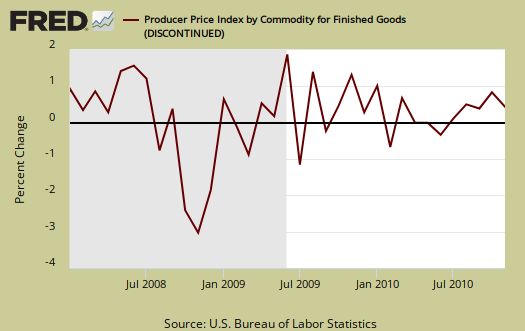

The Producer Price Index for finished goods increased 0.8% in November 2010. The PPI measures prices obtained for U.S. goods. Intermediate goods prices increased 1.1% and crude or raw materials prices went up 0.6%. PPI is often called wholesale inflation by the press.

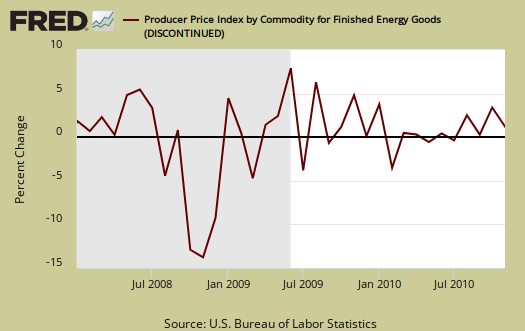

The reason finished goods prices increased was once again energy, up 2.1% in one month. The BLS reports this was 2/3rd of the total PPI increase. Consumer foods increased 1.0%.

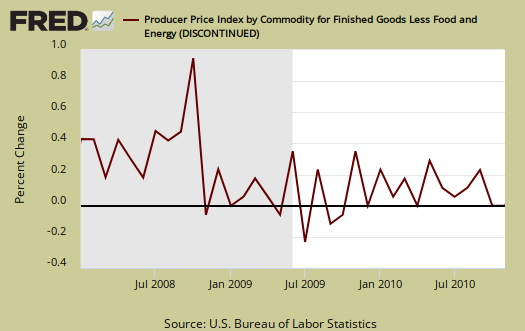

Core PPI or finished goods minus food and energy, increased 0.3% for November 2010. There was a 1.7% price increase for autos in core PPI. While PPI last hit 0.8% was March 2010, this report is simply not indicative of inflation, for core PPI rose only 0.3% for November 2010. Core PPI removes some of the more volatile price fluctuations in food and energy.

Below is Finished energy only for PPI to show the increase in prices. Gas increased 4.7% in one month. Home heating oil was up 7.0% for November. Eggs went up 22.7% in a month and so did milled rice, up 16.4% in a month. Fresh melons and nuts also increased 13.6% for November.

Crude means the items which are used for further processing, or to make other stuff.

Crude energy decreased -1.3% for November, but crude overall was up 0.6%, with crude core, up 3.1%. From the report:

About a third of November’s monthly advance can be traced to a 6.2-percent jump in the index for nonferrous metal ores. Higher prices for iron and steel scrap and for nonferrous scrap also contributed to the rise in the crude core index.

Crude eggs jumped 110.4% and hay related crude goods increased 7.4%.

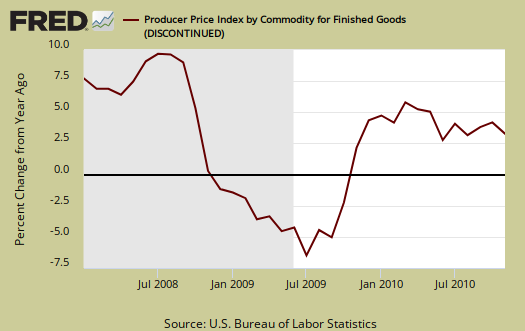

For the year, Finished goods PPI is up 3.5%, while core PPI, or minus food and energy is up 1.2%. As we can see, for all of the crazed hyper-inflation talk, this is the lower yearly increase than last month. Inflation just isn't a problem. Below is the Finished goods PPI percent change for the year.

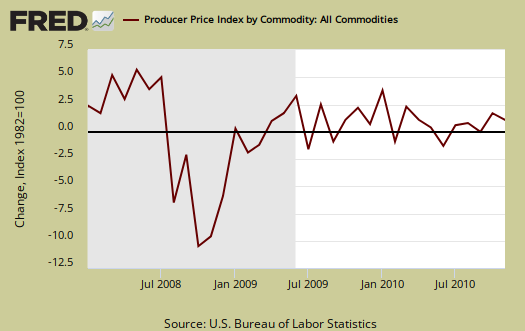

Below is the indexed price change for all commodities. Commodities are not limited to what comes from inside the United States.

Recent comments