Don’t these men know the nasty history of central banks which monetize government deficits as the Fed is now doing?

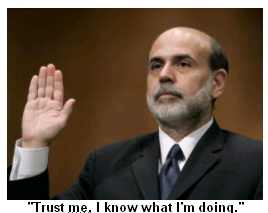

The QE2 left New York harbor yesterday, on its voyage to ports all around the globe. Captain Ben Bernanke has promised to shower the inhabitants of such diverse locales as Brazil, India, and China with up to $600 billion of free money. Following his departure, central banks in these countries announced that they did not want the money and will enact regulations to forbid the QE2 to land in their country. (Image)

Such is the bizarre state of monetary policy in the United States that the second round of Quantitative Easing by the Fed is already being feared and rejected by economists and financial analysts around the world before it is even implemented. It may be that the market has come to realize that QE1 did not perform as promised. Job creation remained anemic, economic growth declined, commodity inflation accelerated, and bubbles popped up in a variety of markets.

Pumping up the Market

A second matter of concern could be that Ben Bernanke this time around has pulled open the Fed’s cloak of secrecy to reveal a dirty secret: the Fed has been actively targeting a higher stock market as one of its monetary policy goals. In an op-ed published yesterday in the Washington Post, Bernanke wrote that a higher stock market has resulted merely from the speculation that QE2 would be implemented (this is true), and that because consumers will feel wealthier, spending will pick up (this is highly dubious not least because consumers have been ditching the stock market all year).

Then of course there is the fact that all this liquidity is supposed to wind up in the pockets of Americans, but it somehow does not. Through a mechanism called the carry trade, hedge funds and banks borrow super-cheap dollars and invest in Brazil, India, China, Australia and elsewhere because interest rates are so much higher in these countries. This is why Americans never see any of this money. The carry trade works well as long as the dollar deteriorates on the foreign exchange markets, which has been the case ever since the Fed announced it was thinking about QE2.

Bernake?

These are reasons enough to question the competence of Ben Bernanke and his fellow Fed governors and presidents who voted for QE2 (only one person dissented). Don’t these men know the nasty history of central banks which monetize government deficits as the Fed is now doing? Can’t they see the asset bubbles that are getting out of control in corn, copper, sugar, wheat and of course the precious metals? Don’t they realize a bubble is underway in the junk bond market, and the last time this occurred was right before the credit crisis of 2008? Haven’t they read the Flash Crash reports that show US stock markets are broken to the point that 70% of trades are done by computers and the average trade is now held for less than two minutes? Don’t they see that their favorite inflation indicator – the GDP price deflator – is at 2.2% and already exceeds the upper bound of their accepted range? What about the fact that real GDP itself came in during the third quarter at 2.0%, hardly a level justifying a dangerously speculative monetary policy? Is there anyone at the Fed who remembers the currency wars of the 1970s and how quickly they got out of control?

Either one of two things is going on here: the people running the Fed are grossly incompetent to the point of malfeasance, or they are fully aware of the risks they are running but are going ahead for some unstated purpose, probably having to do with the need to continue to pour capital into the Big Four American banks which are closer to collapse than the public is allowed to know. These are the banks, after all, which have been making hundreds of millions of dollars off free money and the carry trade, and these are the banks which are at risk of insolvency as the foreclosure crisis grinds on.

Different Market, Different Reaction

As of this moment, the markets continue to be schizophrenic now that QE2 is official. Some markets dread the inflationary potential of this policy, which is why gold is up, the dollar is down, and the US Treasury bond market is selling off. Some US stock markets set new highs for the year yesterday, on the belief that only a fool would stand in the way of free money being poured into stocks by the Fed. “Don’t fight the Fed” has been a hallmark of stock traders for decades now, so why not follow what has always worked in the past, especially now that the Fed has explicitly stated that its goal is to get stock prices higher.

