US oil and gas drilling operations continued to shut down at an unprecedented rate last week, as Baker Hughes reported the rig count on February 13th was at 1358, down by a record 98 rigs from February 6th, with oil rigs down 84 to 1056, gas rigs down 14 to 300, and rigs classified as miscellaneous unchanged at 2. This follows last week's report when total US drilling rigs in use fell by 87, and the prior week when the count fell by what was then a one week record of 90 rigs. The count of land-based rigs fell by 99 to 1298, and one of the nine rigs operating on inland waters was taken out of service, while an additional two drilling platforms were added in US waters offshore, raising the offshore rig count to 52. The count of horizontal well drilling rigs was down by 63 to 1025, the number of directional well rigs fell by 12 to 123, and the count of vertical well rigs fell by 23 to 210.. This report left the US rig count 406 rigs lower than the count from the report of last February 13th, with oil rigs down 367, gas rigs down 37, and miscellaneous rigs down 2 from a year ago.

Most of the rigs that were shut down this week came from central US shale plays, with the 49 rigs that were pulled from operations in the Permian Basin accounting for half of the total rigs idled. Thus Texas, also losing multiple rigs in the Eagle Ford and the Barnett Shale, accounted for more than half the shut downs, as 56 rigs were taken out of service in that state, leaving 598 rigs still operating in Texas on Friday. Another 12 of those Permian shale shutdowns were on the New Mexico side of the Texas border, where that decrease of 12 rigs left 66 operating in that state. In addition, 9 rigs were taken out of service in North Dakota, leaving 132, 6 were shut down in Colorado, leaving 49, and Oklahoma's rig count fell by 5 to 171. Rounding out the rest, Wyoming's count fell 3 to 39, Ohio's count fell by 2 to 37, West Virginia's count fell by 2 to 17, and Arkansas dropped one rig leaving 11. Meanwhile, Louisiana drillers added a rig, bringing their total to 108, and rig counts in Alaska at 10, California at 16, Kansas at 18, Pennsylvania at 54 and Utah at 12 were unchanged....

Despite the ongoing drop in rig counts, US oil production continued to rise, reaching a record 9,226,000 barrels per day in the week ending February 6th. There are a few obvious reasons for this. First, many of the rigs that were initially taken out of service were working in marginal areas where significant oil output was chancy anyhow, and hence their loss did not materially impact overall production. Secondly, this past spring and summer saw a large expansion of US drilling as oil prices floated above $100 a barrel; and many of those wells that were drilled then were just completed in the fall, and hence their new output is adding incrementally more oil production to the output of the previously producing wells, which are only slowly being depleted. The effect of this can be seen in the chart below, where the recent historical oil rig count in red shown on the far right scale is superimposed on a graph of oil production in thousands of barrels of oil output per day, shown in blue by the inner right scale. We can see that our oil production has pretty much continued to rise uninterrupted (except for a few Gulf hurricanes), nearly irrespective of the count of oil drilling rigs operating at any point in time over the past 3 years...

