The underlying assumption that the current world monetary system is built upon is that America will always over-consume and the world will always accept our debt at face value. It's a warped and unhealthy relationship, but its worked (sort of) for several decades. That's why it was notable when a Chinese central banker spoke up last week.

"The United States cannot force foreign governments to increase their holdings of Treasuries," Zhu said, according to an audio recording of his remarks. "Double the holdings? It is definitely impossible."

Impossible? That's absurd. For decades foreigners have been more than willing to exchange their excess dollars from trade surpluses for our debt in order to keep their currencies at artificially low levels.

It turns out that the problem isn't foreigner's willingness to lend to us.

"The US current account deficit is falling as residents' savings increase, so its trade turnover is falling, which means the US is supplying fewer dollars to the rest of the world," he added. "The world does not have so much money to buy more US Treasuries."

The problem is that the American middle class is broke and unable to continue to over-consume.

The current global monetary system is known as Bretton Woods II. The idea is that the world uses dollars it receives from trade surpluses with America for its purchases from third-party countries of commodities that are priced in dollars, such as oil.

Once global trade is satisfied, these dollars are reinvested in America in the form of bond purchases. This allows America to finance its enormous debts at artificially low interest rates. Also, by purchasing American debt, it artificially inflates the dollar, thus allowing the American consumer to purchase goods at artificially low prices.

With their artificially suppressed currencies, Asian nations were able to put millions of people to work in factories producing goods for export to America.

Through the years some people questioned whether foreigners would continue to purchase debts that America obviously will never be able to repay. Yet year after year the foreigners continued to play their part in this prisoner's dilemma.

However, while no one was watching, the other side of the equation was breaking.

The artificially low interest rates in America led directly to asset bubbles. These asset bubbles were used to mask the fact that wages weren't keeping up with living standards. Our manufacturing base was being put out of business by the artificially high dollar.

The American consumer borrowed against these inflated assets, primarily houses, to live a lifestyle that their wages couldn't support. When multiple asset bubbles popped in 2008, the American consumer no longer had an asset to leverage against, and banks, in order to survive, had to cut back on consumer credit lines.

Suddenly one side of the Bretton Woods II monetary standard - America's ability to over-consume - was busted.

"Foreign Central banks aren't going to finance much of the 2009 US fiscal deficit; Their reserves aren't growing anymore."

- Brad Setser, Council on Foreign Relations

At this point the American government stepped in. Instead of trying to address the source of the problems with the economy and put Americans to work, the government tried to re-inflate the consumption bubble with programs like Cash4Klunkers and HAMP. Except for some extremely short-term results, these expensive programs have completely failed because they have only addressed the symptoms rather than the disease.

Real Unemployment

All this government borrowing adds up.

As the world watched America go on a borrowing binge unprecedented in the post WWII era, their first response was to roll their long-term dollar assets into short-term assets as they expired. This reduces risk for the lender, plus reduces rates for the borrower.

However, it causes a potential problem for the borrower - America - because it requires an increasingly large amount of debt that must be rolled over every few months. If, for whatever reason, there is an unexpected, short-term financial crunch, then it can quickly become a crisis.

The more fundamental problem with this "solution" of government borrowing replacing consumer borrowing was largely unmentioned until Mr. Zhu brought it up last week. It's relatively easy to finance a $400 Billion budget deficit when the trade deficit is also $400 Billion. The trade deficit dollars get recycled as is normal.

But how do you finance a $1.4 Trillion budget deficit when the trade deficit is only $300 Billion?

You have to get the money from somewhere else. For a couple of months we can issue our debt in short-term bills to match our foreign creditor's desire to reduce their risk. This will only mask the problem, and in fact, its already run out.

"It would appear, quietly and with deference and politeness, that China has canceled America's credit card," Kirk told the Committee of 100, a Chinese-American group.

Instead of buying American debt, China has gone on a worldwide shopping spree for natural resources, and spent another $586 Billion on themselves to stimulate their economy. China is also making currency swap agreements with other nations, so it no longer has to use dollars in its foreign trade.

Or as Bank of America put it:

The financial crisis delivered a clear verdict, in our view, on the limits to the Asian growth model. It no longer makes sense to pursue double-digit growth by lending cheaply to the US consumer.

“Confidence in the U.S. dollar is ‘fraying’ and a shift away from the greenback after the financial crisis is inevitable."

- Nobel Prize-winning economist Joseph Stiglitz

It begs the question - where will the money come from?

Sometimes people ask that question, which is a very good question, but stop there.

