Welcome to the weekly roundup of great articles, facts and figures. These are the weekly finds that made our eyes pop.

Welcome to the weekly roundup of great articles, facts and figures. These are the weekly finds that made our eyes pop.

Strange and Unusual Curious Events at the Federal Reserve

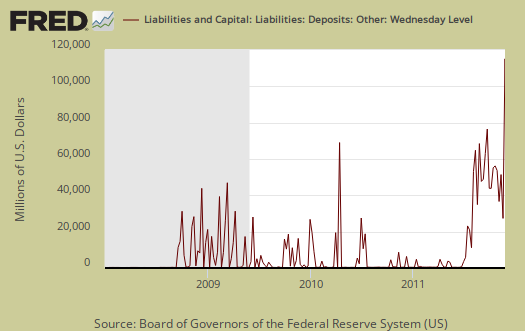

Zerohedge saw something interesting. The Federal Reserve injected a cash account with an $88 billion one day jump while you all were eating Turkey.

Something more troubling has just been spotted. In today's one-day delayed issue of the Fed's H.4.1, literally the very last number on the very last subpage in the weekly update reveals something quite disturbing. Namely the Fed's "other" non-reserve based factors absorbing liquidity. And specifically, the actual number, which rose by an unprecedented $88 billion in one week to an all time high of $115 billion for the week ended November 23!

Why is this troubling? Because unlike reserves, this number is effectively not defined, and there is no clear transposition between assets and liabilities, not to mention that "other" could mean virtually anything.

The definition of this other account, one of many from the H.4.1: Factors Affecting Reserve Balances, statistical report, is:

Other deposits at Federal Reserve Banks include balances of international and multilateral organizations with accounts at FRBNY, such as the International Monetary Fund, United Nations, International Bank for Reconstruction and Development (World Bank); the special checking account of the ESF (where deposits from monetizing SDRs would be placed); and balances of a few U.S. government agencies, such as the Fannie Mae and Freddie Mac.

The ESF is for emergency foreign currency exchange intervention, used during 2008 and the Mexico 1994 crisis. Hmmm....beyond conjecture, we have to agree with Zerohedge these funds are simply not Freddie and Fannie and agree, an all time record of $88 billion being dumped into this account on November 23rd is most interesting.

Eurocarnage

The phrase it's too late is popping up in Europe's never ending financial crisis. Naked Capitalism is no exception:

It seems almost as if the European leadership has successfully faked its way through so many past crunches that they are unable to perceive that the same old tricks are no longer working. And it is increasingly looking as if their dulled reaction times are so out of line with market events that even if they were to snap our of their stupor now, it would be too late.

The latest Euro buzz is sovereign bilateral loans are the new cure. No, it's not groundhog day ...yet.

S&P 500 Worse Thanksgiving Since 1932

This headline is somewhat apocalyptic, yet gives a good overview of the recent stock market carnage. Macro factors include Europe.

This headline is somewhat apocalyptic, yet gives a good overview of the recent stock market carnage. Macro factors include Europe.

The market’s not trying to distinguish between stocks right now, it’s focused almost exclusively on macro factors,” John Linehan, director of U.S. equities and a portfolio manager at T. Rowe Price Associates Inc., said at a press briefing Nov. 22 in New York. “ There’s a tremendous amount of volatility in the marketplace. The market’s on the gas pedal and the tires are spinning, but we’re really actually not going anywhere.”

U.K. Prepare for Riots & Euro Collapse

This is nice, the Telegraph is claiming the U.K. is preparing for riots in the streets when the Euro collapses. Lovely. So glad we funded all of that police state technology and weapons in the face of 9/11.

British embassies in the eurozone have been told to draw up plans to help British expats through the collapse of the single currency, amid new fears for Italy and Spain.

Gold Hording

The gold bugs should be scurrying over this story. Due to Europe, gold hording is hitting an all time high.

Gold traders are more bullish after investors accumulated the biggest-ever hoard of the metal, with Europe’s deepening debt crisis driving them to protect their wealth with this year’s second-best performing commodity.

Eighteen of 26 surveyed by Bloomberg expect bullion to rise next week. Holdings in exchange-traded products backed by gold reached a record 2,350.8 metric tons on Nov. 23, now valued at $127.6 billion.

Riots & Pepper Spray Over....an Xbox?

There is nothing more despairing than watching people turn into animals over $7 dollar thread bare sheets, $2 dollar waffle irons and $50 buck discounts on overpriced machines. Think about it. We have riots over products while other nations riot over economic screw jobs. How embarrassing to be an American.

If there was ever an example of how screwed up America is, this is it.

