Welcome to the weekly roundup of great articles, facts and figures. These are the weekly finds that made our eyes pop.

RealtyTrac on Foreclosures

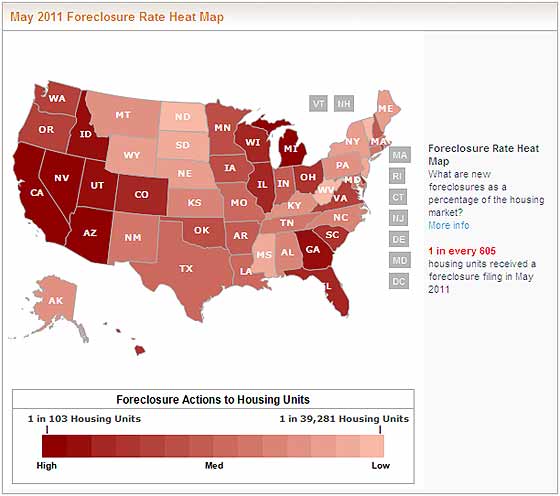

Below is the latest foreclosure map from RealtyTrac. Since when is America painted red with economic disaster.

1 in every 605 housing units received a foreclosure filing in May 2011. RealtyTrac's latest home foreclosure report is a real horror show. While foreclosures have slowed, that ain't great news. Banks are sitting on the properties, unable to sell them.

Dan Rather Pipes Up for U.S. Tech Workers

Dan Rather gets the facts right. Not only is there no shortage of Science and Engineering talent in the U.S., there literally are not enough jobs to employ those graduating from college in it.

Recent research shows the number of STEM students graduating each year from U.S. universities far exceeds the number of new jobs.

And while U.S. corporations decry the shortage of tech talent -- industry data indicates there are upwards of 200,000 tech workers unemployed across the country today.

Great call out on Obama's team labor arbitrage as economic policy agenda.

Crackdown on Use of Illegal Labor

The Obama administration is supposedly cracking down on 1000 employers of illegal immigrants. So says the Wall Street Journal. There are some money quotes from the U.S. Chamber of Commerce which prove illegal immigration is all about labor arbitrage:

Businesses across the U.S. that rely on low-skilled labor are working to stave off Immigration and Customs Enforcement audits, which can lead to the loss of large numbers of employees, reduced productivity and legal expenses.

Wednesday's surge in so-called silent raids drew criticism from both the U.S. Chamber of Commerce and immigrant advocates.

Lots of quotes about lost productivity, which is a fancy way of saying we need illegal labor to increase our profit margins.

29 Facts about Income Inequality

Business Insider loves slide shows, but this one, 29 Facts about Extreme Income Inequality is worth viewing.

Q2 GDP Downgrades

Here on the Economic Populist we often like to calculate out the effects of monthly economic reports on GDP, but this is a nice collection of posts on how Q2 GDP sure ain't gonna be stellar. Don't expect GDP to go negative....yet, but we have one month to go on raw monthly data too.

Soylent Green

If this were false it would be a lot more fun. Japanese Researchers can now literally tell you to go eat shit. They have made steak from human excrement.

Reverse Mortgages

Banks are hanging it up on reverse mortgages. Lots of excuses about people not paying their taxes and insurance. Has nothing to do with falling values on residential property now, could it?

McKinseyGate

Paul Krugman is calling out McKinsey on a bogus white paper. What Krugman doesn't mention is the numerous bogus white papers McKinsey Institute has released over the years. Congress is railing on McKinsey:

Refusing to release the underlying questions and methodology undermines the credibility of the findings. We are concerned that, if the survey based its conclusions on a questionable instrument and potentially biased methodology, McKinsey may have provided the American public with invalid information about the impact of the Affordable Care Act.

We are therefore writing to obtain additional information that would allow interested parties to objectively assess the implications of the report’s findings. We ask that you provide the following information:

I don't recall ever Congress calling out a bogus lobbyist white paper as spin before. Wouldn't it be great if at least, the white paper policy came about, trashing these realms and volumes of bunk and spin?