U.S. stocks have shot higher and higher since September 1 when QE2 was first announced, and there has been no significant correction to this advance. More unusual still is the fact that corporate CEOs have been relentlessly selling their stock for months now; the ratio of insider stock sales to purchases each week has been running as high as 1,000:1, which has never been experienced before. Insider selling is always a reliable sign of a stock market at its peak. At the same time, retail Mom and Pop investors have been deserting this market every week since Spring, which is again a highly unusual circumstance and one the stock market would never have ignored in the past. There are so many other unusual circumstances to this stock market that it is hard to pick out the most alarming, but one that everyone has noticed is that we have gone the longest period on record where the stock market is rising but the bond market is falling. Always in the past, the stock market could not advance if the bond market was expressing fear about inflation or the economy, which it has been for months now.

These type of discrepancies always get rectified, and the longer they go on the worse the reaction for the stock market. We are very overdue for that reaction by almost every technical and sentiment indicator that is published, and we have gone so long now without even a modest correction that the sell-off is going to be brutal. It is going to look as if the market is rejecting QE2, or at least it will look that way temporarily if the sell-off is a short term correction rather than a new leg down in a bear market.

Things to Watch

Here are some of the things to watch for that could trigger a sell-off: a) a complete rout of the dollar leading to a currency crisis that can only be solved with higher interest rates in the U.S., b) a collapse in the U.S. bond market as traders respond to fears of hyperinflation, c) a blow-out acceleration of the price bubbles underway in commodities, d) a return to $100/bbl oil, which already crossed above the $85/bbl level yesterday, e) a major credit default affecting the junk bond market, f) a statement by the new House of Representatives leadership that Republicans will not vote for an increase in the debt ceiling, implying a possible default by the U.S., g) a massive lawsuit against a TBTF bank for tens of billions of dollars in damages due to fraudulent activity in mortgage securities transactions, h) capital controls imposed by a major country like Brazil, and possibly involving large-scale selling of Treasuries and agency securities (Fannie and Freddie) by these central banks, or i) a failure in Europe by Greece, Ireland or some other heavily-indebted country to roll over its public debt.

This list could be longer still, but you get the idea. So much could go wrong given how over-stretched these markets are around the globe. If any of these things happens, it will expose the fragility still extant in the markets and the global economy, and it will make people understand that QE2 isn’t able to solve these problems. That’s when the realization will dawn on everyone that the Federal Reserve is not simply powerless to improve the economy, it is making things much worse.

Comments

Actual Bernanke Op-Ed here

He needs to link to what he actually wrote.

On QE1

While none of this turned into jobs or anything for the real economy, there is one element I think is missed here.

That's the pull out of the deflationary spiral that was going on.

Carry Trade

The Carry Trade is very real, and other financial press are talking about it. It like they don't get that everything just flows out of the U.S. and gets parked in some emerging economy, such as our manufacturing base, our jobs and now our money.

Here are some posts on the carry trade from QE1.

On actual U.S. inflation, I'm not so sure. I mean we had a demand from the Q3 2010 GDP report of a meager 0.7%.

Pensions

I just had a thought, artificially inflating the stock market might be about filling the empty public pension and other retirement fund coffers. I don't know the latest but earlier they were in huge trouble. Just sayin'.

Clever folks

Right, then they're not obligated and they can just start ignoring them again after the market trick. Good point. The varieties of Wall Street deception are endless.

Michael Collins

Carry Trade

3 Month Treasuries pay 0.01%, 10 Years pay 2 3/4%. Selling this paper is playing pusherman at the high school, so the money goes to the coffee can or the BRIC markets. The rest of the central banks denounce the Fed because ot the series of bubbles Bernanke is creating. Watch what Bernanke is also not doing.

He will not fund community banks or U.S. agencies who support commerce. Goods producing jobs fell massively in the last month.

Like all true socioppaths, the Fed, the Administration, and the rest of the corporate ruling class can look at the faces of the victims and not really be concerned about the effect of the crime.

Burton Leed

We are nothing to them. You're right

This is a business hostile, creativity inhibiting economy right now. How can people start a business when going dependent means you either can't get health insurance or you pay exponential amounts. The lack of credit is the big picture impediment of the business creation environment.

I used to think that it was all about money with these folks but now I'm seeing money as a by product. They're afraid that enough people will figure out the various scams and throw them in jail. It's just amazing to see the wasted potential of a great country.

