Originally published in a collection of opinions on the question Is Financial Globalization Beginning A Process of Reversal? (pdf) The collection notes The European Banking Sector is 65% of all global banking.

Globalism is a conspiracy against First World jobs. It is the process by which capital extracts surplus and appropriates the earnings of labor. By moving offshore the production of goods and services for the home market, corporations benefit from labor arbitrage. Because of large excess supplies of labor, corporations can hire employees in China, India, Indonesia, and elsewhere at wages below the value of the marginal product of labor, thus raising the returns to capital.

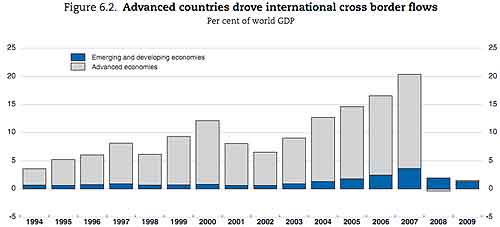

Source: OECD, Economic Outlook 2011

If globalism reverses, it will have little to do with capital adequacy, deregulation, and sovereign debt. It will have to do with the fact that corporations, by offshoring jobs in pursuit of short-run profits, have undermined domestic First World economies by moving countries' GDP, tax base, consumer incomes, and career opportunities to developing countries.

The extraordinary debt leverage and fraud made possible by financial deregulation produced the financial crisis. The crisis of globalism is the inability of First World economies to produce new jobs other than in domestic non-tradable services.

As Michael Hudson has shown, the response to the debt crisis is to shift the costs of the mistakes made by banks and governments onto the backs of ordinary people. Thus, the large and persistent protests in the streets of Greece and Spain against allegedly "representative" governments for implementing the bankers' policies that reduce the living standards of people in order to protect bankers and their shareholders from losses.

It was ever thus. In his classic history, The Rise And Fall Of The British Empire, Lawrence James writes that the Anglo-Egyptian War of 1882 was perceived "as having been foisted on the government by a clique of investors. Sir William Gregory, a former Tory MP and governor of Ceylon, argued that,

We are the only nation which had an honest sympathy with the unfortunate peasants of the Nile Valley, and yet we are forced to be the n-word-drivers, the administrators of the lash to exact the last piastre from these poor wretches for the benefit of bondholders.

Today economists are allied with globalists to drive wages to subsistence levels and to privatize for the benefit of the banks and their customers the remaining areas of public domain. To quote Hudson, globalism and financialization (the drive by the financial sector to absorb the entire economic surplus in the form of profit, interest, penalties, and fees) are

economic warfare by non-military means.

This article originally appeared in the summer 2011 edition of The International Economy

Comments

These Chinese Banks Aren't Banks as You Know Them

Naked Capitalism just put up an in depth interview on the Chinese banking system. This might make it to the FMN, but for now, since it goes along with capital flows and EEs, you might want to checked it out.

Complicated, not sure about FMN

At first I didn't think so, but you have put this note-worthy discussion of China banking at the right place!

I am in the middle of scrutinizing all four videos carefully. But I'm not sure that it would be of interest to everyone -- maybe not up to the FMN standard in that way. The viewer has to be willing to put some mental energy into trying to see things from the point of view of Beijing or Shanghai.

I found it puzzling the way these guys more or less shrugged off monetarism. They didn't use the term 'fiat money' but that was the way they looked at things, talking about "printing up" money. I mean, we all understand the importance of keeping money supply right and transparency and all, but is the People's Bank the only central bank in the world that "prints up" money? I have this idea that the Federal Reserve effectively does that too. And is "printing" money in and of itself a bad thing? Of course, it's wrong the way it's done, but monetarism itself isn't the problem, or, if it is, JP Morgan is in deep doodoo.

