When Reagan (Wisely) Cut & Run From The Middle East After Marine Barracks Bombing

Authored by Jim Bovard

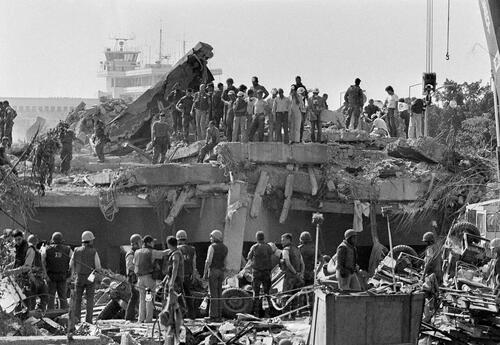

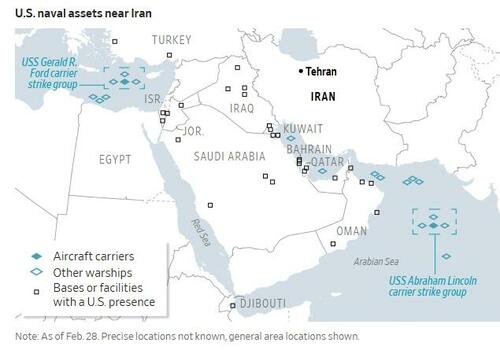

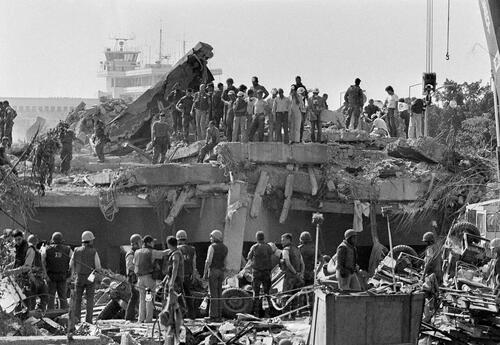

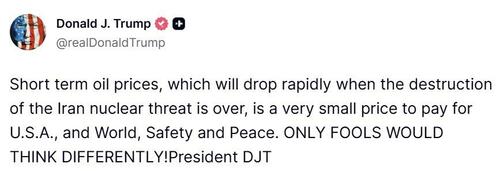

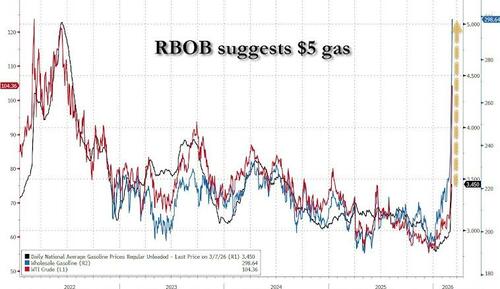

In his recent comments justifying a preventive war against Iran, President Donald Trump declared, "In 1983, Iran’s proxies carried out the Marine barracks bombing in Beirut that killed 241 American military personnel." Secretary of War Pete Hegseth has invoked that attack numerous times. The 1983 Beirut barracks attack is one of the most cited and least understood pretexts for the new war with Iran.

That bombing was one of President Ronald Reagan's biggest foreign debacles. Lebanon had been wracked by a brutal civil war for seven years when, in June 1982, Israel invaded in order to crush the Palestinian Liberation Organization (PLO). US troops were briefly deployed in August 1982 in Beirut to help secure a ceasefire to facilitate the withdrawal of the PLO forces to Tunisia.

via Wikimedia

via Wikimedia

US troops exited Beirut after the PLO withdrawal was largely completed. However, in mid-September 1982, the massacre of more than seven hundred Palestinian refugees threatened to plunge Lebanon into total chaos. Lebanese Christian Phalangist militia butchered residents of the Sabra and Shatila refugee camps. The militia was armed, aided, and fed by the Israeli Defense Force, which surrounded and blockaded the camps.

The Lebanese government appealed to President Reagan to send American troops back to Beirut as a stabilizing factor, and Reagan quickly obliged. As fighting escalated between Christians, Muslims, Syrians, and Israelis in Lebanon, the original US peacekeeping mission became a farce. The US forces were training and equipping the Lebanese army, which was increasingly perceived as a pro-Christian, anti-Muslim force. (Most Lebanese were Muslim, though possibly a thin majority at that point.)

