Why oh why does this man irritate me so? Now don't get me wrong, John Stossel is probably a nice man. But for a man who can garner audiences, he is "dangerous" (well not really, but the guy's on TV and he is on the ra-ra free market Right's side promulgating this crap) with his half ass grasp on our economy. Recently, on Daily Kos's evil twin, he wrote up a piece on how the economy really isn't doing bad. That it was all media hype.

Now for a man who wrote a book called "Myths, Lies, and Downright Stupidity: Get out the shovel- Why Everything You Know is a lie", one would think he knew that the way they compute much of the economic indices was complete crap. Yet, his basis for his "optimism" is stemming from official data produced by the likes of the Bureau of Labor Statistics. In a sense, I'm really disappointed in John. He's always trying to show where there's a scam or something, and you'd think he would've done his research on this. Alas, no.

He thinks that the media tends to over do it by comparing the state of the US economy to that of the Great Depression. His source is a study done by the Business & Media Institute (formally known as the Free Market Project), whose mission statement is:

The mission of BMI is to audit the media’s coverage of the free enterprise system. It is our goal to bring balance to economic reporting and to promote fair portrayal of the business community in the media.

And if one still doubts the political leanings of BMI, consider who founded it, the Media Research Center. Now for those who don't know who they are, just turn on Faux News (if you can stomach it) and wait for them to have a talking head going on about "liberal bias" in the media. Alas, if you're STILL not sure, here is there statement from their 'About Us' section:

" Leaders of America's conservative movement have long believed that within the national news media a strident liberal bias existed that influenced the public's understanding of critical issues. On October 1, 1987, a group of young determined conservatives set out to not only prove — through sound scientific research — that liberal bias in the media does exist and undermines traditional American values, but also to neutralize its impact on the American political scene. What they launched that fall is the now acclaimed"

Now that you know where Stossel is basing his crappy article on, you begin to see how the whole thing could fall apart. He likes to harp on how the media likes to harp on gloom and doom. The underlying premise is that the whole thing is a lie to make you feel so bad that you will vote for a Democrat. He tends to slide in his underwhelming economic analysis in his statements.

America is not in recession, and who knows -- maybe we'll be less likely to have one if my compatriots would just chill. A recession is defined as two quarters of negative economic growth. We haven't even had one quarter of negative growth.

Yes, growth has slowed, and many people are suffering because of falling home prices and higher food and energy prices. These are real problems, but watching TV, you'd think we were in a recession so severe it must be compared to the Great Depression.

- excerpt from "Dire News from My Colleagues", Townhall.com

Ah...this is something I have heard from Larry Kudlow and Rush Limbaugh. Listen to any conservative or libertarian free-trader on the media, and chances are you would've heard that shpiel about two quarters of negative growth. Yes, classically, that would be true. But, as everyone who follows economic numbers knows that the way they calculate has changed. Several times, but most notably under Reagan and then Clinton, they changed what they counted. Each time, there was no real economic/scientific reason to change the way say inflation or unemployment was figured; it was always a political rational.

However, if you go based off the way the original designers had intended, or at least the setup before Reagan and Clinton messed with it, one will see a very different picture! There is a site, called Shadowstats, where this fantastic person actually took the time to compile all those government numbers and run them through the original setup. Now the site is subscription-based, so I don't think I have permission to put up a chart (if I'm wrong here, please let me know.). But you can click on the link and see the charts for free.

What you will notice is that despite what Stossel has said, we not only had two negative quarters of growth, but have been in a long period of negative growth. While the government releases a GDP figure of above 2%, in reality we're more like - 3%! Tell me, John, keeping in tune to the theme of your book and being honest, would you say we're still growing?

But wait, my friends, he goes even further off the reservation. He cites BMI's study on how reporters reacted back in 1929 and 2008. That journalists shouldn't be setting off panic today, because well, the reporters in 1929 didn't. To John, of course, how can we say there's an economic Depression when in 1929 reporters of that year didn't? Suffice it to say, I nearly dropped my rum and coke when I read that.

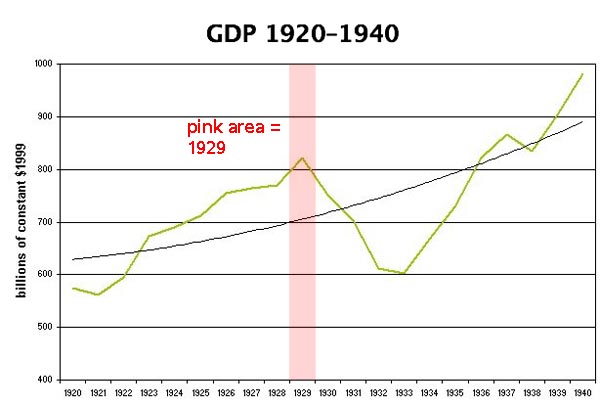

Can anyone tell me what's wrong with this picture? I'll save you the time. 1929 was the year of the infamous stock market crash. In reality the market before that fateful event had been in a downward motion already since the middle of September, losing 17%. The "crash" actually was more than one day, starting on the 24th of October (known as "Black Tuesday") and ending on the following Tuesday the 29th (also known as "Black Tuesday). The market (already off its peak as shown by the graph, of 381 in September) entered on that first Black Tuesday at about 340 and ended the following Tuesday at 230, a 32% drop over seven trading days (it would make a small brief recovery the following few days).

