Epstein Ally Was Talking To Feds About Flip, Wanted $3 Million To Keep Quiet, Then Backed Off Deal

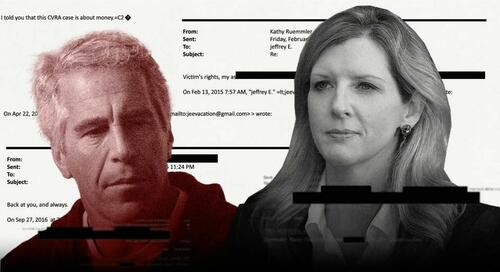

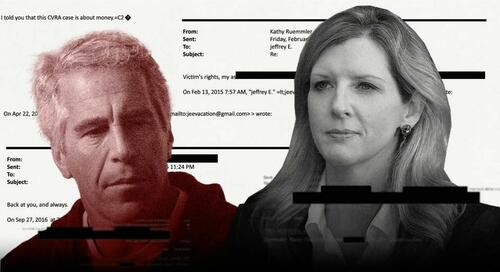

French modeling agent Jean-Luc Brunel - whose network delivered new girls from around the world to Jeffrey Epstein on a regular basis, was prepared in 2016 to tell U.S. prosecutors what he knew about Epstein’s sex-trafficking operation. According to newly released files from the DOJ, the now-deceased Brunel’s lawyer was negotiating with attorneys for Epstein’s victims about a possible meeting with federal prosecutors in New York in exchange for immunity - and Epstein knew it. And of course, Goldman Sachs (soon to be ex-) General Counsel Kathy Ruemmler is involved.