An even better question to ask is - is there enough money?

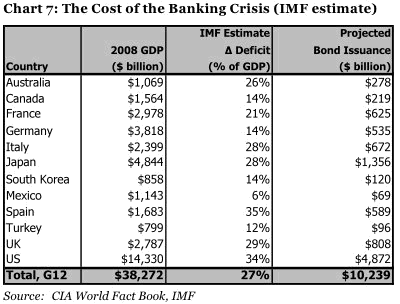

The IMF, which has repeatedly underestimated the economic crisis, has produced some numbers which are scary in and of themselves.

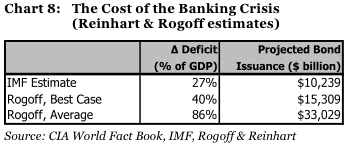

Fortunately, Carmen M. Reinhart and Kenneth S. Rogoff have studied dozens of historical examples since 1800 and tried to answer that question by basing it what that history teaches us.

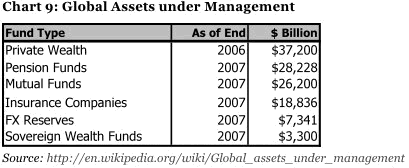

If you are like me, $33 Trillion are so far above my ability to imagine that they may as well be using another language. That's why it is important to put things into perspective by comparing this number to other asset classes.

If you understand the significance of these numbers you have arrived at the "Oh, shit" moment. The amount of money required to bail the world out of the current economic crisis, if this crisis plays out at a historical average, is nearly equal to all the private wealth currently in the world.

To repeat the obvious, this doesn't add up. What about the capital needed to fund the businesses of the world? What about the capital needed for private consumption?

There is no "what if". The odds of all this deficit spending getting financed at an affordable rate is zero. It's simply not going to happen. You can close your eyes and cross your fingers. You can pray to your Gawds. You can chant "I believe" all you want, but at the end of the day the laws of supply and demand will win.

Once you wrap your mind around this horrible fact, you realize that we are in for a world of hurt.

There are only three possible outcomes: 1) interest rates skyrocket to crushing levels, or 2) the central banks print money on a massive scale, or 3) some combination of the first two choices.

ZeroHedge does the math.

Accounting for securities purchased by the Fed, which effectively made the market in the Treasury, the agency and MBS arenas, but also served to "drain duration" from the broader US$ fixed income market, the stunning result is that net issuance in 2009 was only $200 billion....

Out of the $2.22 trillion in expected 2010 issuance, $200 billion will be absorbed by the Fed while QE continues through March. Then the US is on its own: $2.06 trillion will have to find non-Fed originating demand. To sum up: $200 billion in 2009; $2.1 trillion in 2010. Good luck.

The Federal Reserve, the lender of last resort, has also become the buyer of last resort.

The Fed stepped into the mortgage market is a very big way.

In other words, the Federal Reserve alone bought $722 billion of mortgages and agency debt when only $686 billion in new mortgages were issued. So, through August, the Fed bought more than 100% of the entire supply of new (purchase) mortgages in 2009.

The reason for this is three-fold: 1) foreigners began dumping Fannie Mae and Freddie Mac bonds the moment the Treasury had to nationalize these agencies, 2) no one trusts our mortgage-backed securities anymore, and 3) the desire of Washington to bail out Wall Street via re-inflation of the housing bubble.

The Fed has already purchased over $1 Trillion in mortgage-backed securities and it is approaching its self-imposed limit.

On the other side of the scale was the Fed's completed purchase of $300 Billion worth of Treasuries. Yet despite the Fed's monetization being over, interest rates remain low and the auction bid on Treasuries remain high.

It brings up the question of who is buying all these Treasuries?

the United States increased the public debt by $1.885 trillion dollars in fiscal 2009... According to the same report, there were three distinct groups that bought more than they did in 2008. The first was “Foreign and International Buyers”, who purchased $697.5 billion worth of Treasury securities in fiscal 2009 – representing about 23% more than their respective purchases in fiscal 2008. The second group was the Federal Reserve itself. According to its published balance sheet, it increased its treasury holdings by $286 billion in 2009, representing a 60% increase year-over-year.

So who is the third group that is buying all these Treasuries? It's you and me.

US households purchased $529 billion of US Treasuries in the first nine months of 2009, accounting for 45% of total new Treasury issuance.

