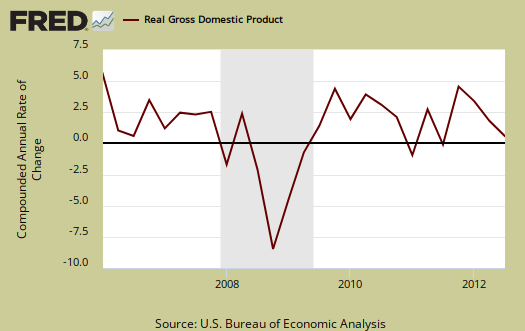

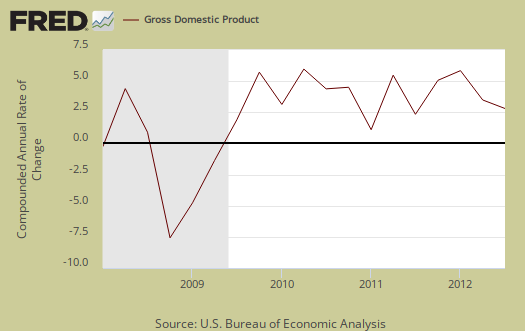

Q3 2012 real GDP shows 2.7% annualized growth, revised from 2.0% in the advance report. There was a significant upward revision to inventories, yet consumer spending was revised down. Exports were revised up as trade statistics became more complete. Q2 GDP was 1.25%.

A quarterly GDP of 2.66%, unrounded, is slightly above treading water economic growth. Consumer spending was barely breathing in Q3. Government spending alone attributed for 0.67 percentage points of Q3's 2.66% GDP. The change in private inventories alone contributed 0.77 percentage points to Q3 GDP. The drought negatively impacted economic growth as farm inventories reduced GDP by –0.39 percentage points. Government spending and inventory build up isn't exactly the kind of economic activity news we want to see. While these both add to economic growth, overall weak demand is still present in the economy.

As a reminder, GDP is made up of: where Y=GDP, C=Consumption, I=Investment, G=Government Spending, (X-M)=Net Exports, X=Exports, M=Imports*.

The below table shows the percentage point spread breakdown from Q2 to Q3 GDP major components. GDP percentage point component contributions are calculated individually.

| Comparison of Q3 2012 and Q2 2012 GDP Components | |||

|---|---|---|---|

|

Component |

Q3 2012 |

Q2 2012 |

Spread |

| GDP | +2.66 | +1.24 | +1.42 |

| C | +0.99 | +1.06 | -0.07 |

| I | +0.86 | +0.09 | +0.77 |

| G | +0.67 | –0.14 | +0.81 |

| X | +0.16 | +0.72 | -0.56 |

| M | –0.02 | –0.49 | +0.47 |

The below table summarizes the revisions to Q3 GDP components from this revision and the advance report. These revisions are from a percentage point contribution to Q3 GDP growth. We expect exports and imports to be revised again for there is lag in trade statistics coming into the Census.

| Comparison of Q2 2012 GDP Component Revisions | |||

|---|---|---|---|

|

Component |

Q3 Advance |

Q3 Revised |

Spread |

| GDP | +2.01 | +2.66 | +0.65 |

| C | +1.42 | +0.99 | -0.43 |

| I | +0.07 | +0.86 | +0.79 |

| G | +0.71 | +0.67 | -0.04 |

| X | –0.23 | +0.16 | +0.39 |

| M | +0.04 | –0.02 | -0.06 |

Consumer spending, C in our GDP equation, showed slightly negative to flat growth in comparison to the 2nd quarter. Durable goods consumer spending contributed a 0.64 percentage points to personal consumption expenditures. Motor vehicles & parts alone was revised upward from 0.18 percentage point contribution to 0.25 percentage points. In nondurable goods spending, adjusted for prices gasoline personal consumption subtracted –0.11 percentage points from Q3 GDP. People used less gas, which is interesting. Final consumption expenditures of nonprofit institutions serving households, or NISH added 0.20 percentage points to Q3 GDP. NISH is really charity or spending on behalf of households by nonprofits and the largest area of this spending is health care. Graphed below is PCE with the quarterly annualized percentage change breakdown of durable goods (red or bright red), nondurable goods (blue) versus services (maroon).

