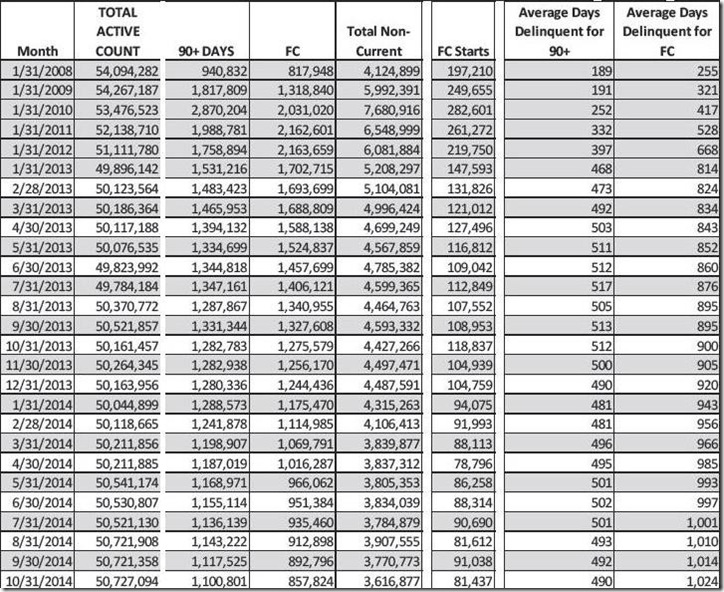

According to the Mortgage Monitor for October (pdf) from Black Knight Financial Services (BKFS, formerly LPS Data & Analytics), there were 857,824 home mortgages, or 1.69% of all mortgages outstanding, remaining in the foreclosure process at the end of October, which was down from 892,796, or 1.76% of all active loans that were in foreclosure at the end of September, and down from 2.54% of all mortgages that were in foreclosure in October of last year. These are homeowners who had a foreclosure notice served but whose homes had not yet been seized, and October’s so-called "foreclosure inventory" was the lowest percentage of homes in foreclosure since early 2008. New foreclosure starts fell in to 81,437 in October from 91,038 in September, the lowest since 78,796 foreclosures were started in April and well below the 118,837 foreclosures that were started in October of last year...

In addition to homes in foreclosure, October data showed that 2,759,053 mortgage loans, or 5.44% of all mortgages, were at least one mortgage payment overdue but not in foreclosure, down from 5.67% of homeowners with a mortgage who were more than 30 days behind in September, and down from the delinquency rate of 6.28% a year earlier. Of those who were delinquent in October, 1,100,801 home owners were considered seriously delinquent, which means they were more than 90 days behind on mortgage payments, but still not in foreclosure at the end of the month. Thus, a total of 7.13% of homeowners with a mortgage were either late in paying or in foreclosure at the end of October, and 3.86% of them were in serious trouble, ie, either "seriously delinquent" or already in foreclosure at month end...