Michael Collins

The worst tends to be true

You know I balked at the idea of a major financial crises when it was predicted in 2006! I'm not baulking at the worst case predictions for Wiemarica now! Its going to end up worse than the worst case!

J'espere;)

I agree. We're at the point where this axiom applies to the White House and any of those claim a role in governance:

If they did it, there's probably something very wrong with it.

It's a seamless, unyielding tide of incompetence and greed.

Michael Collins

Let Ben Speak

Since this post is increasingly popular, might let Bernanke have his say on this.

not to spark inflation.

What I think, from the results of QE1, is that this will not spark inflation. I predict it will spark another massive carry trade. A carry trade is when institutions, investors, banks borrow in the U.S. and lend to other nations. i.e. cheap money here, but instead of investing it in the U.S., they invest it in say...China. NOT GOOD!

But in terms of looking at PPI, CPI, our inflation measures, it's more to stem a potential deflationary event, QE2. I don't think people realize that we had a major deflationary event before QE1 and the Great Depression accompanied deflation.

That's actually not too great of a good thing, case in point farmers in the Great Depression poured out their milk because it cost more to bring it to market than what they could get for it.

On the other hand, oil is rearing it's very ugly head. We're once again heading to $100 oil and that's BAD for the economy, it hurts consumers, hurts businesses with energy costs, and oil by itself can do real damage.

Just take the oil bubble in 2008 and the consequences as an example.

Anyway, in spite of on the surface it seems like we'd head to the Weimer Republic German hyperinflation, how this really works is a little more tricky than that.

Dollar devaluation helps the trade deficit, our debt, hurts our PPP (standard of living).

This is the third Weimar reference I've seen on EP today

I'm fond of the art that was produced during that period. The German Expressionist film makers were the epitome of cinematic art. Brecht, Kafka, and Erich Maria Remarque were powerful writers and social commentators. Hartfield, Ernst, and Grosz are remarkable.

Unfortunately, the Weimar Republic took the blame for the consequences of the Kaiser's madness and, at the same time, did little to address the needs of the people. We're not there yet, but, in our own way, we maybe headed that way:

Michael Collins

The Sky is Falling

People react when they see this massive money supply and things like QE2. It is scary! The first time I saw the money supply graph it scared me, but that said, people don't realize money velocity is another part of that equation and money...ain't moving.

With Bernanke's move of QE2, people fear we're heading towards hyperinflation. No, we're not. Inflation is near zero as it is and what people do not realize is the Great Depression had serious deflation.

You'll see me question QE2 as stimulating much domestically too, and all of these people need to demand Congress and this administration sharply curtail the offshore outsourcing of U.S. jobs and do something about the trade deficit, China.

People also flip out at the debt, yet don't look into the tax code, which is obscure, to see a government needs revenues or the actual breakdown of the budget. Sure it needs to be cut but the government also needs revenues...

of course Congress and Obama aren't helping things by bailing out the Banksters and Wall Street, more and more people just want to drown government in a bathtub (Grover Norquist) simply because government actions in large part, left the middle class as well as the will of the people behind.

we're not that stupid

No one talks about Obama's $9fig clan trip to

Asia when we the people r unemployed & can't make ends meet, he went to sell USA products to Asia? r u kidding me? they work for $2 a day, no unions, long hours, better products,what the hell can we sell them? A GM car? they just beat the US market with the TATA NANO. Why is this admin think we're stupid?

kiss of death

I'll try to find out exactly what deals were made in India but that trip cost figure is just not validated and frankly it doesn't add up, make sense.

Right now Obama is claiming India creates American jobs, which assuredly will put the nail in his re-election coffin. That said, I am trying to find out specifics and will post if I can...

in the interim, don't believe everything you read out on the Internets.

Need to be seen doing SOMETHING

I think what many people fail to see is that the fed was likely under pressure from the administration to be seen to doing something shortly before mid-term elections. $600 billion sounds like a lot, but it is likely the smallest amount the Fed could put out there and still appear that they are taking efforts to "do something". From the response of the market, this and things like leaking the bit about wanting to push the market higher has obviously had the effect they intended and after the crash there will be 2(ish) more years for the administration to "fix" things again before the next election.

