The June Consumer Price Index increased 0.5% from May. CPI measures inflation, or price increases. This is the largest monthly CPI increase since February where inflation rose 0.7%. The culprit this time is gasoline, which caused two thirds of the increase in CPI and by itself rose 6.3%. Take food and energy items out of the index and core inflation rose 0.2% from May.

CPI is now up 1.8% from a year ago as shown in the below graph. This is quite a jump from May's reported 1.4% annual increase in inflation.

Core inflation, or CPI minus food and energy items, increased 0.2%, the same as May. Core inflation has risen 1.6% for the last year and is the lowest annual increase since June 2011. Core CPI is one of the Federal Reserve inflation watch numbers and 2.0% per year is their boundary figure. Those wanting the Fed to continue their quantitative easing will be pleased with these low annual inflation figures. Graphed below is the core inflation change from a year ago.

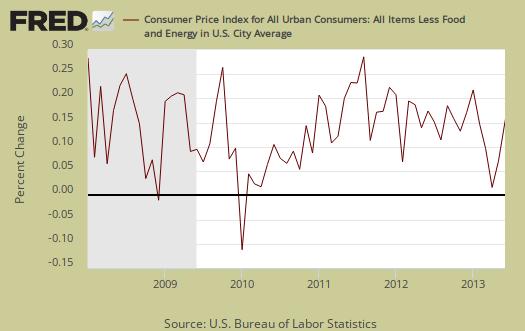

Core CPI's monthly percentage change is graphed below. The ten year average for core inflation has been a 1.9% annual increase.

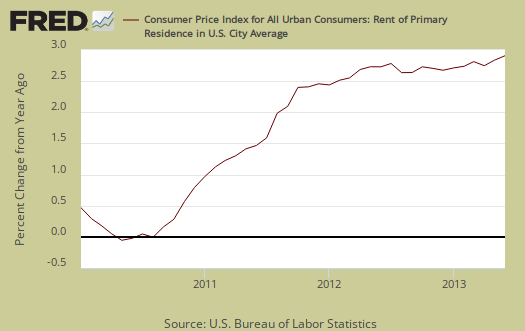

Core inflation's components include shelter, transportation, medical care and anything not food or energy. Shelter increased 0.2% and is up 2.3% for the year. The shelter index is comprised of rent, the equivalent cost of owning a home, hotels and motels. Rent increased 0.2% for the month as did the equivalent of owning a home. Lodging away from home, or hotels and motels, has much less weight in the shelter index and decreased -0.8% for the month. Apparel increased 0.9% and this was the largest price jump for clothing since August 2011. New cars and trucks prices increased -0.3% while used autos declined by -0.4%. Airfares dropped -1.7% balancing out last month's 2.2% rise. Graphed below is rent, where cost increases hits people who can least afford it most. Rent has increased 2.9% for the year.

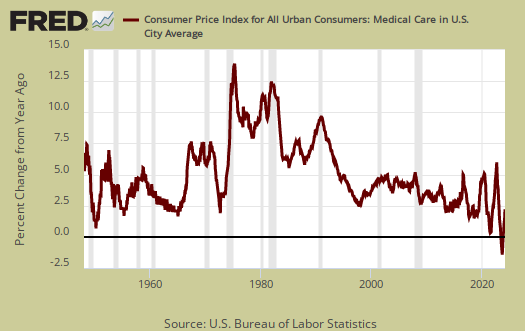

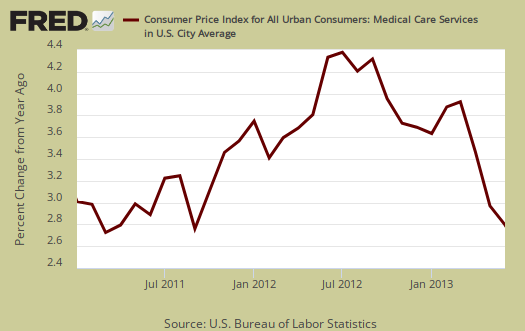

A core inflation cost which almost never drops is medical care and this month is different. Medical care increased 0.4%, the largest increase since last July, Prescription drugs increased 0.5% and medical services increased 0.4%. The Medical care index has increased 2.1% over the last 12 months. While the last two months medical care dropped, generally speaking this is a never ending increasing cost. Graphed below is the overall medical care index change from a year ago.