On April 18, 1983 a delivery van pulled up to the front door of the US embassy in Beirut and detonated, collapsing the building and killing forty-six people (including sixteen Americans) and wounding over a hundred others. The US embassy was a sitting duck for the terrorist assault: unlike many other U.S. embassies in hostile environments, it had no sturdy outer wall. Newsweek noted, "Delivery vehicles are supposed to go to the rear of the building. Why Lebanese police guarding the embassy driveway would have made an exception in the case of the black van remained a mystery." The attack lacked novelty value, since the Iraqi and French embassies had been wrecked by similar car bomb attacks in the preceding eighteen months.

Five days later, on April 23, 1983, Reagan announced to the press:

"The tragic and brutal attack on our embassy in Beirut has shocked us all and filled us with grief. Yet, because of this latest crime we are more resolved than ever to help achieve the urgent and total withdrawal of all American forces from Lebanon, or I should say, all foreign forces. I'm sorry. Mistake."

But the actual mistake was a US policy that would cost hundreds of Americans their lives.

By late summer 1983, the Marines were being targeted by Muslim snipers. Reagan administration officials seemed surprised at rising attacks on American soldiers. The Reagan administration responded to sniper potshots and scattered mortar attacks on US troops with a massive escalation. On September 13, Reagan authorized Marine commanders in Lebanon to call in air strikes and other attacks against the Muslims to help the Christian Lebanese army. Defense Secretary Caspar Weinberger vigorously opposed the new policy, fearing it would make American troops far more vulnerable. Navy ships repeatedly bombarded the Muslims over the next few weeks.

At 6:20 A.M. on Sunday morning, October 23, 1983, a lone, grinning Muslim drove a Mercedes truck through a parking lot, past two Marine guard posts, through an open gate, and into the lobby of the Marine headquarters building in Beirut, where he detonated the equivalent of six tons of explosives. The explosion left a thirty-foot-deep crater and killed 243 marines. A second truck bomb moments later killed 58 French soldiers.

Colin Powell, who was then a major general, commented in his autobiography, "Since [the Muslims] could not reach the battleship, they found a more vulnerable target, the exposed Marines at the airport." A surprise attack on a troop concentration in a combat zone does not fit most definitions of terrorism. However, Reagan perennially portrayed the attack as a terrorist incident and the American media and political establishment accepted that label.

Reagan administration officials scrambled to assert that the administration was blameless. White House press spokesman Larry Speakes declared on the day of the attack that the bombing "definitely was a difficult situation for us" since "people come out of nowhere and perform these acts." Vice President George H.W. Bush rationalized, "It’s awfully hard to guard against that kind of terrorism." Defense Secretary Weinberger announced that "nothing can work against a suicide attack like that, any more than you can do anything against a kamikaze flight." Actually, during World War II, the U.S. Navy quickly responded by placing rows of antiaircraft guns on the sides of its big ships.

In the aftermath of the Marine barracks bombing, Reagan made a mockery of the truth. In a televised speech four days after the bombing, the president portrayed the attack as unstoppable, declaring that the truck “crashed through a series of barriers, including a chain-link fence and barbed-wire entanglements. The guards opened fire, but it was too late.” Reagan claimed the attack proved the U.S. mission was succeeding: “Would the terrorists have launched their suicide attacks against the multinational force if it were not doing its job?…It is accomplishing its mission.” He warned that an American withdrawal could result in the Middle East being “incorporated into the Soviet bloc.” Reagan also declared that the United States was involved in the Middle East in part to secure a “solution to the Palestinian problem.”

Reagan sent Marine Corps commander Paul X. Kelley to Beirut. Kelley quickly announced that he was “totally satisfied” with the security around the barracks at the time of the bombing. Upon returning to Washington, Kelley was summoned to Capitol Hill and bragged to Congress that “In a 13-month period, no marine billeted in the building [destroyed by the truck bomb] was killed or injured” from incoming fire. Kelley inaccurately testified that the Marine guards had loaded weapons and that two of them had been killed in the attack. When congressmen persisted questioning, Kelley became enraged and shouted, “We’re talking about clips in weapons, but we’re not talking about the people who did it. I want to find the perpetrators. I want to bring them to justice! You have to allow me this one moment of anger.”

