Futures Flat Despite Blowout Nvidia Earnings

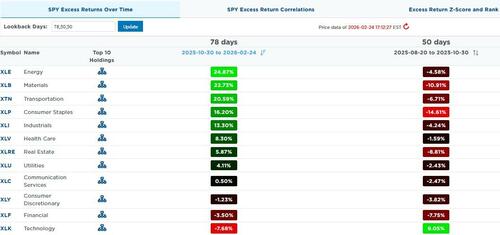

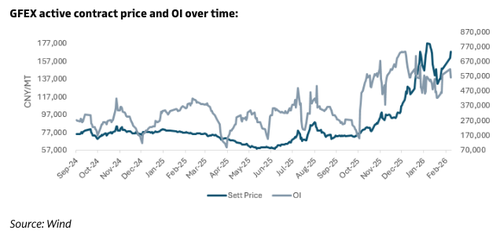

US equity futures managed to erase overnight losses and were trading flat after Nvidia and Salesforce failed to assuage fears about an overheated AI economy while traders awaited color from today's round of US / Iran talks. As of 8:00am S&P futures were unchanged and nasdaq futures were down 0.1%, with NVDA up 1% premarket but well off overnight highs after its earnings report and guidance smashed expectations while CEO Jensen Huang talked about “exponentially” growing computing demand and “skyrocketing” adoption of AI agents. It wasn’t enough, especially as software companies Salesforce and Snowflake both provided lukewarm sales guidance to an already-nervous market. “Aside from fireworks, champagne and dancing robots, we are not quite sure what more Nvidia could have done on the 4Q call to get the market re-excited,” said Jim Fontanelli, co-founder of Arete Research. Discretionary, Financials, and Industrials are outperforming with notable weakness in Energy and Materials. In premarket trading, Mag7 names were mostly weaker ex-NVDA though, as JPM says, bulls should not panic as we await Long Only demand once the market opens. AI-related plays are higher pre-mkt. Bond yields are flat, the USD is flat; in commodities lithium prices surged after Zimbabwe, one of the world’s top producers, suspended concentrate exports. Brent crude edged lower as nuclear talks take place between the US and Iran while silver stalled as it reached nearly $90/oz. Today’s macro data focus is on jobless claims, KC Fed, and several Fed speakers.

In premarket trading Nvidia Corp. (NVDA) rises 1.3% after its latest sales forecast drew a muted response from investors. Other Magnificent Seven stocks are mixed (Amazon -0.1%, Apple -0.04%, Microsoft -0.06%, Alphabet -0.06%, Tesla -0.6%, Meta -0.6%)

- Array (ARRY) drops 22% after the renewable energy company’s 2026 adjusted Ebitda guidance missed the average analyst estimate.

- C3.ai (AI) slumps 25% after the AI company cut its revenue guidance for the full year, missing the average analyst estimate.

- Celsius Holdings (CELH) rises 12% after posting sales which more than doubled from a year earlier following its acquisition of Alani Nu, allaying concerns that a change in distribution channels would disrupt sales.

- FTAI Aviation (FTAI) falls 4% after the aerospace company reported total revenue for the fourth quarter that missed the average analyst estimate.

- GoodRx Holdings (GDRX) falls 15% after the health-care platform forecast revenue for 2026 that fell short of Wall Street’s expectations. It also gave an estimate for the lower bound of 2026 Ebitda that would be below expectations. Multiple analysts said they were surprised by the scale of margin deterioration implied by the profit outlook.

- IonQ (IONQ) rises 13% after the quantum computing company reported fourth-quarter results that beat expectations.

- Janus Henderson Group (JHG) climbs 6% after Victory Capital offered to acquire the company for $57.04 per share.

- Krispy Kreme Inc. (DNUT) climbs 15% as the company expects leverage to decline further this year as it advances its turnaround plan following the end of its US partnership with McDonald’s Corp.

- Nubank (NU) slips 2% after the lender reported higher costs and provisions that analysts say offset net income increase in the fourth quarter.

- Nutanix (NTNX) rises 18% after Advanced Micro Devices said it will buy $150 million in the software company’s stock as part of a new partnership. The news was seen as overshadowing a reduced full-year forecast.

- Papa John’s (PZZA) falls 5% after the pizza chain reported weaker-than-expected sales results, which reflect a “weak consumer backdrop and elevated promotional environment.”

- PROCEPT BioRobotics (PRCT) sinks 24% after the medical equipment maker forecast revenue for 2026 that fell short of Wall Street’s expectations. The firm also posted results for the fourth quarter that Leerink Partners called a “painful miss.”

- Salesforce Inc. (CRM) falls 3% after the company gave a lukewarm outlook for sales growth in the new fiscal year, fueling investors’ worries that the software giant will lose out to new competitors in the age of AI.

