La Caisse Invests $240M in Cologix’s MTL 8 Data Centre

Monte Steward of Connect Canada CRE reports La Caisse Invests $240M in Cologix’s MTL 8 Data Centre:

Monte Steward of Connect Canada CRE reports La Caisse Invests $240M in Cologix’s MTL 8 Data Centre:La Caisse has provided $240 million in senior financing for Cologix’s MTL8 colocation data centre in Montreal.

The global investment group announced the financing agreement with Cologix, a North American network-neutral interconnection and hyperscale edge data-centre company. Construction of the facility’s structure and building envelope has been completed, and the AI-ready data centre is now in service. La Caisse supplied the entire debt financing to support Cologix’s continued investment in the site.

Located in Technoparc Montréal near Montreal–Pierre Elliott Trudeau International Airport, the MTL8 facility will deliver 21 megawatts of capacity and is powered by hydroelectricity. The site integrates with Cologix’s interconnection network across its 11 other Montreal facilities.

In 2025, the MTL8 data centre achieved LEED Gold certification, confirming its sustainability features meet high green building standards and making it one of the first facilities of its kind to earn the distinction. Cologix plans to use MTL 8 as a model for more green data centres.

“For close to a decade, we’ve invested in high-quality digital infrastructure assets that deliver long-term value, supported by strong fundamentals and growing demand for hyperscale capacity and computing power,” said Jérôme Marquis, managing director and head of private credit at La Caisse. “Our partnership with Cologix began in 2021, and since then, the company has reinforced its leadership across Canada and in Quebec. This third investment reflects our conviction in scalable digital-infrastructure platforms that enable businesses and communities to thrive.”

Scott Schneider, CFO for Montreal-based Cologix, said its partnership with La Caisse reflects his company’s continued commitment to invest in critical digital infrastructure across Canada.

“We have a strong, longstanding relationship with La Caisse, built on shared priorities around responsible growth, long-term value creation and supporting the growing needs of customers and communities, he said. “Together, this partnership positions us well to continue scaling infrastructure in Canada in a thoughtful, sustainable way as demand for cloud, AI and interconnected services continues to grow.”

The company operates 46 data centres in Canada and the U.S., including facilities in Montreal, Toronto, Vancouver and Calgary.

Last week, La Caisse announced it invested CAD 240 million to advance Cologix’s AI-ready MTL8 data centre in Montreal:

La Caisse, a global investment group, and Cologix, a network-neutral interconnection and hyperscale edge data centre company in North America, announce today they have concluded an agreement for a CAD 240 million senior financing for Cologix’s Montréal MTL8 colocation data centre. Construction of the structure and building envelope are completed, and the AI-ready data centre is in service. La Caisse has provided the entirety of the debt financing to support Cologix’s continued investment in the site.

Located in Technoparc Montréal, a major aerospace and technological hub situated near the Montréal-Pierre Elliott Trudeau International Airport, the MTL8 facility will deliver 21 MW of capacity and is powered by hydroelectricity. It integrates with Cologix’s dense interconnection network across its 11 other Montréal facilities. In 2025, the MTL8 data centre achieved LEED® Gold certification, confirming its sustainability features meet the highest green building standards, and making it one of the first facilities of its kind to earn this distinction.

“For close to a decade, we’ve invested in high-quality digital infrastructure assets that deliver long-term value, supported by strong fundamentals and growing demand for hyperscale capacity and computing power,” said Jérôme Marquis, Managing Director and Head of Private Credit, La Caisse. “Our partnership with Cologix began in 2021, and since then, the company has reinforced its leadership across Canada and in Québec. This third investment reflects our conviction in scalable digital infrastructure platforms that enable businesses and communities to thrive.”

ABOUT COLOGIX“Canada has always been a core market for Cologix and this partnership reinforces our continued commitment to investing in critical digital infrastructure across the country,” said Scott Schneider, Chief Financial Officer of Cologix. “We have a strong, longstanding relationship with La Caisse, built on shared priorities around responsible growth, long-term value creation and supporting the growing needs of customers and communities. Together, this partnership positions us well to continue scaling infrastructure in Canada in a thoughtful, sustainable way as demand for cloud, AI and interconnected services continues to grow.”

Cologix powers digital infrastructure with 45+ hyperscale edge data centers and interconnection hubs across 13 North American markets, providing high-density, ultra-low latency solutions for cloud providers, carriers and enterprises. With AI-ready, industry-leading facilities, Cologix offers scalable, flexible and sustainable data center options to help its customers accelerate their business at the digital edge. Cologix provides extensive physical and virtual connections, including Access Marketplace, where customers gain fast, reliable and self-service provisioning for on-demand connectivity. For more information, visit cologix.com or follow us on LinkedIn and X.

ABOUT LA CAISSEAt La Caisse, formerly CDPQ, we have invested for 60 years with a dual mandate: generate optimal long-term returns for our 48 depositors, who represent over 6 million Quebecers, and contribute to Québec’s economic development.

