In 1971 America had a currency crisis. Other nations had stopped accepting our paper dollars as payment for our debts and were demanding gold instead. The problem was that America didn't have enough gold to cover the massive debts being run up because of the war in Vietnam.

What did we do? We simply defaulted on our debt by repudiating the promise to back our currency with gold. The situation was epitomized by Nixon's Treasury Secretary John Connally, when he responded to the complaints of 29 trading and banking allies:

“It may be our currency, but it's your problem.”

37 years of massive budget and trade deficits later it is still our currency and it is still someone else's problem. However, every game must someday end. Eventually the costs of playing the game become so great that the benefits of not playing become attractive.

The world is now approaching a point where it is being forced to make a choice.

The Prisoner's dilemma is a mathematical game theory developed in 1950 by Merrill Flood and Melvin Dresher.

In its "classical" form, the prisoner's dilemma (PD) is presented as follows:Two suspects are arrested by the police. The police have insufficient evidence for a conviction, and, having separated both prisoners, visit each of them to offer the same deal. If one testifies ("defects") for the prosecution against the other and the other remains silent, the betrayer goes free and the silent accomplice receives the full 10-year sentence. If both remain silent, both prisoners are sentenced to only six months in jail for a minor charge. If each betrays the other, each receives a five-year sentence. Each prisoner must choose to betray the other or to remain silent. Each one is assured that the other would not know about the betrayal before the end of the investigation. How should the prisoners act?

In the classic form of this game, cooperating is strictly dominated by defecting, so that the only possible equilibrium for the game is for all players to defect. In simpler terms, no matter what the other player does, one player will always gain a greater payoff by playing defect. Since in any situation playing defect is more beneficial than cooperating, all rational players will play defect, all things being equal.

The purpose of the game is to show the divergence of self-interest and group interest, where collective betrayal leaves everyone poorer.

What does this have to do with the dollar? To answer that you must understand the concept of reserve currency.

"If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has."

- John Maynard Keynes

Before 1944 a nation's currency reserves was usually called gold and/or silver (i.e. real money). When the world's leaders made the Bretton Woods agreement near the end of WWII all that changed. The critical element of the agreement was that the dollar would be pegged to the price of gold, while currencies of the rest of the world would be pegged to the dollar.

The advantage to this agreement was that other nations didn't have to gold and silver in their vaults. They merely had to hold American dollars, which were supposedly good as gold. Thus the dollar became the world's reserve currency.

That all changed in 1968 when French President Charles de Gaulle started demanding gold, instead of dollars, to settle trade imbalances. It didn't take long before other nations did the same. What they were doing was calling America's bluff and betting that we didn't have enough gold to cover all the debt it was issuing to pay for the expensive war in Vietnam.

Three years later they were proven correct.

That's when Nixon and Connally called the world's bluff and basically dared them to do something about it. The rest of the world blinked. The world didn't have a Plan B.

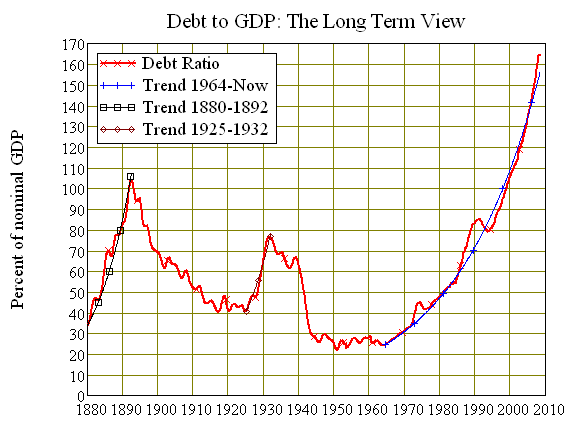

Thus began the Great Experiment. Never before had the entire world functioned on anything other than an asset-based currency. Now the world's reserve currency was debt-based.

As you probably can guess, when the currencies are debt-based that the overall debt levels in the world would increase exponentially. As debt levels soared the creditors, the bankers, have gained more more and more power and influence.

The financial system has mutated into a parasitical system. Whenever a parasite goes unchecked the body it infects becomes sick and doesn't function normally. To put it another way...