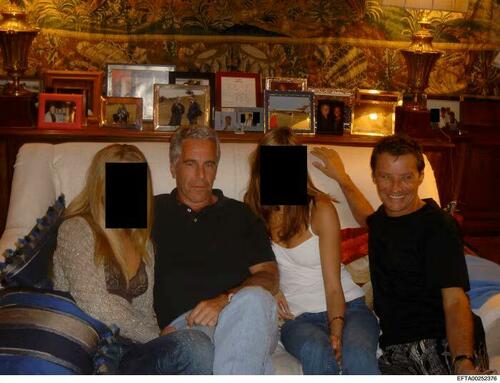

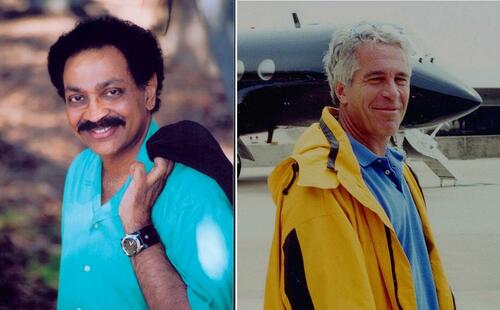

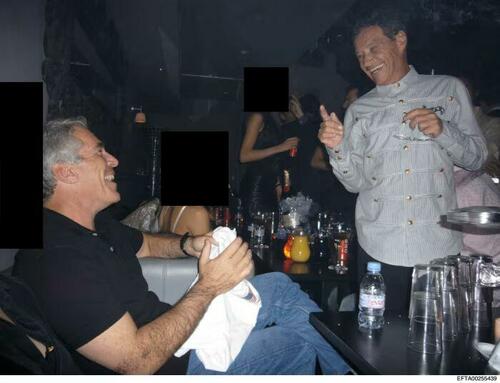

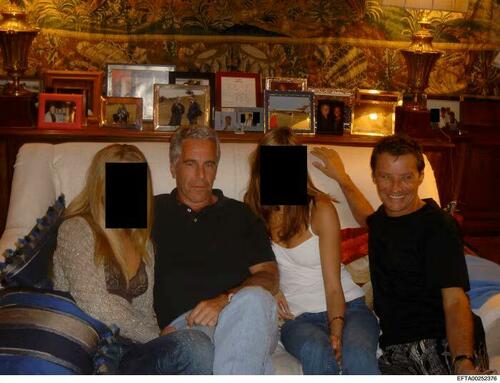

Jeffrey Epstein and Jean-Luc Brunel in an undated photo. Justice Department

Jeffrey Epstein and Jean-Luc Brunel in an undated photo. Justice Department

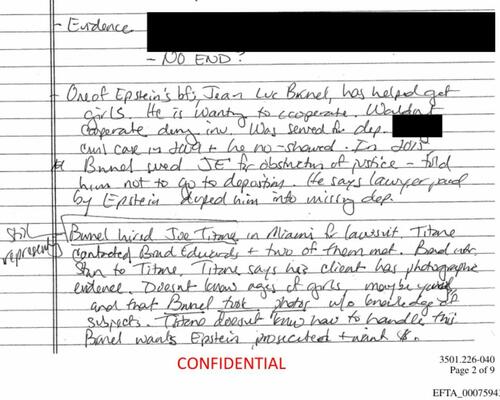

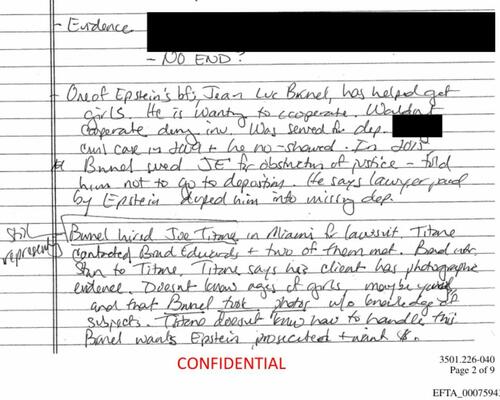

According to handwritten notes taken by a federal prosecutor in February 2016 state: "One of Epstein’s bfs, Jean Luc Brunel, has helped get girls. He is wanting to cooperate." The notes add: "Brunel is afraid of being prosecuted," the Wall Street Journal reports.

Notes by a federal prosecutor in 2016 regarding potential testimony by Brunel. Justice Department

Notes by a federal prosecutor in 2016 regarding potential testimony by Brunel. Justice Department

The discussions contemplated a date for Brunel to walk into the U.S. Attorney’s office in Manhattan. His lawyer said Brunel had recruited girls for Epstein and possessed incriminating photographs, according to the notes.

Then Brunel stopped communicating.

The files indicate that Epstein learned negotiations were underway. On May 3, 2016, Epstein emailed Ruemmler, a top Obama administration attorney who recently announced her resignation over the friendship. Epstein warned that Brunel planned to approach the U.S. Attorney’s office the following week - noting that one of Brunel’s friends had "asked for 3 million dollars so that Jean Luc would not go in."

Epstein said Brunel feared arrest if he did not appear. "I want to know more," he wrote, dismissing Brunel’s lawyer and friend as "scammers."

Ruemmler replied hours later, asking Epstein to call and explain. The next day she wrote: "Awake now. Talking to Poe in 20 mins." Gregory Poe was Epstein’s lawyer in Washington, D.C.

Poe claims he didn't speak with Ruemmler or Epstein about Brunel "on May 4, 2016 or at any other time," telling the Journal that he had a scheduled call that day with Ruemmler about his work on a motion to quash a subpoena directed at Epstein. "My engagement by Jeffrey Epstein was limited," Poe said, adding that he terminated work for Epstein in August 2016.

It remains unclear why Brunel ultimately declined to cooperate, or whether Epstein gave him $3 million not to. What is clear from the files is that no investigation was opened at the time. A 2021 government court filing states that the prosecutor who took the February 2016 notes discussed the meeting with colleagues at the U.S. Attorney’s office and the FBI, but no probe was initiated. The notes referencing Brunel were redacted in that filing. A spokesman for the U.S. Attorney’s office in New York declined to comment.

