Government Steams Towards Partial Shutdown Amid Democrat Demands Over ICE

As a Friday deadline approaches for a partial government shutdown, Republicans are backed into a corner following national uproar over two deadly ICE shootings by federal agents in Minneapolis amid growing concern over the agency's tactics.

Senate Majority Leader John Thune (R-SD) plans to move forward with a six-bill spending package, which includes funding for the Department of Homeland Security (DHS) which runs ICE. Democrats are insisting that R's drop the DHS language from the package, however Republicans are refusing to do so.

The House-passed bill would allocate another $10 billion for ICE on top of the $76 billion the agency is already slated to receive over four years from the One Big Beautiful Bill Act, which was signed into law last year.

Right now Trump is focusing on "de-escalatory measures," as one administration official tells Punchbowl News. To that end, the admin has already demoted Gregory Bovino, the CBP official in charge of Minneapolis operations - who's been replaced by border czar Tom Homan. Trump also spoke by phone with Minnesota Gov. Tim Walz and Minneapolis Mayor Jacob Frey on Monday. Meanwhile, DHS Secretary Kristi Noem has agreed to testify before the Senate Judiciary Committee after months of refusing to do so. According to Punchbowl, Noem "has a real problem on both sides of the aisle on the Hill," and her top aide, Corey Lewandowski, met with Trump for two hours on Monday night.

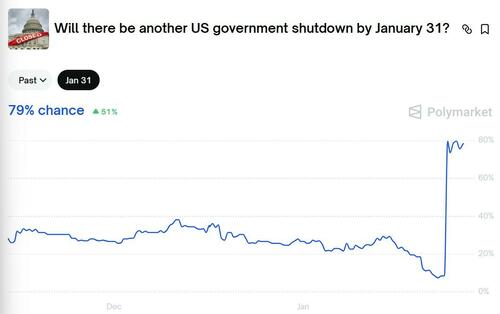

Polymarket odds of a shutdown by Jan. 31 (Saturday) are now hovering around 79%.

Democrats Are Still A NoSenate Democrats - who are vowing to block the funding if it includes the DHS language, say the proposals being floated the the White House and Senate Republicans are unrealistic, and they're a 'no' until they see significant reforms to the conduct of federal immigration officers in Minneapolis and other cities - including prohibiting them from wearing masks during federal operations and requiring judicial search warrants before entering a suspect's home.

On Monday, Senate Democratic Leader Chuck Schumer (D-NY) announced that Democrats will gladly speed through procedural obstacles to pass the funding package as long as it doesn't include DHS funding.

"If [Senate Majority Leader John Thune (R-S.D.)] puts those five bills on the floor this week, we can pass them right away. If not, Republicans will again be responsible for another government shutdown," said Schumer.

Of note, stripping the DHS / ICE funding from the FY2026 package would require a new vote in the House, which is on recess this week - so there would be a short-term shutdown at minimum.

GOP congressional leaders and the White House are desperate to avoid a scenario in which the funding package has to go back to the House, which explains their opposition to splitting off the DHS bill.

Here’s the concern gripping the top levels of the Trump administration — the House simply can’t pass another DHS funding bill under any circumstances.

Even if Trump were to cut a deal with Democrats that can get through the Senate, House Republicans believe they can’t round up 218 votes to pass a rule to get it on the House floor. Or alternatively, find 290 lawmakers willing to pass it under suspension of the rules. Republicans just don’t believe there’s a coalition in the House that can pass another DHS bill.

That’s why Trump has been focused on “de-escalatory measures,” as one administration official told us, a first step toward placating Democrats. -Punchbowl News

The Senate is expected to hold an initial vote to advance the package on Thursday, the day before Friday's deadline.

Republican Lawmakers ScrambleFollowing the incidents in Minnesota, Republican lawmakers in both chambers began calling for a thorough investigation into Saturday's shooting, and have asked the Trump administration to immediately ease tensions in Minneapolis.

"If I were President Trump, I would almost think about, ‘OK, if the mayor and the governor are going to put our ICE officials in harm’s way and there’s a chance of losing more innocent lives, then maybe go to another city," said Rep. James Comer (R-KY), chairman of the House Oversight and Government Reform Committee in a Sunday comment to Fox News' Maria Bartiromo.

Sen. Ted Cruz (R-TX) called for "everyone" to "ratchet the anger down," while noting that the two US citizens "who have been killed in confrontations with law enforcement" were "from all appearances ... not violent criminals," The Hill notes.

Sen. Rand Paul (R-KY) who chairs the Senate Homeland Security Committee, sent letters to the heads of CBP, ICE, and US Citizenship and Immigration Services on Monday calling on them to testify on Feb. 12 before his committee.

How Far Will Dems Push?While Democrats currently appear to have the upper hand in this fight, Punchbowl asks how far should they push it? While specific targeted policy changes and reforms are likely to gain traction with the White House - which is desperate to get past the moment, calls to "abolish ICE" will be ignored.

There’s also the obvious risk for Democrats: The political fallout from triggering a partial government shutdown just a couple of months after instigating a record 43-day funding lapse. And for DHS, this would hit FEMA at a time when much of the country is dealing with the aftermath of a severe winter storm. The Coast Guard and TSA are under DHS too. Plus, ICE would be funded anyway because of the cash infusion it got from the GOP’s One Big Beautiful Bill last year. -Punchbowl

Then there's the Pentagon, Labor, Transportation, and HUD departments which would be directly affected by the shutdown. The risk for Democrats is that Trump makes concessions on ICE but Democrats continue to 'resist.'

Tyler Durden Tue, 01/27/2026 - 19:10

People march and gather near the post office during a protest, Sunday, Jan. 18, 2026, in Minneapolis. AP Photo/Yuki Iwamura

People march and gather near the post office during a protest, Sunday, Jan. 18, 2026, in Minneapolis. AP Photo/Yuki Iwamura

Recent comments