(Since I am a supporter of the American Monetary Institute, I have a particular opinion on all this. And, beyond AMI, I hold the work of Henry C. Simons very high, even though I am fundamentally a protectionist whereas Simons was the opposite at the end of World War II, without the experiential knowledge of globalism that we have today. Of course, Simons, founder of the original 'Chicago School', advocated for a publicly owned banking system, at least for public ownership and control of the Federal Reserve, if not more.)

I understand that these guys are not meeting to discuss monetary theory. But they are discussing a huge experiment in monetarism. And they bring their theoretical prejudices with them (which doesn't make their empirical observations less valid).

Everything discussed brings Singapore to mind. Of course, China is huge, Singapore is tiny. But there are many similarities in their economies, such as the numerous "entities" that are actually government-run and public-funded and/or public-owned, even when foreign capital is involved.

Here's a remarkable factoid, assuming that these guys have the numbers: they say that China (I believe that means People's Bank of China, the government-run central bank) is currently increasing money supply some 15% to 20% per year. They don't have much population growth and I don't believe that even China's economy is growing 15% per year or that their savings in real terms are increasing 20% per year.

It's complicated. Really complicated. Like Singapore, there's a lot more government in everything and everywhere than is visible on the surface.

See, David Cay Johnston's Reuters column on Singapore (including comments) -

Think Sinagpore is a Low-Tax Haven?

Applause

Could I just say that I love reading your comments? Every time I do I learn about something new I'll need to research in my free time.

Thank you!

EP in general is awesome!

Outsourcing is a monetary phenomenon

Outsourcing is a monetary phenomenon that depends on continued world inflation. In order for foreign labor costs to be artifically cheaper based on exchange rates; foreign countries have to keep creating new money out of thin air faster then the US. Labor arbitrage and trade today is nothing more than a money printing out of thin air game.

The reason not many jobs have been created in the US with the money printing stimulus packages is because the tax cuts and stimulus money created out of thin air have been used to fund the outsourcing of jobs, factories, technology transfers overseas, wars, overseas military bases, infrastructure projects abroad, commodities speculation and the consumption of foreign subsidized manufactured goods.

Yes taxes in the US could be lower because on paper they are high but the big multinational corporations don’t pay much tax anyway and get free services from government like the US military making the world safe for outsourcing. Even if taxes were set to zero in US, the multinationals would still find an excuse to outsource because countries that manipulate their exchange rates by creating new money out of thin air faster then the US would still make foreign labor costs artificially cheaper. The reason that tax cuts are not creating jobs in the US is because the money is being used to consume foreign subsidized manufactured goods and is being used to build factories overseas.

Japan, Germany and China are an interesting mix of countries because they have higher and lower taxes, higher and lower regulations, higher and lower valued exchange rates, higher and lower labor costs, higher and lower inflation then the US but yet they all have trade surpluses and a growing economy. The reason they have trade surplus, a growing economy and lower unemployment than the US is because the money they create no matter how distorting it can be to the economy is used to fund production and industrial activity within their countries.

outsourcing capital flows, monetary

Well, China's currency manipulation (and it's rarely mentioned this is the reason they buy up U.S. Treasuries, they have to in order to manipulate their currency), clearly enables them to undercut the U.S. in overall costs as well as labor costs.

This is interesting. Capital flows, esp. the never ending herd "all rush to EE's" behavior, is something few have really analyzed and I was noticing this from our lovely globalists as somehow a "good" thing to globalize finance and freely play nation-states against each other around the globe.

Germany, France have strong labor laws, a host of policies that keep their wages high, unions strong and jobs in Germany France, so there is much more to that story.

But interesting view, some analysis would be awesome.

Germany, France

The reason Germany and France do so well, in part, is that they are also the beneficiaries of currency manipulation. The strong economies of Germany and France have been tied to the weak economies of Portugal, Ireland, Greece, Italy, and Spain, via the Euro. This gives Germany and France a cheaper currency than they had under the Deutschemark and Franc, making their exports and labor markets more attractive, just like China's exports and labor markets are beating the US'.

