January 2010 Industrial Production and Capacity Utilization was released today. We have a solid gain of 0.9% for the month and the year to year also have a 0.9% gain.

Industrial production increased 0.9 percent in January following a gain of 0.7 percent in December. Manufacturing production rose 1.0 percent in January, with increases for most of its major components, while the indexes for both utilities and mining advanced 0.7 percent. At 101.1 percent of its 2002 average, output in January was 0.9 percent above its year-earlier level. The capacity utilization rate for total industry rose 0.7 percentage point to 72.6 percent, a rate 8.0 percentage points below its average from 1972 to 2009.

Of the major groups, even construction had a positive gain of 1%, but down -5.3% for the year.

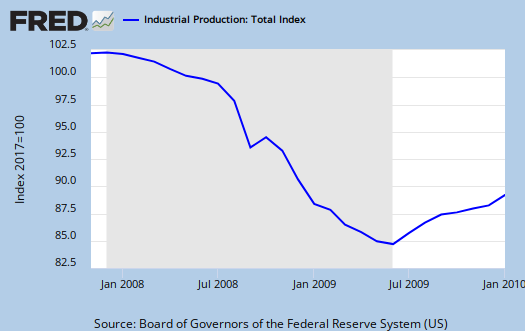

To put this is context, here is a graph of industrial production from right before the start of this recession.

As you can see industrial production is still way below it's value at the start of this recession, defined as December 2007. Also note we see a clear pattern of an upward slope, which is very good news and an implication that the real economy at least is recovering.

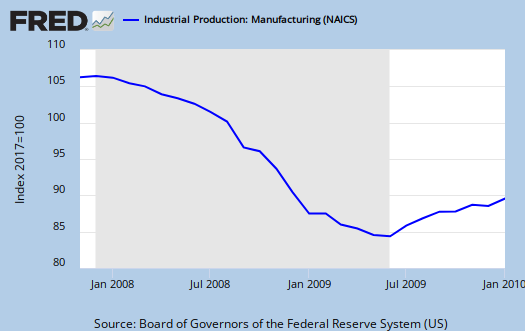

Let's look at total manufacturing, this month's report shows an increase (but note it was flat previously).

and manufacturing capacity:

In terms of durable goods manufacturing, auto products increased 5.1% from last month and weird but true, gas production decreased. I guess people finally wore out their clothes for clothing increased 3.3%.

All in all, this is a pretty good report at least for the real economy. Manufacturing isn't as well defined of an upward trend as the overall industrial production and capacity utilization numbers are, so I have a more wait and see. Of course none of this negates the need for a strong, national industrial and manufacturing strategy as well as a direct jobs program. With an upward trend of this slope, lord knows how long unemployment will stay for it will clearly take months, even years to return to pre-recession levels.

Subject Meta:

Forum Categories:

| Attachment | Size |

|---|---|

| 226.86 KB |

Nice, but....

still doesn't mean the employment situation will improve. Most manufacturing and service sector companies have learned to make due with less employees. Add in technology, and the need for more employees diminishes relative to the rate of productivity one can get out of both capital and technological upgrades. One need look at the changes in unit labor costs and compare that to the productivity output figures. Sadly, what's needed is new employers, new entrapaneurs to pick up the slack labor supply.

That isn't so to say you won't see U3 (or even U6, though I doubt this one) change. RO, I can't shake the feeling that they will once more change the forumula/definition of these unemployment figures. Massaging the numbers to get their favored outcome.

productivity

The "O" word is the one that needs to be mentioned in terms of productivity, offshore outsourcing, the use of foreign guest workers, temporary workers....

Technology (I'm sorry it just has not) advanced this much to account for those soaring productivity rates.

Yeah, it's anything but provide Americans with stable good paying jobs coming from business....it's almost like some sort of culture club to try to get even work for free it's so bad.

Well chime in on DOL analysis because I spend HOURS looking at those stats and deriving, digging around.....and you can see that's where all of the people looking at those numbers, esp. on the econ blogs, it goes haywire, we're all having to extrapolate out the true state of unemployment!

On IP I make a point to differentiate between the slope, which looks very good to the absolute levels, which is so below even the start of this recession. I should do a few graphs next time to show the slow steady decline over 30 years for U.S. manufacturing...that really drives it home.