Another Triumph for The Money Party

Michael Collins

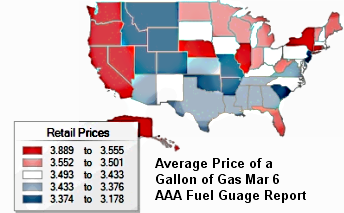

The average price for a gallon of gas rose 30% from $2.69 in July 2010 to $3.49 as of March 6. Most of that 30% has come in just the last few days.

We're about to embark on another period of let the markets take care of it. The Money Party manipulators are again jerking citizens around in the old bottom-up wealth redistribution program. Their imagineers are writing the storyline right now.

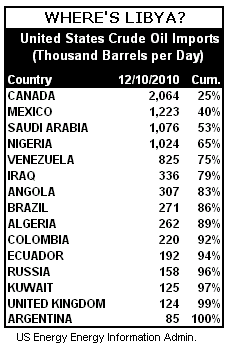

The conflict in Libya is causing the spike in oil prices over the past ten days or so according to the media script. Take a look at the chart to the right. Can you find Libya among the top fifteen nations supplying the United States with crude oil?

Why the Current Panic Over Gas Prices?

The general explanation points to the crisis in Libya as the proximate cause. The anti Gaddafi revolution began in earnest on February 17. But if the Libyan revolution were the cause, we'd have to attribute a 50% drop in a 2% share of the world's oil supply as the cause of the panic. We would also have to attribute the increase in US gas prices to a nation that doesn't impact the US crude oil supply and, as a result, should not impact the price of gas here.

The speculators have an answer. The Libyan situation entails fears of broader unrest in oil and non-oil producing nations in North Africa and the Middle East. There is unrest, without any doubt. Citizens are insisting that their kleptocratic rulers cease and desist from looting their nation's treasuries and resources. The demonstrations across the region, revolution in Egypt, and war in Libya are all being fought under the banner of broader participation in government, greater access to essentials like food, jobs, and hope for future improvements. Notably lacking is anti-US rhetoric or religious fanaticism. (Image)

Somehow, the opportunity for secular, democratic regimes equals a crisis for US energy prices. The embedded assumption is that the conflicts leading to new regimes will cause a disruption in the flow of oil. With the exception of Libya, none of these countries have reduced their oil production, including oil producing Egypt. In fact, Saudi Arabia and the United Arab Emirates increased oil production to compensate for the short fall due to the military conflict in Libya.

If we don't believe that Libya is the cause, then we get the excuse of emerging democracies. If emerging democracies fail to catch on as the scapegoat, there will be other excuses.

The Money Party bottom line is apparent. It's time to take some more money from citizens. Any plausible reason will do. When you own the media, you have no worries. Who's going to bust you?

The Big Payday at Your Expense

The gas price shock and awe is not evenly distributed. The Western states, New York, Illinois, and Nebraska are taking the biggest hits. There's some explanation for this but not a very good one. All that matters is taking as much in extra profits as possible while the extraordinary events in Libya and the rest of the region allow a plausible storyline. This time, democracy is the villain.

These gas prices will have a direct impact on those least able to afford it. It will cost more to go to work or look for jobs. Commodities will go up even more than they are now. Transportation for the distribution of all products will have an impact on prices. Tourism will fall off. The feeble increases in hiring may be at risk and there will be more gloomy news about how this all impacts the prospects for any sort of economic recovery.

What's Really Driving Gas Prices?

In a recent Business Insider column, David Moenning noted:

"At least part of the reason behind crude’s rude rise is the price action itself. Hedge funds and other fast-money types have begun to pile into what appears to be a burgeoning uptrend in the oil charts (take a peek at a weekly chart of USO and you’ll see what we mean). Then when you couple the price action with the news backdrop, this appears to be the new place to be for the ‘hot money.’" David Moenning, Business Insider Mar 6

We have the usual suspects looking for hot money. The fast-money types, as Moenning calls them, smell another victory in the air. Their market activity is driving prices in a self-reinforcing cycle of increases that are highly profitable when you get in and out at the right time (and if you pull the strings for the market, that's easy). (Image: Fuel Gauge Report)

Who is looking out for our interests?