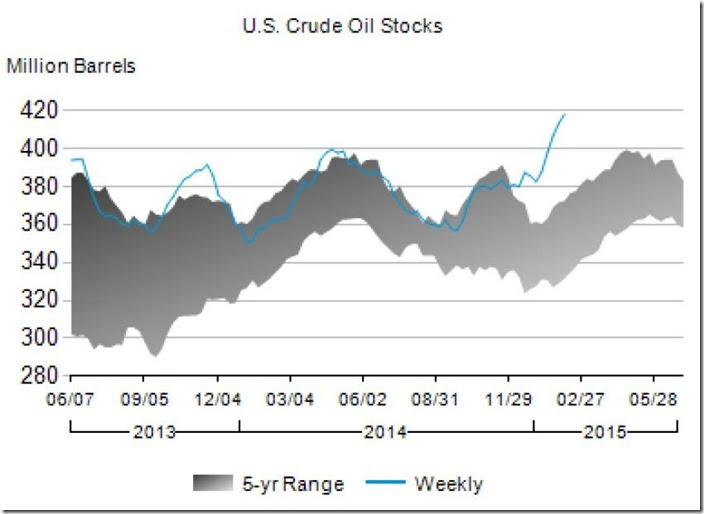

Of course, all this increased production just contributes to the ongoing glut of oil which has been holding oil prices down. As of the latest weekly report, U.S. crude oil inventories increased by 4.9 million barrels from the previous week to 417.9 million barrels, the highest level for early February in the 80 years that oil inventory records have been kept.. We have a picture of what that looks like compared to recent history too, taken from page 10 of the Weekly Petroleum Status Report (pdf) published for February 6th by the Energy Information Administration of the Department of Energy. What the following graph shows in the dark shaded area is the range of US oil inventories as reported weekly over the prior 5 years for any given calendar date since mid 2013, and then in a light blue line we see graphed the recent track of US oil inventories over that same period. It's quite clear from that graph that at the current level of nearly 418 million barrels, US oil inventories are as high as they've ever been in recent years, so much so that whether we'd have enough tanks to store it all in has now become a concern.

Worldwide, the situation is similar. The International Energy Agency warned this week that global inventories will continue to rise and that OECD country's stockpiles would approach a record 2.83 billion barrels by mid-2015 before investment cuts begin to put a dent in oil production. A few weeks ago, oil traders, attempting to take advantage of low prices, booked more than 20 oil tankers to store an estimated 40 million barrels of crude oil at sea, and they're still sitting out there waiting for higher oil prices to bring them ashore. And this week,Iran launched a 2.2-million-barrel floating oil storage unit in the Persian Gulf to store their surplus for eventual export.

So it looks from here like further cuts in the expensive US fracking and Canadian tar sands operations will continue to be necessary for quite some time before the glut is relieved. In keeping with that likelihood, and following last weeks announcements of cuts by several oil companies, a handful more companies laid out plans for their cutbacks this week. On Tuesday, Halliburton said they would cut up to 6,400 workers from their global operations, citing a "challenging market environment"; that total includes the previously-announced cuts of 1,000 jobs in their Asian operations we mentioned last week. Then Swiss based Weatherford International, another large international oil service firm, announced job cuts of 5,000 from their global workforce of 56,000, with 4,250 of those job cuts to be workers in the US and Western Europe. On Wednesday, Houston-based oil equipment maker FMC Technologies announced Wednesday that it will be cutting about 2,000 jobs, about 10% of their workforce.. Then on Thursday, Apache Corporation, one of the top U.S. shale oil producers, reported a quarterly loss of $12.78 per share, against its year-ago profit of 44 cents per share, and said they'd spin off or sell their international operations in order to focus on and consolidate their shale operations, where they'll be cutting their rigs by another third, leaving them 27 rigs at the end of this month, down from their average of 91 rigs last summer. Also on Thursday, Pioneer Natural Resources said they'd cut their exploitation budget by 45% in 2015, with more than half of what they will spend intended for the Permian Basin, as they'll be shutting down their vertical drilling operations. And on the same day, Denver based WPX Energy Inc. announced their 2015 budget at $725 million, less than half of their $1.5 billion capital spending for 2014...

(note: this was crossposted from Focus on Fracking)

Comments

ND miracle no more?

This is a canary in the coal mine...UNLESS, once again, it's just our HFT groups putting a yo-yo on. Key is physical supply as well. Remember in 2008 they had supply sitting on tankers way out at sea, "hidden"?

the only miracle was $100 a barrel oil

it's mostly because OPEC refused to cut output at their Thanksgiving meeting, so now everyone is producing to the hilt...

remember, the WTI oil price quotes are for light sweet oil at or delivered to the depot in Cushing Oklahoma; other prices may differ, depending on transportation costs, specific gravity and sulfur content…so in the last week of January, Williston Basin sweet crude from N. Dakota was quoted at $28.19 a barrel, while Williston sour had dropped down to $19.08 a barrel...

rjs