At The Money: Finding Alpha via Unique ETF Strategies (March 12, 2026)

If you want market performance (beta), you buy broad index funds. But what if you want to use a portion of your portfolio to try to beat the market (alpha)? One option is to pursue alpha via quantitative ETFs.

Full transcript below.

~~~

About this week’s guest:

Wes Gray is founder and CEO/CIO of Alpha Architect. He helps managers turn strategies into ETFs by providing turnkey, white label platforms to handle all of the complex and expensive office operations.

For more info, see:

Professional website

Masters in Business

Personal Bio

LinkedIn

Twitter

~~~

Find all of the previous At the Money episodes here, and in the MiB feed on Apple Podcasts, YouTube, Spotify, and Bloomberg. And find the entire musical playlist of all the songs I have used on At the Money on Spotify

Transcript:

Intro:

Only to be with you

But I still haven’t found

What I’m looking for

But I still haven’t found

What I’m looking for

Barry Ritholtz: Index funds have dominated capital flows since the Great Financial Crisis. One of the rare exceptions is the pursuit of alpha via quant funds. These create very specific return characteristics that aim at somewhat different goals than the big broad indexes.

I’m Barry Ritholtz, and on today’s edition of At the Money, we’re gonna discuss how to pursue alpha through exchange-traded funds. To help us unpack all of this and what it means for your portfolio, let’s bring in Wes Gray of Alpha Architect. He’s a quant who also specializes in ETF constructions. Wes also runs ETF architect.

So let’s start very basically, Wes, when you talk about alpha in an ETF wrapper, what do you actually mean? And we are talking about excess returns over cap weighted beta or is it something else?

Wes Gray: Yes. So let me frame it – alpha is obviously a loaded word and it can mean a lot of things to a lot of people. On one extreme, you got Jim Simons, you know, busting out 50% returns with no risk. But guess what? You are never gonna be offered this ever in your life, period. Because if I could do that, I would just manage my own money and become a billionaire, right?

The alpha for the rest of us, at least in my mind, is it’s basically delivering unique differentiated strategies – after fee and after taxes – that help you shape or differentiate your portfolio beyond the core of what you already have there in the form of like your Vanguard Beta, right? But, but let’s be honest, we’re we’re not gonna, it’s, it’s not the alpha in the RenTech sense, it’s the alpha in unique different boutique helps you shape your portfolio outcomes.

Barry Ritholtz: And, and just to clarify, if we ought to believe Greg Zuckerman’s book on, Jim Simon’s, it was 62% a year and they did kick out everybody except the founding partners in the Medallion fund. It didn’t scale much beyond a few billion dollars, but still 62% annually for 30 years, nobody’s even in second place. It’s, it’s amazing.

Let’s delve a little deeper into Alpha. How do you think of it? Is it behavioral? Is it structural? Is it informational? Or is it simply here’s where the model generates returns above what the market is, is doing on average?

Wes Gray: Yeah, so if we’re gonna talk about kind of alpha or the kind of stuff that we wanna focus on in the context of a ETF wrapper that’s public and has some capacity, I think it really boils down to boring things like that Vanguard can’t do.

For example, like how do I differ? How do I deliver something low cost, great tax outcomes, that’s also very unique, trades a lot and is gonna change or, or shape your portfolio in ways that could be favorable for you beyond just buying SB 500. And usually that’s gonna be related to diversification benefits, portfolio insurance benefits and what have you.

It’s the poor man’s alpha. It’s not the, it’s not the two and 20 alpha, but that’s just the reality of, you know, being in a product with a lot of scale and serving the public.

Barry Ritholtz: It’s funny you say that I, when I think of alpha, I typically just think of factor exposure, value, momentum, quality, etc. How much of ETF based alpha – “poor man’s alpha” – is really heavily focused on factor exposure?

Wes Gray: I would say pretty much all of it is. And if it hasn’t been factor exposure yet, it will be ’cause people just need to invent the factor that then explains that aspect of your performance.