No one. Have you heard of any congressional investigation? The oversight committees for the Departments of Energy and Commerce are two likely starting points. Nothing. President Obama is threatening to tap the US strategic oil reserve to use market forces to push crude oil and gas prices down. Fed Chairman Ben Bernanke sees commodity price increases, including crude oil, as a temporary phenomenon. They may create a problem, however.

"Rises in the prices of oil or other commodities would represent a threat both to economic growth and to overall price stability, particularly if they were to cause inflation expectations to become less well anchored," Bernanke said before Congress last week. Ben Bernanke, March 1

Doing nothing, like Congress, and trying to manipulate market forces, as the president says he might, are not the heavy-hitters needed to stop this latest rip off. They both buy into the belief that there is some sort of occult mystery to why prices are going up. Everyone who benefits will raise prices because they can. They have no concept of enough and there is nobody standing in their way.

What would JFK do?

There was a time when the president of the United States stood up to big business. President John F. Kennedy put his prestige and word on the line when he helped the steel industry and labor unions negotiate a contract that the president thought was fair to all, a deal he hailed as "non inflationary." Just days after the settlement, US Steel turned around and issued a major price increase. This would have hurt the economy due to the central role of steel at the time.

Kennedy felt betrayed by US Steel and the others that raised prices. He wasted no time in his response. The Department of defense said it would buy steel from the lowest bidder. This would have excluded US Steel and their fellow price gougers. The Justice Department began investigations and issued antitrust indictments by the big steel producers. Kennedy also went to the public to gain support for his efforts.

Big steel backed down. The broader business community complained. The Kennedy administration and others reminded everyone that the government acts in the public interest when business threatens the interests of the people. What a novel concept.

Comments

Unilateral Disarmament

Great blog by Michael Collins. Main stream media is hopeless, of course, and that's what is great about Economic Populist and also what is great about getting rid of your tv.

Of course, it would be laughable today to imagine that a U.S. president could negotiate an arrangement between the U.S.W. and U.S. Steel that would actually reduce the price of steel (unless undermined by monopolistic profiteering) or have any substantial effect on anything.

A U.S. president could, given propitious political conditions, negotiate an increase in the price of steel by putting a tariff on steel imports, but that would be problematic as to real and lasting prices or anything else. The FTAs were intended to, and do, preclude any such thing.

Such an institutional firewall limiting the ability of national governments to interfere in what should be strictly business (market-driven) decisions would be a force for individual liberty and world prosperity -- in an ideal world of free enterprise economics. And if pigs had wings ...

So it is, I believe, with Obama and the strategic oil reserve. Wouldn't the increase in crude oil just be a drop in the bucket of the globalized oil market?

Of course, Obama could require that the U.S. military would buy only from refineries in the U.S. that are buying the oil from the strategic reserve ... but electrons would simply be shifted around in Dubai, Houston and the Grand Caymans to eliminate any salutary effect on prices at the pump. Indeed, it seems likely that the effect of any U.S. attempt to influence the global market through further reducing our strategic oil reserve would undoubtedly become the scapegoat seized upon by the imagineers as the most likely "cause" of further increases in price at the pump. In any event, the spin would be that the deal was breaking the delicate budget compromise managed by Secretary Gates.

TRADE GLOBALIZATION = UNILATERAL DISARMAMENT

The U.S. has unilaterally disarmed respecting all the assets applicable in economic warfare or global financial regulation ... and who knows where the one ends and the other begins? Yet - in the worldview promoted by the 'imagineers' - the U.S. retains all the responsibility for global stability and progress implied by the term 'the last remaining super-power'.

We inherit the worst of two worlds. Responsibility without power.

And, if that isn't bad enough ... considering the situation about Taiwan, Korea and the territorial ambitions of China ... could our national security interest possibly afford any reduction in the already repeatedly raided strategic oil reserve?

So, I conclude, whatever President Obama has said about the strategic oil reserves ... it won't happen ... and if I can figure that out ... everybody knows it won't happen!

