Last week, Ben Bernanke blamed lax regulation for the financial crisis. He was responding to those who claim low interest rate environment caused the crisis. Conservatives blame Fannie Mae and Freddie Mac. These all were contributing factors and not the real cause of the crisis. The depth of this crisis is too severe to blame one or several contributing factor.

It was economic policy that took root over 25 years ago and fostered since then that caused this economic crisis we know as the Great Recession. I am afraid we are failing to recognize the real cause of this crisis and instead focusing on treating the symptoms and not curing the disease. Failure to correct the defective economic policies will only welcome another economic crisis probably in the not too distant future and probably more severe.

There are two major macroeconomic arrangements that have existed for the past 25 years and that can explain this economic crisis. First, the U.S. economic growth model and the pattern of income inequality and demand generation (the driving force of economic growth) within the economy. Second, U.S. model for global engagement and U.S. participation in globalization. According to Dr. Palley:

The macroeconomic forces unleashed by these twin factors have accumulated gradually and made for an increasingly fragile and unstable macroeconomic environment. The brewing instability over the past two decades has been visible in successive asset bubbles, rising indebtedness, rising trade deficits, and business cycles marked by initial weakness (so-called jobless recovery) followed by febrile booms. However, investors, policymakers, and economists chose to ignore these danger signs, resolutely refusing to examine the flawed macroeconomic arrangements that have led us to the cliff’s edge. It is time to take a step back and look at how we got ourselves in this precarious position. Then perhaps we can figure out where to go next.

I. Bad Economic Growth Model

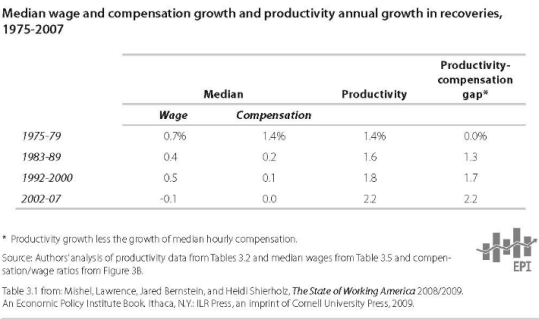

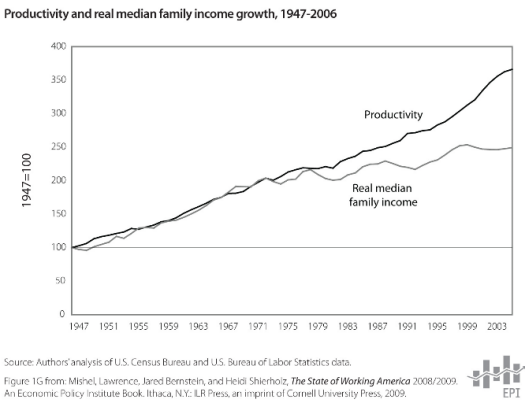

Before 1980, economic policy was geared towards full employment and we had an economy where wages grew with productivity. It was a system that worked for the greatest number of people. Here is how Dr. Palley described it:

This configuration created a virtuous circle of growth. Rising wages meant robust aggregate demand, which contributed to full employment. Full employment in turn provided an incentive to invest, which raised productivity, thereby supporting higher wages.

But this all changed with the election of Ronald Reagan and the emergence of neoliberalism and monetarism. Emphasis turned to inflation. Wage growth and full employment were seen as inflationary and anything related to wage growth including unions had to be destroyed.

And this:

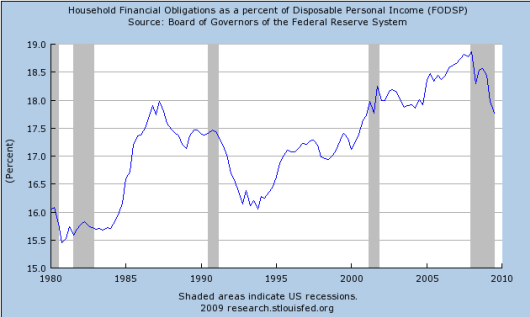

Notice the gap between wages and productivity starting to grow around 1980. What replaced wage growth as a source of demand - hence economic growth? Debt and something called asset price inflation. Check this graph out:

The above graph shows the amount of financial obligations as a percentage of disposable personal income. This measures leverage/debt of a household. Notice a trend? Asset price inflation such as stocks and particularly home prices is needed for collateral to support debt financed spending:

Asset prices are bid up by a host of measures, including higher profits, savings by the super-rich that are directed to asset purchases, borrowing to buy assets, and such institutional changes as the shift from traditional defined benefit pension plans to defined contribution—such as 401(k)—pension plans. Consumption is maintained by lower household savings rates and by borrowing that is collateralized by higher asset prices. The reduction in savings rates is partly a response to squeezed incomes and partly rationalized on the grounds that households are wealthier because of higher asset prices (including house prices).

