Ladies and gentleman, it's the start of the week, so you know what that means! Welcome to another edition of Manufacturing Monday! This week, one could possibly say, is the first in our new financial post-apocalyptic age. Last week we saw the market face a level of decimation not seen in almost a generation! The heart of the problem was, well actually still is, credit. Credit is the life blood of our economy, from aiding customers buy products to helping businesses meet payroll.

In the wake of this destruction, that I dare say is still progressing across the world despite the recent actions of many governments, the landscape of industry has changed. Expect economic numbers to reflect this current catalyst deforming the old "free trade" system. No, China isn't going anywhere, you can expect them to continue to make stuff. But don't expect the dragon to bear us as many cheaply-made gifts in the future.

Back home, things have not turned out for the better. This issue we cover the possible shrinkage of the "Big 3" into the Dynamic Duo (would the term 'dynamic' even be apropos with these auto manufacturers?). Secondly we cover the current decline and possibly rebirth (?) of Advanced Micro Devices (AMD). Lastly, Industry Week takes apart the two candidate's plans on trade and manufacturing.

But first, the numbers!

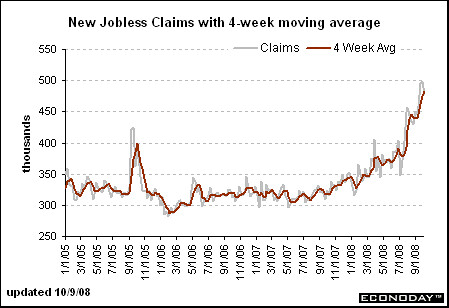

Last week's Jobless Claims numbers still pointed to an economy in sick mode. While smaller than the previous week, the numbers are still astounding. For the uninitiated, Jobless Claims are a weekly figure of new claims by folks filing for unemployment for the very first time. The reporting of the numbers, particularly in regards to this weekly column, can be confusing. The actual numbers in the Jobless Claims report reflect the previous week. So in reality, this week's numbers represent last week's activity. But, adding to the confusion, we publish Manufacturing Monday the following week, so the numbers are really two weeks old. Perhaps I should change the day when this column comes out? I will let you the readers decide.

Anyway, back to the numbers! So the week before , we had 497 thousand Americans file for unemployment. The consensus was 480 thousand new files, yet the final number on Thursday was 478. Not great, an improvement on relative terms, but still not great. This coming Thursday, the consensus is for 475 to half a million new filings for unemployment.

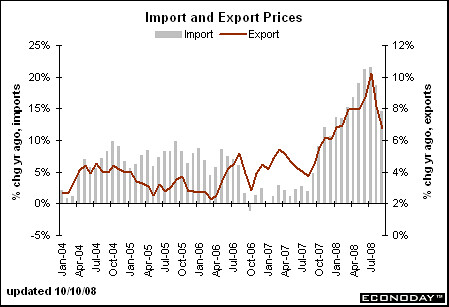

On the inflation front (or should I now call it deflation front? hrmm), we got on Friday the latest import and export prices. The data reflects price activity for the month of September. It should be no surprise to the average person that falling demand would lead to falling prices eventually (unless the good or service is truly "inelastic."). Import prices overall for goods entering the country are indeed falilng. The previous report (for August's data) showed a decline of 3.7%, and the consensus was for a smaller drop of 2.5%. The final number, at a solid minus 3%, is below consensus. So what does this tell us and what does this mean going forward?

The late Summer was, as many economists are now saying, the true start of the recession. We had the beginnings of the credit crises, don't forget we just came off the collapse of Bear Stearns. Around this time, LIBOR spreads started rising, that is the rates banks charge to lend out, thus making it more expensive to borrow. Businesses are naturally going to cut back.

Of course one should expect that demand for our products to decrease as well. This is best reflected with Export Prices, which conveniently enough is presented in the same report! Like Import Prices, Exports $$$ were down as well. The previous report showed a decline of 1.7%, and the new number, reflecting September, shows a decrease of of 1%.