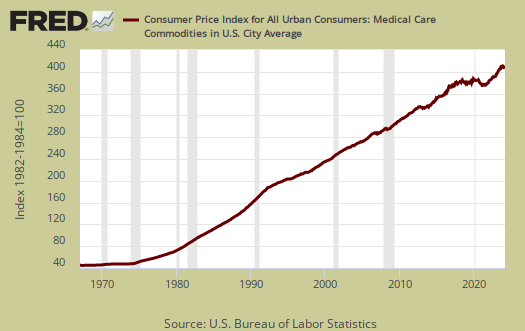

;Below is a graph of the medical commodities index, which in large part consists of prescription drug prices and overall increased 0.5% for this month. Notice the beyond belief never ending increases since 1975, yet starting around 2013, we see some drops. Unfortunately the trend did not continue.

Medical services prices increased 2.8% for the year. You'll never see the below graph of Medical care services change from a year ago go below zero, unlike other item prices.

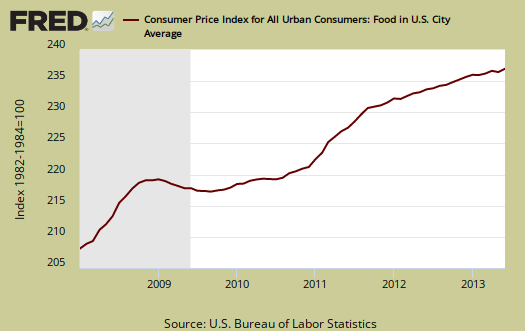

Food and beverages overall increased 0.2% and have increased 1.4% from a year ago. The food at home index (think groceries) also increased 0.2% for the month. Food for home is now up 0.9% for the year. Eating out, or food away from home increased 0.2% from last month and is up 2.2% from a year ago. Graphed below is the overall food index.

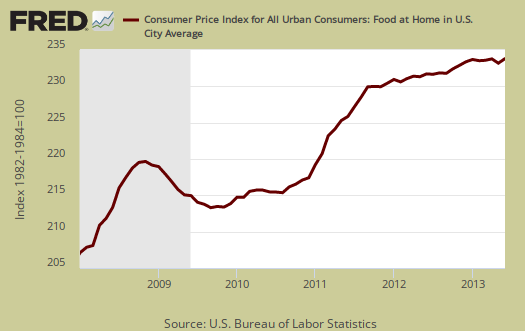

Graphed below is the food at home index. CPI does numerous substitutions on food, where if the price of steak increases, they claim hamburger is equivalent. Substitutions in part explain why you see $7 for some crappy frozen take out at the grocery, yet the food index rise appears relatively tame. From the BLS:

Four of the six major grocery store food group indexes posted increases. The indexes for cereals and bakery products and for meats, poultry, fish, and eggs both increased 0.4 percent. The indexes for nonalcoholic beverages and for other food at home each increased 0.2 percent in June after declining in May. In contrast to these increases, the indexes for fruits and vegetables and for dairy and related products both declined slightly in June, falling 0.1 percent.