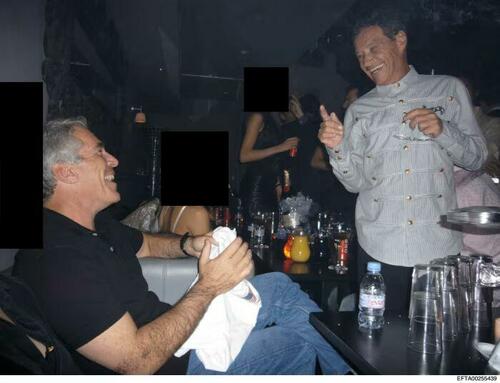

Epstein and Brunel during a birthday party for Epstein. Justice Department

Epstein and Brunel during a birthday party for Epstein. Justice Department

Epstein remained free for another three years, until his arrest in 2019. He died in a New York jail cell later that year in what the city’s medical examiner ruled a suicide.

"It set us back a couple of years," said David Boies, an attorney who filed civil suits on behalf of Epstein victims, referring to Brunel’s decision not to cooperate. "We know from our lawsuits that there were more than 50 girls that were trafficked after this."

Brunel occupied a central place in Epstein’s orbit. As head of a U.S.-based modeling agency, he recruited foreign girls and young women, secured work visas and provided the appearance of legitimate employment, according to the files. He traveled on Epstein’s private jet, visited his private island and exchanged hundreds of emails with him.

Federal prosecutors in New York were briefed in 2016 on details of Epstein’s trafficking scheme, including allegations that Brunel, Ghislaine Maxwell and others recruited dozens of underage girls, the handwritten notes show. The Justice Department did not move on Epstein until after a Miami Herald investigation in late 2018 renewed scrutiny of his earlier plea agreement in Florida.

When Epstein was arrested in 2019, Brunel and Maxwell were identified as co-conspirators in the FBI investigative file, according to the documents. Maxwell was convicted in 2021 and is serving a 20-year prison sentence.

Joseph Titone, Brunel’s attorney, said he advised his client to cooperate with authorities and cut ties with Epstein. "I recommended and advised him to stop communicating with Epstein, but he never did," Titone said.

Brunel was arrested in France in 2020 on allegations of rape and supplying girls to Epstein. He died in jail in 2022. Prosecutors in Paris said Saturday they would re-examine the case and create a special team to analyze evidence that could implicate French nationals.

Ruemmler has said she never represented Epstein and regretted her association with him. A spokeswoman, Jennifer Connelly, said, "This was another instance of Epstein attempting to engage Ms. Ruemmler on a matter about which she had no knowledge, and she appropriately directed him to his legal counsel." Connelly declined to specify which counsel.

As details of Ruemmler’s communications with Epstein became public in the recent files, she said last week she would resign in June from her position as general counsel of Goldman Sachs.

A Modeling Agency as Pipeline

Brunel was always a creep, even before he met Epstein. In 1988, CBS’s "60 Minutes" aired an investigation featuring women who said they were drugged by Brunel and pressured to have sex with his associates to obtain modeling work. One woman alleged on camera that Brunel had drugged and raped her. No criminal charges were filed, and Brunel denied the allegations.

By the early 2000s, Brunel and Epstein had developed a close relationship. Flight logs show Brunel frequently traveled on Epstein’s private jet beginning around 2000.

In 2005, Epstein wired up to $1 million to help Brunel launch MC2 Model Management, which opened offices in New York and Miami. According to the report, the MC2 was an inside joke, referring to the equation E=MC², with the E referring to Epstein.

According to the new files, Epstein used the agency to procure women and as a payroll vehicle. Emails from July 2006 show Epstein instructing Brunel to put a woman "on your payroll" at a $50,000 annual salary. When Brunel asked whether the woman should scout models, Epstein replied: "Start salary as soon as possible." He added that he would be in Paris the following week and "could see her then."

After Epstein pleaded guilty in Florida in 2008 to procuring a minor for prostitution and served jail time, Brunel visited him nearly 70 times, according to jail logs.

Control Through Visas and Debt

Following his 2006 arrest in Florida, Epstein focused on recruiting women in their late teens and 20s from Europe and Russia, the files indicate. Dependent on work visas, housing and financial support, they were vulnerable to control.