The world economic crisis which has now begun is systemic in nature. It is conditioned by the contradictions of the neoliberal model of capitalism, with the world economy unable to develop further in the old manner. The potential of economic policies based on systematically lowering real wages while stimulating consumption has been exhausted.

Which brings us to our current situation.

Inflate or Die

As a reserve currency, all other currencies are derivatives of the dollar (in the same way that all currencies were derivatives of gold and silver a century ago). Therefore when America's debt burden becomes too onerous it effects everyone else.

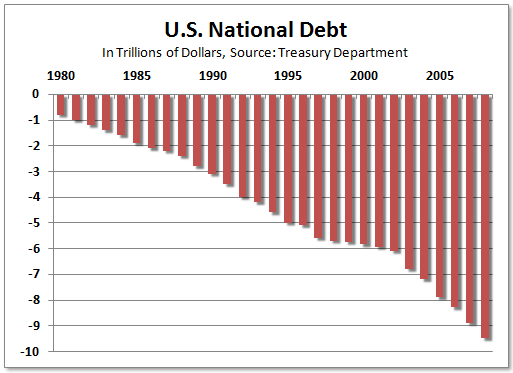

The simple fact of the matter is that our national debt can never, and will never, be paid back. We don't have the industrial base or the savings to do so. Therefore we only have two choices: inflate the debt away or default.

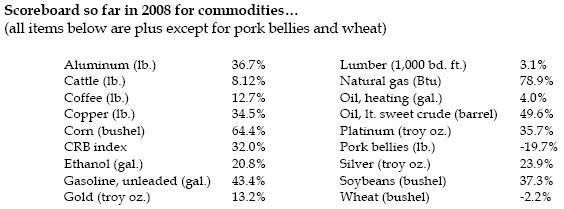

Given the fall in the dollar and the rise in commodity prices, it appears that the choice has already been made.

The point I'm trying to make here is how this effects the rest of the world. As we try to inflate away our debt by debasing our currency, the nations who peg their currencies to the dollar are suffering.

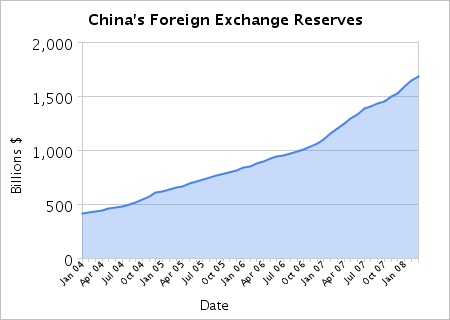

How this works is countries like China, with massive trade surpluses, must "sterilize" all those surplus dollars that come into their country in order to maintain the artificial currency peg. The central bank does this by buying up those dollars and exchanging them for a given amount of local currency that is printed out of thin air. They then take those dollars and buy America's debt at interest, thus recycling the dollars.

It is estimated that America absorbs 85% of all the world's capital flows in this way.

This creates two problems: 1) monetary inflation which eventually leads to price inflation, and 2) oversized currency reserves which represents wasted capital that could be used on domestic infrastructure and bettering the lives of the people.

Why would nations put themselves into this position? Two reasons, and both reasons go back to the Prisoner's dilemma.

1) Competitive trade advantage: These nations, most of them poor, third-world nations, need export jobs for their people for reasons of social stability. In China's case, they have hundreds of millions of people migrating from the countryside to the cities. Without jobs for the teaming masses, the nation's leaders might find themselves out of power. By artificially suppressing the value of their currencies they enable their exports to sell competitively on the world market.

The drawbacks to this strategy is that everyone else is also using the same strategy. Thus no one can make their currency fairly valued without losing their trade advantage. By doing this, they make their nation's assets undervalued, and their savers poorer.

2) Protect their previous investment: If China were to decide to suddenly start selling their massive pile of dollar assets the value of the unsold pile would plummet. To put it another way, there simply isn't enough dollar demand out there to buy up all those dollars. If China only wanted to sell, say, 20% of their stockpile, it would overwhelm market demand and the value of their remaining 80% would plummet by more than they would save from selling the 20%.