Increased borrowing was spurned on by 'financial innovation' and deregulation - anything to increase leverage/debt in order to provide a substitute for wage growth. Financialization increased leverage and widened the range of assets that could be collateralized. In the end, financialization and financial innovation did very little for us but did wonders for financial conglomerates and the financial oligarchy.

This flawed economic growth model gets worse. Cheap imports were used to compensate and appease the masses for stagnate wage growth. Rising income inequality and wealth made high-end consumption a larger and more important component of economic activity (See these Citigroup reports regarding U.S. Plutonomy: here and here ). According to Dr. Palley:

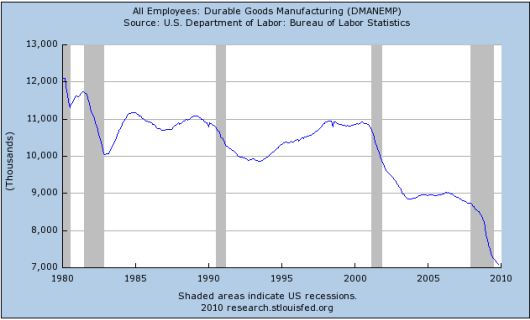

These features have been visible in every U.S. business cycle since 1980, and the business cycles under presidents Reagan, Bush père, Clinton, and Bush fils have robust commonalities that reveal their shared economic paradigm. Those features include asset price inflation (equities and housing); widening income inequality; detachment of worker wages from productivity growth; rising household and corporate leverage ratios measured respectively as debt/income and debt/equity ratios; a strong dollar; trade deficits; disinflation or low inflation; and manufacturing job loss.

At the foundation of this flawed economic growth model, whether intentional or unintentional, is redirection of income from low income and middle income households to corporate profits and upper income households. We wonder why the middle class is disappearing. How does this happen: through wage stagnation and huge tax cuts.

The major problem with this economic growth model, and it is what we are experiencing now, is that it is NOT sustainable. Our economy relies heavily on consumer spending and to maintain the level of consumer spending required even more debt and even lower savings rates. There are limits to both requirements: more debt requires even higher asset prices to borrow against but asset prices, as we found out the hard way, don't always go up; and we can't maintain a negative saving rate for long periods of time without severe consequences.

So, we are basically screwed, unless something changes - even government stimulus has its limits, the two drivers of economic growth are exhausted - more debt and lower savings rate. And we wonder why our economic recovery will be sluggish to non-existent. If we try to rebuild our financial worth and repair our family balance sheets that will increase savings rates, which will further deepen and prolong the downturn. This should be a good thing but not with our flawed economic growth model.

The economic growth model adopted after 1980 lasted far longer than it might have been expected to because of our capacity to expand access to debt and increase leverage. That is the real significance of deregulation and financial innovation. However, delaying the day of reckoning also made it more severe when it arrived. When the subprime detonator set off the financial crisis, the economy’s financial structure—25 years in the making and integrally linked to the economic logic of the neo-liberal growth model—proved to be extremely fragile and akin to a house of cards.

II. Bad Global Engagement

Our currently flawed economic growth model other major weakness is HOW we participate in globalization. It wasn't enough to engage trading partners in a fair and equitable way that would support both countries economically and environmentally. This economic growth model depends on U.S. companies turn multi-national corporations (MNC) to maximize corporate profits at the expense of U.S. families. But this flawed global engagement did another thing that is often overlooked: it accelerated the accumulation of unproductive debt - that is, debt that generates economic activity elsewhere rather than in the United States.

