10 Presidents Day Reads

My three-day weekend reads:

• Why a ‘K-Shaped’ Economy Means More Risk for Stock Investors: The wealthy are propping up consumer spending thanks to a multi-year bull run, while lower earners pinch pennies. That creates a fragile circular dynamic — if stocks stumble, spending drops, and the whole thing unwinds fast. (Morningstar) see also Older Americans power a gray-shaped economy: Forget K-shaped, try gray-shaped: Boomers aren’t just aging — they’re reshaping the entire labor market. Health care job growth is booming, the retirement wave is accelerating, and the economy is increasingly being built around serving people over 65. The changing demographics in the U.S. — more old people, fewer young ones — are reshaping jobs and spending in all kinds of ways. (Axios)

• The Mega-Rich Are Turning Their Mansions Into Impenetrable Fortresses: Anxiety over high-profile violence has the wealthy spending big on armed security, bunkers and even moats to keep themselves safe from intruders. (Wall Street Journal)

• Who Is Paying the Trump Tariffs? Until recently the question of who pays tariffs wasn’t controversial among economists. The overwhelming consensus was that under normal circumstances tariffs — taxes on imported goods — are passed on to consumers in the form of higher prices. There are caveats and exceptions to this consensus, but these caveats are well understood and for the most part don’t apply to the tariffs imposed by the Trump 47 administration. (Paul Krugman) see also How a supplier of nuts and bolts could curb Trump’s tariff overreach: A new lawsuit reveals how businesses are forced to navigate an opaque and arbitrary system. (Washington Post)

• $185 billion is the down payment — the 4 skills that survive when agents code for months The infrastructure bubble for AI is actually just a down payment, and only a handful of human skills will remain valuable as AI agents become more capable autonomous workers. Here’s what changed and what it means for your career (Nate’s Newsletter / Substack)

• The British Are Furious at Donald Trump Over Chicken. They Actually Have a Pretty Good Point. The UK’s “chlorinated chicken” panic is back — Trump is pressuring Britain to accept American poultry in exchange for a tech deal, and 150,000 Brits have signed petitions to keep it out. It’s part food safety fight, part cultural identity crisis. (Slate)

