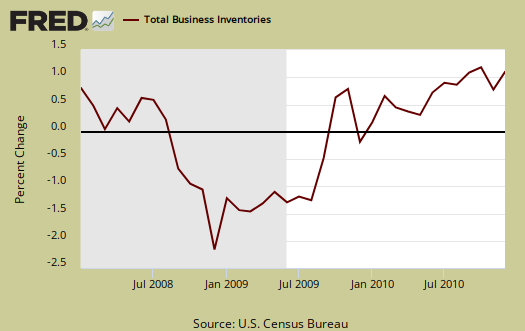

Below is the monthly percent change for business inventories. Inventories have been a large part of GDP. They are annualized, quarterly. This report is only part of the total inventories in the U.S.

Assuming there is zero percent change from November to December in business inventories implies the percentage change contribution of private inventories to Q4 GDP would be 7.41%. This is in comparison to a Q3 11.6% annualized growth rate in business inventories. In Q3 2010, the changes in inventories 63.1% of total GDP growth.

On the other hand, PCE, or personal consumption increased for Q4 2010 with the current estimate being at least a 4% growth contribution to GDP from personal consumption. This is much higher than the third quarter, where PCE was 2.4% of an increase. To see the actual equations used to create these estimates click here.

This Census economic report covers Retail, Manufacturing and Wholesale inventories, which is pretty much most of the non-farm inventories the BEA uses for their change in private inventory calculations in the GDP report and national accounts.

This gives a reasonable guesstimate that changes in private inventories will not be contributing nearly as much to Q4 GDP growth.

playing catch up with economic reports

If anyone knows or has some reference to, without me running through the BEA NIPA tables and running calculations (if I can even find all private inventories in one place), what the percentage breakdown is vs. this report, I'd like to see it and overview it.

0% change next month is a really low estimate in business inv.

In the rough Q4 GDP contribution guesstimate, notice that I set December to zero percent change. That's unlikely. Still, we can see that because two of the three months of inventories are reported, which is not all inventories, but a large part, is in, this is on a trajectory to not be the large amount Q3 was.

There are other inventories which go into the GDP calculation and finding the typical percent breakdown of how much the business inventory report represents of all inventories, I could not locate that. I even went into the BEA NIPA database and couldn't find a good past data sheet to even estimate the ratio of business inventories to total inventories.

If a reader knows the breakdown or have historical data for ALL inventories in the BEA GDP calculation and their past numbers, I can calculate out a reasonable percentage contribution to be expected from the business inventories reported.

Even if it's 50%, this gives at least a reasonable thumb in the air metric that changes in private inventories for Q4 will be below Q3.

I've not seen one economic report to suggest percentage change on business inventories would go negative, but it is possible. (for 12/10).

Just in case, this report is for November 2010.