The thing to understand is that the economic impact of all this didn't start to take effect until 1930. Looking at the chart below, one will see that 1929 was a "peak year" for the Gross Domestic Product numbers besides that of the stock market. The year ended slightly below where it started. The economy would begin to tank by the following year, reaching a bottom around 1933-34. So there really wouldn't be all this talk throughout 1929 of economic woes. It wasn't until just after the crash, did the headlines start to flutter about an economic impact.

BMI and Stossel's assessment of news coverage in 1929 is unfair, because that generation of reporters had not seen an economic fallout of the likes that would soon befall the nation. The last time anything close to this happened was the Bank Panic of 1907, where the market then fell from it's peak nearly 50%. So, taking that into consideration, imagine you were a veteran reporter in 1929, and you needed a historical example to go by, what conclusions would you take? Also, something else, that BMI and Stossel neglect to tell you, this was the age before there was a Securities and Exchange Commission and the host of other regulations that would come about with FDR. It was an almost lawless period on Wall Street, and you can't tell me that the bankers didn't have friends with the newspaper publishers (Hearst anyone?).

Of course, Stossel isn't finished, he wants to talk about jobs. He goes forward to 1933 now, when the Great Depression was at its worse. The goal is to highlight how the current job situation now is no where as bad as it were in the 1930s. To do this, he brings up another source, author Amity Shlaes's "The Forgotten Man: A New History of the Great Depression."

As Amity Shlaes points out in her book "The Forgotten Man: A New History of the Great Depression" -- which has just been released in paperback -- by November 1933, unemployment had skyrocketed to over 23 percent. Think about that: 5 percent unemployment today vs. 23 percent during the Depression.

- excerpt from " Dire News from My Colleagues", Townhall.com

Oh John, come on now, 5%? The spread between that Depression-era number and that fake government number is 18%. Pretty wide, big difference between today and 1933! Too bad that it doesn't hold up.

Out of all the government numbers that has seen the most changes would have to be the unemployment one! That equation has been changed, guessing here, about 3-4 times. Now I could be wrong, and feel free to let me know. But at the end of the day, the number you see published isn't the true picture of employment in this nation.

For starters, they don't really count those who have given up. Indeed, the unemployment numbers are basically centered around those seeking compensation. Besides the former, how about those who are underemployed? At my mother's job, they purposely give her under 40 hours. And judging from my friends and family experience, many more are also not getting the hours they need. I won't even go into benefits.

So what's the real deal on unemployment? Alas, John Williams' (no not the famed movie Orchestra composer)Shadow Government Statistics comes through once more! Once again, my apologies for no charts, but without permission, I won't post them, I hope you understand. Anyways, the Shadow Government Statistics site shows that, using the formula the way it was supposed to be, that unemployment is really nearing 14%.

Hey John, a big farcry from 5%, eh?

Yesterday, it was revealed that, despite what Stossel may let you believe, the economy IS getting worse! Unemployment expanded again for another month. And forecasts are now looking good either.

July 3 (Bloomberg) -- U.S. employers cut jobs for a sixth straight month and service industries shrank in June, signaling that the economic slowdown may deepen as the impact of federal tax rebates fades.

Payrolls fell by 62,000 after a 62,000 drop in May that was greater than first reported, the Labor Department said today in Washington. The unemployment rate held at 5.5 percent after soaring the most in two decades in May. The Institute for Supply Management's non-manufacturing index sank to a five-month low.

- excerpt from "U.S. Economy: Employers Cut Payrolls for Sixth Month", Bloomberg.com

Just a second! Did that say employers cut jobs for a sixth straight month?!? Now, if the economy was expanding all those months, they wouldn't really be on a job cutting spree. Of course I could be wrong, we have to exclude businesses that made bad decisions or just a run of bad luck, like GM and other US auto makers. But overall, if they've been cutting, that tells me that for the past six months the economy has been receding. Wait...didn't John Stossel say that the definition of a recession was at least 2 quarters of negative growth? Uh oh John...sounds like a recession to me!

