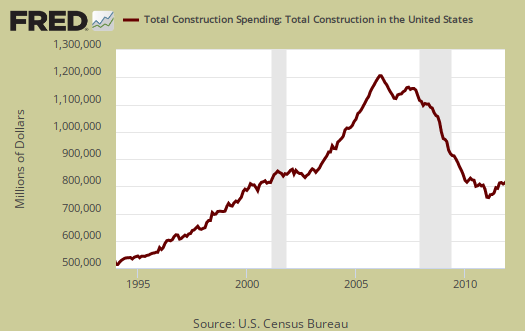

The Census, part of the Commerce Department, today released the monthly construction spending report. This is a monthly tally of how much money was spent on construction and the survey has been done since 1960. The below graph shows just how badly construction spending imploded since 2008. Dollars are not adjusted for inflation, so the overall decline is even more dramatic.

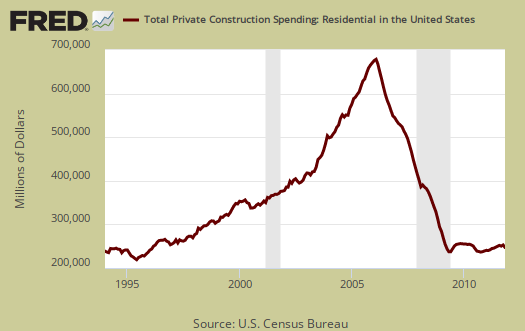

For November construction spending increased 1.2% from October. Private construction spending increased 1.0% overall, with private residential construction increasing 2.0% from last month. Below is the graph for residential construction spending. One can track the entire housing bubble rise and burst by this graph.

Public construction spending was up 1.7% for November. The reason was highways, up 1.9% for the month.

Construction has been one of the most decimated sectors from the recession and housing bubble collapse. For the year, construction spending is down -2.5%.

During the first 11 months of this year, construction spending amounted to $ 724.8 billion, 2.5 percent (± 1.1%) below the $743.6 billion for the same period in 2010.

As you know, we here at The Economic Populist love graphs, especially the Saint Louis Federal Reserve FRED tools. FRED has a host of construction spending graphs by individual sectors. Covered is spending on highways, sewers, commercial, manufacturing, water supply and so on.

For example, below are the details of all manufacturing construction spending. Seeing a decline in 2010 is not good news. These new facilities eventually should be stuffed with middle class jobs. Less new construction spending, less opportunities for jobs to be created in order to staff those facilities later down the road. The data includes only plants, facilities directly related to manufacturing, versus corporate offices to manage their offshore outsourced manufacturing.

As an economic report, this data is considered minor by analysts and economists, yet when one really looks at the series over time, it shows how investment, construction and especially residential real estate really was an economic neutron bomb.

Recent comments