Even though there had already been numerous major car bombings in Beirut that year and scores of other suicide attacks, Kelley told the committee that the truck bombing “represents a new and unique terrorist threat, one that could not have been anticipated by any commander.” Kelley denied the Marines received any warning of an impending attack. However, on the morning of Kelley’s second day of testimony, The New York Times reported that the CIA specifically warned the Marines three days ahead of time that an Iranian-linked group was planning an attack against them.

Other military officials involved in Lebanon also denied any culpability. Vice Admiral Edward Martin, the commander of the Sixth Fleet, declared, “The only person I can see who was responsible was the driver of that truck.” Martin stressed in an interview, “You have to remember that prior to Oct. 23, there hadn’t been any real terrorism threat.” A New York Times investigation concluded:

“Marine officers in Beirut and the admirals and generals in the chain of command above them did not consider terrorism to be a primary threat even after the embassy bombing, and even though Beirut had been full of terrorists for years.”

Shortly after the bombing, Reagan appointed a Pentagon commission headed by retired Admiral Robert Long to investigate. The commission report, finished in mid-December 1983, concluded that military commanders in Lebanon and all the way back to Washington failed to take obvious steps to protect the soldiers. The commission suggested that many fatalities might have been prevented if guards had carried loaded weapons. The report stated that the only barrier the truck overcame was some barbed wire that it easily drove over. The commission also noted that the “prevalent view” among U.S. commanders was that there was a direct link between the Navy shelling of the Muslims and the truck bomb attack.

When the White House saw the final version of the commission’s report, they issued a stop order. The Washington Post reported that the White House “delayed release of the report for several days, allowing Reagan to respond to its criticism before it became public, and then attempted to play down its impact by vetoing a Pentagon news conference on the document.” On December 27, 1983 Reagan revealed that “we have never before faced a situation in which others routinely sponsor and facilitate acts of violence against us.” Reagan sought to make the report “old news”:

“Nearly all the measures that were identified by the distinguished members of the Commission have already been implemented and those that have not will be very quickly.”

Reagan announced that the Marine commanders in Beirut “have already suffered enough” and should not “be punished for not fully comprehending the nature of today’s terrorist threat.” Reagan then effectively declared that no one would be held accountable. “If there is to be blame, it properly rests here in this office and with this president,” he announced, just before leaving Washington for a vacation in Palm Springs, California.

The Reagan administration blamed its anti-terrorist failures on the Carter administration. White House press spokesman Larry Speakes announced:

“We don’t quarrel with the fact that the CIA and other intelligence-gathering agencies have been crippled by decisions of the previous administration, and we are in the process of rebuilding capabilities. But it takes time…to re-establish our intelligence-gathering methods.”

The following September, shortly after a suicide bomber again obliterated much of the poorly-defended U.S. embassy in Beirut, Reagan blamed the debacle on Carter administration CIA cutbacks. “We’re feeling the effects today of the near destruction of our intelligence capability in recent years before we came here,” Reagan said, falsely asserting that the Carter administration had “to a large extent” gotten “rid of our intelligence agents.”

Reagan quietly withdrew U.S. combat troops from Beirut in early 1984. During the 1984 presidential election, the Reagan administration also responded to its Beirut debacles by attacking the patriotism of Democrats. In the vice presidential candidates debate, George H. W. Bush denounced Democratic candidate Walter Mondale and his vice presidential pick, Geraldine Ferraro. “For somebody to suggest, as our opponents have, that these men died in shame, they had better not tell the parents of those young marines,” he said. Neither Mondale nor Ferraro had said that the Marines “died in shame.” Bush denounced Mondale for running a “mean-spirited campaign,” saying “We’ve seen Walter Mondale take a human tragedy in the Middle East and try to turn it to personal political advantage.” But Mondale’s criticisms of the Reagan administration’s failures in Lebanon were less strident than Reagan’s criticisms of Jimmy Carter for the Iran hostage crisis during the 1980 presidential campaign.