What no one in America wants to talk about is the fact that there is going to be a restandardization of how Americans are living, and not for the better. Instead of focusing on the root causes of these financial problems and working to improve peoples' situations long-term, we're just patching things and hoping that things get better. Keeping the train moving as fast as possible even though the bridge is out up ahead. That's likely because politicians are focused on giving Americans what they want (immediate, visible, short-term gains) rather than what they need (increased competitiveness in the global market; primarily education) so they can be reelected. For example, if China was to let their currency float at a faster pace as many American politicians have been screaming about, it would be disastrous for the majority of Americans. It would immediately prompt massive inflation as most consumer goods are produced or have components from China. And despite many peoples' belief that it would help bring jobs back from China, it would just send those jobs to other countries like Thailand and Vietnam faster than they are currently moving to those countries. The vast majority of those jobs are NEVER coming back.

What can we do about it? I have no idea. Americans have lost their will to improve their own situations blaming their problems on everyone else: The government, the Chinese, illegal immigrants, etc. Apparently we're just getting what's coming to us. People tend to get the government they deserve.

China instantly turning the screws

unpredictable timetable for instant hyper inflation is what is the scariest. If China makes good on their anger over QE2, America will be caught with its pants down in this game of chicken. Go to bed after a glass of milk, wake up and the price of milk is $500 a gallon!

I present you, the QE II

http://users.on.net/~jvizard/myne/qe2.jpg

Seriously though, how awesome is that iceberg's shape?

I present to you back the real graph of QE2

In this post. It has the St. Louis Federal Reserve graph of current Treasury holdings and how that will expand and in what timeline.

Great photomontage

Ben looks into it, like he knows what he's doing.

I fired of the link to Numerian.

Michael Collins

Real Inflation is Much Higher

If inflation was calculated using the same criteria as was used in the 1980s it would be around 10%. All of these activities by Bernanke

appear insane to me.

What criteria is that?

Look over in the left hand column. or click on the meta tag CPI. Every week it is flat. Maybe you are thinking of wages, which in real terms are depressed.

What they are trying to do is increase loans and counter the lack of money velocity.

So far, I would claim it did help someone keep deflation at bay in QE1, but in terms of lending, banks are sitting on loans, the money is not circulating, it's sitting in the super rich and also creating a massive carry trade.

One reason they would do this is to devalue the dollar. Why would they do that? Because the Federal Reserve cannot walk into Congress and demand they pass tariffs against China for currency manipulation. If you look at U.S. GDP, it's being eaten alive by a massive trade deficit. Lowering the value of the dollar makes our exports cheaper and their imports more expensive, except for China of course, because they are manipulating their currency and have it pegged. But....China does that by buying U.S. Treasuries, so this move should hit them as well by lowering the value of their holdings.

I'm not saying this is so great and as mentioned previously, another $100+ oil event is a terrible thing for the economy, really bad, as in trigger double dip bad, but on the other hand, it was clear from GDP report, demand in this country is anemic, and increasing exports is a way to increase demand.

Destruction of the Dollar

To understand U.S. monetary policy, you need to understand that the people in power in U.S. federal government are, for the most part, wanting to destroy the dollar and the free market system here. Their view of the average American is that we are all greedy bastards who feed on the remainder of the world and we must be "brought to heel". You don't really believe that Bernanke holds the dollar or free market dear to his heart do you? Open your eyes, please. This struggle is as old as mankind. Hint: If it looks like a communist, and acts like a communist, it's a communist and baby, we got them in power over here in the good old U.S.of A. The folks in power are revolutionaries and anarchists and have focused their entire lives on destroying America; it is their life's dream and goal. Those in power in Washington will wake up soon and realize they are dealing with communist revolutionaries and wonder how it happened. Easy to see how it happened from back here in fly-over country, mankind is fallen and corrupt in general and in Washington in particular. Fasten your seatbelts everybody.

rhetoric vs. fact on "destruction of the dollar"

Honestly, hang out here and learn how to read graphs and statistics. This claim "free market" is mostly politickin' and not what reality is.

A "free market" has never exited but more importantly, it was the right mix of mixed economies, not a "free market" which build the U.S. in the first place.

