The Federal Reserve's Industrial Production & Capacity Utilization report, G.17, shows a 0.6% increase in industrial production for July 2012, an improvement from recent months. Manufacturing increased 0.5%, mining 1.2% and utilities 1.3%. June industrial production was revised down, from 0.4% to 0.1% and May revised up from -0.1% to 0.2%. This report is also known as output for factories and mines.

While total industrial production has increased 4.4% from July 2011, the index is still down -2.0% from 2007 levels, that's right, five years. Here are the major industry groups yearly industrial production percentage changes from a year ago. Utilities is fairly surprising, considering the drought and heat domes.

- Manufacturing: +5.0%

- Mining: +6.0%

- Utilities: -2.4%

Below is the Fed's description of Market groups from the report and their monthly percent changes. The report also gives annualized rates and bear in mind these are much higher than monthly percentage changes by their nature. Autos are doing well.

The production of consumer goods increased 0.6 percent in July after having decreased 0.4 percent in June. The output of durable consumer goods advanced 1.5 percent in July. Within durable consumer goods, the production of automotive products increased 1.9 percent and was 15.5 percent above its year-earlier level. The output of home electronics moved down for a fifth consecutive month and was 5.2 percent lower than its year-earlier level. The indexes for appliances, furniture, and carpeting and for miscellaneous durable goods increased in July; both measures were higher than a year earlier. The output of consumer nondurables rose 0.3 percent in July. The production of non-energy nondurables edged up 0.1 percent, with increases for foods and tobacco and for paper products mostly offset by a decrease for chemical products. The output of consumer energy products moved up 0.8 percent as a result of higher utilities output. During the past 12 months, the index for consumer goods has risen 1.8 percent, with the production of durable consumer goods up 10.4 percent and the output of nondurable consumer goods down 0.7 percent.

The output of business equipment declined 0.1 percent in July after having jumped nearly 2 percent in June. In July, a drop of 1.9 percent in the index for industrial and other equipment outweighed substantial gains in transit equipment and in information processing equipment. Over the past 12 months, the overall index for business equipment has advanced 12.3 percent, with sizable gains in all three of its major categories.

The output of defense and space equipment rose 2.8 percent in July, as workers returned from a labor strike at a major military aircraft manufacturing facility. The gain nearly reversed the declines in the previous three months; the level of the index in July was 5.2 percent above its year-earlier level.

Among nonindustrial supplies, the output of construction supplies decreased 0.5 percent in July. The index has fallen in four of the past five months. The production of business supplies rose 0.3 percent in July after having edged down in the previous month.

The output of materials to be processed further in the industrial sector rose 1.0 percent in July after having increased 0.2 percent in June. The output of durable materials advanced 1.1 percent in July, with a jump of 4.2 percent in consumer parts and smaller improvements in its other major components. The production of nondurable materials increased 0.4 percent. Although the output of textile materials decreased 1.5 percent, all of the other major nondurable materials categories recorded gains. The index for energy materials strengthened 1.2 percent, supported by gains for natural gas and crude oil extraction, coal mining, and electricity generation.

Below is a graph of just the manufacturing portion of industrial production.

Below is another graph of industrial production since September 1990, indexed to that month. Look at the slope, the growth through the 1990's and then compare to 2000 decade. It was in 2000 when the China trade agreement kicked in and labor arbitrage of engineers, advanced R&D, I.T., STEM started in earnest. We see many economic metrics which are known to use offshore outsourcing start to flatten around year 2000.

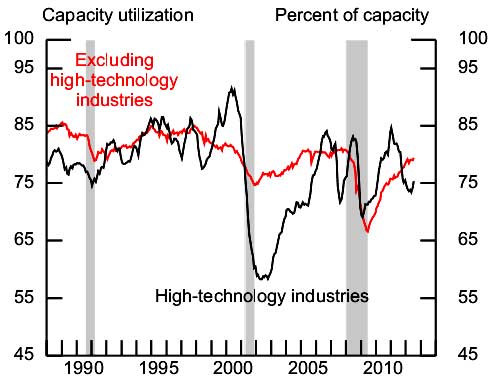

Capacity utilization, or of raw capacity, how much is being used, for total industry is 79.3%, now 1.0 percentage points below the average from 1972 to 2011, 80.3%. Capacity utilization has increased 2.3 percentage points from July 2011. Manufacturing capacity utilization has increased 2.8 percentage points from a year ago to 77.8%. Utilities are actually down, -3.4 percentage points, to 75.7% in utilization of capacity from a year ago. Mining has increased 3.4 percentage points, to a 90.4% utilization rate.

Capacity utilization is how much can we make vs. how much are we currently using, of what capacity is available now. Capacity utilization is industrial production divided by raw capacity.

Capacity growth is not to be confused what what is being utilized. Instead, this is the actual growth or potential to produce. Capacity is the overall level of plants, production facilities, and ability to make stuff, that we currently have in the United States. Think about a new factory being built, or a factory shut down and it's machinery sold at auction and shipped to China. This is capacity. Capacity growth overall has increased only 1.4 percentage points from July 2011. Below is the capacity growth increase from a year ago.

- Manufacturing: +1.2%

- Mining: +2.1%

- Utilities: +2.3%

According to the report for 2011, manufacturing uses 77% of capacity, with durables and nondurables each about 50% of that. Utilities use 10.3% and mining 12.8% in 2011 (rounded) to give a ratio of manufacturing vs. mining and utilities in terms of capacity. Selected high tech industries holds a measly 3.45% of the industrial portion and with computers only 0.44% and communications equipment only 0.66%. Below is the graph for high tech industries capacity. We can almost plot the move to manufacture in China from the slope.

Below is the Manufacturing capacity utilization graph, normalized to 2007 raw capacity levels, going back to the 1990's. Too often the focus is on the monthly percent change, so it's important to compare capacity utilization to pre-recession levels and also when the economy was more humming.

The Federal Reserve releases detailed tables for more data, metrics not mentioned in this overview, although we hope to have explaining some of the more confusing aspects of the industrial production report.

If you are baffled by what crude, finished mean from the G.17 report, read these stages of production definitions. Stages of production have implications for exports and imports. Finishing industrial production implies goods for final sale and thus what kind of output one will see for the month.

Recent comments