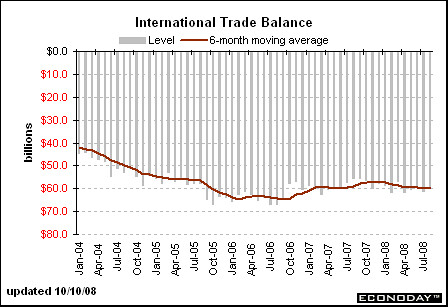

Last, but not least in our numbers section, we have the latest figures for International Trade Balance. As expected, we racked up another deficit. Though, it should be noted, that it has been going down. Given the direction of the economy, just like the previous indicators, perhaps we should expect the figures to narrow as time goes on. Now the Trade Balance figure, which came out on the 10th of October, represents data for August (yes, another lagging indicator).

We came in at a deficit of $59.1 billion for the month of August. I know...I know, it sickens me as well. The figure was right on line with the consensus estimate, well actually they were also talking about 64 billion as well. Looking at the graph above, as you can see, we are "improving", last month's number was $62.2 Billion.

And then there were 2?

By now you may have heard about the talks between General Motors (GM) and Chrysler or more specifically GM and the latter's owners, Cerberus Capital Management (wow, what a name!). On Daily Kos, our fellow Kossak, briefer, managed to break the story on the site. Hey, we may not be the Financial Times or the Wall Street Journal, but rest assured someone's on top of the story around here! Well, as briefer's diary piece noted, GM and "Chrysler" talked about a possible merger deal.

It should be said, as of now, nothing has been agreed to. In fact, the Wall Street Journal is writing about how GM's board was "cool" about it. Basically, that's the Street's lingo for "meh...maybe, but not right now."

General Motors Corp.'s board gave a cool reception to the idea of acquiring Chrysler LLC after GM's top management discussed the matter at a meeting last week, people familiar with the matter said.

Despite huge losses over the past four years, a plunge in GM's stock price and growing worries about whether the auto maker has enough cash to turn itself around, GM's board has continued to support Chairman and Chief Executive Rick Wagoner. But the board's cautious reaction to the proposed merger suggests it may assert itself more than in the past if Mr. Wagoner and his team try to move ahead with a Chrysler deal.

- excerpt from "GM Board Was Cool to Chrysler", WSJ.com, 2008.

The American Auto Industry (actually, given how a good chunk of the product is also made in Canada, could we also Canadian-American Auto Industry?) has been in crisis mode since, God only knows, what the late 70s? Let's be honest, Americans have been telling Motown for years what they've wanted. Going back decades, following an oil embargo when Americans started buying more fuel-efficient Japanese cars, Detroit should've seen the light. Their fortunes since then have seemed to be on a roller coaster ride. The last big boom time for them was in the 1990s, when petroleum was cheap, and SUVs were king. Yet here, the brains over in Detroit should have realized that betting the farm on large trucks and SUVs was as they say in spanish...muy peligroso! The era of cheap oil was bound to end, hell they've been talking about Hubbert Peak since the last time Detroit was in the dire straits!

Well look, we all know the arguments and reasons why Detroit is in the jam it it's in. So lets examine instead what this deal, if it goes through, would mean. For starters we would have excess capacity in manufacturing. Using that, and the current credit crisis, expect all labor deals to either be renegotiated or thrown out the window. This new GM/Chrysler (something tells me though that they may not opt to using the latter's name) would also cut back in the number of brands they utilize. Both GM and Chrysler have products that overlap each other.

But what's in it for Chrysler? First off, I think at this point, the company now just is a financial investment company that just happens to make cars. Whereas GM is an auto company that just happens to have a finance firm. And it is that finance firm, GMAC, that Cerberus Capital Management wants in return for the Chrysler auto divisions. GMAC, while also serving to provide loans for car customers, also was a big player in the home mortgage business. Given the current calamity in housing, why wouldn't GM want to give it up? I have some ideas, but I suspect one large one is that GM may not have alternatives right now to provide customers for financing of their own products. It should be known that Cerberus already owns 49% of GMAC.