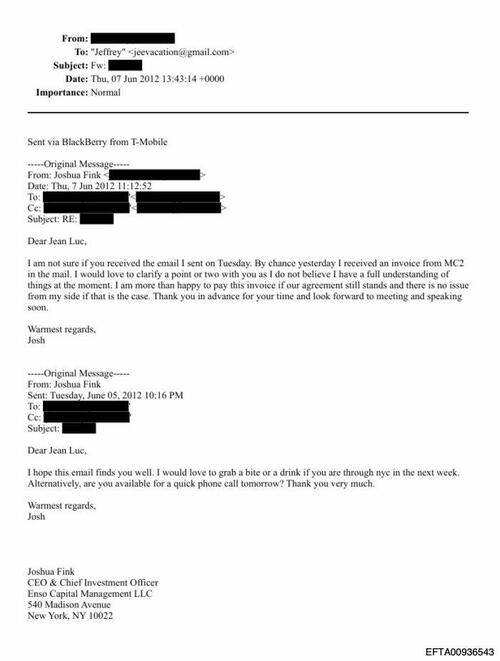

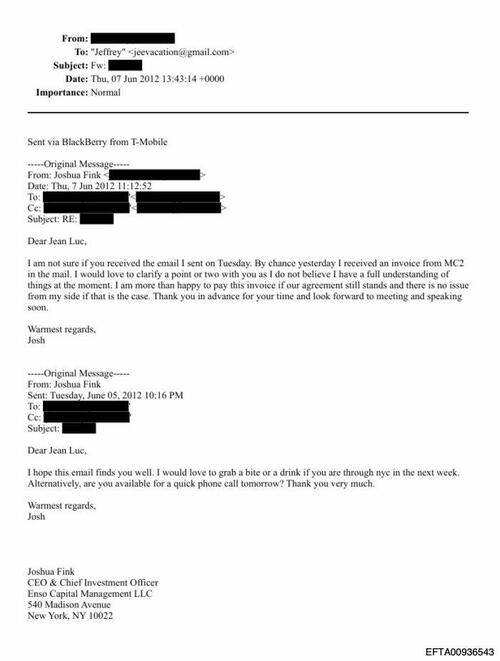

In June 2012, Joshua Fink - son of BlackRock CEO Larry Fink - emailed Brunel about an MC2 invoice concerning a 'model' he was 'dating'... Brunel said he would suspend billing. When Brunel forwarded the exchange to Epstein, Epstein replied: "Talk to me first please."

The invoice related to a work visa through the agency. The woman had forwarded chat logs with Fink to Epstein, including messages in which Fink wrote: "And with your visa, I have no idea what it is I can do beyond pay your agency to supplent (sic) your income and theirs because you are not getting work as a model."

Fink said he met the woman at a dinner party and had a romantic relationship lasting about a year. "I had no relationship with Epstein or Brunel," he said. "I am totally shocked that she was forwarding electronic correspondence to Epstein." He said he loaned her money to settle debts with the agency.

"It was a personal relationship, and personal things happen," Fink added.

The woman told the Journal she felt trapped in a web of abuse controlled by Epstein and Brunel. After signing with MC2 and obtaining a work visa, she said, modeling jobs dwindled while fees mounted. She described the relationship with Fink as consensual and a potential escape. She said Epstein blocked plans for Fink to meet her in Paris to discuss marriage, and the relationship ended.

Brad Edwards, a lawyer representing more than 200 Epstein victims, said, "Epstein’s wealth and power allowed him to infiltrate industries, perhaps most pervasively the modeling industry. He found in Jean-Luc a like-minded predator with whom he could conspire on a daily basis to recruit and control the lives of countless young women, including Jane Doe."

Fracture and Reconciliation - a ruse?

In 2014, Virginia Roberts Giuffre filed a motion alleging Brunel trafficked girls as young as 12 to his associates, including Epstein. As public scrutiny intensified, Brunel and MC2 sued Epstein in Florida in January 2016 - claiming the agency’s value had collapsed due to notoriety surrounding Epstein. The suit alleged up to $10 million in lost profits and difficulty recruiting models.

Titone later contacted Edwards, suggesting Brunel might possess photographic evidence against Epstein. Victims’ attorneys, including Stan Pottinger and Boies, relayed information to federal prosecutors.

