It's hard to believe it, but the housing bubble has not finished bursting.

Four years after the collapse of the U.S. housing bubble, flipping homes is back in fashion.

...

The minimum bid, as set by a unit of Citigroup Inc., which had a $1.3 million mortgage on the home, was $379,900. After several minutes of bidding among investors and their representatives, some wearing shorts and flip-flops, Mr. Mirmelli won the home for $486,300. A week later, he agreed to sell it for $690,000 to a woman who moved in this month.

After all these years, and all that heartbreak, people are still trying to get back to 2006.

Just witness the failure of the HAMP program and Fannie Mae's desperation. Everyone is trying to return to a past that was unsustainable.

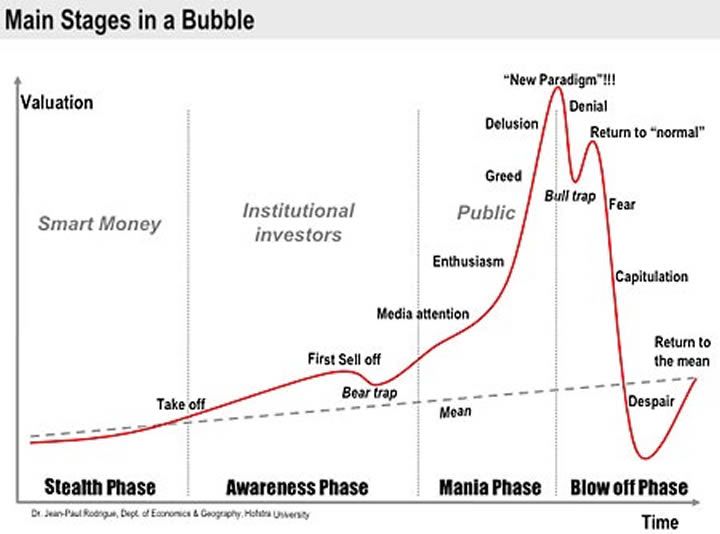

I would like to refer to this chart.

Notice the "Return to normal" mark. That appears to be where we are now.

Now compare that chart to this chart.

If you want to know what happens to housing bubbles, remember what happened to Japan.

If you think we aren't like Japan, think again.

"I thought America had studied Japan's failures," said Hirofumi Gomi, a top official at the Japanese Financial Services Agency during the crisis. "Why is it making the same mistakes?"

Good question. Maybe the reason has nothing to do with economics, and everything to do with politics.

have you read Krugman's Japan book?

I haven't yet, it's on the list.

Can you uprate and read the derivatives post? This is moving beyond belief quickly and we're missing the boat ....we're going to get gutted legislation if we don't move (probably happen anyway, but it's a matter of hours as I understand the legislative process). Looks like we need "all hands on deck".