So what's in it for GM? So far, the only word we've gotten out of Rick Wagoner (Chief Executive and Chairman of GM) or anyone connected to the Board or management, is that the Jeep brand seems to be Chrysler's gem. Oh how Lee Ioccocca must be grousing right about now. GM right now is in the midst of launching the Chevy Volt, their answer I suppose to the Toyota Prius.

What GM, I suspect, is trying to do is buy time. This, perhaps would explain, as the Wall Street Journal noted in that article, why they approached Ford this past Summer for a possible merger. Compared to Chrysler, the other two are in relatively tip top shape. But the market has changed, both from the consumer's point and that of the producer.

Consumers may not be able to tap the credit markets like they used to here in the US, and abroad the situation may be worse. Commercial orders are shrinking as businesses are also finding the credit spigot drying up. Replacing fleet of autos, especially in the fuel environment that we are in, requires a longer term investment.

On the production front, the "Big 3" have to contend with the fact that they are disadvantaged with excess capacity, various labor deals and some healthcare costs. But above all, foreign competition is smarter and now more quicker to meet the demands of the consumer than Detroit. Japan has shown this time and time again with the aforementioned Prius. That isn't to say that Ford or GM could not do this, just that under current operating conditions they can't. Fact is, they are bleeding money even when they do nothing. In the short term, for GM, it's all about getting as much cash as they can to get to full production and sale of the Volt and whatever fuel efficient car they can sell. Ford, though I'm not sure what electric/alt-fuel car they got coming out, also is in a similar position. But it is this factor, in the short-term, that could dictate if they survive in the long term. For Chrysler, the situation seems much darker.

AMD splits itself to survive

Anyone who has purchased a desktop computer or notebook in the last 5 years, chances are the CPU inside it has come from one of two companies. OK, yes, I'm well aware of other processors, but most people don't run a computer with a Freescale PowerPC or a Sun SPARC! What we have, in all honesty, is something of a duapoly between two US-based chip firms, Advanced Micro Devices (AMD) and Intel; with a tiny share going to smaller firms like Winchip or VIA.

AMD for the longest time has been the underdog in the chip race with Intel. Out of the many other x86 chip makers that competed with Intel, they were the only ones (outside of VIA) to expand in direct competition with Intel. AMD managed to steal Intel's thunder a few years back by beating Intel to the punch with dual core processors. Still, Intel caught up and has been pounding AMD ever since. A recent attempt to expand by buying Ontario-based ATI Technologies, failed to produce growth shareholders expected. The stock has been on a downhill ever since. To save itself, the company recently made a deal with an Abu Dhabi venture firm, Advanced Technology Investments Company (ATIC), where the latter would purchase the fabrications plants.

To avoid "nerding it up" further, let me say that essentially chip firms like AMD have two major components, design/engineering and manufacturing. Yes, I know to many other geeks like me, I'm leaving out a ton of stuff, but really if you had to break it down, wouldn't these two meet the needs? Well, it is always the manufacturing part that tends to suck up a good chunk of the capital. And in AMD's case, most of the capital.

The move should help shore up AMD's finances, but it also amounts to a recognition that AMD can't compete dollar-for-dollar on manufacturing against Silicon Valley rival Intel Corp., the world's biggest semiconductor company.

Building ever-more sophisticated chips requires billions of dollars in factory upgrades every few years. With a market value more than 30 times that of AMD, Intel has vastly more resources to pour into developing new manufacturing technologies.

That dynamic pushed AMD in 2002 into a partnership with IBM Corp. to jointly develop new chip-making technologies, a relationship that will continue under AMD's new structure.

"This isn't sleight of hand — this is a very hefty investment that helps clean up AMD's balance sheet," said analyst JoAnne Feeney of FTN Midwest Securities Corp. "This is the beginning of turning AMD around."

- excerpt from "Fabless future: Struggling AMD spins off factories", AP, 2008.

"Fabless" chip companies aren't exactly uncommon. NVIDIA for one designs chip sets but outsources production to other companies. The new ATIC/AMD joint venture, to be known as Foundry Co. would be US-based and have already announced a new production facility in Saratoga County, New York. For the folks behind ATIC, Abu Dhabi (part of the United Arab Emirates), it's a way for them to diversify away from petroleum products. This is also, as you can imagine, another result of the recent run-up in oil, as wealth being transferred over there gets "returned" as investment over here.