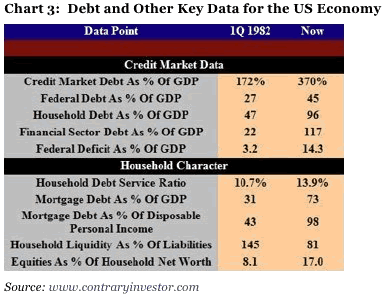

Wait a second. Something is wrong with this picture. The balance sheet of the American household is in terrible shape.

Unemployment is at post-Great Depression highs. Even people still employed are working fewer hours. The bursting of the housing and stock bubbles has devastated the investment portfolio of the American family. What's more, the "Household Sector" is outside of mutual funds, money market funds, pension and retirement funds, and life insurance companies.

So how does the "Houseshold Sector" go from purchasing $15 Billion in Treasuries in 2008 to purchasing $528 Billion in 2009?

we discovered that the Household Sector is actually just a catch-all category. It represents the buyers left over who can’t be slotted into the other group headings. For most categories of financial assets and liabilities, the values for the Household Sector are calculated as residuals. That is, amounts held or owed by the other sectors are subtracted from known totals, and the remainders are assumed to be the amounts held or owed by the Household Sector. To quote directly from the Flow of Funds Guide, “For example, the amounts of Treasury securities held by all other sectors, obtained from asset data reported by the companies or institutions themselves, are subtracted from total Treasury securities outstanding, obtained from the Monthly Treasury Statement of Receipts and Outlays of the United States Government and the balance is assigned to the household sector.”(Emphasis ours)10

So to answer the question - who is the Household Sector? They are a PHANTOM.

They don’t exist. They merely serve to balance the ledger in the Federal Reserve’s Flow of Funds report.

Our concern now is that this is all starting to resemble one giant Ponzi scheme.

The fact that the Treasury can't actually identify the one of the largest buyer of its debt can't help but raise a few eyebrows.

Can you imagine a private company that couldn't identify its largest customer? Can you imagine a government who couldn't identify its largest creditor? Oh wait...It's beyond suspicious.

Are these phantom creditors hedge funds? Probably not.

It makes a person wonder if the Fed and/or Treasury hasn't been involved in either some shady accounting tricks, or hidden monetization of debt. Even if the these are legitimate investors, is it realistic to expect a savings-poor America will increasingly buy these Treasury bonds that yield almost no interest?

The math is clear - there isn't enough money in the world to fund these massive deficits, at least not with the current monetary system. So it would not surprise too many people to find out that the government is taking extreme measures to balance its budgets.

Remember, you can't spell "confidence" without "con".

Comments

oh shit

To me, the U.S. should threaten tariffs if China does not float it's currency. They have our jobs, and now threaten to stop this absurd game, which obviously cannot continue, and U.S. manufacturing cannot get a leg up it seems (and I was surprised by this) by China's currency manipulation alone. We're not even talking about their other numerous manipulations on trade, from tariffs schedules, to their VAT...

Great piece midtowng! Scares the shit out of me and unless something drastic happens....

Well, let me put it this way, I really cannot understand why U.S. debt is considered so safe, why the U.S. in no way is at risk of sovereign default...

I can't, not with those numbers and the cost of the "financial crisis", those numbers just make my blood boil! (I believe most of America's blood is boiling over it as well!)

Great piece, although I almost would prefer some fantasy fiction just because this freaks me out so badly....I have visions of Russia, 1998 in my head!

Great piece Midtowng

As usual, you highlight the problems our country faces with great clarity. I agree that the confidence in U.S. debt rightfully appears misplaced. I can't believe we aren't on the brink of sovereign default already.

So what happens when all of this comes to a head - when no one will buy a penny more of U.S. debt? Maybe we should all start stocking up on MREs and firearms.

http://jims-blog.com

"when all of this comes to a head"

We default. Dollar loses value. American goods become cheaper. We rebuild our manufacturing base. We get good jobs again and real prosperity.

I don't doubt I'm missing something. Feel free to correct any of my misconceptions.

miasmo.com

The part you are missing

You are right, but with one HUGE omission - the intervening years.

It's the part where all the pension funds go broke. Where the savings of people get wiped out. Where the standard of living in America gets knocked down. Where our democracy comes under assault.

Seems like we should be able

Seems like we should be able to minimize the pain in getting from here to there, except for the fact that our government is too corrupt to enact the smart policies to accomplish that. I can think of a few: higher taxes for the super rich, carbon tax, increased social safety net, fix our inefficient healthcare system, massive spending on infrastructure and green energy technology, print money instead of continuing to borrow it. Oh, yeah... and cut our military budget in half.

miasmo.com

Come on G!