At the same time, the PIIGS get lower interest rates for their debt, but in a stronger currency, where they're ultimately unable to compete. Of course, the endgame for Europe will be different than for US+China.. In the US-China case, the debtor also controls the interest rates and value of the currency underlying the debt. The PIIGS won't be so fortunate.

Even King Gold is subject to fundamentals

The question posed by Paul Craig Roberts reduces to "Is the world system of financial capitalism subject to fundamentals?" We could compare that to a question like "Is Disney World a suitable model for civilization?"

I think that just as surely as all men are animals implies that all men are mortal ... just as surely as all things come to an end ... even King Gold is mortal. And when the public comes to that realization, the world system of financial capitalism will once again consider itself to be immortal ... but in that regard, every world system is delusional.

Meanwhile, although banks are still stressed by Europe news, the stock market is said to be stabilizing today (22 August 2011). Paradoxically, gold still rides high and the reign of the Gold King continues.

What we should be watching more than the US$ price of gold and much more than US$ "targets" for gold (e.g., Ron Paul's $5000 per ounce) is US$ adjusted for inflation, production volume (including reclamation) and trading volume.

Graph from RealTerms.de via Wikipedia (released by owner to public domain)

We may be nearing a situation where prices remain high because few buy, few also want to sell. When volume is low enough, reported trading prices inevitably become meaningless as they can be manipulated by a few gold holders or brokers selling and buying among themselves.

Excerpting for review purposes from Jan Harvey, writing in London for Reuters via NewsFeedResearcher.com

With gold, you have to consider not only Wall Street or Main Street, as you have to consider "the street" all over the world. If you find numbers for Wall Street to be elusive and numbers for Main Street to be controversial ... try numbers from "the street" all over the world!

From the Bangkok Post (August 22 in USA/August 23 in Bangkok) --

There is an excellent discussion going on, along with an online poll, available at a Wall Street Journal webpage, online.wsj.com --

For example, Ryan Shells (22 August 2011) opines:

However, Michael Smith has a different opinion, not exactly free of political passion:

But financial advisor Hal E. Berger (August 22) writes:

I continue my speculation (with words rather than with my hard-earned dollars) that the Gold King continues to ride high, but there will be a decline in the price of gold in about a month, and that will correlate with what will be celebrated as a bull market in equity markets following the President's signing of Super Congress legislation, including several FTAs and despite continuing bad numbers for U.S. employment. That's possible, since US economy and NYSE are not necessarily coupled as has been classically presumed. Holding equity in MNCs may be seen as a hedge against US $ dollar inflation just as much as gold!

Are we (US) a first world nation like members of the EU or are we a third world nation? We need to keep in mind that in third world nations. the national stock exchange operates independently of little changes that affect the impoverished masses. Indeed, stock market averages may be inversely related to the impoverishment of the masses!

Is there no ring of truth in the observation that "gold is an emotional commodity"?

[NOTE: All links tested as of posting, but some of them may go away tomorrow or so.]

Gold becoming rational?

Of course, spin is never rational, what with the media hype of "July durable goods" -- hardly sufficient to signal a recovery in the midst of so much other bad economic news.

According to TheStreet.com --

The irrational bubble aspect of the gold market was clear, gold had to fall, stocks had to rise, but it's happening much faster than I thought. This probably has much more to do with the Libyan situation than with the durable goods report. Fall of Qaddafi is lowering the uncertainty level by increasing confidence in the U.S. government, Obama administration, NATO and the EU.

On the USA side, there's also the all-time-high in disapproval rating for Congress. Many congress critturs were afraid to hold any August Town Hall meetings. Instead -- realizing they had had a good run -- they realized that for congress critturs and friends to hang on to their gold required more courage than they are accustomed to using. So the cash-out has begun.

My predictions were good as an overall framework for the dynamics, but my timing was off -- I thought in terms of things changing slowly, as befits the thinking of an old man. Markets are moving much faster than I thought they would.