See below

:)

Michael Collins

Thanks for your gems 2OLD4OKEYDOKE

Sometimes a simple equation sums up the varieties of argument and data, as you just did:

And isn't this the unvarnished truth:

We're stuck in a culture of symbols that represent...symbols. There's no connection to reality. "Tapping the strategic oil reserve" is a phrase we've heard before. It's supposed to mean that the government is on our side. But it's just a sound byte, a remnant of a better PR machine, one that will have a palliative effect on our psyche. It amounts to nothing, as you so well articulated.

We're victims of a system that serves the interests of a very few with nihilistic goals like bigger yachts, better electronic toys, and badder Praetorian Guards.

None of that will work, including the guards. Gaddaffi is the true paradigm. After an endless orgy of material gorging and paranoid fortification, perfectly balanced (he thought), he's about to lose to an angry, unorganized, largely unarmed populace that's had enough.

Michael Collins

Thanks for an excellent article

that, in a normally functioning society, would be appearing all over the traditional mass media. Those hedge funds sure do have some pull, don't they!?

Very Welcome!

Distribute it at will. Those hedge funds hog the news, at least anything to do with their in crowd manipulations.

At another publication site, a few people said, 'Well, prices were going up anyway.' This misses the point. This is an intense short term play that will rake in a ton of money for the participants, all at our expense.

The awareness is accumulating out there, another story not covered, and people will reach a saturation point. As for now, just more of the same from those who offered "hope" and not much else.

Michael Collins

basic supply and demand

It doesn't matter if Libya sells directly to the US. Whoever they do sell to – and they exported a lot – will now be bidding up the price of oil from other suppliers, our suppliers.

The supply went down. The demand did not.

Saudi view of oil shortage

"The supply went down. The demand did not."

In theory, of course, IF supply goes down and demand stays constant, price will rise. And, with trade globalization, it doesn't much matter what the sources of U.S. imports are. But maybe demand will prove to be elastic. Maybe also supply.

Following is from today's Associated Press (tomorrow in Australia) --

DUBAI, United Arab Emirates

Saudi Arabia's oil minister denied that the surge in oil prices reflects a shortage of crude on the market but said that the kingdom is committed to tapping excess supplies if needed.

An uprising in OPEC member Libya has stoked supply concerns, increasing pressure on the producer bloc to pump more to ease prices. The oil minister of Saudi Arabia said the oil market remains well-supplied, however. He reiterated the kingdom's stance that the spike in oil costs stems more from financial speculation and unwarranted investor sentiment than industry fundamentals.

Associated Press (via Sydney Morning Herald online) March 9, 2011

http://news.smh.com.au/breaking-news-technology/a-look-at-economic-devel...

hidden supply

The argument against speculation is at some point someone must take possession of physical supply. So, a key is to locate that parked supply.

2old, consider learning how to format your links. If you're really ambitious, consider learning how to format a post and ask me for an author account. You seem itchin' to write and have good insight!

Over in the user guide is some help to get started on formatting, or writing in XHTML.

Thank you, and, hidden or fictitious supplies

Thank you for the compliment. Your remark about locating bulk commodities in storage and the related paper or electronic proofs of possession (and of existence!) goes to a deeper level of understanding than mine. That's one of the reasons why I am content to remain a commenter rather than an originator of articles posted at Economic Populist.

My knowledge of commodities trading is entirely derivative (ha, ha, that's a joke, I guess). What I know leaves me very skeptical of that aspect of economic phenomena, even though I realize that it has to be acknowledged as fundamental to all the rest of economic analysis and measurement.

My learning on these matters started many years ago when I read Jim Fisk: The Career of an Improbable Rascal by W. A. Swanberg (published by Scribner, 1959). I am thinking, of course, of the history of Black Friday when paper could be called in Manhattan for more gold bullion than existed in the world. Then, at various times and through various personal sources, I became aware of the dense secrecy that is characteristic of every aspect of what we call 'Big Oil' (and even Big Oil's brother, 'Little Oil'). Then there was the great Enron scandal (Tails: Enron loses; Heads: a Grand Cayman LP partner wins). And then there is the mostly forgotten Great Soy Bean Scandal that brought down American Express, back when American Express was seen as a greater bastion of fiscal stability than the Bank of England.