Obviously, if you’re in a transparent wrapper, like at an ETF, everything can be explained with factors at some level. It’s just a matter of, did we think about that factor yet? And so again, the alpha idea is like, we wanna deliver you these u these unique market factors, but, and we wanna make sure you capture all those efficiently, low cost and with good taxes. That’s kind of the goal of ETF Alpha.

Barry Ritholtz: I have an academic question for you, and you’re kind of an academic, so you’re the right person to ask. You know, you, you studied with Gene Fama; all of these factors are public and well known and in an ETF where it’s transparent and disclosed, why doesn’t this alpha just get arbitraged away? How does this still persist if everybody knows about it?

Wes Gray: Yeah, so I think humans are gonna human…

And let’s just take the most basic example, the value factor. Buy cheap stuff everybody hates.

We all know that over a hundred years or 200 years in every market and every data set you can ever find, there’s typically some sort of edge to buying cheap stuff that everyone hates. But then there’s a dirty secret for 10, 20 year stretches. It can underperform your benchmark and you’ll look like the biggest idiot on the planet.

Everybody knows it has a long game historical edge. Everyone knows if you buy the cheap house in the neighborhood versus the most expensive, you’re probably gonna make money on average over the long haul. But that doesn’t mean everybody is gonna go all in on buying like the, the value factor, right? They’re gonna go buy Bitcoin, they’re gonna go do momentum, they’re gonna do all, all kinds of other things.

I think a lot of like the quote unquote alpha, it’s alpha in plain sight, but it’s, that doesn’t mean it’s like easy to do because it, you know, you gotta have discipline, you gotta have long time horizon, you gotta stick to the plan, you gotta stick to the program.

It’s, it’s kinda like dieting and like being in shape. Like we all know how to get ripped, eat, exercise and sleep appropriately. Don’t eat bon bons, don’t eat McDonald’s, but the alpha is there. We all know what you’re supposed to do, but that doesn’t mean everybody does it. It’s the same exact problem with investing in these quote unquote alpha factors and why they don’t get arbitraged away.

Barry Ritholtz: It’s funny, I’m gonna paraphrase my favorite white paper of yours that you put out a quite a while ago. “Even God would get fired as an active value investor or fund manager.”

How is that possible? I love how you sum up so many different parts in the title of that, but if God’s gonna get fired as a value investor, what chance do the rest of us have?

Wes Gray: Well, exactly, and there’s been follow on research, I think someone in your shop actually did it where what if we were God the tactical asset allocating manager, same problem. Like you could underperform the benchmark for a long period even though you’re literally perfect and you’re like Biff, if you remember back to the future where he is got like the little almanac. It’s just the, the reality is markets are volatile and they generally work in a way that they’re gonna push you to maximal pain before the gains are there. And, and that’s just the nature of how markets clear and how they work. So is what it is, and I can’t explain it, but like I said, humans are gonna human in the past, in the present and in the future.

Barry Ritholtz: So I have a couple of technical questions to ask you and then I wanna dive into some of the more really interesting ETFs Alpha architect manages. But before we get to that, the perennial challenge with everybody who is a quant and everybody who works with factor investing is that they do these back tests and there’s a tendency to either overfit, I mean, we’ve never seen a back test that we didn’t love. The problem is if the future looks exactly like the past, well then the back test is great, but most of the time that doesn’t happen.

How do you prevent that sort of overfitting? How do you prevent, oh my God, here’s the perfect back test and, and not understand why that that model isn’t really gonna work in the future.

Wes Gray: I think at the outset the best rule is just never trust any past performance, especially hypothetical, but even live past performance.

The reality is what you should understand is what is the process fundamentally, and then obviously why has this work and why will it continue to work?

For example, if if someone shows me a back test that says, Hey, I made 50% returns a year with like no risk and you don’t have a 250 IQ like, you know, the RenTech guys, which nobody else does, I’m gonna say, well that’s great, it’s in the back test and I’ll grant you, let’s just assume it’s true. That’s pretty straightforward. Why would that exist in the future?