What's Wrong with the Economy?

This comes way of Angry Bear, Robert Reich Draws What's Wrong with the Economy in 2 minutes.

I think this is a first where Reich has acknowledged all economic things static, importing more people will cause worker displacement and conflict, of course dismissing it as fear. But bottom line, he is correct, you cannot grow an economy, especially in the United States without a strong middle class.

Comments

Soylent, reverse mortgages, Reich, preference taxation

1. Japanese steak:

2. Had not thought about reverse mortgages lately, but that they are a thing of the past? That sure fits! More fowl come home to roost!

3. Robert Reich makes a good point about the tax preference for investment income over earned income. I wish Reich and others would call it like it is: a preference system that differentially punishes earned income!

Otherwise, I think that Reich and many other economists tend to neglect consideration of two underlying factors: population growth and resource depletion.

4. "29 Facts about Income Inequality" -- and related taxation preferences

BusinessInsider.com --

With taxation, the is always in the details -- whether it's reforming the old or reframing the "entirely new" system.

is always in the details -- whether it's reforming the old or reframing the "entirely new" system.

Happy to see Citizens for Tax Justice cited!

Also, happy to see the CTJ point that tax reform must be revenue-enhancing! (Anybody saying different is either talking up fantasies or planning on a time soon-to-come when "blood runs in the streets.")

Do not see, but would like to see, three points:

A. Profits from derivatives arbitrage should be treated exactly like profit from gambling.

B. We need across-the-board tariff (VAT) in order to control transfer-pricing scams by MNCs. Corporate income taxes should be passed through to investors (that file returns) who hold shares for a year or more, with partial-period carry-back to prior year (or 100% carry-back for complete years).

C. All income should be taxed equally, that is, there should be no preference for investment income or inheritance income over earned income. There should, in such a system, be no 'death tax', which is really a preference system for redistribution of tax liability. Of course, income averaging should be brought back.

Preference for certain income over earned income is an egregious example of what should be called a "generalized preference system" -- the practice of disguising political payoffs as preferences underwriting this, that or the other presumably benign 'social' or 'societal' goal or 'national interest'. The public would hardly tolerate these tax preferences if they were understood as what they are: preferential subsidies (or disguised redistribution of income).

(Keep in mind: computers and internet make previously complex record-keeping and calculation easy to do, with results and choices easy to examine.)

Definitely Read the Rather Article, People

Cannot recommend it enough.

First of all, you will probably learn something you didn't know about employment and immigration.

You will also discover that apparently even a presidental visit and a presidental speech can be based on erroneous information. That is not a point that Rather makes, but his story shows it.

Property needs to be valued at its economic value

"Banks are sitting on the properties, unable to sell them."

This isn't true. Banks are sitting on the properties unwilling to sell them.

The banksters have foreclosed ... it is time to foreclose on the banksters.

Equal justice

true, banks are unwilling to sell them

They are sitting on properties and just holding them, at least in my area I know they are. Foreclosures pop up like mushrooms yet never appear on the market.

I'm not a bank fan, but isn't

I'm not a bank fan, but isn't it their right as property owners to decline to sell houses in an unfavorable market?

I understand that this also has the effect of restricting supply to keep prices high, but it seems like something that can't be helped.

banks as landlords

Yes and no. Homes used to be heavily regulated. The idea was home ownership and one has families living in these structures, their home, and also their number one investment.

So, having banks serve themselves instead of Americans to buy a home is probably something to be revisited. Obviously turning people's homes into glorified derivatives gambling chips, plus using any excuse to foreclose, even one missed payment, isn't exactly helping the American people much, ore the middle class or even the real economy.

Sure they have rights but when those rights perpetuate disaster, I'm not so sure what good it is.

"Rights" of banks, corporations ???

Did not Dame Margaret Thatcher once say, to the cheers of pseudo-libertarians everywhere, that there is no such thing as "society"?