(Not even reaching here Fisk's printing press for New York Central shares or the Savings and Loan industry scandal or the 1994 bankruptcy of Orange County California due to losses when the Orange County Treasurer decided that derivatives were a sound investment ... )

The thing is that although I have acquired some knowledge of economics, I am not a specialist and am not competent to post articles with the depth of evidential support that I admire greatly here at the Economic Populist. However, I'll take care in the future to make use of the real text editor and create links that are more descriptive of the source.

Norman C. Miller's 1964 Saturday Evening Post article on the American Express Vegetable Oil Scandal currently available online at David Xia's blogsite

Is 'oil future' a good bet or an oxymoron?

Is a contract for an oil future transaction a derivative or an oxymoron? 'Derivative' because, to make sense in the real world, it derives from a presumption that there will be a notarized paper somewhere verifying that the oil exists or will exist (on the call date) in some verifiable storage facility.

Report by Fortune.com's Colin Barr ('Street Sweep' blog hosted by CNN.com) on Monday morning --

"Large noncommercial speculators – firms that play the futures markets without taking delivery – added to their long position in West Texas Intermediate crude by 50,200 contracts last week, according to Commodity Futures Trading Commission data."

Citing Stephen Schork's Schork Report (energy markets newsletter), Barr gives us the big picture, as follows:

"Schork notes that speculators now own nearly six times as many barrels of oil – 268,622 futures contracts representing nearly 269 million barrels – as can be stored at the WTI trading hub in Cushing, Okla. And since the CFTC numbers released Friday only go through last Tuesday, they likely underestimate the degree of speculative fervor building in the energy markets."

the corporate pawns still

the corporate pawns still pushing their anti-tax agenda. If corporations have all this wealth and can't pay taxes, then I say let them go, we don't need people/business like that in OUR country, OH and take your supporters with you! We don't like fascism. n'cest pas?

Halliburton went to Dubai

Yet they still get that money from Uncle Sam in the form of contracts. There was a bill before Congress about four years ago tat would bar US government contracts with corporations that off shored their headquarters. The screaming and moaning could be heard within a 100 mile radius of the Hill. It failed. That might be a good one to bring up again.

Michael Collins

Government contracts and WTO

I am not sure, but I have seen some interpretations to the effect that for the U.S. to limit government contracts to "U.S." corporations would be grounds for a claim in the WTO quasi-judicial system.

Also, I believe that Halliburton has 'resolved' all thses problems by way of co-HQs located in as many countries as may be convenient.

I think what we really need to watch isn't a business or a corporation at all but the supply chain itself.

For the U.S. to survive, we absolutely need an across-the-board tariff, call it a VAT if that is helpful, although not if VAT implies what some say it does. The VAT, or whatever you call it, needs to replace all other trade barriers -- the targeted stuff whereby political (mercantilist) intervention becomes tangled with all business activity.

The classical monetarist (libertarian or classical liberal) objection to tariff logically is more that they are targeted industry-by-industry or country-by-country than that they are imposed to pay for the value that is added by virtue of access to a stable market and the infrastructure necessary to sustain that market. Otherwise, the only objection reduces to that there should be no regulation of labor conditions by any WTO member.

The objection to the ad hoc system of trade barriers (that, in truth, characterizes the WTO system) is that success of any free enterprise system depends on stable and predictable conditions. If you have to go, wallet in hand, to your Grand Exalted Ward Healer in some national political committee or lobbyist group whenever you are thinking to start an enterprise and whatever you get is subject to constant change ... free enterprise will be stifled.

At least, that's my two cents worth.

Tax dodging by international income- and profit- shifting

The thing is that without some form of tariff (call it a VAT, if you like and if the WTO approves), there is no way to enforce taxes on international corporations. And all the corporations of any size ARE essentially international regardless of where their HQs are located.