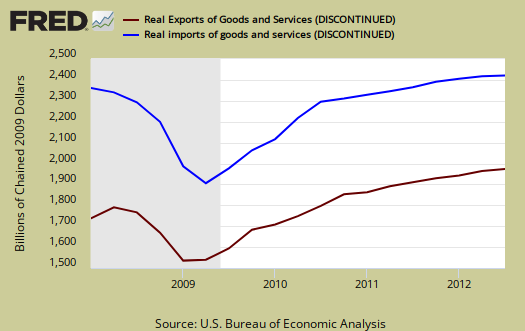

Imports and exports, M & X are greatly impacted by real values and adjustments for prices from overseas and they are usually revised again in the next estimate. Import growth in real dollars has slowed, subtracting only -0.02 percentage points from GDP growth while export growth increased. Exports were significantly revised up as trade data comes in from various ports. Exports still are much less of a contribution to GDP than in Q2. The below graph shows real imports vs. exports in billions. The break down of the GDP percentage change to point contributions gives a clear picture on how much the trade deficit stunts U.S. economic growth.

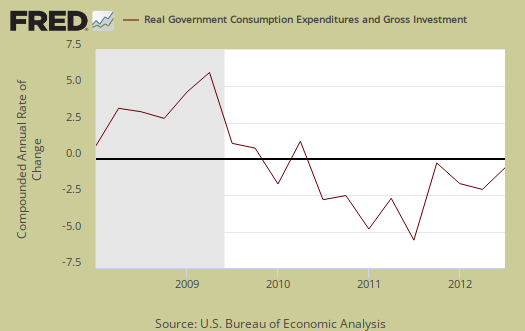

Government spending, G was 0.67 percentage points or 25.22% of Q3's GDP growth. This was all federal spending, and of that Federal 0.71 percentage point GDP contribution, 0.64 of it was national defense. State and local governments subtracted -0.04 percentage points from Q3 GDP and was revised downward from the original -0.01 percentage points. Local and state governments are still hurting and contracting in their expenditures. Below is the percentage quarterly change of government spending, adjusted for prices, annualized.

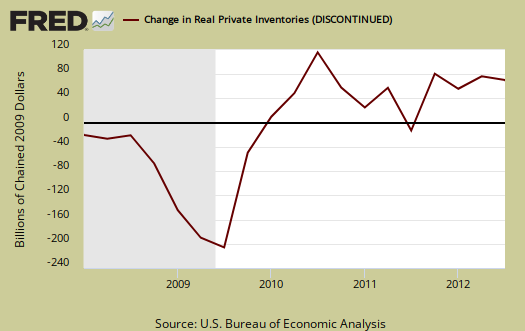

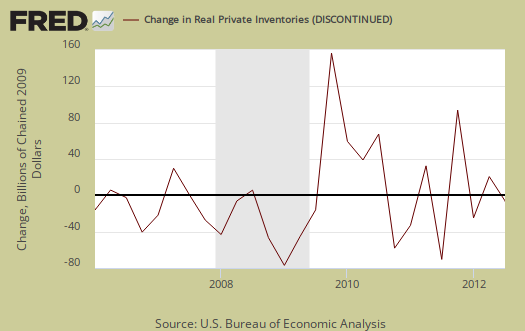

Investment, I is made up of fixed investment and changes to private inventories. The change in private inventories alone gave a 0.77 percentage point contribution to Q3 GDP, or 30% of Q3's growth is due to changes in inventories. Below are the change in real private inventories and the next graph is the change in that value from the previous quarter.