Credit Ratings are not Free Speech

A Judge hands down a blow to the credit rating agencies in a new ruling. Surprise, labeling trash as AAA is not free speech:

A federal judge has said credit ratings are not always protected opinion under the First Amendment, a defeat for credit rating agencies in a lawsuit brought by investors who lost money on mortgage-backed securities.

The November 12 decision was a little-noticed setback for McGraw-Hill Cos' Standard & Poor's, Moody's Corp's Moody's Investors Service and Fimalac SA's Fitch Ratings, which have long invoked First Amendment free speech protection to defend against lawsuits over their ratings.These agencies had argued that the Constitution protected them from claims they issued inflated ratings on more than $5 billion of securities issued in 2006 and 2007, and backed by loans from former Thornburg Mortgage Inc and other lenders.

Buddy Roemer Makes It to Bloomberg

We've written about the beyond belief complete media blackout on GOP Presidential candidate Buddy Roemer. Finally Bloomberg mentions him, but only context of Newt Gingrich.

Roemer Calls Republican Rival Gingrich a ‘Lobbyist Writ Large’

H-1 Visas are a notorious labor arbitraging tool of professionals. The U.S. Chamber of Commerce and multinationals demand all sorts of guest worker Visas or corporate controlled immigration for technology transfer out of the country. Of course our publicly visible GOP candidates promote them as a result. There is no STEM labor shortage and no, these will not help the U.S. economy. Watch out for spin when it comes to anything immigration related, for it's almost always about global labor arbitrage, whether the spin is amnesty o no.

Comments

My 2¢ on gold, etc.

IMO, what goldbugs are waxing enthusiastic about is possibility of runs on French banks due to collapse of Italian bonds due to a default by Greece. (See, my comment at FMN blog on videos of professors' analyses of Euro zone crisis.)

And of course, gold may well be a good bet for professional PM speculators right now, but for people who are looking to hedge against a future USD collapse, this may not be a particularly great time to buy. Nonetheless, it's entirely possible that gold will finally hit it's long-anticipated 2011 highs above $2000. (A couple of months back, a JPMorganChase economist predicted $2100 before end of 2011, after that bank's depository reported increased holding of physical gold.)

Goldbugs are talking along the lines of the ECB will "print" despite every indication that the ECB will not. The essence of goldbuggery is to see everything in terms of the impending collapse of all paper currencies globally (even though there's no evidence of that for the renminbi or the Japanese yen and not all that much evidence for the pound sterling and several others). In the goldbug mindset, the ECB must "print" because that's what governments always do (ignoring possibility that sometimes 'central bank' may not equate to 'government' and the reality that the ECB cannot be equated to any government other than itself). This relates to USA goldbuggery's fundamental belief that the Fed will not be able to resist the overpowering temptations that inevitably and universally lead to hyperinflation.

____

Here's my various 2¢ers all around, just for the record --

(1) GOLD. It's entirely possible now that gold will reach its long-anticipated $2000-and-up levels before the end of 2011, although it may only peak and then fall back into the $1900s.

(2) EURO. The Euro will survive in good condition, and there will be no great "printing" by the ECB -- neither in 2011 nor in 2012.

(3) QE3 and the Fed. Since any further bail-outs in USDs are not in the cards for at least a year, pressure will be on the Fed (from within by some members of the FOMC) for another QE3 in the form of a MBS buy-out (touted as a "solution" to the continuing "jobs recession" by way of promoting a come-back for housing construction). Hopefully, there won't be anything like that, because (IMO) it's just more subsidizing of the bloated international financial sector, but it does seem likely given realities of campaign politics. On the other hand, looking closely at the composition of the FOMC and the stale-mate in Congress, it's possible that there will be no QE3 in any form, at least not before November 2012.

(4) Second Great Depression. The world is definitely headed into the Second Great Depression, or is already there. Even China is and will be heavily impacted. As for the USA, we are already in a period of high inflation. The Fed will not be able to continue much longer in denial of this reality -- another reason why I am not at all sure that there will be a QE3 (at least not before November 2012).

(5) Monetary, political and financial reform. Huge changes are due both for the EU and for the USA, but these probably will not begin to take shape until after 2012.

(6) Stocks and investment in growth. The analysis that stocks are trading entirely on the news cycle or other macro-economic news, rather than on long-term investments in particular companies, is becoming less convincing now. Look at recent actions by Berkshire Hathaway.

(7) Bonds and T-notes. I don't see any reason to presume that T-notes inevitably must fall significantly in 2012, but that probably could happen if there is a QE3. On the other hand, it's becoming more credible that individual states and other jurisdictions (California, for example?) may default and (one way or another) go into bankruptcy.

Oh well, maybe I'm wrong about everything. We'll see.

Euro Bond

Many are pinning their hopes on a European bond, a way to put all sovereign debt spread across all Eurozone countries. I'm just giving updates on all of this, supposedly Merkel has reaffirmed "no way" to a Euro bond. But people at the moment are scouring obscure documents trying to find a glimmer of hope for a Euro bond issue.