We are going to have a whopping 3% growth in GDP, stable unemployment with stable wages (lower) and a strong service sector with a dominate finance sector. We have nothing to worry about.

Happy New Year!

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

But our economic system depends on asset inflation/bubbles

That's part of the game. With out them we have nothing.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

How long can the unsustainable last?

We've had an unsustainable economic system since 1972. It's gotten particularly bad since 1997.

It's now hitting a terminal state. The U.N. and our Asian creditors have called for a new global economic system.

Everyone knows what is coming, but no one will do what is necessary until they have to.

But even then it will be short term solution

It's time to shed this neoliberal economic model. I offer the following as a basis to shedding it:

1) In short-term a direct jobs program including training program (bring back the trade school). More efficient and targeted stimulus spending.

2) Increase marginal tax rates on top bracket and reform rest of code.

3) Eliminate tax code bias in favor of debt and sorry that includes tax deduction for mortgage interest.

4) Defend our manufacturing sector by continuing to enforce trade agreements.

5) Make the financial sector smaller - break up "too big to fail" or provide concrete disincentives to be big.

6) Support policies such as the Employee Free Choice Act - we need as Prof. John K. Galbraith said - Countervailing Power to big corporations.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

As I said on the other....

....website where this diary is cross-posted: GREAT diary!

I always love your analysis and eloquence. If I had a FRACTION of your skills perhaps I would not have become an economics grad. school dropout!

Much of this stuff I have been saying and studying for a long time, although credit must go to one of my profs.---ironically NOT an econ. prof., but a political science one, who was pointing out these uncomfortable trends since the early 1990s.

"....under Capitalism, man exploits man. Under Communism it's just the opposite..." ---John Kenneth Galbraith

"....under Capitalism, man exploits man. Under Communism it's just the opposite..."

---John Kenneth Galbraith

Dude! Welcome to the Populist site!

Not to belittle midtowng's analysis and insight...

but EP exists for the ....economics grad. school drop outs...

it exists for all who can do self-study, get some help in reading some graphs, the entire idea is regular folk, esp. those with just a little mathematics and a little econ from undergrad, if you do just a little self study, you can start doing some monitoring on what's really going on economically.

In my opinion, we must. People cannot be turned off or think they just can't get it because some charts, graphs, mathematics and data/statistics pop up in a story.

We need regular folk to start understanding the details...

for the rule of thumb in most scams and twists is....

to hide the facts in mountains of information so the general public has no friggin' clue on what's really going on.....

Dude, thanks...

....but I've been here for almost a full year now :-)!!! I know I haven't contributed much in terms of comments, etc., but I read this site avidly.

"....under Capitalism, man exploits man. Under Communism it's just the opposite..."

---John Kenneth Galbraith

"....under Capitalism, man exploits man. Under Communism it's just the opposite..."

---John Kenneth Galbraith

The Headlines:

We have been warned,

AND

Screwed!

Frank T.

Frank T.

Brad Sester & Household Tresury Purchases

I could be wrong but I believe that just before Brad Sester ‘went off the air' so to speak and stopped blogging, he wrote something to the effect that Treasury was not dependent on foreign investors because Households were buying so much. I could not understand how that could be, given that Households were having trouble coming up with the rent. But, then again I never did understand Brad Sester, he is out of my league.

But, the above section on the “Phantom” category is making me think I understood more than I thought. If anyone remembers Sester’s comments on the subject or knows how to find them it would be interesting to review them in the context of Midtowng’s discussion.

We have been warned, indeed

Wow, I had not realized that the situation was quite this bad, and you outlined it in perfectly rational form. It kind of seems like there isn't really much that could be done in the way of remedying the current situation, aside from trying to avoid making it worse. The next couple decades will surely unfold to be tough times for all of us as a result of the past year.

I'll just start with a

I'll just start with a thanks for the work (and which I have cited) that midtowng and others at the Economic Populist have done.

That said, that $528 billion of US govt. debt was bought by the household sector in 2009 does not seem to be that amazing to me considering that Private Wealth (as pointed out in the post) was $37 trillion. No doubt that value rose in 2007, fell in 2008 and rose in 2009, still it is more than enough to cover a $528 billion purchase when other asset classes were in doubt or falling. Most of that wealth was owned by the top 10%, who are not likely to have suffered as much as the rest of us.

In 2009, the savings rate rose dramatically, and capital investment fell, so increasing government deficit spending is not that far from the mark if we didn't want another great depression. Color me not fearful ... for now.