Worst yet, if the Shadow Stats are correct, we're only about 60% of what we saw in the Great Depression! No, my friends, this isn't a mild recession. This ain't even like the one we saw under Papa Bush! This is worse. Borderline economic depression, if you ask me! Sorry John, see you at the soup line!

Comments

job cutting

There are a couple of ongoing debates on EP and on the economic blogs generally. One is Economic Armageddon or no? and the second is are commodities futures speculators the main cause of a oil price bubble?

That said, one thing I note generally is that global economics isn't discussed much and especially global labor markets isn't well understood.

One can have good economic indicators and still lose jobs because of global labor arbitrage. For example, even though one has job losses, the productivity from those offshore outsourced jobs is calculated into US firms, incorporated in the United States, productivity figures. So, the corporation can "go up", while the U.S. middle class "goes down".

Now they may not be migrating as much jobs, but in terms of creation of jobs overseas, well, that won't even show up in the BLS stats at all. So, a job that should be created in the United States instead is created overseas, wala, job losses, yet the stock market recovers and the corporate profits recover. Obviously there is a long steady erosion for the US economically because it is a consumer society and there is only so long one can wipe out the economic livelihoods of a nation-state and except to remain a 1st world economy and we might be at that tipping point, but it's a long dribble from what I've been watching so far. (I'm in the long dribble economic conditions vs. the Economic Armageddon camp because of this).

Not sure on which camp

Assuming for a moment that we are heading into an economic depression, does that automatically equate to armaggedon? We've gone through other depressions before, it is at the end of the day, the cyclical nature of the game we are all thrusted in. Inflation, or specifically the causes of such, could come from commodities. But then we enter the realm of elasticity, which of these resources has the least of which and which has the most? I would argue, that outside of the grains for food, that surprisingly oil is the most elastic. Already we are hearing reports of the Saudis losing buyers and that could have been the real reason for their sudden drop in their offering. One could cite China, but eventually people will say no there and find other means of transportation. The same could be said here as well, I might add.

Eventually, though, add in the fear of rising prices and job losses, and we lose demand to participate in the economy. In our case, that being of consumption, we won't see an increase in personal spending. Well, no, let me correct myself, you could, but that could simply be a by product of rising prices versus increased number of goods and services purchased. But overall demand will eventually deflate. The problem then becomes, if one cannot buy X, can they sustain themselves on Y? If I normally go out to eat, but because of a job loss, can I simply eat at home? Will my savings cover such an expense? If there is no savings, then things get prickly.

negative savings

Last I checked Americans have negative savings, meaning they are already living on credit cards, loans. So, whether it's a sudden collapse or a long drip, drip, drip, I think all are reaching a similar conclusion, the US is losing it's first world economic status and it's due to messed up, corporate written policies.

I believe the debate is all about timing and slope of the downward spiral.

(at least on here, but we're not exactly a corporate public relations sounding board!)

Primary reasons for negative savings

Thje main reason we have a negative savings rate is that the cards are stacked against saving

Too cheap and easy credit as espoused by "easy" Al Greedspan is the primary culprit - this encourages borrowing and the use of the home as an ATM - plus created the bubbles and contributes to the trade deficits as more and more is spent on imported consumer products bought on credit cards.

Interest on savings is taxed as income. So what meager interest you gain from a traditional savings account a good chunk is taken away - what is left rapidly evaporates due to inflation and dollar devaluation. The single digit interest paid by banks is also a result of the too cheap and easy credit policies of the Fed. These are major disincentives to saving

Middle and lower income savings interest should not be taxed. There should be a cap, above which a percentage of savings interest could be taxed, under should not, and only if you are a higher income bracket.

Ultimately getting the budget and trade deficits under control, and a Volker like return to sanity on Fed interest rate policy should create the conditions to encourage savings.

We have created an economy based around rampant consumption and materialism, while at the same time dismantling our means of production and wealth generation, without a restoration of balance we will continue to have an econmy mbased on shifting wealth around and upward.

Conservatives

I feel sorry for conservatives because as we've seen even on here, they mix social agenda that is simply not palatable with most of America. There are also paleo-conservatives who really have a lot of good economic policy and observations and one of the reasons this site is non-partisan officially. They too are looking at the statistics and are horrified by US trade policy, tax policy and the budget deficits.

Then, unfortunately the corporate agenda people like to mask themselves as conservatives, but they really are not and they use the social wedge issues to advance their corporate agenda.

The left has the same thing going on. Use of name calling all sorts of things as racist and so on when in reality it's a corporate global agenda.

My hope is that these two schools of people looking at the realities on the ground for the US economically and the people of the United States can, through common consensus points agree to advance policy that is in the US interests, the middle class interests for playing this game on name calling wedge issues is one of the reasons we're in the mess we are in in my opinion.