The world of economics is every moving, ever changing. What was true 65 years ago, or even 38 years ago, is no longer true today. The world has moved on.

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century.

...

The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained the exchange rate of its currency within a fixed value—plus or minus one percent—in terms of gold and the ability of the IMF to bridge temporary imbalances of payments.

The Bretton Woods system was created during the final days of WWII and we still live with its legacy today. However, it has morphed into something very different since then.

38 years ago President Nixon separated the dollar from the external gold standard, after the costs of the Vietnam War caused growing federal deficits. This marked the end of the traditional Bretton Woods system, where nations would peg their currencies to the dollar, which would then be pegged to gold.

The monetary system that has grown up after 1971 has been called by some Bretton Woods II.

Bretton Woods II was an informal designation for the system of currency relations which developed during the 2000s. As described by political economist Daniel Drezner, "Under this system, the U.S. is running massive current account deficits to be the source of export-led growth for other countries. To fund this deficit, central banks, particularly those on the Pacific Rim, are buying up dollars and dollar-denominated assets.

This has always been an unstable system, and the time has been marked with massive asset bubbles at home and frequent currency crisis abroad. But bankers in New York and London made enormous amounts of money under this unstable system, so no reforms were ever pushed.

Critics of this monetary system (such as myself) always assumed that our foreign creditors would one day choke on all those dollar-based debts they were forced to buy with their recycled trade surpluses. It seemed counter-intuitive that countries like China would forever sink nearly all of their profits funding America's overconsumption while their people lived in poverty.

I was wrong. So were the other critics. Our foreign lenders, with only a couple minor exceptions, have never slackened their appetite for our dollar-based debt. China may complain once in a while, but there was never any serious measures taken to ween themselves off of dollars.

The reason is because dollars are still the premium hard currency in the world. Just like savings in a fractional-reserve banking system, or gold in a central bank vault, foreign nations need our dollars (and dollar-based debts) in order to feed their own internal credit markets. Plus, the very nature of a debt-based currency requires a constantly growing economy in order to service the debts, and a growing economy requires credit.

All those Asian nations intentionally suppressed domestic labor unions and working salaries in order to undercut competition for shares of the American consumer market. This allowed them quick access to dollars, but prevented them from creating domestic demand of their own.

So if our foreign creditors are unable, or unwilling, to stop buying our dollar-based debts, then why should Bretton Woods II ever end?

The reason it is ending is because of the other side of the ledger - the American consumer.

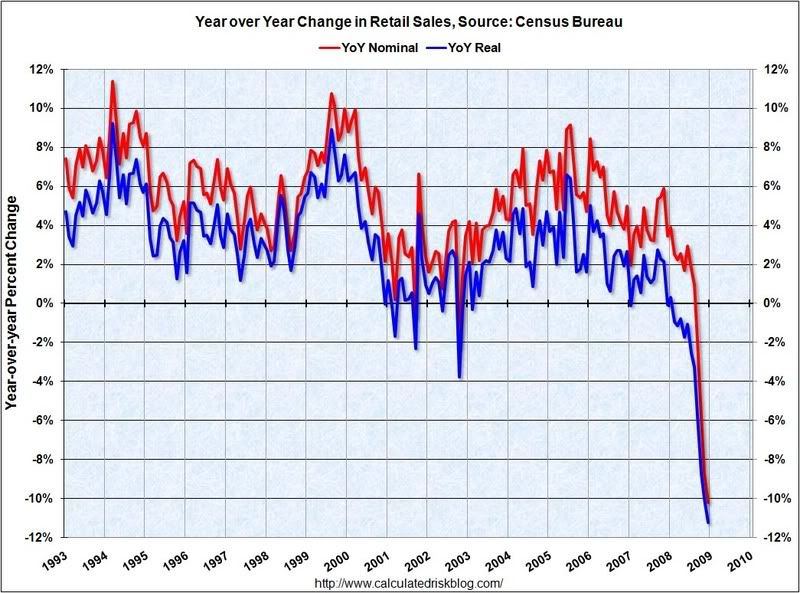

The last couple days have witnessed an epic collapse in the American consumer's purchasing power. Never before has retail sales fallen so far and so fast.