The good old fashioned "bankruptcy", i.e. nationalize the banks, cancel the debt should have been done in 2008, this is basically the Swedish solution and their economy is humming. They had a banking crisis before 2008.

I don't know how Europe really gets out of this w/o some haircuts at least and those haircuts upset "investors" because they lose huge on their sovereign CDSes and they then pull out of the sovereign bond markets as well.

The downgrades aren't helping either.

This post, I'm just amplifying warning signs. It sure isn't a recommendation for people to go horde gold.

Gold, like any investment, can be tricky and you sure can get burned as we saw a couple of months ago when Gold crashed.

Don't even get me started on CA and other states. They are busy giving instate tuition to illegals, other special favors, while jacking tuition up to complete unaffordable for all. California is a great example of special interest politics trumping the statistics and economic realities and I sure hope the rest of the nation isn't stuck footing their bill.

But even worse, Newt Gingrich just won the NH newspaper endorsement and is the top of the GOP polls. Either these polls are all rigged or surveyed people are insane. The guy is a walking corporate lobbyist wish list, almost everything out of his mouth has been written by some corporate lobbyist for him to promote. Just unbelievable and the only thing I can think of is the "people" being surveyed are Exxon and Goldman Sachs.

Second look at euro bond

"Supposedly Merkel has reaffirmed "no way" to a Euro bond. But people at the moment are scouring obscure documents trying to find a glimmer of hope for a Euro bond issue." -- Robert Oak

Thinking positive, it makes sense to amortize the sovereign debt, but the devil's in the details. Amortization in of itself cannot eliminate fundamental risk or turn losses into gains. Surely, some 'haircuts' will be required, some write-downs.

From EconMatters blog at ZeroHedge (27 November 2011), Euro Bond: Europe's Only Way Out For Now

Europe, IMF update

There are a lot of reports, yet no official announcement of a $600 billion bail out from the IMF to Italy....with the IMF via the U.S. Fed., setting up some sort of rescue fund generally. Rumors and runaways move too fast to be sure, will probably write up a solid update when the European markets open.

Americans should catch on fire if the Fed is indirectly bailing out yet another European domino. Of course they only riot over black Friday.

Black Friday/Cyber Monday sales

You might be wondering why I am ignoring the various reports. I don't buy these numbers frankly, I think it's all hyped out. Not only the "sales", which to me look like those "sales" where the price is jacked up to make it look like one, but we've seen this hyped out numbers reports previously. 2008 Black Friday was off the hook and so on in reported sales, yet Q4 2008 retail sales tanked, as one would expect after millions get fired. 2007 was a black friday record and guess what started in December 2007? Yes, recession, economic tanking.

Also, this is ridiculous. As an example, there was really only one great deal at Best Buy, but the free publicity they get from new interviewing idiots camping outside their store for $300 bucks off, earning basically $1.78/hr. gives the retailer millions in free advertising and hype. The ultimate deal is for Best Buy, not shoppers. Think about that loss, those millions in advertising dollars given away for free by hyping reporters and press.

I'll wait for Q4 results or at least November monthly numbers thank you.

Capital gains tax research (free download)

Thanks to Angry Bear's Taxprof blog for this item.

There's substantial research now available as a free PDF from Social Science Research Network (New York) that relates to the question of whether or how wealth is systematically shifted from the middle upwards into global capital held by the few, through inequities in tax law. (The paper is dated November 20, 2011.)

Title: 'Is Capital Gains Tax Law Biased Against Low Income Investors?'

Authors:

Min Dai, National University of Singapore (NUS) - Department of Mathematics

Hong Liu, Washington University in St. Louis - Olin Business School; China Academy of Financial Research (CAFR)

Yifei Zhong, University of Oxford - Mathematical Institute

PDF download currently available at webpage --

papers.ssrn.com/sol3/papers.cfm?abstract_id=1962118

favor request

Sum up the main conclusion and for your comment subject line, put a descriptive title.

i.e. new research proves capital gains tax bias against middle class.

Your comments look like referrer spam links, which as admin I'm immediate moving to delete until I realize it's you.

New research shows capital gains tax bias against middle class

Referring to the SSRN research (PDF) --

The authors' analysis assumes that capital gains tax rates for low income investors are always lower than for high income investors. Nonetheless, the authors conclude that capital gains tax favors high income investors, based on analysis of differential value of investors' option to realize losses at the higher marginal ordinary tax rate while realizing gains at the lower tax rate for (longterm) capital gains.

PDF download currently available at webpage --

papers.ssrn.com/sol3/papers.cfm?abstract_id=1962118

(Thanks to R.O. for positive criticism.)