The economy has fallen off a cliff, but there are at least some hopeful indications that we might not have too much further to fall. Both Calculated Risk and Econbrowser have posted graphs indicating that the severe credit crunch evident during September has eased, and while the indicators haven't gone back to normal, they are at least out of the panic zone.

In addition to those, both monetary indicators I have been tracking now point to recovery.

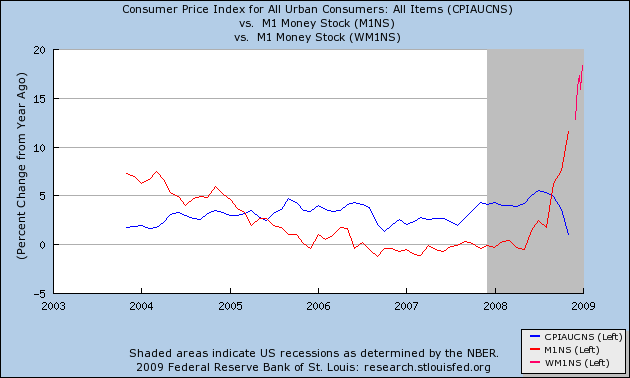

First is the Kasriel indicator I have been tracking for the last few months.

Whenever inflation (blue line) has been less than the expansion in M1 (red line) for at least 3 months, by at least 1%, (together with a positive yield curve in the bond market one year previously) a recovery has taken place. This is not just true in the post-WW2 era, but it is also true, at least on an annual basis, during the Great Depression (I haven't yet crunched all of the monthly numbers for the 1930s, so take this indicator with an extra grain of salt).

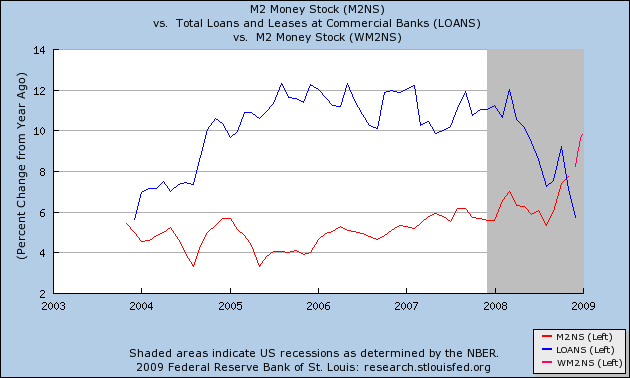

Second is the expansion of bank loans compared with M2.

With the sole exception of the "w" shaped 2001 recession, since WW2 whenever M2 (red line) has exceeded loans (blue line), a recovery has started.

In addition to the positive yield curve from one year ago (the reliability of which during deflation is in serious question), all of the monetary indicators I track now point towards recovery, and soon.

One other item of good news (more like bad news that didn't happen) is that, unlike the denouncement to Black September, when forced liquidations to meet hedge fund redemptions caused a market crash during early October, there was no evidence of large forced hedge fund redemptions during the January window that just closed.

Two other indicators do not confirm the monetary indicators at this time. Leading economic indicators, needless to say, are still bad (this week's data re pitiful work hours will add to that pain). We won't know about real relative residential investment (its decline now vs. a year ago) until the initial report of Q3 GDP is released at the end of this month.

And of course, even if it turns out that there are a couple of quarters of positive GDP growth ahead, the misery of layoffs and unemployment, being lagging indicators, will continue to worsen substantially.

Comments

It says something

that so much effort and resources have gone into saving the financial system, and it's basically financial indicators that are signaling the bottom is near.

The real economy is another story altogether.

And there is no movement toward a fundamental shift away from the oil-for-paper foundation of the economy. Which means another crash in a few years, and resource wars in the next two decades.

The real economy

Good point. The Q3 "real residential investment" number that will be released with the GDP at the end of this month will be the first good leading indicator of the real economy later this year.

The definition of recovery

Speaking of economic indicators divorced from reality, this is one. I think you're probably right on the recovery on very mild GDP growth (although Dr. Doom Roubini is saying none with a total 5% GDP decline in 2009) but to me the most odious thing is one can have layoffs going to hit an official (and let's talk about the real unemployment rate!) but an official one of > 9%. I saw 9.2% in the CBO report and many are indicating a 10% unemployment rate.

So, I find the entire definition skewed and only when one has unemployment below < 5% should they be allowed to claim the term "recovery". It's just another thing that bugs me because it's all focused in on the power elites, Wall street instead of the citizens of a nation.

direct manipulation by the Fed

But the money supply is directly influenced by the Fed, isn't it? Bernanke's philosophy is that the Great Depression was exacerbated by tightening of the money supply, so he's done everything he can to flood the money markets.

So it seems to me that you're not looking at the *natural* signs of an economic recovery, but rather, a snapshot of the Fed's efforts to spur one on.

It doesn't address the fundamental problems of widespread bank insolvency or middle class turmoil (fewer jobs, foreclosed homes, spiraling healthcare costs). You can pour all the gasoline you want into the carburetor, it won't improve engine performance if the spark plugs aren't firing.

Precisely

That is why I am putting together graphs, based on Milton Friedman's "Monetary History of the US" that has monthly M1 and M2 all the way back through WW1. When those are complete, I will post them.

As I have said before, what we are experiencing right now is a huge real-world experiment by the Fed to see if Milton Friedman's theory of the Great Depression was correct or not. Your criticism may be spot on.

I look forward to that piece!

It's going to be a blockbuster. I don't think I've seen that done!

Let's hope you're right

Your article points out several pertinent facts and lends hope for a recovery by end 2009. I'm not sure I like the idea of being part of "a huge real world experiment by the fed to see if Friedman's theory is correct" though. These are uncertain times.