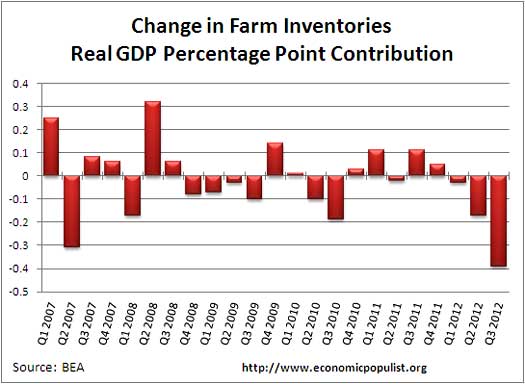

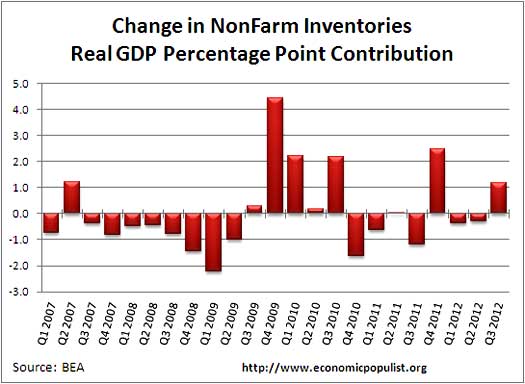

The drought is causing farms to reduce their livestock and crop yields are way down. While nonfarm inventory level changes contributed 1.16 percentage points to GDP, farm inventories reduced GDP by -0.39 percentage points, or `14.7%.

Below is the GDP percentage point contribution for the change in nonfarm inventories. This was significantly revised, from 0.30 to 1.16 percentage points. The change in nonfarm inventories was 43.6% of Q3 GDP growth.

Fixed investment is residential and nonresidential. Residential fixed investment was +0.32 percentage point contribution to Q3 GDP. One can see the housing bubble collapse in the below graph and also how there is no meteoric recovery for Q3, in spite of all of the housing data hype. What's happening is there is activity in residential real estate but by volume will not return to the housing bubble years.

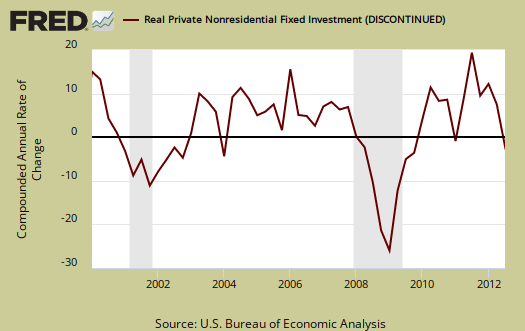

Nonresidential fixed investment was negatively revised, from a –0.13 percentage point contribution to a –0.23 Q3 GDP percentage point contribution. This shows regular investment is sorely lacking in our economy. Structures, or commercial real estate, contributed -0.03 percentage points and was revised upward by 0.10. Equipment and software was revised to a –0.20 GDP percentage point contribution. Individually, computers and other peripheral equipment was almost all of it, with a –0.19 percentage point contribution. The other negative was transportation equipment, which contributed a –0.22 point to fixed investment's overall measly +0.10 contribution to Q3 GDP.

Motor Vehicles as a whole was revised significantly, from a –0.47 percentage point GDP contribution to -0.24. Computer final sales, contributed to GDP by 0.12 percentage points. These two categories are different from personal consumption, or C sub-components, such as auto & parts. These are overall separate indices to show how much they added to GDP overall. Motor vehicles, computers are bought as investment, as fleets, in bulk, by the government, as well as part of consumer spending, government spending and so on.

The price index for gross domestic purchases, was revised down a percentage point to 1.4% for Q3, whereas Q2 was 0.7%. In other words, there was twice as much inflation than last quarter, corresponding to the rise in oil prices for Q3. Core price index, or prices excluding food and energy products, was revised down 0.2 percentage points to 1.1%. Q2's core price index was 1.4%.

Nominal GDP: In current dollars, not adjusted for prices, Q3 GDP, or the U.S. output, is $15.797 trillion, an upward revision of $21 billion from the Q3 advance estimate and a 5.5% annualized increase from Q2. The 2nd quarter saw a 2.8% increase. Applying the price indexes, or chained, real 2005 dollars, Q3 2012 GDP was $13.638 trillion. All figures are annualized.

Gross domestic purchases are what U.S. consumers bought no matter whether it was made in Ohio or China. It's defined as GDP plus imports and minus exports or using our above equation: where P = Real gross domestic purchases. Real gross domestic purchases was revised up, from 2.1% to 2.4%, whereas last quarter was 1.0%. Exports are subtracted off because they are outta here, you can't buy 'em, but imports, as well a know all too well, are available for purchase at your local Walmart. When gross domestic purchases exceed GDP, that's actually bad news, it means America is buying imports instead of goods made domestically.