By early 2016, Brunel appeared ready to cooperate. The Feb. 29, 2016 notes state: "Titone says his client has photographic evidence." They also note: "Brunel doesn’t want to implicate himself."

Epstein and Brunel with women whose faces have been redacted. Justice Department

Epstein and Brunel with women whose faces have been redacted. Justice Department

On May 3, 2016, Pottinger wrote to a prosecutor referencing Daniel Siad, whom Brunel described as a recruiter for Epstein. Emails show Siad updating Epstein about potential recruits and writing, "please send me the details of the girls names etc." In another message, Siad compared recruiting to fishing: "In This busyness I feel like fisherman some time I cache quick , some time no fish." He itemized expenses of 2,700 euros.

Siad later said in a video broadcast in France that he introduced models to Epstein professionally. "With time, we have learnt that he committed atrocities," he said.

The breach between Brunel and Epstein proved temporary (perhaps as designed). By April 2015, Brunel proposed mediation, and Epstein wrote: "I have some ideas. that I think you will like." Titone said the lawsuit was eventually settled under confidential terms.

When Epstein was found dead in 2019, Brunel went into hiding. French police arrested him in December 2020 as he attempted to board a flight to Senegal. He was charged with sex crimes and, in February 2022, was found hanged in his prison cell.

The Justice Department files suggest that in 2016, a potential turning point slipped away. Brunel did not walk into the U.S. Attorney’s office. The investigation did not advance. And Epstein continued recruiting victims for years afterward.

Tyler Durden

Thu, 02/19/2026 - 10:55

A man holds his 14-month-old son while he gets the MMR vaccine at a clinic in Lubbock, Texas, on March 1, 2025. Jan Sonnenmair/Getty Images

A man holds his 14-month-old son while he gets the MMR vaccine at a clinic in Lubbock, Texas, on March 1, 2025. Jan Sonnenmair/Getty Images

Image via NiemanLab

Image via NiemanLab Elizabeth Bruenig, who fabricated measles scare piece without a disclaimer.

Elizabeth Bruenig, who fabricated measles scare piece without a disclaimer.

The crew of the U.S. Coast Guard Cutter Mohawk (WMEC 913) and a Coast Guard MH-60 Jayhawk helicopter flight crew conduct training evolutions in the Caribbean Sea, on July 15, 2025. Seaman Corrie Gill/U.S. Coast Guard

The crew of the U.S. Coast Guard Cutter Mohawk (WMEC 913) and a Coast Guard MH-60 Jayhawk helicopter flight crew conduct training evolutions in the Caribbean Sea, on July 15, 2025. Seaman Corrie Gill/U.S. Coast Guard Vilayanur Subramanian Ramachandran and Jeffrey Epstein

Vilayanur Subramanian Ramachandran and Jeffrey Epstein EFTA01013830.pdf

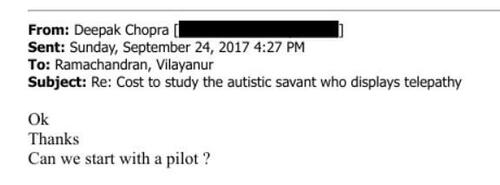

EFTA01013830.pdf Ceepak Chopra

Ceepak Chopra Jeffrey Epstein and Jean-Luc Brunel in an undated photo. Justice Department

Jeffrey Epstein and Jean-Luc Brunel in an undated photo. Justice Department Notes by a federal prosecutor in 2016 regarding potential testimony by Brunel. Justice Department

Notes by a federal prosecutor in 2016 regarding potential testimony by Brunel. Justice Department

Epstein and Brunel during a birthday party for Epstein. Justice Department

Epstein and Brunel during a birthday party for Epstein. Justice Department

Epstein and Brunel with women whose faces have been redacted. Justice Department

Epstein and Brunel with women whose faces have been redacted. Justice Department

CQ Roll Call/Sipa USA via Reuters Connect

CQ Roll Call/Sipa USA via Reuters Connect

DataBank’s IAD4 data center under construction in Ashburn, Va

DataBank’s IAD4 data center under construction in Ashburn, Va

Recent comments