Industry Week takes an eye on the candidates

Finally, I would encourage you good folks out there to take a gander at Industry Week's latest issue. Why? Because they've got a piece that essentially spells out what both Senators Barack Obama and John McCain would do about manufacturing and trade.

In actuality, it's a summary of the stuff you'll find in their respective websites. No critical analysis. But still, they did a decent job spelling out what both candidates are promising. You'll notice, almost immediatly, the differences in the perspective of the proposals. Now I you can probably guess that I'm an Obama supporter, that doesn't mean I can't be skeptical. He could make all the promises he wants about manufacturing and trade, but if he should win (which I hope he will), we'll see for sure what he'll accomplish in regards to these issues.

Still, looking the the first paragraphs on just the issue of Trade, you'll see at what angle they are both coming from.

McCain: McCain has been a long and ardent supporter of fair and open world trade. Trade greatly benefits America and the American worker. The best protection for American workers is to ensure that they have access to the world's customers, 95% of whom live outside the United States. This access is particularly important for workers in the information technology sector where the United States has so much to offer the rest of the world. Lower tariffs on American products benefit American companies and create American jobs. Moreover, the Internet allows a global marketplace to emerge as the Internet knows no boundaries. As president, McCain will promote fair trade agreements to give America's high-tech workers the opportunity to compete and continue to win in the global marketplace.

Obama: Trade can create wealth and drive innovation through competition. Obama supports a trade policy that ensures our goods and services are treated fairly in foreign markets. At the same time, trade policy must stay consistent with our commitment to demand improved labor and environmental practices worldwide. He will fight for fair treatment of our companies abroad.

Take a look at what they say in regards to energy:

McCain: The current federal moratorium on drilling in the Outer Continental Shelf stands in the way of energy exploration and production. It is time for the federal government to lift these restrictions and to put our own reserves to use. There is no easier or more direct way to prove to the world that we will no longer be subject to the whims of others than to expand our production capabilities. We have trillions of dollars worth of oil and gas reserves in the United States at a time we are exporting hundreds of billions of dollars a year overseas to buy energy. This is the largest transfer of wealth in the history of mankind. We should keep more of our dollars here in the U.S., lessen our foreign dependency, increase our domestic supplies, and reduce our trade deficit -- 41% of which is due to oil imports. McCain proposes to cooperate with the states and the Department of Defense in the decisions to develop these resources.

Obama: We need to rely on technology to help solve the critical energy and environmental problems facing this country. Obama will invest $150 billion over the next 10 years to enable American engineers, scientists and entrepreneurs to advance the next generation of biofuels and fuel infrastructure, accelerate the commercialization of plug-in hybrids, promote development of commercial-scale renewable energy, and begin the transition to a new digital electricity grid. This investment will transform the economy and create millions of new jobs.

These are but a few things. It's interesting that on Intellectual Property, McCain doesn't even mention the source of piracy while Obama nails China from the get go. Take a look at what they say on government projects and the auto industry. I find McCain's idea of the Clean Car Challenge interesting, but I don't think it goes far enough.

Comments

China, Fabuless, Trade

First, Monday is a good day to write the manufacturing weekly because believe this or not, people read blogs more during the business week and esp. M-TH. Then as far as EP goes it seems more people write on the Weekend, which leaves the week lacking for in depth posts.

To pick up the most readers, assuredly something should be posed M-TH generally.

I keep wondering in this financial crisis where is China? They are now a larger economy than most of Europe and magically they are not on the hook in all of this. Either is India!

That's the common message that GM, big 3 have to "renegotiate" labor costs and have "problems" with pensions, health care costs. I would really like to see that one more in depth because last I heard they had renegotiated new hires to something like $13/hr? For skilled factory work????? I suspect poor management or something else beyond worker costs so maybe you can check out if that is true or not. Always the first thing up is to squeeze workers, never executive management being incompetent.