Unless you got a great story about how terrible this is simultaneous to how great it is, it’s just not believable or credible, right?

And, so that’s my benchmark is don’t believe any back test, especially if it shows a great thing, unless it also shows why it’s so bad, why is there so much career risk? Why is this underperformed the benchmark year in year out, potentially for decades to get me fired and to wanna jump off a cliff? Like I wanna know that information because now I’m like thinking, oh, that back test might actually be legit then, but, but there’s, but there’s a trade off. It’s not like it’s an easy thing to deal with in the future. So, you know, that’s what I’d say.

Barry Ritholtz: Let’s talk about some other risks from back tests, drawdowns tracking error, trail risk, crowding. What other things do investors tend to underestimate or quants underestimate when they’re looking at a model?

Wes Gray: Just pick ’em all. They underestimate everything. And the reason is because of incentives.

Generally speaking, I only focus on academic research and peer reviewed journals, not because academics are the best or smartest or most practical, but they have the least warped incentives in a sense that they’re, they’re also warped too. Like no one’s biased.

Barry Ritholtz: Well they want tenure, but they’re not, they are not Form fitting; not fabricating alpha.

Wes Gray: Exactly.. Their currency is like ego prestige like getting published, which is, it’s not show you this back test to go buy my product. So, so just because of the incentive problem tied to like back test from an asset manager, it, it’s, you know, it’s just, it’s, it’s like kinda like there’s a, there’s a study on how to, there’s drug from like sponsored by Pfizer research, like I just can’t believe it at the outset, right?

I think in our business where if it’s a back test and unfortunately it was produced by an actual firm that sells the product, you just have to discount it damn near 99% and, and you know, go look for like other evidence from like quote unquote people who are less biased and you know, unfortunately that that’s really boils down to academic researchers, but they have their own biases as well.

As far as I know, that’s the best you can find out there.

Barry Ritholtz: Let’s talk about some of the funds that you help put together and help manage starting with both momentum and value: QMOM and IMOM are US-based or international momentum strategies and then QVAL and IVAL as US-based or international value strategies. These seem like such core factor models. Tell us a little bit about these four products and who tends to be the investors in these?

Wes Gray: Generally speaking, what’s the genesis of these products and and why are they very different but also very bad potentially for people?

I was an academic, right? I’m a PhD sitting around here spinning the data tapes and I just wanna figure out how to invest my own money. And I read all these papers, they’re like, great, take the thousand largest stocks, you buy the top 10% on book to market and this works over long-haul.

So naturally, because I’m not in the investment management industry, which we’ll talk about in a second, like these products are designed like that to deliver these kind of academicy factor looking things like, hey, top 1000, let’s go buy the top five or 10% on momentum and call it a day monthly rebalance. I’m oversimplifying. That’s the idea. And I like that because it’s grounded in the actual formation of how academic portfolios are actually created.

Now that’s not what normal people do. I learned what normal people do is you start with the S&P 500 index, right? And then you do little tilts plus or minus because why would you wanna do those academic factor things? Because you’re gonna get your booty fired real quick because you’re gonna deviate like a madman from those underlying core benchmarks. And that’s just the, the lot that we chose.

Barry Ritholtz: But that also means you have a very high active score and you’re not a closet indexer.

Wes Gray: We, yes, it, it’s, we are, we are not closet indexers and we have very high active share and we’re definitely doing something different and unique, but we don’t like to sell our products be because it’s really important that people buy our products to understand what they’re getting into because of this whole problem that they can outperform and we look like heroes, they can underperform, we look like zeroes and everything in between. It, it really does require kind of this 10-year horizon and a lot of understanding of the process and why it works.