I thought gold would start to get rational after the President signs the Super Congress legislation in a month or two. It now looks like all that markets will need is enactment of the three FTAs, and markets are busy discounting (anticipating) that already.

Since I am advocating defeat of the FTAs -- or Obama simply NOT sending the FTAs (all negotiated during the Bush administration) to Congress. If any wonderful surprise like that should occur, of course, gold will zoom up again.

There's probably some play left in gold as it continues down overall. The year still could end with gold at or near $2000, depending on unforeseeable events. Meanwhile, talk will be about fundamentals -- gold production, gold reclamation, industrial applications, jewelry demand.

I thought the Gold-King-rides-high period had enough momentum to carry it another month or so. I thought the goldbugs had enough guts to make that happen. I should have realized that the basic motivation of goldbugs is greed, and courage has nothing to do with it. Fear? Yes. Courage? No.

We appear to be already in the period of people cashing out to buy into equity shares while there's still juicy bottom-feeding available there. The other thing is, once the cash-out begins, greed works differently because you now have to think about the possibility that you can sell gold now and buy it back later, ending up with maybe 150% of what you sold. So, even from the point of view of a gold hoarder, selling is the thing to do, once the cash-out has begun.

The herd is on the move, to settle down once they run out of energy and find some decent grazing.

The Gold Sky if Falling, but wait for it.....

It's down over $100 in a day, but I think when Q2 GDP revisions happen on Friday plus, all week Bernanke's Jackson hole speech is being "previewed" and I believe they will be sorely disappointed on QE3, not only were the result questionable, but this time, core inflation is just a little too high, so I don't think they are going to do it.

Add some more bad news from Greece, Europe, and I'll bet Gold stops it's ugly fall for now.

Ya sure

As I have remarked above, gold could still end the year at $2000. I doubt that it will fall much below $1500, for sure not below $1000.

As I also have noted, extrinsic factors such as the recent Libya news actually have an effect on the gold markets.

I find deeply irrational markets to be troubling. Just my sense of fitness. So I welcome rationality.

Strauss-Kahn versus reversal of financial capitalism

Put down that copy of David Cay Johnston's Perfectly Legal: The Covert Campaign to Rig Our Tax System to Benefit the Super Rich - and Cheat Everybody Else -- no sex angle there!

Get rid of Paul Craig Roberts' Is Fiinancial Globalization Beginning a Process of Reversal?

There's more IMPORTANT news!

Nafissatou Diallo and Dominque Strauss-Kahn!

This story's got it all -- documented gossip about everything from immigration scams to socialist do-gooder subsidized apartments in Manhattan to money laundering to financial hanky-panky around Greek bonds!

There's an old saying among 'criminal lawyers' (almost as interesting a term as 'criminal law') that you can beat the charge but you can never beat the rap. This was widely applied to who was it? -- oh, yeah, that OJ guy!

Anyway, here's the IMPORTANT news about the unfortunate Dominique Strauss-Kahn -- important here at EP because of the connection with how the IMF may or may not have been handling bonds issued by, or to be issued by, the government of Greece and possible related financial (as distinguished from sexual) hanky-panky --

See, my comment back on 1 July 2011, titled 'Economic aspect of the case' at Robert Oak's 'We Don't Believe Her' (and my earlier comments back into May) linking to remarks of Forrest Cookson at DebateRX, 'Deep Doings at the IMF' (more than 6,000 viewings, not bad for a little independent blogger out of Bangladesh).

From KABC (New York) --

The news:

The rap:

But the rap goes on!

According to New York Post exclusive --

Okay, that's enough. Where did I put my free download of Paul Craig Roberts?

[Links verified as of posting.]

It is interesting to note how

It is interesting to note how few entities control/influence the world's financial system. This study shows that it is 140 or so entities who control nearly 40 percent of all of monetary value of transnational corporations

https://docs.google.com/viewer?a=v&pid=explorer&chrome=true&srcid=0B2iJE...