On McCain/Obama on trade....both are pathetic frankly. Bill Clinton ran the same "oh we need labor and environmental standards" and that's just a canard to pass more corporate lobbyist/Goldman Sachs written bad trade deals that by the clauses are guaranteed to be glorified outsourcing agreements.

McCain is incredible with such a trade deficit trying to promote their version of "free" trade" which is usually biased against the US trade deals.

Did I mention where is China when they are loaded with wealth now on the financial crisis?

On the Fabless deal I just don't know....this is so common but it would seem that AMD should have organized those FABS to make other companies chips on contract.

I think the only (?) FAB coming into the US these days is from a Japan company in Austin. i.e. US companies are not invested in the US and seemingly Japan is investing these days more in the US than so called "American" companies.

Communists don't buy into central banks

I keep wondering in this financial crisis where is China? They are now a larger economy than most of Europe and magically they are not on the hook in all of this. Either is India!

That is because, by and large, their fiat money system is not based on debt, the way ours is. Unlike us, they don't have a 300 year history of making money out of thin air, so when the thin air bubble burst, they were left with large cash reserves in a variety of foreign monies, while their internal economy ran on money that was out of favor outside of their own countries.

We could take a lesson from this, but we won't- because we like being slaves to big bankers.

-------------------------------------

Maximum jobs, not maximum profits.

not so sure

We are borrowing heavily from China, so clearly they enjoy debt ....of other nations.

China had a paper money meltdown

Actually, China does have a recent history of a fiat money paper meltdown, in the 1920s and 1930s as Chiang's regime continually debased the currency.

writing

I've been mulling what to write about and frankly I'm just stunned except it seems they are willing to do any damn thing to stop a market crash.....and....I'm reading horror stories on violence, murders - then suicide, even murders of one own pets.

This roller coaster of a Russian Roulette gambling wheel called the stock market is assuredly causing those folks who really should have solid pensions instead of 401ks to have anxiety/major stress attacks.

It's like they are putting the world on bi-polar disorder.

The big winner in fractional reserve banking

And the reason fractional reserve banking exists, has always been the wealth of the guy owning the debt. Of course China wants to own our debt, how else are they going to get their hands on those interest payments that we'll be making long after we can no longer afford their latest cheap-labor plastic crap that breaks in two weeks?

I'm not sure I totally agree with the conclusions of that video linked to above (some are pretty out there, like we should have an economic system based entirely on infrastructure paid for with fiat dollars) but the lessons of the premise itself are important enough that it is a DVD I'll be giving to the nephews for Christmas (it's about that 5-to-10-year-old comprehension level).

-------------------------------------

Maximum jobs, not maximum profits.

AMD selling to UAE - United Arab Emirates

details

Everyone realizes that the Soverign Wealth Funds are now hunting for bargains, assets to buy in the U.S.?

What is probably not realized is a major processor FAB can also be a security threat, but of course no one realizes that to this day on China, in spite of many documented cases of phony chips, bad chips, going into major military projects and the grave potential for sabotage, industrial espionage via engineering.

(Those damn geeks)...they are so busy trying to labor arbitrage STEM professionals it's like the US is oblivious to the complexities of engineering or how critical technology can be utilized against the US on a multitude of fronts.

Information Security and built-in backdoors

The potential for "bad chips... going into ... military projects" is a very valid concern. There's an incredible amount of time and effort devoted to firewalling and security scanning systems in the DoD. However, these measures do not address the potential for built-in backdoors or other "stealth software" built into systems at the hardware level. Given the pace of the offshoring, some of us have wondered if it wouldn't be prudent for the government to randomly perform random security "teardowns" of computers, routers, etc.

I note that it appears the Chinese are determined to control all aspects of their computer systems. At the OS level, they utilize "Red Flag" Linux... Meanwhile, HP, IBM, Sun and Microsoft, makers of commercial alternatives to Linux, have large offshore R&D centers. How much of their OS work is actually performed by Americans onshore is anyone's guess. (I'm told that most of Solaris OS development and support is now in India.)