Muslims also responded to U.S. troops by seizing American hostages. Reagan sent military equipment to Iran as a means to entice the Iranians to exert pressure to get hostages released. After the “arms for hostages” deal became public (along with the illegal funneling of the proceeds to the Nicaraguan Contras), Reagan’s credibility was devastated. Reagan went into such a tailspin after the crisis broke that his new chief of staff, Howard Baker, briefly examined invoking the Twenty-Fifth Amendment to remove Reagan from office because of medical unfitness. The Tower Commission report on the debacle concluded, “The arms-for-hostages trades rewarded a regime that clearly supported terrorism and hostage-taking.”

The 1982-84 deployment of U.S. troops in Beirut achieved nothing. The Israelis were far more aggressive against perceived opponents in Lebanon than were the American troops. But even the Israelis were effectively driven out of Lebanon over a decade and a half later, after failing to suppress Hezbollah and losing more than twice as many soldiers there as it lost during the 1967 Six-Day War.

The United States got dragged into a Mideast conflict and then recklessly failed to defend it own troops or American national interest. The 1983 Beirut barracks bombing does not prove that Iran has always been a deadly enemy. Instead, it shows how folly and deception pervaded even a presidency much less imprudent than subsequent administrations.

Tyler Durden

Sun, 03/08/2026 - 23:15

via Duvar English

via Duvar English

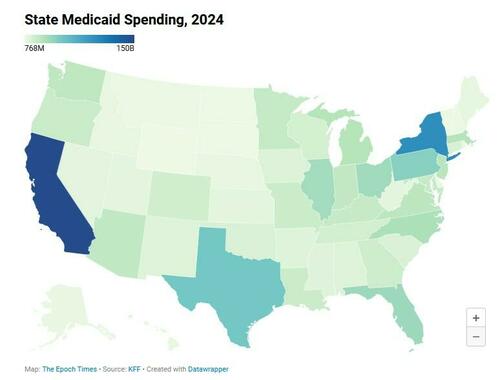

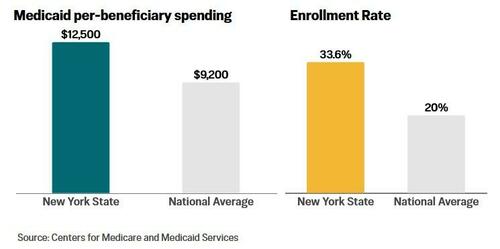

Dr. Mehmet Oz, administrator for the Center for Medicare and Medicaid Services, speaks at a press conference in the Library of the Eisenhower Executive Office Building in Washington on Feb. 25, 2026. Travis Gillmore/The Epoch Times

Dr. Mehmet Oz, administrator for the Center for Medicare and Medicaid Services, speaks at a press conference in the Library of the Eisenhower Executive Office Building in Washington on Feb. 25, 2026. Travis Gillmore/The Epoch Times

Image source: White House

Image source: White House The U.S. Department of Homeland Security in Washington on Feb. 17, 2026. Madalina Kilroy/The Epoch Times

The U.S. Department of Homeland Security in Washington on Feb. 17, 2026. Madalina Kilroy/The Epoch Times

Rep. Darrell Issa (R-Calif.) speaks at a hearing on oversight of the Federal Trade Commission in Washington on July 13, 2023. Madalina Vasiliu/The Epoch Times

Rep. Darrell Issa (R-Calif.) speaks at a hearing on oversight of the Federal Trade Commission in Washington on July 13, 2023. Madalina Vasiliu/The Epoch Times via MR online

via MR online Source: Intrepid Times

Source: Intrepid Times via BBC

via BBC

via Wikimedia

via Wikimedia

A grave marker for an unknown casualty from the USS Arizona is shown at the National Memorial Cemetery of the Pacific, on July 15, 2021, in Honolulu. Caleb Jones/AP Photo

A grave marker for an unknown casualty from the USS Arizona is shown at the National Memorial Cemetery of the Pacific, on July 15, 2021, in Honolulu. Caleb Jones/AP Photo

Recent comments