From this site I don't think you'll "feel the love" for Bernanke. That said, this isn't out to "destroy free markets", about the only way you can look at that is from the angle of Wall Street, or the Banks. If you look at crony capitalism as not "free market", then the rhetoric has more of a chance.

But this I honestly think is about the only tool the Fed has left and it is in part trying to spur demand in the economy...

So, you might look at government to get off of their bi-partisan rear ends and pass some direct job problems, infrastructure that is efficient, not loaded with political favoritism, to spur demand.

The Federal Reserve as

The Federal Reserve as "Federal" as Federal Express and "Owe"bama are going to collapse the US Dollar. They are intentionally bringing on inflation. We are going the direction of Zimbabwe or other nations that have tried to print away their debts and obligations. Wake up people! The Treasury has no one to buy the US debt, nobody wants the worthless paper. The Fed is the lender of last resort. It's going to get a whole lot uglier. I would listen to people like Peter Schiff and start preparing. Buy food, supplies, a functioning gun, lots of ammo, gold, silver, and other barter items (smokes and alcohol). It's coming.....weeeeeeehhhhhhhhhhhhh

Too late for guns and ammo,

Too late for guns and ammo, these items have outstripped inflation years ago! Add to that a continued ammo shortage. If you have them and lots of feed for them, your GTG. If you missed out, well its like gold-you missed out ans its too late. Look for custom gun companies to go out of business by spring 2011. All custom smiths are trying to figure if they can get away with huge custom gun price increases from commodity costs and general inflation. They know consumers won't buy so most smiths are planning to shut down next year! Just ask them-most aren't taking on anymore orders! The only gun and ammo companies that can stay affloat are the big ones that supply the military. In a way your tax dollars are buying more guns that you can't own, at prices increasingly you can't afford!

TBA, Les Baer, you guys are awsome, I'm sorry your country has let you down!

What should we do

So it seems we are all in agreement that all hell is going to break loose but, I for one don't know what to do I just know I need to do something to protect what little I have. So how about some proactive steps we can take.

I am all in 401k about 300k and 55 years old, I can't stomache the the penalities much less the taxs to take it. I am at a loss as to what to do.

Advice please

not sure

but there are gold ETF's you could hedge and buy w/in your 401k, although it's at record highs so that might be a little too late, other precious metals are also soaring. You can buy other ETF's which are baskets of commodities.

Go watch some of Peter

Go watch some of Peter Schiff's videos http://www.youtube.com/user/SchiffReport

Particularly check out the 2006 mortgage brokers speech.

If what he says makes sense to you, check out his book - Crash Proof.

If that makes sense to you too, talk to his firm.

Good luck buddy. You're going to need it.

I'm safe and sound in Australia, but I really do feel bad for what is going to happen over there.

In Service Distributions

Some 401k plans allow you to rollover your company match funds (assuming your vested and your employer matches obviously). Ask if your plan allows “in service distributions”. If your plan allows this, you could roll this part of your 401k into a traditional IRA w/o penalties and try to buy something safer (like directly buying a treasury bond instead of your 401k's managed bond fund). Not a complete solution, but it could limit the damage.

Quantitative Easing

As buying of the central government's own bonds to stabilize or raise their prices and thereby lower long-term interest rates is also quantitative easing. For QE 2 every country and every person is having some or the other differ in their respect.

Maybe I'm Just Dense

Last night, Uncle Ben starts out by saying "We do not print money." Well, yes, that is done by the Bureau of Printing and Engraving over at Treasury. He goes on to say he will purchase up to 600 billion dollars face value of Treasury securities "with our reserves." I take this to mean that he has a huge VISA card in his wallet, one which he never has to pay. In fact, the Treasury will have to pay him interest -- a pretty cool deal when you think about it.

I don't know what these reserves are -- maybe a pile of rare coins or gold bars or maybe a Rembrandt or two in his vault. Or maybe they're money -- I don't think the Treasury will accept loaves of bread or jugs of wine in exchange for their bonds.

Can someone please reify this notion of "reserves"? Do they really exist or is it just my imagination?

Frank T.

Just for you Frank

I'll put up a Ben Said post soon, with graphs of them facts. I must be nuts because to me Ben is the least of our woes at the moment.