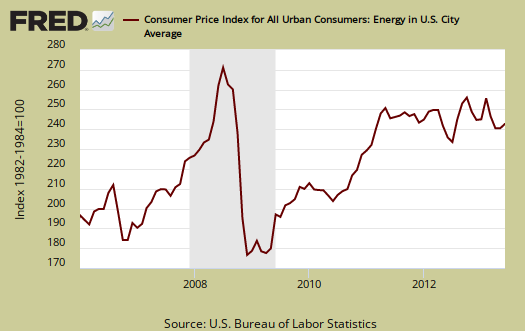

Energy overall jumped 3.4% and energy costs are now up 3.2% for the entire year. The BLS separates out all energy costs and puts them together into one index and this one includes gasoline which jumped 6.3% for the month and has increased 2.8% for the year. For the month, fuel oil increased 6.3%, natural gas decreased -0.4% and electricity increased 0.1%. Natural gas is now up 11.7% from a year ago. Energy costs are also mixed in with other indexes, such as heating oil for the housing index and gas for the transportation index. Below is the overall CPI energy index, or all things energy.

Graphed below is the household energy index which includes electricity and natural gas, shown by monthly percentage change. This month there was no change and for the year has increased 3.8%. This is a different, special index to show the overall costs for energy into your home only. Household energy represents about 4.1% of month assumed expenditures, yet for the poor or those on fixed incomes, we suggest this is a critical inflation measure, to heat or cool one's home.

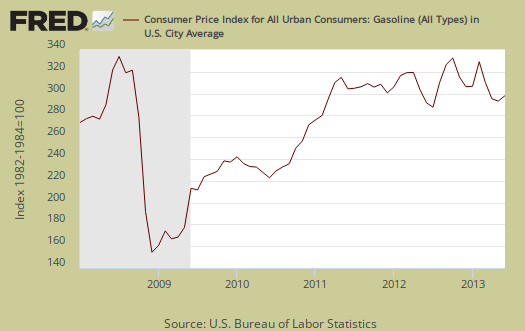

Graphed below is the CPI gasoline index only, which shows the volatility of gas prices. This isn't the first time, nor will it be the last, where the monthly inflation numbers jump on gas prices.

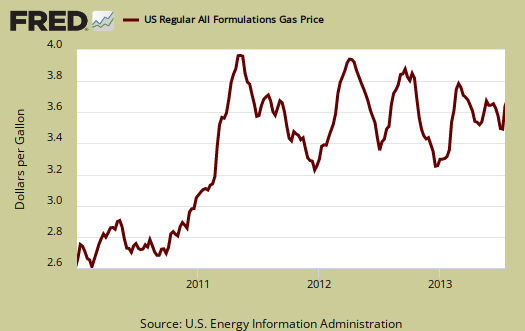

Below are gas prices, last updated July 15th, where gas was $3.639/gal., although you couldn't get that if you lived in thewest, where consumers repeatedly get gouged. From the below graph, we can assume gasoline will also be in flux for July's inflation numbers, so we can expect gasoline to cause a higher CPI in July from the change in gas prices.

According to the BLS, for the year, food and beverages, which includes food at home, made up 15.3% of the index. Housing is 41% and transportation, including gas for the car, is 16.9% and all energy is 9.5%. Medical care is only 7.2%, they claim, which goes to show what averages can remove. Most people are not sick and why the average costs are so low. A Medical event can bankrupt a family, with insurance.

CPI-W is used to calculate government transfer payments, such as social security increases. CPI-W increased 0.3% and for the year has increased 1.8%. This index is not seasonally adjusted.

CPI details

The DOL/BLS does take yearly surveys on where the money goes in the monthly budget, but as one can see, food and energy are significant amounts of the monthly finances. Run away costs in these two areas can break the bank, so can food. Additionally CPI uses substitution, so if flour goes through the roof, somehow we're all just fine with oats and prices didn't really overall increase much. Here is the BLS CPI site, where one can find much more details, information on calculation methods and error margins.

Other CPI report overviews, unrevised, although most graphs are updated, are here. If you're wondering why the graphs look weird, the graph calculates percentages from the index and doesn't round. The actual data from the BLS report does round to one decimal place. In other words, 0.05% is rounded to 0.1%.

Recent comments