Greece is getting a bail out. Well, not really, because they are getting loans, oops, wait, yes really.

The Wall Street Journal notices Greece will pay more in interest than if it had gone to the IMF. According to the Wall Street Journal the two possible rates for the €30 billion in loans is 5.33%, fixed and 4.14% variable.

Either way, the IMF is way cheaper. It uses it’s own interest rate as a base, and it levies different surcharges. The fund’s rate works out to 2.71%, as of last week, for a €10 billion package.

Now Bloomberg is reporting a €45 billion loan package, €30 billion from the Euro-Zone finance ministers and €15 billion from the IMF. Bloomberg is reporting the current Greek bond yield is 6.98%.

But this thing isn't over.

The 30 billion euros from the EU “will not fully cover the Greek government’s financing needs for the next 12 months, let alone for 3 years, so Greece will still rely on commercial money beyond the April-May payments, and whether such money will become available will very depend on how credible the policy framework is and what investors think will happen beyond the program period,” he said. “Unfortunately, this thing is unlikely to go to bed any time soon.”

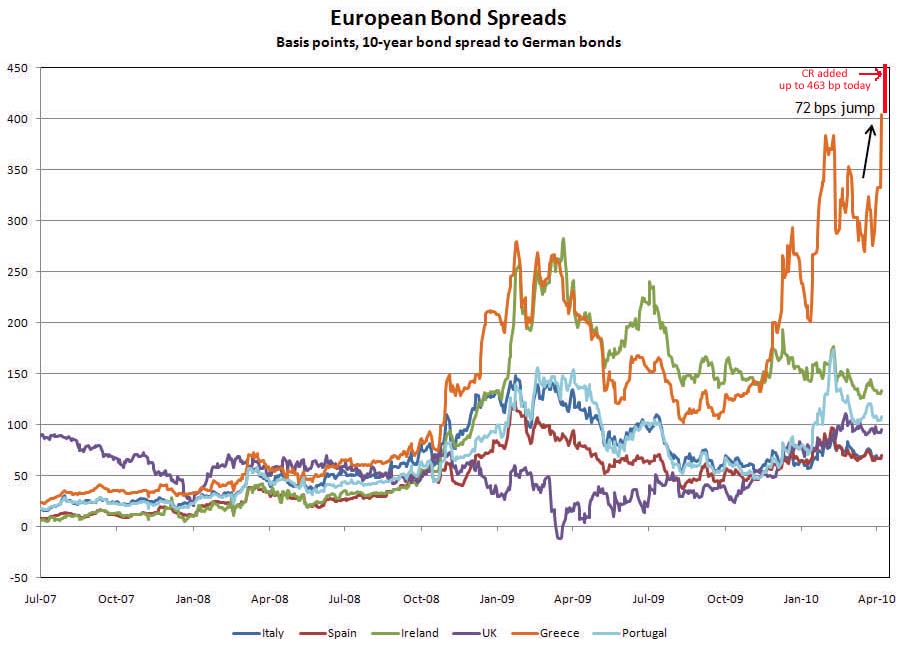

The bond spread blew up this past week. According to Calculated Risk the spread is now 463 bps.

It appears all of this is to prevent a sovereign default in case Greece cannot finance it's own debt on commercial markets.

Reuters has the latest terms, which imply more bail out money is coming.

The EU/IMF aid to Greece will be significantly higher than 40 billion euros over the next three years if the mechanism is triggered, a senior finance ministry official said on Sunday.

"A logical amount for the three-year period would be significantly higher than 40 billion, but this has not yet been determined," the official said, correcting previous comments.

The official had previously said that it would be logical for the mechanism to amount to some 80 billion euros ($107 billion) over the next three years.

So, these loans are waiting in the wings, just in case. What does this mean for the United States? It's more of a model for trying to stop currency speculation as well as what happens when one has too much sovereign debt.

The Financial Times notes:

Banks that own Greek bonds to exchange their assets for cheap central bank funds.

So, we have a non-bail out bail out, through lower interest rates and then an additional exchange to get out of Greece bonds. No default, no restructuring and no printing paper money so far.

Recent comments