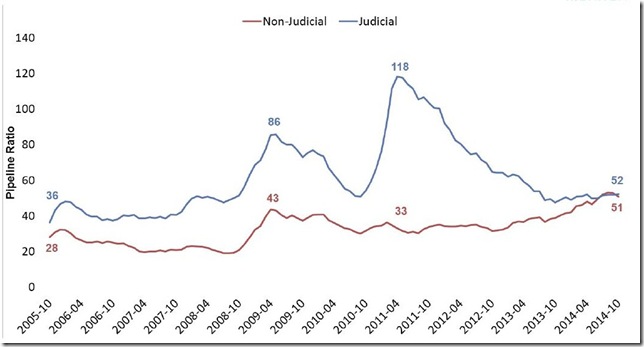

As you'll recall, the mortgage monitor is a mostly graphics presentation that covers all aspects of the mortgage servicing business, and today we'll just focus on a few graphs that show the lengthening period of time that those are in foreclosure remain stuck in the process. You might also recall that the pipeline ratio is a mortgage industry metric indicating how many months the average troubled home loan typically remains in the foreclosure process in each state, and it is computed by adding those homes that are seriously delinquent to those already in foreclosure and dividing that sum by the average number of completed foreclosures per month in each state over the previous 6 months. What that results in is the average number of months a problem home loan would be in the "foreclosure pipeline" at the current pace of foreclosure in each state, before the foreclosure process on all seriously delinquent homes would be completed. The first graph below, from page 11 of the Mortgage Monitor, shows the historical pipeline ratio for judicial states, where a court proceeding is necessary to complete a foreclosure, in blue, and the same ratio in non-judicial states, where such a proceeding isn't necessary for the banks to have the the home seized, in red, from 2005 to the present. Obviously, early on in the crisis, the process was taking much longer for judicial states, with their average pipeline ratio at 118 months and the foreclosure pipeline ratios reaching over 50 years for New York and New Jersey, but as we can see on the graph, the difference between the types of states has closed, as judicial states have moved to speed up the process. Even so, the pipeline ratio now averages more than 4 years for both types of states; 52 months for judicial states, and 51 months and rising for non-judicial states. The reason for the increase in the foreclosure pipelines recently is not so much delays in court anymore, but procrastination on the part of the mortgage servicers and banks, possibly because of defective titles, but also because they've experienced quite a bit of deterioration in the properties they've already seized, and would rather have them occupied by delinquent homeowners than ravaged by vandals..

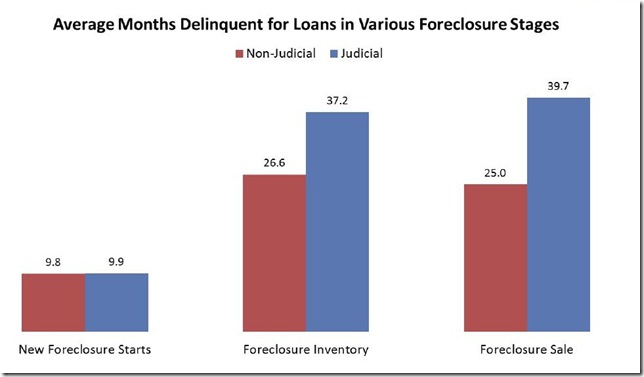

The next graphic, from page 12 of the mortgage monitor, shows the average number of months that loans have been delinquent for each type of state and for each stage of foreclosure, again with blue indicating judicial states and red indicating non-judicial states. We can see that foreclosures are typically initiated after an average of nearly ten months of delinquency for both types of states, but once in the process they remain in the "foreclosure inventory" for over 2 years in non-judicial states and for over three years in judicial states. Quite similarly, the length of time that mortgages have been delinquent when the foreclosure sale is finally closed is also over 2 years in non-judicial states and for over three years in judicial states. To clarify that, a foreclosure sale is the legal auction wherein the bank acquires the title after the foreclosure completes; after a foreclosure sale, the home moves into the bank's property inventory, also known as REO inventory (Real Estate Owned - metric definitions are on page 33 of the pdf).

Lastly, we'll again post part of the Mortgage Monitor table showing the monthly count of active home mortgage loans and their delinquency status, which comes from page 30 of the pdf. The columns here show the total active mortgage loan count nationally for each month given, number of mortgages that were delinquent by more than 90 days but not yet in foreclosure, the monthly count of those mortgages that are in the foreclosure process (FC), the total non-current mortgages, including those that just missed one or two payments, and then the number of foreclosure starts for each month shown going back to January 2008. In the last two columns, we see the average length of time that those who have been more than 90 days delinquent have remained in their homes without foreclosure, and then the average number of days that those in foreclosure have been stuck in that process because of the lengthy foreclosure pipelines. Notice that although the average length of delinquency for those who have been more than 90 days delinquent without foreclosure has remained fairly steady and is now at 490 days, the average time for those who’ve been in foreclosure without a resolution has lengthened to a record average 1024 days…

(the above was excerpted from my weekly summary at MarketWatch 666)

Comments

that's just rocking on foreclosures

It's astonishing. While this will rip people's credit obviously, are they staying in these houses without paying the rent and just paying taxes and utilities?

free ride

yeah, those who live in their homes without making payments through these long foreclosure processes are pretty much living rent free, as are those who've been delinquent nearly 500 days without proceeding to foreclosure...this has been offered as an explanation as to why personal consumption expenditures have remained strong despite unemployment and stagnant wages...

rjs