Well, whatever we may think about society or civility or nationhood ... there is no such thing as a corporation or a bank (corporation, "national association", etc.) possessing rights. The SCOTUS has misinterpreted the Constitution through their (5-4) decisions like Citizens United.

It is certain that where rights are mentioned in the Constitution, they were in the minds of all the Founders, rights of individual human beings. Whatever "rights" banks may have, those rights are strictly derivative of the rights of individual human beings.

We are living in a time of extremist judicial activism on the highest court in the land!

SCOTUS ???

Yes, it's true, but is it 'unable' or 'unwilling'?

For sure. ArkansasAngie's distinction between "unable" and "unwilling" is generally important in life.

Of course, a corporate entity is "unable" to act against the best interests of its shareholders, so must maximize ... what? Short-term profit? Assets? Book value? Dividends?

Actually, these inhuman entities (just being accurate here, not intending any moral judgment) often tend to maximize income of CEOs and the like, who sometimes are in charge of disappearing the entity altogether for the sake of increasing after-tax (or unreported) income of certain share-holders who have no intention of holding on for the long run.

In other cases, corporations never issue dividends -- J. Paul Getty's Mission Development was famous for that, and it was part of the DJIA back in the day. In reality, corporate entities like banks are legal fictions and tools used by individuals for a huge array of purposes.

The absurdity of the globalized system became clear when mortgagees found that it was often impossible to determine who, what or where the mortgage holder was!

WHAT WE HAVE SEEN SINCE 2008 AND CONTINUING

For example, a property goes up for auction (supposedly "cash" or with a minimum that pays the back taxes) and the high or only bid is rejected by 'the bank'. (The bank or agent of the bank pays up the back taxes while any second mortgage or other complication, e.g. roboprocessing, is disposed of.) Happens all the time!

Sometimes a place is listed several times, "sold" and then the financing fell through or whatever, "sold" again, and then it ultimately is "sold" very quietly while independent (unconnected) investors were unable to get the realtor on the phone! And who knows what really happens in these situations -- what are the real numbers? You would have to study each closing in detail, and even then ...

MARKET THEN AND MARKET NOW -- RULES CHANGE DURING THE GAME

Consider how it was in an inflationary market -- heated bidding wars were frequent, ending in closing price greater than the asking price! The same people would buy and resell a house several times over, elevating the "value" by double-digit percentages with each turnover.

But now, would you think that real auctions would be quickly sought by banks to clear the books? Yes, you would suppose that ... by way of symmetry with what happened in the inflationary market ... but it ain't happenin'! Real estate was an unreal world before the crash, and it's still not a real world. It's manipulated, like all the markets in this wonderful best-of-all-possible globalized "free" market worlds.

SOME FEW ORDINARY WORKING PEOPLE BENEFIT

It is true that real prospective home-owners are able (if they have financing, which is problematic for most, at best) to buy at realistic prices rather than at the insanely inflated prices of a few years ago (when everyone could get financing). But that's only sometimes and in certain select areas, with motivated buyers looking for a long-term home to live in (and who somehow manage the financing).

MEANWHILE

Yes, of course, what Robert Oak reports here is true. Banks are sitting on properties. They don't like to admit to it. And they are determined to hold on until the market bottoms out. So is everybody else ... often those who are evicted would also have preferred to hold on until things improve ... meanwhile ...

"62 years to foreclose in New York" NYT

The New York Times is running some "article" on the backlog of foreclosures in New York. Naked Capitalism calls this dubious research and so did Calculated Risk (in a more politically polite manner).

Bottom line banks are sitting on properties but watch out when someone calculates out "timeline" for foreclosures and then blames homeowners.

Nebraska Nuclear Meltdown???

Business Insider has a press from Pakistan and Russia claiming due to the floods, there is a nuclear reaction in Nebraska having a nuclear meltdown and the Obama administration is covering it up.

Wow. Anyone can take the time to find out about this and verify if it's true, please do. Get another credible source and we'll post it.