Chinese Defense Labs Exploit Nearly $1 Billion In US Research Funds, Report Says

Authored by Dorothy Li via The Epoch Times (emphasis ours),

Nearly $1 billion in U.S. federal research funds have been funneled into projects involving the Chinese regime’s defense laboratories that pose “critical risks” to America’s national security, according to a new study.

Chinese missile launchers are seen during a military parade marking the 80th anniversary of the end of World War II, in Tiananmen Square in Beijing on Sept. 3, 2025. Kevin Frayer/Getty Images

Chinese missile launchers are seen during a military parade marking the 80th anniversary of the end of World War II, in Tiananmen Square in Beijing on Sept. 3, 2025. Kevin Frayer/Getty Images

Nearly $1 billion in U.S. federal research funds have been funneled into projects involving the Chinese regime’s defense laboratories that pose “critical risks” to America’s national security, according to a new study.

The report, released by the Center for Research Security and Integrity (CRSI) on Feb. 19, identifies nearly 1,800 research papers published between January 2019 and July 2025 that involve U.S. collaborations with Chinese defense laboratories.

About one-third of the articles specifically credited U.S. federal funding for the research. The topics of these projects ranged from directed energy systems and energetic materials to radar and sensing, artificial intelligence, flexible electronics, and high-performance computational physics.

“These are critical technology fields that can fundamentally change future military and warfighting capabilities, yet PRC defense laboratories are directly benefiting from this research,” analysts wrote in the report, using the acronym of the Chinese communist regime’s official name, the People’s Republic of China.

The report estimates the total value of these research projects at approximately $943.5 million, noting that the figure could be much higher due to ambiguities in certain research grants and facility contracts.

Jeffrey Stoff, founder of the Virginia-based nonprofit CRSI and co-author of the report, said the U.S. government and academia “lack the will, resources, or priorities” to effectively safeguard its research and innovation.

“This is largely because there are very few regulations that restrict such collaborations. In other words, research-performing organizations, including government laboratories, are not concerned with protecting national interests, even when the research is funded by taxpayers,” Stoff told The Epoch Times via email.

The report was released following multiple congressional investigations into projects involving researchers funded by the Pentagon or the Department of Energy collaborating with Chinese institutions that advance China’s military.

Stoff, a former China adviser for the U.S. government, said the latest study was “intentionally limited to collaborations with a subset of PRC entities that unambiguously pose critical risks to US national security: official PRC defense laboratories.”

‘Unacceptable Risk’The study identifies 45 Chinese laboratories, acknowledged by Beijing itself as key state-level defense laboratories, that have collaborated with U.S. entities.

Almost all of these laboratories removed the terms “defense” or “national defense” from their official English titles, the report notes, saying that this lack of transparency could complicate U.S. institutions’ due diligence and risk assessment efforts.

Among the most active collaborators with American researchers is the State Key Laboratory of Powder Metallurgy at Central South University in Changsha, China. Over the past five years, its personnel co-authored 285 articles with American researchers from public and private universities and federal laboratories. Of these publications, 80 credited U.S. government funding.

Even though the metallurgy lab omits the term “defense” from its official Chinese name, the report notes that its core mission is to support the Chinese armed forces, particularly in the defense aerospace sector.

Established in 1989 by Huang Peiyuan—a key scientist involved in China’s first atomic weapons and missile development programs—the lab is currently led by Zhou Kechao, who has worked on projects funded by the People’s Liberation Army’s (PLA) Equipment Development Department.

A security guard stands beside a screen showing a video about China's atomic and hydrogen bomb research during an exhibition on the Chinese regime's rejuvenation at the Military Museum of the Chinese People's Revolution in Beijing on Oct. 17, 2007. China Photos/Getty Images

A security guard stands beside a screen showing a video about China's atomic and hydrogen bomb research during an exhibition on the Chinese regime's rejuvenation at the Military Museum of the Chinese People's Revolution in Beijing on Oct. 17, 2007. China Photos/Getty Images

About 70 U.S. institutions have published research papers with the Chinese metallurgy laboratory since 2019, with the University of Tennessee being the most frequent partner. The Knoxville-based university didn’t respond to a request for comment by publication time.

The report also gives case studies of three other Chinese laboratories that frequently collaborate with U.S. institutions and scholars, including a national welding laboratory operated by China’s primary missile designer and producer, the China Academy of Launch Vehicle Technology. The lab is located within the Harbin Institute of Technology in northern China, a top-ranked member of the “Seven Sons of National Defense,” a club of Chinese universities with deep ties to the PLA.

“US institutions and federal research facilities’ critical-risk collaborations with entities supporting China’s defense [research and development] are significant and continue unabated,” the report reads.

“This raises a fundamental question: if collaborating with PRC defense laboratories is not considered an unacceptable risk that should be restricted, then what is?”

US FundersThe National Science Foundation (NSF) stands out as the largest sponsor of U.S. institutions partnering with these Chinese laboratories, accounting for more than 71 percent of federal funds identified in the report. While the NSF grants largely support theoretical and early-stage fundamental research, the report said, the collaborating Chinese laboratories clearly seek to apply the research in defense and even weaponry.

Other federal funders of such collaborations include the Pentagon and the Department of Energy (DOE).

The report found that 10 federally funded research centers affiliated with the DOE have had researchers working with Chinese defense laboratories. For instance, at the DOE-sponsored Argonne National Laboratory, researchers have co-authored 19 articles with identified Chinese laboratories since 2019, in which they credited U.S. government funds.

An undated aerial photo shows the Argonne National Laboratory in Illinois. Argonne National Laboratory/Getty Images

An undated aerial photo shows the Argonne National Laboratory in Illinois. Argonne National Laboratory/Getty Images

The report offers several recommendations to policymakers, including creating a government-run research center to oversee all research security and due diligence functions for federal agencies that allocate fundamental research funding.

In response to the study, Emil Michael, under secretary of war for research and engineering, told The Epoch Times that the Pentagon is “intensifying its efforts to safeguard taxpayer-funded research and is upholding the integrity of America’s scientific community.”

The DOE, NSF, and Argonne didn’t respond to a request for comment by publication time.

Tyler Durden Tue, 02/24/2026 - 23:25

via state media: CM-301/YJ-12

via state media: CM-301/YJ-12

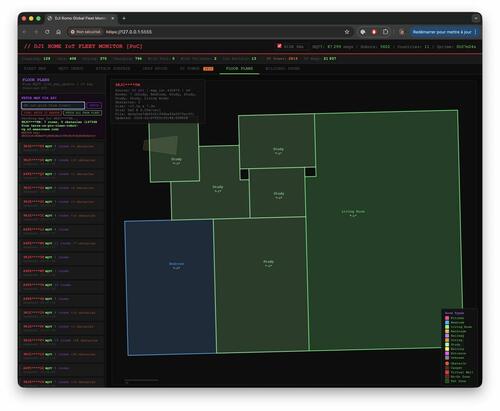

Azdoufal says he could remote-control robovacs and view live video over the internet.

Azdoufal says he could remote-control robovacs and view live video over the internet.

Rost9/Shutterstock

Rost9/Shutterstock

The DeepSeek app on an iPhone screen in San Anselmo, Calif., on Jan. 27, 2025. Justin Sullivan/Getty Images

The DeepSeek app on an iPhone screen in San Anselmo, Calif., on Jan. 27, 2025. Justin Sullivan/Getty Images

Recent comments