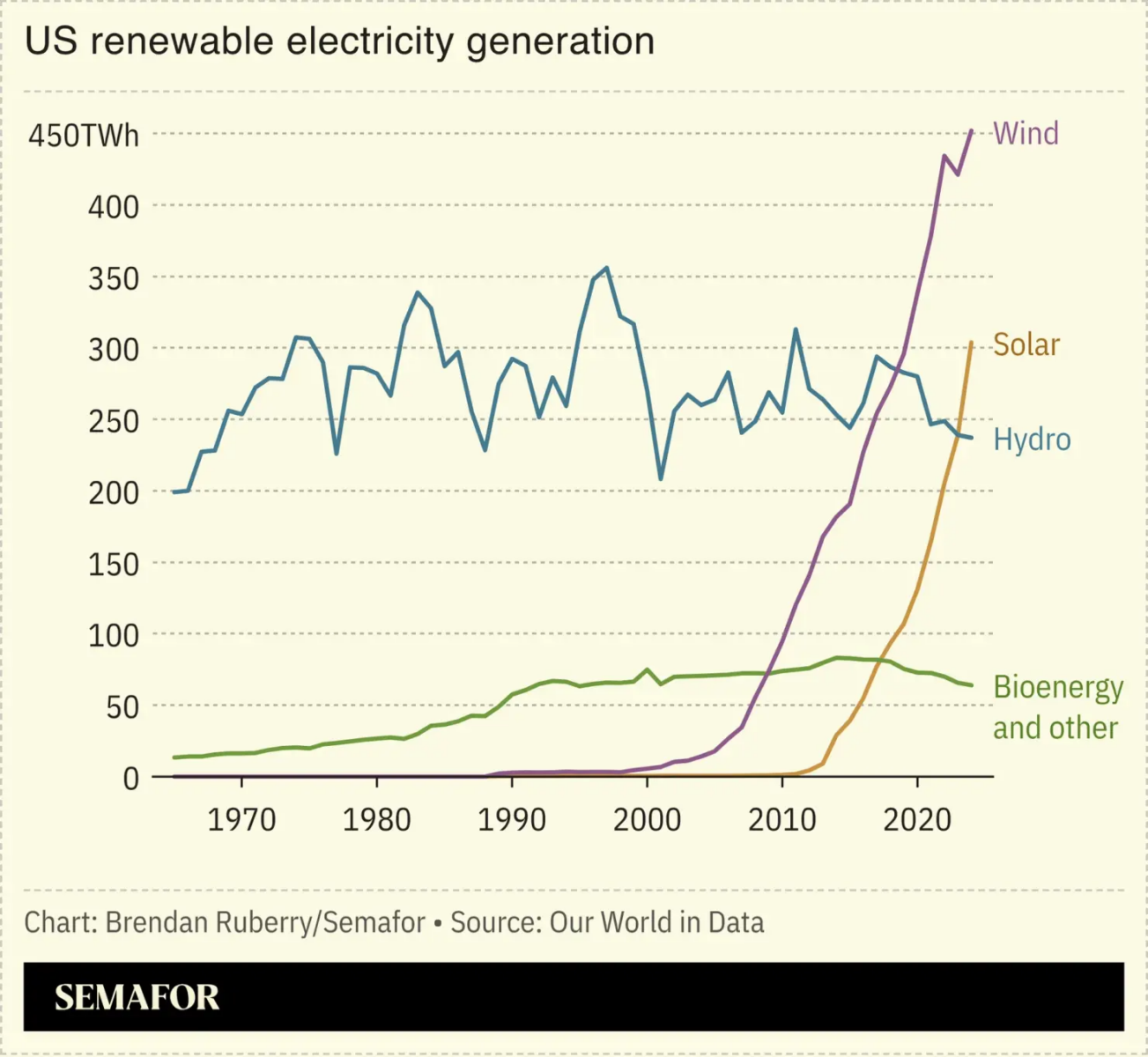

• This venture capital firm believes investing in climate is ‘Obvious’—and just raised another $360 million to prove it: Obvious Ventures managing director Andrew Beebe tells ‘Fast Company’ why now’s a great time to be backing climate tech, the trendy idea he’s glad the Trump administration is killing, and why he’s still optimistic for the future of the planet. (Fast Company)

• Gallup Will No Longer Measure Presidential Approval After 88 Years: The most-cited barometer of presidential job performance since FDR is being retired. Gallup says it’s a strategic shift in research priorities. The timing — with Trump’s approval at a historic low of 36% — is purely coincidental, of course. (The Hill) see also Poll: Trump’s Ratings on Immigration Tumble as Americans Lose Confidence in His Top Issue: The one issue that was supposed to be Trump’s ace in the hole is now underwater. Americans are losing confidence in his handling of immigration, even among Republican-leaning voters. (NBC News)

• AI Helps Scam Centers Evade Crackdown in Asia, Dupe More Victims: Scam operations across Southeast Asia are using AI to scale up fraud, outsmart law enforcement, and target more victims than ever. (Bloomberg)

• The Bay Area’s most unlikely landmark: A 125-year-old light bulb that’s still burning: A typical light bulb can last about a year. The one hanging from the ceiling at Fire Station No. 6 in Livermore has lasted more than a century. The Centennial Light Bulb, as it’s known, has been glowing almost continuously since 1901. In June, it’s expected to reach its 125-year mark. Time has turned a simple light fixture into one of the Bay Area’s head-scratching curiosities. (San Francisco Chronicle)

• TV, It’s Not Just for Humans Anymore: Videos aimed at pets are drawing millions of views. But who’s actually watching? (New York Times)

Be sure to check out our Masters in Business this week with Heather & Doug Bonaparth, a married couple who work together and wrote a book on the financial challenges couples face: “Money Together: How to find fairness in your relationship and become an unstoppable financial team.” Our discussion sits somewhere in between financial planning and couples therapy, built around real stories that try to help couples find a healthier approach to money.

U.S. government has lost more than 10,000 STEM Ph.D.s since Trump took office

Source: Science

Sign up for our reads-only mailing list here.

The post 10 Presidents Day Reads appeared first on The Big Picture.

Recent comments