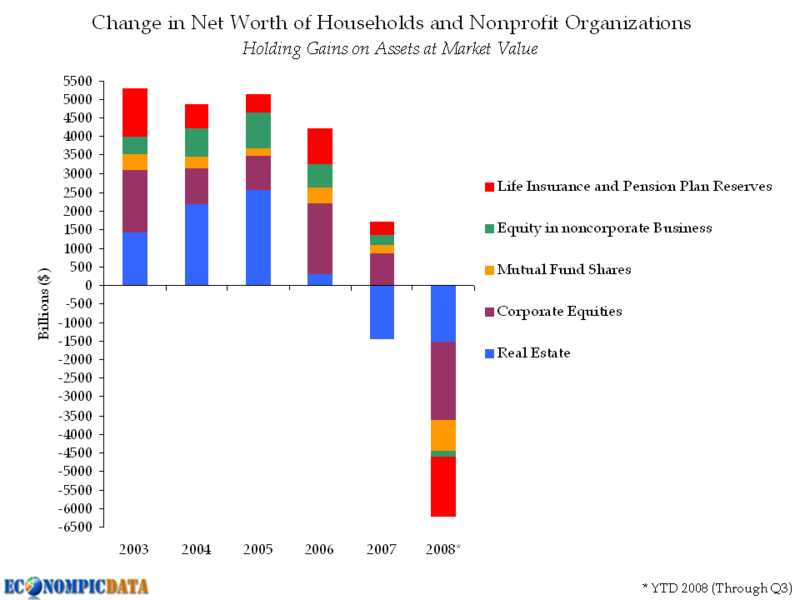

This is happening because the various asset bubbles have burst (housing and stocks), and the American consumer is no longer able to borrow against those assets to fund a lifestyle that his/her salary couldn't afford.

Rehashing the troubled American consumer is probably old news to you by now. It's been done to death.

However, what isn't talked about much is how this effects our foreign creditors.

Remember, they buy our dollar-based debt from their trade surpluses with us. Thus America must live and consume foreign goods far beyond its means for this dysfunctional system to continue.

So what happens when foreigners can't sell their cheap goods to America?

Freight rates for containers shipped from Asia to Europe have fallen to zero for the first time since records began, underscoring the dramatic collapse in trade since the world economy buckled in October."They have already hit zero," said Charles de Trenck, a broker at Transport Trackers in Hong Kong. "We have seen trade activity fall off a cliff. Asia-Europe is an unmitigated disaster."

Shipping journal Lloyd's List said brokers in Singapore are now waiving fees for containers travelling from South China, charging only for the minimal "bunker" costs. Container fees from North Asia have dropped $200, taking them below operating cost.

Industry sources said they have never seen rates fall so low. "This is a whole new ball game," said one trader.

The Baltic Dry Index (BDI) which measures freight rates for bulk commodities such as iron ore and grains crashed several months ago, falling 96pc. The BDI – though a useful early-warning index – is highly volatile and exaggerates apparent ups and downs in trade. However, the latest phase of the shipping crisis is different. It has spread to core trade of finished industrial goods, the lifeblood of the world economy.

...

"This is no regular cycle slowdown, but a complete collapse in foreign demand," said Lindsay Coburn, ING's trade consultant.

Vast naval fleets of empty container ships are anchored in the ports of Singapore and Hong Kong. Almost nothing is moving, and even if it does, it is selling at below cost.

The unsustainable in the long-term is becoming the unsustainable in the short-term.

Shippers can't afford to ship product "at cost" for long, and producers can't afford to sell product "at cost" for long.

Meanwhile America's trade deficit is shrinking fast.

Normally this is not a big deal. The weak go out of business. The strong takes them over. Bad debt is washed out of the system. Capitalism moves on.

However, we don't have a non-dysfunctional monetary system. We have a very dysfunctional one that requires the American consumer to keep buying things he doesn't need with money he doesn't have. Without our wasteful consumption of their goods our foreign creditors have neither the means nor the reason to keep buying our debt. Bretton Woods II breaks.

The Bretton Woods 2 system – where China and then the oil-exporters provided (subsidized) financing to the US to sustain their exports – will come close to ending, at least temporarily. If the US and Europe are not importing much, the rest of the world won’t be exporting much.And rather than ending with a whimper, Bretton Woods 2 may end with a bang.