The only way that we can hope to enforce corporate income taxes is through some kind of tariff. The result will (or would) be that an international business (supply chain) can pay greater tax on increased income due to that the cost of the imported good or component has decreased while retail/wholesale price remains constant OR the business (supply chain) can pay greater tariff due to that the cost of the imported good or component has increased. All this is relative to the jurisdiction of the IRS (that is, borders of the U.S.A.).

Googling about this, I see that the main objection raised by apologists for the rules of our current world system is ... it doesn't matter because corporations have much better methods available to them! Go figure. Apparently we are just to give up and accept that, thanks to years of sustained efforts by tax code lobbyists (and now the Citizens United ruling by the SCOTUS), all the taxes need to come from the humble American working people, who are duty-bound somehow to subsidize their competition.

Proof of the big lie

If international relationships were such a trigger to price increases, then we'd have a repetitive trigger in the form of Venezuela, supplier of 10% of domestic crude imports.

The Bush administration was so indifferent to this, it tried to overthrow Chavez and failed. The Bush people continued their harassment of Venezuela. When Obama came in, the meddling was put on a lower flame but it is still there.

So, if hostile/unstable regimes are such a trigger to prices, why isn't Venezuela mentioned as a cause to price increases? Ten percent of direct imports is certainly bigger than 2% from Libya that goes elsewhere. If hostile/unstable regimes of oil producers are such a trigger, why does the US government, over a 10 year period, try to destabilize and thus create hostilities with Venezuela?

There is no empirical basis for these histrionics impacting prices. It is selectively manufactured.

Michael Collins

Here's the deal

Here's the deal folks. We can gripe all we want about Goldman Sachs finally off-loading its floating sea of contango oil at a huge profit - at our expense - and yes, 40 cents of every gallon of gas you buy goes into some speculator's pocket (or some other such unnacceptable amount).

So the price of gas goes up 30%. Can you drive 30% less? I can. And I save wear and tear on my vehicle too. Now I won't cut off my nose to spite my face, but I've already planned for this and made my home a very nice place for grill-outs, hobby time and horticultural pursuits. And I don't drive to restaurants to eat out much either (sorry local restauranteurs, but keep the faith).

We're gonna collapse these bubbles if we stick together and boycott the fantasy of $4.00 gallon gas. People who HAVE TO drive less will have to drive less, but if people who can afford not to drive less, we'll make a demand impact. We did it in 2008 and we'll do it again even the wheels falkl off this economy again, which it will.

Beyond that, it's a great article and you might find some interesting affirmations and counterpoints here:

http://letthemfail.us/archives/7951

All this economic activity is inter-related, it's NOT just a series of coincidences.

-WM

http://letthemfail.us

Let them fall

I forgot to mention this, if you're interested in writing a post for EP, we'd love to have ya. Rules for cross posts in the user guide.

I tracked the speculation in 2008, but now i have to do a research refresher for the speculation of 2011. Greenburg? Testimony expert?

That's excellent material and analysis

"The conflict in North Africa was a predictable outcome of the US Monetary Policy of Quantitative Easing. It is not plausible that the US Federal Reserve, as the manager of the world’s Reserve Currency, did not fully recognize the global ramifications of such monetary inflation actions well in advance." Let them Fail

I agree with you entirely. However, these people don't consider people in the equation when they think of ramifications. One reason the Wall Streed crowd liked Egypt was the predictability of absolute rule. Same for Tunisia and Libya. Tere's a "strongman" in charge who will deliver whatever deals, regulations, etc. seem necessary. They forget that the "strongman" is there at their bidding. He's just a puppet and vulnerable to real strong people, like those figting in all three countries; people who know they're bein screwed.

In my observations on the IMF, I noted:

"The International Monetary Fund (IMF) made an embarrassing error just two days before the start of the Libyan people's revolution on February 17. This quote from an IMF country study appeared in a previous article: The outlook for Libya’s economy remains favorable." IMF Feb 15

There's more in there from IMF, failures on projecting the future of the very nations in turmoil right now. My point is that these people are truly limited in their analytic capacity by one huge flaw - they think people all over, in these cases, North Africa and the Middle East - they think that the people are perpetual chumps and that their bought and paid for "strongman" can handle anything.

Thanks for your comment. The replies on this thread are excellent.

Michael Collins