Barry Ritholtz: So let’s talk about what’s I think is your largest ETF and, and it’s a based on a box spread that ETF I’m gonna say that again. It’s based on a box spread that option riders have been using for a long time to generate a low-cost lending situation against stocks. BOXX is the alpha architect one-to-three-month box ETF that’s coming up on $10 billion and then a little more intermediate duration underlying box a tell us about these two strategies. They seem really interesting.

Wes Gray: The fundamental idea here is that we can access the market price risk free rate through the box spread market, which we can have a whole nother podcast on how the heck that works and what it is. But just think about like instead of going through the treasury market where I access what the government’s gonna give me, effectively I can go through the box spread market and access the implied risk-free rate amongst like broker dealers, banks and traders and everyone else in between

Barry Ritholtz: Which is much lower.

Wes Gray: Yes, and, and, and so what box is trying to do is how do we deliver excess returns, net of fees and taxes and all that good stuff over the equivalent duration.

We’re, we’re targeting one of three month duration. You know, obviously if you’re gonna do treasury bills, you could do one to three month duration there. The, the key goal is how do we beat that?

And, we have done this and the idea is like it’s just that funding market has a little bit less slack and there’s some other reasons why it outperforms, but we’re just trying to capture that net of fees and net of taxes in box and in box A. There’s also a trend component, but it’s the same idea. How do we, how do we access these funding markets and fixed income markets but deliver ’em in such a way that ideally we can outperform and, then potentially have other benefits along the way.

Barry Ritholtz: Let’s talk about two really interesting funds. I love the stock symbol chaos, CAOS, the alpha architect tail risk. I’m assuming that’s exactly what it sounds like? You are, you are managing the potential for there to be a market crash.

Wes Gray: Yes, with a twist

There is no free lunch in in options and, and broad market exposure. I’m not here to say that this is a alpha generator in some sense, but what that product is doing is most tell risk funds. Like why do you buy a tail risk fund? And I wanna get protected if the market blows up. Well what’s the downside of a tail risk fund? Well, we bleed out to zero over time because I’m buying puts all the time.

What CAOS represents is a trade off where we say, listen, we’re gonna buy the protection. So if the market bombs out, it’s gonna make money, we’re gonna be selling put spreads to fund that, and we’re gonna invest your collateral as efficiently as possible. And what does that mean? Well that means that we’re not protecting you in like say the 0 to 20% range in like a slow bleed out. You’re also gonna lose money, right?

So, chaos is just saying, hey, we’ll deliver the deep tail risk but we’re gonna have to pay for it by eating risk in like the, the small drawdowns, but that’s what pays for our insurance. And then we’re just trying to deliver all that in a tax-efficient, you know, fee-efficient manner. So, you know, people kind have tail risk protection but without the bleed. But again, it’s just reiterate, it’s not a free lunch in the sense that we just, you know, sell you insurance that always works and you never lose money. Just to be clear on that,

Barry Ritholtz: I do recall was it the first quarter of 2020 during the pandemic, this exploded upwards like 25, 30%. Am I remembering that right?

Wes Gray: Yes. It’s designed where if the market blows up and the VIX explodes, this thing, I mean, I can’t guarantee anything, but it should, with very high expectations, make a lot of money if that fact pattern is true.

So if Trump says something crazy or you know, North Korea nukes us tomorrow and the VIX goes to a hundred, and the market’s down by 50, chaos will probably be doing pretty well.

Barry Ritholtz: And the last one I want to ask ’cause I love all of these unusual box chaos sort of things that are not the typical ETF hide high inflation and deflation. I love the symbol, HIDE hey you need a place to hide during an inflation spike or deflation HIDE is is the place. Tell us a little bit about that ETF.

Wes Gray: Yeah, same idea. We call this poor man’s managed futures ’cause it’s 29 basis point and we’re trying to deliver that kind of exposure if you’re familiar with it. But the basic idea is like listening to you.