Therefore, China and the rest of our 3rd-world Asian creditors must continue to prop up the wasteful American lifestyle by buying our overvalued debt (i.e. vendor financing) if they want to protect the value their nation's savings. They are prisoners of a currency system that resembles a confidence game.

As a first step to extracting themselves from these shackles, Asian creditor nations have created Sovereign Wealth Funds. Using these funds, the governments of the world are buying up companies all around the world, rather than just keep recycling their funds into treasuries that earn less than the rate of inflation.

Let's take a step back and consider just how sick and twisted of a relationship that is.

Here you have the nations of billions of people that struggle to make about $2 a day lending $2 Billion a day, 365 days a year, to one of the wealthiest nations on earth so that it can continue to spend it on

imported electronics, textiles, and speculating on stocks and real estate.

To put it more simply: the poorest of the earth are subsidizing the lifestyles of the richest of the earth.

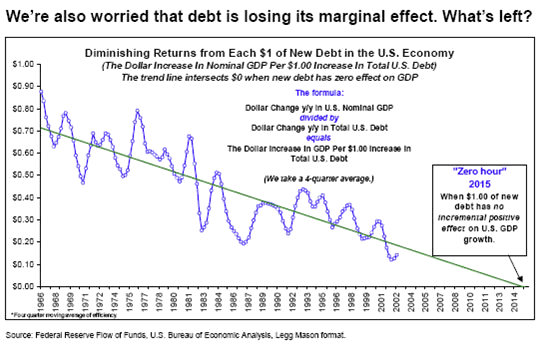

And if that isn't sick enough, the enormous amount of money that America borrows each day doesn't go to building factories, or upgrading infrastructure, or mining and oil production, or anything that would enable America to pay back all the money it borrows. Instead we get more strip malls, track housing and smart bombs.

When you consider that 85% of all the world's savings gets redirected into these non-productive ways, this era will be remembered as the biggest malinvestment in human history.

How can a situation like this continue?

The answer is that it can't. Eventually it must break.

Why Bretton Woods II Must End

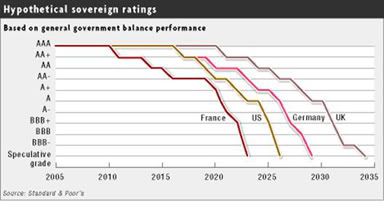

First and foremost, you can't keep taking on more and more debt without it eventually effecting day-to-day operations. All that debt requires interest payments and degrades overall credit quality. When credit quality declines interest payments rise. Eventually these forces start a negative feedback loop and the whole system crashes.

When will that happen? That totally depends on our 3rd-world creditors.

In the meantime, the deteriorating credit quality in America has led the financial system to make more risky loans, which has led to more defaults. The immediate ramifications from this situation is banks all over the world stuck with nearly worthless mortgage-backed securities on their books.

To put it another way, the world is realizing that America no longer has that much quality debt to sell that is worth buying.

The deteriorating condition of credit in this country has led to ever larger bailouts of the financial system. The bailouts so far is estimated at a staggering $1.43 Trillion. About 10% of America's GDP.

This shows all the classic trends of a flawed economic system in a downward spiral. Our Asian creditors must increase their lending to America in order to keep the unsustainable system functioning.

Our Asian creditors have only recently woken up to this dilemma. Through their Sovereign Wealth Funds, they are now diversifying out of dollar assets.

The day that one of the Prisoners betray the other is approaching.

The second, and more immediate reason, for an end to this agreement is because of the amount of monetary inflation America is pushing out on the rest of the world through the system of currency pegs. It is this system, more than any other reason, that is creating the commodity price inflation the world is currently experiencing. For poor creditor nations like Thailand, Malaysia and Indonesia (and even China to a lesser degree), this creates an immediate and critical problem for the governments.

Rapidly rising prices of rice in a nation full of people that can barely feed themselves on prevailing wages is a powder keg waiting to explode. Asian nations need those jobs reliant on exports to America, but they need their people to be able to eat even more. A government in a nation of starving people usually doesn't last long.

The easiest way to reduce the price of rice is to let their currency rise, but that would require depegging their currency from the dollar. Hence, the Prisoner's dilemma. Who will be the first to betray the others?

What comes next?