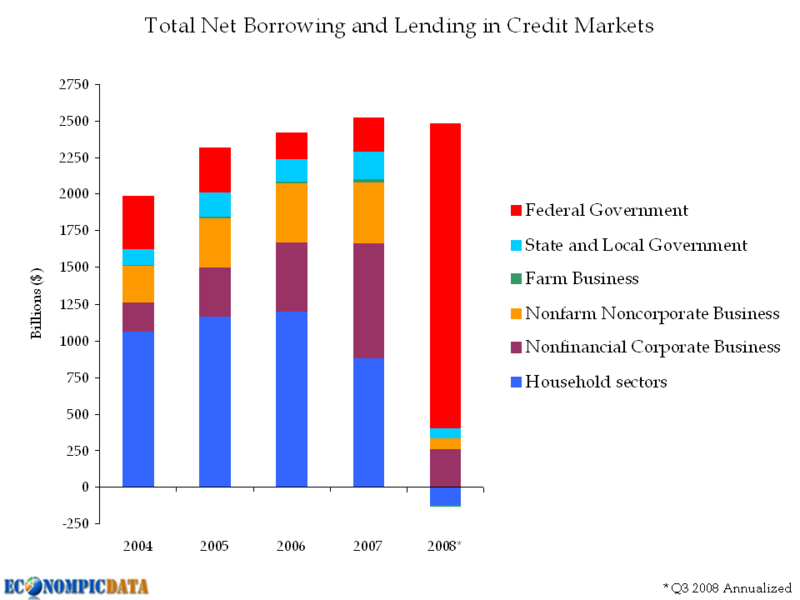

The federal government is trying to offset the drop in economic activity with increased borrowing and spending. However, that just puts more strain on the system because a) it doesn't do much to restore the falling trade deficit, thus not putting many new dollars in the hands of our foreign creditors, while at the same time b) it requires much more borrowing from our foreign creditors.

Where will our foreign creditors get the money to loan us if they don't have significant trade surpluses? If they don't loan us the money, where will the federal government get the cash to fund stimulus packages?

On November 14 and 15 most of the world leaders met in Washington for what many called Bretton Woods Summit 2. It was characterized by statements from French President Nicolas Sarkozy who said, "The evil is deep, We must rethink the financial system from scratch, as at Bretton Woods."

World Bank president Robert Zoellick got directly to the point by saying, "We will not create a new world simply by remaking the old."

Despite all the talk, Britain and America were more interested in remaking the old, thus nothing important was decided. Even more importantly was the dominance that America and Europe took in the talks.

Normally when a creditor and debtor talk, it is the creditor that holds the power. Yet the world still talks about money as if the debtor does. What is Asia's position on this?

I don't know. I'm not sure if even they know. Asia appears to lack competent leadership, and that is giving Bretton Woods II a little more breathing room. But the fundamental dysfunction of the current system is getting critical, and Asia is going to have to take a leadership role whether it likes it or not.

It's a Brave New World.

Comments

your graphs

man, your graph on the change of net worth is just eye popping, some pictures are more visual than others and this one hit me.

It's already begun

The Chinese Government announced on Dec 24 that it would begin settling trades with neighboring countries in yuan. I guess that was a heck of a "good tidings to all"...it just didn't include the US under "all". It's just a start, but you're absolutely right. The dollar will not be the world's reserve currency much longer. Great post.

A few points

You write, "All those Asian nations intentionally suppressed domestic labor unions and working salaries in order to undercut competition for shares of the American consumer market." That is not true in the case of Japan. When he was the Occupation Authority, Gen. Douglas MacArthur initiated a deliberate policy of promoting trade unionism, explicitly to prevent Japanese products from being so cheap they would over-run the American market. And in the 1960s, the Japanese had their famous policy of "income-doubling" aimed at driving up employee earnings very quickly. I think South Korea followed a similar policy. The spectacular gains the Japanese made in the U.S. market came in the 1970s and 1980s, because, I believe, of two things. First, U.S. businesses failed to invest in themselves, especially as the "go-go" years of the 1960s on the big wave of multi-national conglomerates developed into the leveraged buyout banditry of the 1970s. Second, the Reagan administration rejected almost all the unfair trade petitions and administrative actions that were filed by a host of U.S. industries and companies, most notably steel, auto, and the really, really crucial one, machine tools. In short, Reagan simply dismantled what was left of the Hamiltonian program of deliberate industrial policy, and threw the entire U.S. economy open to competition, which was supposed to weed out losers and make winners stronger.

