Back in early July, I wrote a diary called Neutron Bomb over Wall Street in which I speculated that the ongoing old-fashioned "slow motion bust" was destroying Wall Street finance but leaving the Main Street economy largely intact. Shortly afterward, a few mainstream economists such as Prof. Brad de Long of Berkeley picked up on the same point.

After the bloodbath on Monday, a bloodbath that seems to be spreading almost by the hour to other banks and financial houses, it is worthwhile to revisit that idea: just how much of the financial system disaster is spreading into mainstream Main Street America?

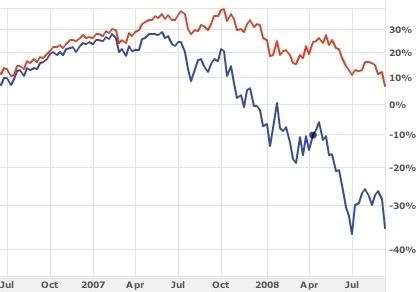

The financial sector and the mainstream economy began to diverge, as shown on the accompanying graph, in about February 2007.

Including Monday's 500 point loss in the DJIA, the financial sector had lost nearly 50% of its value since that time (-46.5% to be more precise). The overall S&P had lost only 14.6% since then. Since Wall Street constitutes 16.19% of economy, by using some pretty simple math it is easy to calculate that since February 2007, the value of the non-financial part of corporate America has not contracted at all, but rather grown 8%!

In my original discussion over 2 months ago, I noted that both manufacturing and services were holding up rather well. While they weren't growing, they weren't contracting either. That is still the case:

And consumers, as measured by retail sales, hadn't given up the ghost yet either. That part of the picture has dimmed a little, but still is much better than in our last recession:

So, even though as of today, there is no doubt that the "neutron bomb over Wall Street" has exploded, there is still relatively little evidence that Main Street America is being significantly impacted.

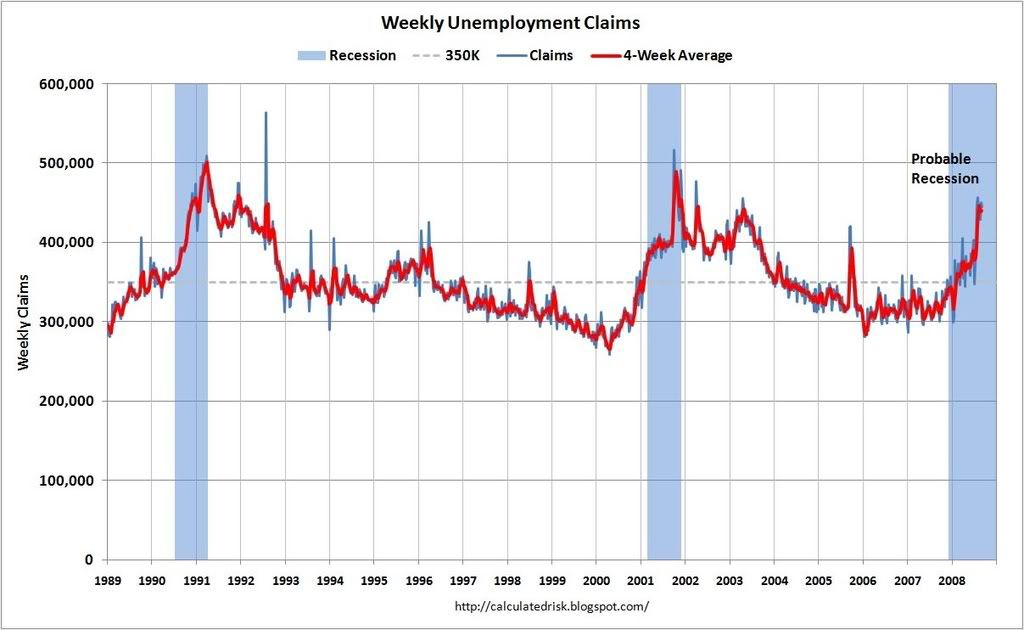

That might be beginning to change, however. In the first place, jobless claims have risen into recessionary territory:

While by the standards of past recessions, the most recent data is still pretty tame, jobless claims are a leading indicator, meaning that by early next year sometime, there could be a "second leg down" in the recession, this time more directly impacting ordinary consumers (including, needless to say, consumers who had nothing to do with the housing bubble). If you return to my first graph above, note that since the last bottom in July, the broader market has actually fared slightly worse than the financial sector!

Additionally, the latest companies put on the critical list (and may be D.O.A. by the time this diary is published) include the nation's biggest insurer (AIG) and two of the nation's most prominent banks: Washington Mutual and Wachovia. If the crisis of financial confidence spreads to insurers and commercial banks, all bets for containment of the crisis to Wall Street are off.

UPDATE: Prof. de Long (coincidentally today) and bonddad argue that Industrial production data just released, show the recession is spreading to manufacturing as well. A longer-term chart:

confirms the slowdown is spreading, but also confirms that the slowdown is not nearly at the levels of the last recession (which was pretty tepid) -- yet.

Comments

Containment?

This is eerily similar to the idea in the early aughts that the dot.com meltdown wouldn't necessarily spread to the "old economy".

The non-bailout bailout of Lehman

Remember how the government didn't bail out Lehman? Just just one little thing about that.

who is keeping score?

I just sent out the $3T Stiglitz Iraq war estimate claiming this is currently about $500B and ...hitting maybe $1T...

but now I'm wondering. Surely someone out on the Internets has a nice little bailout counter.

I also posted last night that report on an analyst in Asia with the "D" word for US and EU.

That's another question, where is the tipping point in US national debt where the US would actually default?

Ah, corporate socialism. I guess that's what happens since our government represents the corporations and not the people.