As a global investment group, we’re active in the major financial markets, private equity, infrastructure, real estate and private credit. As at December 31, 2025, La Caisse’s net assets totalled CAD 517 billion. For more information, visit lacaisse.com or consult our LinkedIn or Instagram pages.

After reading more about Cologix and what they do, I'm not surprised La Caisse partnered with them in 2021 and has provided the entirety of the debt financing to support the company's Montréal MTL8 colocation data centre.

In short, this is an extremely impressive company:

Even more impressive, Cologix is a leader in sustainability in its industry.

For example, I read these highlights from its fourth annual ESG report:

At Cologix, we aim to achieve more while considering the resources we deploy across our footprint. Scaling Sustainably means we grow carefully, we hire thoughtfully and we make decisions based on Cologix’s goals for our employees, customers and communities. One cannot succeed without the others.

We are pleased to share our accomplishments in 2023 across our environmental, social and governance initiatives, which include:

- Reaching 68% carbon-free energy usage across our footprint

- Introducing our ESG Key Performance Indicators that align with our ESG Strategy and Roadmap

- Quantified Scope 3 carbon emissions data and reported publicly for the first time

- Completed certification of five of our U.S. facilities by ENERGY STAR®

- Continued to align our capital expenditure process with our ESG Roadmap. Since 2016, we have spent more than $32M in ESG-related CapEx

- Continued quarterly diversity, equity and inclusion-related training with 100% completion by active employees

- In early 2024, developed a new suite of stand-alone policies for our team including Human Rights, Diversity, Equity and Inclusion, Anti-Bribery and Anti-Corruption and Whistleblower Guidelines.

I am incredibly proud of what we have accomplished together in the last year. We are excited to continue to build on these goals and enhance our efforts in 2024, and I am confident that as a team we can achieve more. Read our latest report to learn more about our work toward ESG excellence, and feel free to provide feedback at esg@cologix.com.

What else? I read a white paper on their site on how they are transforming data centers for the AI era:

AI is rapidly transforming industries, driving explosive growth in compute power and data center demand. With AI workloads requiring up to 200 kW per rack—far beyond traditional capacities—data centers must evolve to support this shift.

At Cologix, we build and retrofit data centers designed for AI’s unique needs, delivering advanced power density, innovative cooling solutions, and low-latency connectivity. Our infrastructure meets the rising demands of AI while addressing scalability, reliability, and sustainability, helping businesses stay ahead in the fast-paced AI revolution.

Unlock the future of AI infrastructure, download the full white paper now!

AI infrastructure and Data Center FAQs1. What makes Cologix’s data centers AI-ready compared to traditional facilities?

Traditional data centers typically handle up to 45 kW per rack, but AI workloads now demand densities up to 135 kW — with some projections reaching 200 kW per rack. Cologix addresses this through purpose-built infrastructure featuring advanced Direct-to-Chip (DTC) cooling systems that support 60-120 kW per rack, multi-megawatt ScalelogixSM campuses for hyperscale deployments and strategic edge locations across 45+ data centers in 12 North American markets. Our facilities incorporate extended cold aisle designs, comprehensive power planning and robust connectivity ecosystems specifically engineered for AI workloads’ unique requirements.

2. How does Cologix solve the power challenges facing AI deployments?

AI’s explosive growth is driving data center power consumption from 4.4% of total U.S. electricity in 2023 to a projected 6.7-12% by 2028. Cologix tackles this through a comprehensive energy strategy featuring diverse power sources, with over 60% of our footprint already carbon-free and Canadian sites operating with 98% renewable energy. We partner strategically with utilities like AEP Ohio, invest in innovative energy technologies and design flexible power solutions that accommodate both AI startups scaling incrementally and established providers with consistent high-density power demands across our scalable campus environments.

3. What cooling solutions does Cologix offer for high-density AI workloads?

High-density AI servers generate significant heat that overwhelms traditional air cooling methods. Cologix implements advanced cooling technologies including Direct-to-Chip (DTC) cooling, which circulates liquid coolant directly to high-power components like GPUs and TPUs. This targeted approach enables safe, efficient operation at power densities between 60-120 kW per rack while maintaining operational stability. We complement DTC systems with extended cold aisle designs and leverage Computational Fluid Dynamics (CFD) analysis to optimize cooling layouts for each customer’s specific configuration, ensuring maximum infrastructure efficiency and reliability.

4. How does Cologix support GPU as a Service (GPUaaS) providers?

The GPUaaS market is reshaping cloud computing by providing scalable, high-performance computing specifically for AI, machine learning and deep learning applications. Cologix enables this transformation through infrastructure that delivers the power density, advanced cooling, and robust connectivity that GPUaaS providers require. Our facilities offer direct onramps, diverse carrier options and low-latency connectivity essential for distributed AI workloads. With strategically positioned edge locations and hyperscale campuses, we provide the flexible foundation GPUaaS companies need to scale efficiently while meeting demanding bandwidth and latency requirements.