Still, the cost of the bailouts of wall street and the wealthy are going to be with us for quite some time. From their perspective, we gave them free money for which they have the pleasure of charging us interest. We all know our perspective.

Thanks again for all the info.

Do you think that Government

Do you think that Government Treasury bond funds show under Mutual Funds or the residual? I know that at my work the only option form our 401k that didn't get killed in the downturn was the Government Bonds category and so everybody piled in. If those show under residual rather than the other categories then the number might be real, but not replicable. The money has already shifted and there isn't any more. And as stocks recover a little (for no good reason) the flow will go other way. Anybody know what happens to Government Bond funds as money flows out massively? I am not sure. If it were stocks I'd say it'd get killed. But since bonds have a real yield it probably wouldn't be so bad. Maybe it is only inflation that slaughters bond funds.

Government problems

I saw yesterday that Eric Sprott is betting on another significant downturn in the markets and a much higher gold price, because of all the government intervention and consequences of their policies which would probably imply a lot more problems in housing as well: http://www.businessweek.com/news/2009-12-29/sprott-says-s-p-500-to-tumble-below-its-march-low-update2-.html

there's also some interesting stories on his firm's site on these topics: http://www.sprott.com/PreciousMetals.aspx?id=53

I wasn't aware of this...

This is really a nice read, not just the article itself but the responses posted by your followers. I learn something today that I wasn't aware of until I read your blog.

Fantastic blog, midtowng

Like many of us who have known the numbers haven't added up for quite some time, and those shadowstats (a la John Williams) are forever in the shadows.

You have nicely pulled together all the data to demonstrate those trillions pumped out by the Fed probably went to a variety of central banks (and Fed or gov't-owned offshore entities probably posing as hedge funds) to purchase those Treasuries --- which is why the Fed wants to continue a policy of zero transparency on the matter of those mysterious trillions.

This is a unique point in humanity's economic history, one which makes all predictions highly impractical --- given the extreme number of variables in play.

The one constant we can be sure of: those numbers we hear about -- on a daily, weekly and quarterly basis -- are so terribly skewed such that one must doubt every single indicator and look towards the individual data and note all the variances and discrepancies, be they between real unemployment and fantasy government stats; real agriculture reports from the states, and those fantasy USDA reports, etc., etc., etc.

Again, we should all note that the extremely high number of billionaires of American origin are primarly debt-financed billionaires, they peddled debt for money --- unfortunately saddling the rest of us with that debt.

One giant Ponzi-Tontine-Pump-and-Dump Scheme!

Happy New Year, all!

AWESOME!!!!

This is the single best post made on any economic blog in 2009 and I read them all.

Just to emphasize this part again because it gives legs to what I know has been happening since Nixon took us off the gold standard and started to intentionally hide inflation to keep wages low.

"The artificially low interest rates in America led directly to asset bubbles. These asset bubbles were used to mask the fact that wages weren't keeping up with living standards. Our manufacturing base was being put out of business by the artificially high dollar"

share button

Few use this but there is a share this button on each post.

If you find it awesome, you can submit it to reddit, email it, put it on facebook and all of that stuff.

and of course linking to it in a comment on another site (when it makes sense to mention).

Globalisim Fat Cats on the take and getting Fatter each day

My opinion:

I am wondering, why does this have to be so complicated? We in Amerca did not have a housing bubble problem until we had the sharp rip off rise in energy prices first, It is called a trickle down effect. How strange, we have a oil shortage until the price gets up to a certain point and all the time we have never ran out of oil. I once blamed the greedy oil companies for this, not the bankers for making bad loans, but however it looks as they now are playing the oil futures market. I may be wrong but it looks like to me they are taking interest free money supplied at tax payer expense and instead of lending to small business they rent super tankers and hold the oil at sea until they can screw us futher with a higher price on energy. It does not take a rocket scientist to figure out when you change the price of energy if effects the price of most everything else. I guess the dumbing down of America with programs like no child left be hind kind of helps keep all the sheep in a tighter herd.

http://www.bloomberg.com/apps/news?pid=20601109&sid=abS1HzLIvy_k&pos=13

If the millions of jobs that were once in America were still here, I do not think we would have a health care issue. The money has to come from some where and now you get to pick up the tab. It goes on and on, Makes me want to puke.

Ponzi ??

Well, Bernard Madoff was able to run his Ponzi scheme for 20 years, maybe the US government can do the same ?? what do you think ??