The National Association of Realitors has released Q2 2009 home prices & sales survey results.

First the good news. Sales increased 3.8% from Q1 2009, although still down 2.9% from Q2 2008.

According to the report, each home sale creates $63k into the economy (let's verify this claim!)...

but oops, 36% of these sales were from distressed properties (i.e. foreclosed on homes). Stranger still, 30 yr. fixed mortgages dropped slightly in Q2, down 5.03% from 5.06%. Let's call that a flat line change from Q1 to Q2 2009.

Now for the bad news (or good news depending how you look at it). Median Home prices rose 4% from Q1 2009 to Q2 2009, but are still down 15.6% from Q2 2008.

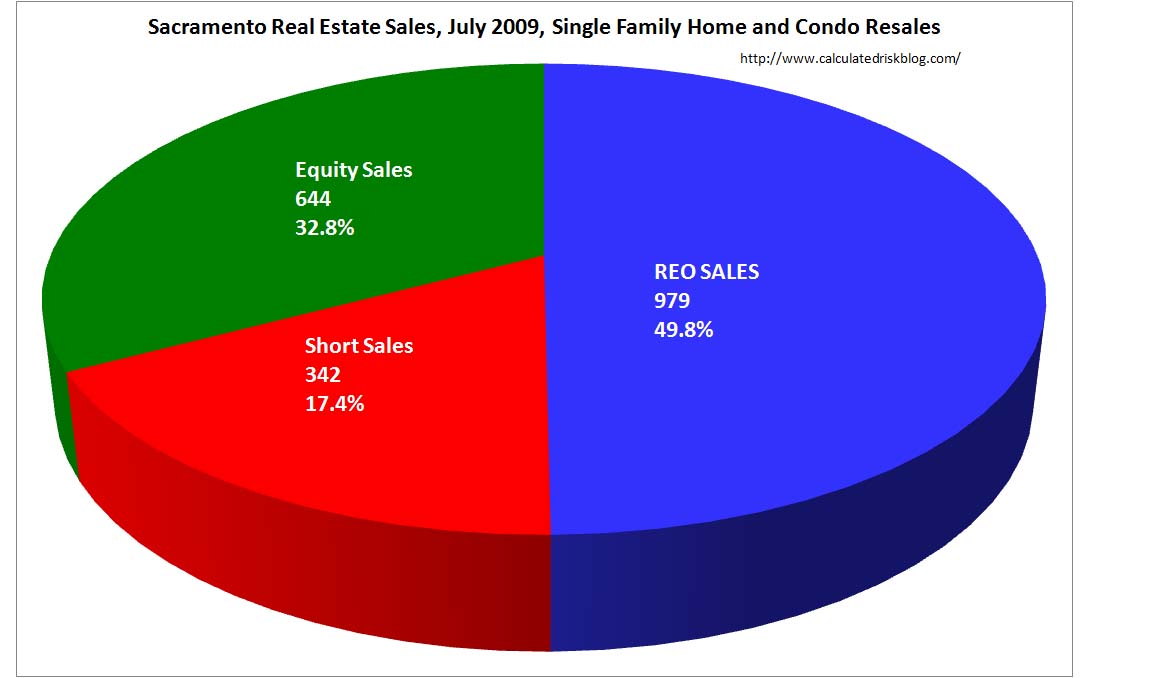

Now for the real news. Calculated Risk, who obviously noted the spin on the NAR report went and dug into the Sacramento regional data and charted out that market.

I suggest reading the entire post, but here is what they graphed on sales from Sacramento:

Src: Calculated Risk

Recent comments