5. What sustainability initiatives does Cologix implement for AI infrastructure?

Recognizing AI’s growing energy demands, Cologix maintains a strong commitment to environmental responsibility with over 60% of our power footprint already carbon-free and Canadian facilities operating with 98% renewable energy. Our comprehensive energy strategy deploys diverse power sources, strategic utility partnerships and investments in innovative technologies to ensure reliable, lower-emission power delivery. We work closely with regional utilities to optimize power solutions and adapt to local energy needs while supporting customers’ long-term sustainability goals, proving that high-performance AI infrastructure and environmental stewardship can coexist effectively.

I am basically offering you a glimpse into this amazing company, and you understand why La Caisse is financing its Montréal MTL8 colocation data centre.

The company checks off all the boxes, including sustainability, and is growing extremely fast.

And with smart financing deals like this, yes, La Caisse can double its allocation to private credit in the next five years.

Alright, let me wrap it up there, I like this deal a lot, and that's why I covered it in a bit more detail.

Below, discover the strategic advantage of Cologix's Montréal Data Centers, offering approximately 1 million square feet across 12 facilities in and around the city. With direct connections to major cloud providers like Amazon Web Services, Google Cloud Platform, IBM Cloud, Microsoft Azure, and Oracle, plus access to over 100 network service providers, Cologix ensures low latency and high-speed connectivity.

Also, in this episode of The Deep Edge Podcast, host Ray Mota sits down with Callum Morrison, Account Director at Cologix, and Wayne Lloyd, CEO of Consensus Core, to discuss their pioneering partnership that is reshaping North America’s AI infrastructure landscape.

The guests delve into the launch of the first NVIDIA-powered GPU-as-a-Service (GPUaaS) at Cologix’s MTL10 data center in Montreal, exploring how scalable, on-demand GPU resources are empowering businesses in AI, machine learning, and 3D rendering.

The conversation covers the strategic role of connectivity and interconnection in delivering optimal performance for AI applications, Canada’s emergence as a global AI infrastructure hub, and the vision for AI-ready data centers poised to support future edge innovations.

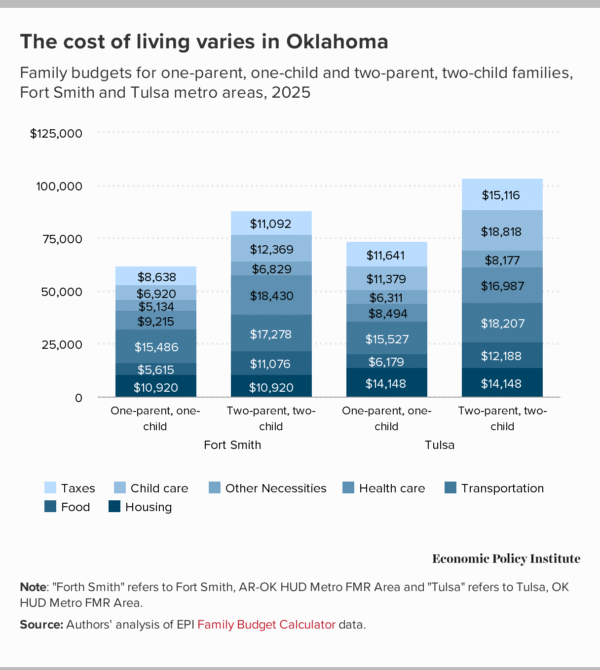

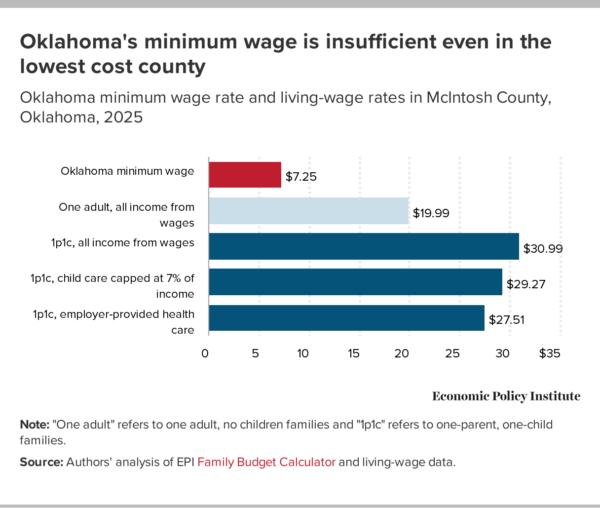

The Family Budget Calculator can be used to calculate living wages

The Family Budget Calculator can be used to calculate living wages

Oklahoma needs a higher minimum wage

Oklahoma needs a higher minimum wage

Recent comments