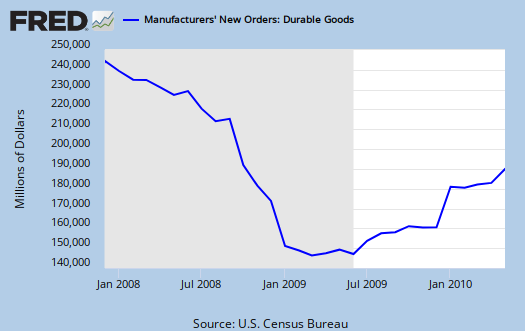

The Durable Goods advance report for May 2010 showed a -1.1% decline in new orders. This month the real story is non-defense capital goods dropped -2.8%, although minus defense and aircraft, core capital goods new orders increased 2.1%. Mixed bag. Last month's core capital goods new orders were -2.7%.

Last month's new orders were revised up, from 2.8% to 3.0%.

This month (original on Census.gov), shows non-defense commercial aircraft & parts, dropped 29.6% after last month's beyond belief 228% increase. In May, excluding transportation, new orders increased 0.9 percent. Excluding defense, new orders decreased 1.1 percent.

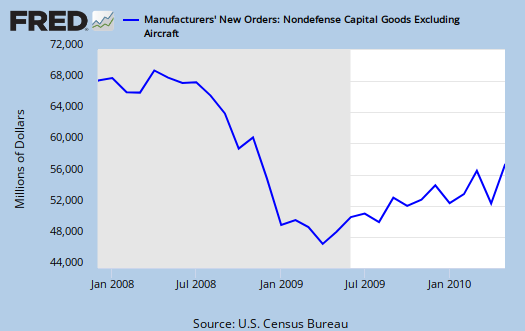

Below is non-defense new orders minus the volatile aircraft. While the press is going to blame the decrease in new orders on air-o-planes, obviously that number has been much more volatile in the past. This report, bottom line, implies a little slowing, as did last month when taking out non-defense aircraft & parts. As you can see in the below private sector graph, without air-o-planes, new orders are up, which is good.

The below graph is core capital goods. This is the stuff manufacturers use to make more stuff, (no it's not soft drinks, they ain't durable). A positive is a good indicator for future growth usually. These are also referred to as the means of production. Taking out the military and aircraft gives an indicator (or no) on production expansion.

Shipments increased 0.4% with capital goods shipments down -0.6% while non-defense, non-aircraft capital goods shipments increased +1.6%. Last month shipments were zero in core capital goods. This value plugs into the GDP equation for investment.

Inventories increased as well, 5th month in a row, up 0.8%. Primary metals inventories increased 3.0%. I wonder why they are hording that stuff? (sic)

Machinery new orders increased 5.6% while communications equipment decreased -9.4%.

Recent comments