Below are real final sales of domestic product, or GDP - inventories change. This gives a better feel for real demand in the economy. This is because while private inventories represent economic activity, the stuff is sitting on the shelf, it's not demanded or sold. While real final sales increased, it was revised down for Q3, from 2.1% to 1.9%. In other words, with this revision demand became weaker than in the advance report.

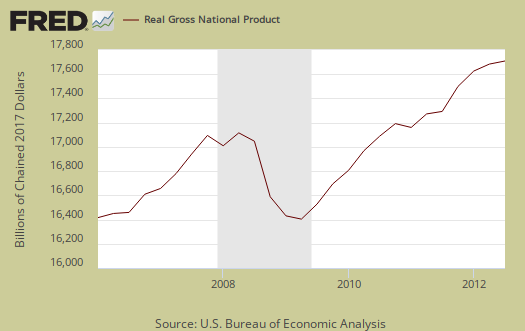

GNP - Gross National Product: Real gross national product, GNP, is the goods and services produced by the labor and property supplied by U.S. residents.

GNP = GDP + (Income receipts from the rest of the world) - (Income payments to the rest of the world)

Nominal GNP was $16.048 trillion for Q3, real GNP was $13.854 trillion. Real GNP increased 2.7% in Q3 whereas in Q2 GNP increased 2.1%. Net receipts of income from the rest of the world increased $1.3 billion in the third quarter after increasing $27.4 billion in Q2. In Q3, receipts decreased $1.6 billion, and payments decreased $2.8 billion.

Below are the percentage changes of Q3 2012 GDP components, from Q2. There is a difference between percentage change and percentage point change. Point change adds up to the total GDP percentage change and is reported above. The below is the individual quarterly percentage change, against themselves, of each component which makes up overall GDP. Additionally these changes are seasonally adjusted and reported by the BEA in annualized format. On imports, services include offshore outsourcing and services imports increased 5.9% for Q3. Services exports increased 3.2%.

|

Q3 2012 Component Percentage Change (annualized) |

|||

|---|---|---|---|

| Component | Percentage Change from Q2 | ||

| GDP | +2.7% | ||

| C | +1.4% | ||

| I | +6.7% | ||

| G | +3.5% | ||

| X | +1.1% | ||

| M | +0.1% | ||

The BEA's comparisons in percentage change breakdown of 2nd quarter GDP components are below. Changes to private inventories is a component of I.

C: Real personal consumption expenditures increased 1.4 percent in the third quarter, compared with an increase of 1.5 percent in the second. Durable goods increased 8.7 percent, in contrast to a decrease of 0.2 percent. Nondurable goods increased 1.1 percent, compared with an increase of 0.6 percent. Services increased 0.3 percent, compared with an increase of 2.1 percent.

I: Real nonresidential fixed investment decreased 2.2 percent, in contrast to an increase of 3.6 percent. Nonresidential structures decreased 1.1 percent, in contrast to an increase of 0.6 percent. Equipment and software decreased 2.7 percent, in contrast to an increase of 4.8 percent. Real residential fixed investment increased 14.2 percent, compared with an increase of 8.5 percent.

X & M: Real exports of goods and services increased 1.1 percent in the third quarter, compared with an increase of 5.3 percent in the second. Real imports of goods and services increased 0.1 percent, compared with an increase of 2.8 percent.

G: Real federal government consumption expenditures and gross investment increased 9.6 percent in the third quarter, in contrast to a decrease of 0.2 percent in the second. National defense increased 13.0 percent, in contrast to a decrease of 0.2 percent. Nondefense increased 3.0 percent, in contrast to a decrease of 0.4 percent. Real state and local government consumption expenditures and gross investment decreased 0.1 percent, compared with a decrease of 1.0 percent.

Here is our overview for Q2 GDP previous estimate and other reports on gross domestic product can be found here.

GDP overview is a lot of material with a lot of numbers

Folks, if you see an error or a confusing statement, please let us know. GDP is a massive statistical release and we hand calculate percentages not covered by other sites trying to amplify and illustrate the BEA statistical release.

The idea here is to amplify the report and we want to know if we have succeeded in that effort.