According to Dr. Palley, our flawed global engagement caused a 'triple hemorrhage' within our economy. First economic hemorrhage had to do with leakage out of the economy via spending on imports. Our income and debt went to buy imports from flat screen TVs to cars. This obviously created economic growth and increase incomes offshore or in other countries and not in the U.S. As a result, accumulated debt left behind a footprint but did not create sustainable jobs and incomes in the U.S..

Second economic hemorrhage had to do with leakage of jobs. This flawed economic model depends on suppressing wage growth and what better way to do that then to out source and offshore jobs particularly good paying manufacturing jobs.

Nice downward trend in manufacturing jobs! But even the threat of offshoring jobs was enough for MNC to secure lower wages. This overall strategy was successful in suppressing wage growth. But it also cut into family incomes thereby redirecting income to corporate profits.

Third economic hemorrhage involved new investment or the lack of it.

Not only were corporations incentivized by low foreign wages, foreign subsidies, and under-valued exchange rates to close existing plants and shift their production offshore, they were also incentivized to shift new investment offshore. That did double damage. First, it reduced domestic investment spending, hurting the capital goods sector and employment therein. Second, it stripped the U.S. economy of modern industrial capacity, disadvantaging U.S. competitiveness and reducing employment that would have been generated to operate that capacity.

III. Got it!

As much as the Fed, financial conglomerates, financial oligarchy, Bush and Obama Administrations deserve the criticism, it was actually accumulative effects of economic policies put in place years ago that caused this crisis. This is the Class War that is being lost today. The suppression of wage growth, over reliance on asset prices and debt, and unfettered globalization caused our demise. We must recognize this if we are going to change anything. If we fail to do so any economic recovery will be short lived and more and more families will fall behind.

Cross posted @ Rebel Capitalist

Comments

some more data

Firstly those who are in denial will blame the increases in productivity on technological advances. Part of this is true, but there is a hidden part, in that due to global supply chains and moving production offshore, some of that should not be attributed to U.S. productivity at all, because it's not U.S. wages/workers that are involved in that leg of production.

Secondly, we also have some of U.S. GDP being calculated that also should be attributed to other domestic GDPs because the final products and some of the production is actually going on in other countries.

Manufacturing sector I believe (last 10 years?) has gone from about 15% of the total economy to about 12% currently...

a dramatic shift. Also, high paying jobs are being targeted for labor arbitrage. There was a mass exodus to offshore outsource advanced R&D in pharmaceuticals. Advanced R&D often requires a PhD but at least a B.S. to even work in it. So here are top tier, the highest educated, being subject to labor arbitrage due to offshore outsourcing.

I.T. has been under the worst attack, with entire I.T. departments offshore outsourced and if corporations cannot do that, they use Indian body shops to supply foreign guest workers to do the work in the U.S.

Same is true in high paying engineering R&D. Corporations are using H-1B guest worker Visas as well as offshore outsourcing advanced R&D in all sorts of tech, again to wage repress, arbitrage and most importantly, technology transfer large projects offshore.

Great post and until we get some real action on these affects, I don't believe the U.S. economy has a prayer's chance of recovering.

Example

John F. Welch Technology Centre in Banglore, India - GE's second largest research facility.

I wonder how many U.S. government contracts for various research being carried out in this facility.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

This is what we have become: Bubbles, Bubbles

CR has this post Bubbles and Employment that implicitly supports the argument about flawed macroeconomic policy.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

add to that

I've said this for some time, the real recession started with the mass exodus of jobs due to both the China PNTR (started operating in 2000) and massive offshore outsourcing (on steroids, in every corporate "plan" starting in 2000)

and the housing bubble simply masked those effects by overinflating the residential real estate, construction jobs.

Made the unemployment rate look ok and oh yeah, the only way to see the massive labor arbitrage in tech jobs is to

1. count the H-1B and L-1 Visas in the country for they are counted as "workers" thus depressing the unemployment rate for STEM, plus:

2. the total number of jobs in those occupation sectors, which are lower.

Nicely done, RC. I wish you guys ...

...were getting more visitors. Although I know that Daily Kos isn't always the friendliest environment for serious thought pieces like many that are posted here at Economic Populist, I would urge you all - since you already have done the hard work of researching, thinking and writing, to cross post. Even if you only pick up 10-20 comments, that 10-20 more that you didn't have before. Over time, I think the folks I read here could all find a reasonably sized audience at DK.

But, whether you choose to or not, thanks for your good work.