Contrary to what many people might think, the end of the dollar's status as reserve currency does not mean something catastrophic for the world. In fact, for our Asian creditor nations it will be an extremely good thing in the long run (after some short-term pain).

By no longer funding America's consumption patterns they will suddenly discover themselves flush with funds to improve their infrastructure. Even more importantly, by allowing their currencies to rise in value the purchasing power of the savings of their citizens will increase. Thus the loss of America's markets will be offset by a rise of demand in their domestic markets. This is already starting to happen.

There, of course, will be a loser when this change happens. That loser will be America. Interest rates will skyrocket as our creditors no longer want to lend to us. They may even start demanding payment in currencies other than the devalued dollar, a demand we could not meet at this time.

More significantly, we could no longer consume at our current rate. Our assets, such as stocks and bonds, would fall in value. Our living standards will decline.

On the other hand, the change would force America to start investing rather than speculating. To save rather than spend. To build factories rather than shopping malls.

In other words, in the long run, it will force America to return to the type of system that made America great in the first place, rather than this sick and dysfunctional system we have today.

Comments

reserve currency

I've seen various reports of decoupling from the US economy and using a basket of currencies instead of the US dollar as a reserve currency.

Great post, history is an awesome thing and I had no idea that happened in 1971.

Great diary

Shame it didn't hit Recommended status over at Big Orange.

The "total debt private+public" is an interesting chart, but I'm not sure about its operative implications. It's a little like putting together GM + Ford. One might go out of business, but the effect on the other might be neutral or even contrary.

The most interest thing is, this is the first time in history that every single major currency is backed solely by "good faith." The resulting "competitive currency devaluations" have been a major feature of the global economy for the last 30+ years.

Fantastic piece

Simply brilliant. We are in for a period of pain, I'm afraid. The question is, can we push forth the reforms needed fast enough to get through our upcoming troubling times to that phase of investment that marked the end of this piece?

We've seen recently...

America's currency devaluation and nationalization of the finance industry (Fannie and Freddie among others) looks a bit like Mexico's recent history.

Economic history of Mexico

*******

But economic activity fluctuated wildly during the decade, with spurts of rapid growth followed by sharp depressions in 1976 and 1982.

*******

*******

Fiscal profligacy combined with the 1973 oil shock to exacerbate inflation and upset the balance of payments. Moreover, President Echeverría's leftist rhetoric and actions--such as abetting illegal land seizures by peasants--eroded investor confidence and alienated the private sector. The balance of payments disequilibrium became unmanageable as capital flight intensified, forcing the government in 1976 to devalue the peso by 58 percent. The action ended Mexico's twenty-year fixed exchange rate.

*******

*******

The devaluation further fueled inflation and prevented short-term recovery. The devaluations depressed real wages and increased the private sector's burden in servicing its dollar-denominated debt. Interest payments on long-term debt alone were equal to 28 percent of export revenue. Cut off from additional credit, the government declared an involuntary moratorium on debt payments in August 1982, and the following month it announced the nationalization of Mexico's private banking system.

*******

http://en.wikipedia.org/wiki/Economic_history_of_Mexico#The_Great_Depres...

There is a caveat, America is a prisoner, but America is also the jailer. Abandoning the US Dollar can have catastrophic consequences.

Fom a 2004 artile:

So far only one OPEC country has dared switch to the euro: Iraq, in November 2002,3.

One other OPEC country has been talking publicly about possible conversion to the euro since 1999: Iran2,4, a country which has since been included in the George W. Bush's 'axis of evil'.

A third OPEC country which has recently fallen out with the US government is Venezuela and it too has been showing disloyalty to the dollar

http://www.commondreams.org/views04/1115-31.htm

Kudos For Easy Reading

Lordy, I am no fan of macroecon but I've got to say, you've laid this out in a way that is easy to understand and for that i cannot thank you enough.

So many of us out here are wandering around with our heads up our butts, confused to death about the whole shebang of money and how it makes the world go round.

We know it's important and that much hangs in the balance; just don't understand the intricacies.

You've made it not only understandable but imminently more frightening as well. For that I'd like to both thank and slap you! :-)

Please keep up the great work! I've added you to my rss reader and will be looking forward to additional posts!

Cheers,

Steven