The idea is like this: listen to me. For your diversification, you want something that could protect you if there’s hyperinflation or potentially shield you if there’s deflation, but we don’t know what it’s gonna be. So all that product does is say, hey, we’re gonna focus on bonds, which can help you in deflation. We’ll focus on commodities, which will help you in inflation. And then we have real estate as kind of an in-between option, and we just tre

If the bonds are doing great ’cause we’re trending towards deflation, own those. If, you know, if inflations look crazy, great, we’re gonna own commodities to get ahead of that curve and then if nothing’s got any movement, we’re just gonna own cash and hide literally. So it’s just you hyperinflation or deflation protection in one product, so you don’t have to think too hard.

Barry Ritholtz: So to wrap up, for those of you who have a core index approach, but want some satellite ideas to surround the passive index, consider ETFs that focus either on specific factor strategies or specific option strategies that could work to your advantage, both in terms of diversification and non-correlation to what the core market is doing.

I’m Barry Ritholtz, you are listening to Bloomberg’s at the Money.

~~~

Find our entire music playlist for At the Money on Spotify.

The post At The Money: Pursuing Alpha through Exchange-Traded Funds appeared first on The Big Picture.

Maryland Attorney General Anthony Brown, left, speaks as Gov. Wes Moore listens during a news conference in Baltimore, MD., on Sept. 24, 2024. Stephanie Scarbrough/AP Photo

Maryland Attorney General Anthony Brown, left, speaks as Gov. Wes Moore listens during a news conference in Baltimore, MD., on Sept. 24, 2024. Stephanie Scarbrough/AP Photo

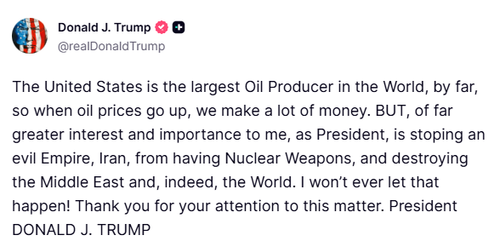

President Donald Trump waves as he boards Air Force One at Joint Base Andrews, Md., on March 11, 2026. Andrew Harnik/Getty Images

President Donald Trump waves as he boards Air Force One at Joint Base Andrews, Md., on March 11, 2026. Andrew Harnik/Getty Images A banner depicting the Iranian regime's new leader, Mojtaba Khamenei, in Tehran, Iran, on March 11, 2026. Khoshiran/Middle East Images/AFP via Getty Images

A banner depicting the Iranian regime's new leader, Mojtaba Khamenei, in Tehran, Iran, on March 11, 2026. Khoshiran/Middle East Images/AFP via Getty Images Blank Social Security checks are run through a printer at the U.S. Treasury printing facility in Philadelphia, Pa., on Feb. 11, 2005. William Thomas Cain/Getty Images

Blank Social Security checks are run through a printer at the U.S. Treasury printing facility in Philadelphia, Pa., on Feb. 11, 2005. William Thomas Cain/Getty Images

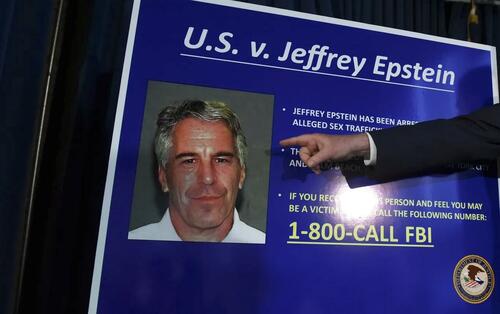

U.S. Attorney Geoffrey Berman announces charges against Jeffery Epstein in 2019. Photo: Stephanie Keith/Getty Images

U.S. Attorney Geoffrey Berman announces charges against Jeffery Epstein in 2019. Photo: Stephanie Keith/Getty Images

A house for sale in Washington on May 19, 2025. Madalina Vasiliu/The Epoch Times

A house for sale in Washington on May 19, 2025. Madalina Vasiliu/The Epoch Times

West Asia News Agency via Reuters

West Asia News Agency via Reuters

Recent comments