Not pretending to be an economist

Not pretending to be an economist

Thanks.

and I enjoyed your preview of FCIC this morning.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

ah yes Meteor

how about cross posting on EP? ;)

FYI Meteor

While the comments are much smaller on EP and hopefully the upgrades will encourage more comments....

as far as I can tell from the published stats per post, we're getting more reads per post than one would on DK, even at the top of the rec for 24 hrs.

I might be wrong, reading the wrong stats but that's what I've come up with so far.

Of course I'm all for cross posting too, just sayin'.

Then, there are some political agendas going on that really don't add up by the econ numbers, so at least for me, I want this space to be about the numbers even when they conclude something not so popular in some political groups.

But yeah, we should all be cross posting around but I'd finally say it appears most of EP readers are coming from the financial blogs, econ blogs and financial press...

at least that's also what the stats say for the site. We get very few link overs from DK and/or other Political sites...which is kind of strange in a way but there ya have it.

Maybe once a month or so I will put up an admin Instapopulist with some of the stats, but we do need to reach out much more!

All EPers: Green Shooter mania, be prepared blip alert!

Q4 GDP blip alert.

Seems GS has projected a 5.8% Q4 2009 GDP number....

so as you can imagine the green shooters will be in hysteria over this one!

Myself, I will be all over GDP details, tracing every variable I possibly can....

cause looking at the overall EIs every day....I will be highly suspect of anything that causes the green shooters to run up and down the halls claiming all of those gloom and doomers "just don't understand econ" BS....

Anywho, I imagine we'll have a few more economics blog wars over this puppy so get your mega calculators out!

difficulty with CAPTCHA field, characters appear double

I got in this time but field is hard to read and tell upper from lower case. Perhaps you would get more postings if this was fixed. I post frequently on Democratic Underground. The threads related to H-1B usually provoke mostly anti H-1B responses.

I suspect that the trade deficit is the macro driver heat engine behind the financial meltdown and I am not an econ guru at all but It just seems like common sense that consuming without producing much is not sustainable and leads to a pileup of debt everywhere.

CAPTCHA

Yes, you are right, the CAPTCHA is a nightmare and I still have to manually monitor comments due to spam getting through.

Bear with me, I am working on site upgrades at which point (I hope) the other security will improve and the intense CAPTCHA will be modified.

I've been working on this for about a week and keep having to do other things and this site upgrade is some intense crap, I expect the site to be down significant time to do it in the final port.

Also, if you create an account, log in, all CAPTCHA is bypassed for you are logged in.

Bear in mind DU requires you to login.

Pretty much everyone who is a U.S. techie knows about H-1B, L-1 and if they have been working for awhile, either has been displaced or one of their friends was. Same with a lot of families now, so word is getting out on what's really happening. The problem is getting people organized to be a political force to do something. Then, there are various opinions on what to do. Some want to just plain ban the program as well as all green cards, some want just green cards, others (like myself) want a a host of conditions as well as hard caps, reforms.......

but it is not a partisan issue, more like "do you know a techie" issue, once someone sees it or experiences it...seems like only then do they believe it.

Someone else concludes a redirection of income

Although for different reasons:

From Albert Edwards, chief strategist for a major international bank.:

Like, Tyler Durden says "These are not the deranged ramblings of a fringe blogger". Although, I don't consider myself deranged (fringe hell yes), people have been saying this same thing for THE longest time - especially Dr. Palley.

Hey, Bloomberg or CNBC before you contact Durden about this why don't you contact some REAL economist who have been studying the redistribution issue for a long time. People such as Dr. Palley or Prof. Emmanuel Saez. But you won't because you don't want the TRUTH.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

fringe? honestly I don't think so

We maybe on line and using graphs, calculators, and mimetex here but I suspect if you go bring up say the Supreme court ruling today to the check out gal at the grocery, she's going to say what bullshit that is in a heart beat.

Minus the graphs, maths and 3 letter mnemonics, I think this site is about as mainstream as it gets.

This is what may happen

CNBC or Bloomberg producer will get hold of Zero Hedge and will contact Durden or even the author of the letter for interviews. The interviews will focus on Bernanke and very little to nothing will be on how middle class is getting screwed by neo-liberal policies started by Greenspan and Reagan.

They won't bother contacting those who really know the truth.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.