On the collapse of Bretton Woods, most specifically the gold convertibility crisis that led to Nixon's actions, what I guess you are really not supposed to talk about is the role of the City of London and the development of the Euro-dollar "market." The British ambassador to the U.S. actually went to the U.S. Treasury to inquire about getting around $1.2 billion in gold. That's the event that precipitated the infamous Camp David meeting where the idea of breaking Bretton Woods was adopted - the idea of an Under-Secretary of the Treasury at the time by the name of Paul Volcker. I forget the exact figures, and all the intrigue, but it was in a book that came out around 1990 by a foreign exchange trader, and I've been kicking myself for the past couple of years for being unable to find it, and what I wrote about it at the time. Suffice it to say that I believe the British financial elites deliberately detonated the crisis as one of the first exercises in the shock doctrine of disaster capitalism. The idea was to eliminate statist institutions that regulated exchange rates and interest rates, and let those rates float as a way of creating "opportunities" for speculation and arbitrage. I'm pretty sure that the first studies on things like currency futures and interest rate futures were actually done at some British institutions, before being adopted in the U.S. And what few people realize is that the City of London is a larger financial center than New York, and has been for a long time.

In other words, there was a deliberate policy of "controlled disintegration" of the world economy. That was the bill of goods that was sold to Nixon, the loutish fool. William Engdahl's material on the web explicates this history in detail. The problem is that "controlled disintegration" rapidly gets you into the tin-foil hat land of the Trilaterals, blah, blah. "Controlled disintegration" is nothing more and nothing less than radical deregulation, applied on a global scale. And we now know what deregulation was really all about.

This is not to argue that the deficit financing of the Vietnam war was not a problem; it most definitely was. But it was a problem that was exploited to the fullest by the British financial oligarchy, I believe.

An interesting note, that again skirts tin-foil hat land, is that a handful of German and Italian leaders and industrialists who were leading the fight against the "controlled disintegration" of London and Washington were assassinated by terrorist groups or "lone assassins" in the 1970s and 1980s, inclduing Aldo Moro and Swedish Prime Minister Olof Palme. I was really shocked when Perkins' Confessions of an Economic Hitman came out a few years ago, and detailed how "jackals" routinely assassinated opponents of the IMF and World Bank in Latin America and Africa.

As for China accepting dollars for ever: I don't think so. The Chinese seem to be straining themselves to get into a position where they can cut the U.S. loose. But I think they're looking at a much longer time frame than we in America are capable of, with our fixation on daily news and quarterly results. The Chinese are building over 30 urban rail mass transit systems - an equivalent program in the U.S. would be around $3 trillion.

So, it's no surprise that "Britain and America were more interested in remaking the old." The present system was designed to benefit their elites, and elites have NEVER willingly surrendered their prerogatives.

I'll be bookmarking that last comment

and using it to guide my continued reading on the topic.

Hearing the mainstream press chide the citizens of main street for our alleged profligacy already annoys me. After reading what was just posted here, those moments of sanctimonious ignorance from the chattering classes are going to bother me even more.

"where will the federal government get the cash"

Why can't the federal government just print it? Money is created out of thin air. Why can't we as a democracy create it ourselves? Why do we allow banks to create it and then lend it to the government at interest?

miasmo.com

Because we don't have a democracy

We have a Republic, not a Democracy, and federalism to boot. Because of that, we have a central bank system.

Otherwise, I agree- the OBVIOUS way out of this is the printing of Friegeld- the method used in Wörgl, Austria during the depression to provide their people with interest-free and inflation-free currency.

-------------------------------------

Maximum jobs, not maximum profits.

???

I don't see the connection between the exact description of our government (democracy vs republic) and whether we can create money or must borrow it from banks who are given license to create it.

miasmo.com

Ok, you need a little history

We don't have a democracy- that means we don't vote on policy directly, but instead hire representatives who create policy for us. Those representatives can be bribed. Banks having the license to create money makes banks more profitable, which gives them more money for those bribes to representatives, and in return banks are given a monopoly on M3 creation.

In other words, we've got a corrupt government, and since actually printing money directly would be profitable only to common people and not to the banks, we won't get that option.

-------------------------------------

Maximum jobs, not maximum profits.

Okay.

I misunderstood your point. We agree that printing the money would be a good solution. The only problem is that powerful elites won't let it happen.

miasmo.com

Printing money all by itself

Just leads to the Weimar Republic and what it did to Germany (think not being able to buy a loaf of bread with money you can carry without mechanical assistance).

My real point is that freidgeld- expiring money- is the way to go. Yes, we need massive inflation to counter the massive deflation. But no- we don't have to put up with that inflation sticking around.

But you're right- the elites will never let it happen. Let somebody normal pay back their loan with money that will go "poof" and disappear after a while?

-------------------------------------

Maximum jobs, not maximum profits.