- Synopsys (SNPS) falls 3% after the electronic design automation software company’s Design IP revenue came in below expectations. The company also forecast weaker-than-expected free cash flow for the full-year.

- Trade Desk (TTD) declines 14% after the advertising technology company gave a first-quarter forecast that was weaker than expected. The report is adding to concerns about competition from Amazon and AI-related disruption.

In corporate news, Apollo and BNP Paribas are said to be nearing a deal to partner up in Europe’s private credit market. Apple is in discussions with key Indian banks and global card networks in preparation to start Apple Pay in the world’s most populous country. American Airlines will invest $1 billion in a concourse expansion at Miami International Airport to bolster its position at its top international gateway.

Despite Nvidia's estimate-busting guidance, and CEO Jensen Huang talking about “exponentially” growing computing demand and “skyrocketing” adoption of AI agents, it wasn’t enough, especially as software companies Salesforce and Snowflake both provided lukewarm sales guidance to an already-nervous market. Yet there is one group of winners: memory chipmakers Samsung and SK Hynix jumped in Asian trading. A huge jump in supply-related commitments by Nvidia “likely reflects a deliberate effort by Nvidia to tie up valuable components,” according to Vital Knowledge analyst Adam Crisafulli.

Nvidia’s shares “not doing much was quite instructive, especially within the context of one of the other companies that reported — Salesforce,” said Gary Paulin, chief investment strategist at Northern Trust Asset Management. “The concern is that the more success Nvidia has, the more concern there is in the market that there is more disruption.”

For Mohit Kumar, chief strategist for Europe at Jefferies, markets are being “too sanguine” about risks of a limited strike by the US on Iran and an increase in short-term tensions. While a long-drawn war is unlikely, the issue could weigh on markets over the coming days.

“We have reduced our risk profile into the weekend,” Kumar wrote. “Our medium-term view remains bullish and we would be looking to add at better levels.”

Private credit continues to be rattled by the software selloff, with Marathon AM Chairman Bruce Richards saying the asset class is way too exposed to the sector, though he sees little risk of contagion to the wider market. The Fed’s Bowman, meanwhile, said banks need “flexibility” to compete with non-bank financial institutions, which continue to increase their share of the total lending market.

In tariffs, the US vowed to maintain high duties on China hours after Beijing warned against any future hikes. Canadian PM Mark Carney’s visit to India this week will cement a diplomatic reset and unlock a wave of new trade opportunities, including in nuclear power, oil and critical minerals, India’s top diplomat to Canada said.

In earnings, out of the 453 S&P 500 companies that have reported so far in the earnings season, 74% have managed to beat analyst forecasts, while 21% have missed. Royal Bank of Canada, Vistra and Warner Bros. Discovery are among companies expected to report results before the market open. Bloomberg Intelligence expect to see continuing wealth growth and sustained profitability in capital markets at RBC, offsetting muted personal and commercial loan growth. Earnings from Dell, Intuit and Monster Beverage follow later.

In Europe, the Stoxx 600 inches higher and is on course for a record close. Financial services stocks outperform while miners and construction shares lag. Here are the biggest movers Thursday

- Rolls-Royce shares rise as much as 8.4%, hitting a record high, after the UK-based engine maker said it was planning a major share buyback and raised its mid-term earnings targets

- Engie shares rose as much as 7.6% after it agreed to buy the UK’s largest power-distribution network for £10.5 billion ($14.2 billion) from Hong Kong billionaire Victor Li’s CK Group

- Indra shares soar as much as 20%, to its highest intraday level on record, after the Spanish defense company’s fourth-quarter results “beat across the board,” according to Morgan Stanley

- Howden Joinery shares surge as much as 11%, the most since July, on what Panmure Liberum analysts call “impressive” full-year results by the kitchen seller that beat the average analyst estimate for profit

- Puma gains as much as 9.1% after the German sporting goods and apparel retailer posted results that showed early signs of a long-awaited recovery, particularly driven by a strong performance in its Asian market

- Syensqo fell by a record after the chemicals maker reported fourth-quarter earnings that missed estimates with an outlook for this year that points to more struggles

- Hikma Pharmaceuticals sinks as much as 18%, the most since February 2016, after the drugmaker’s 2026 core operating profit guidance came in below expectations

- Freenet drops as much as 12%, most since May, after its fourth-quarter results missed expectations. Citi said this can be attributed to impact from a single mobile network operator agreement in which the firm fell short of a gross profit commitment

- Scout24 drops as much as 7.8% amid disappointment over a lack of earnings upgrades as fears of AI-driven displacement continue to weigh

Asian stocks extended gains to a fourth-straight day as South Korean chipmakers extended their rally, offsetting investor caution in the wake of Nvidia’s results. The MSCI Asia Pacific Index climbed as much as 1.1%, on course to close at another record, with Samsung and SK Hynix among the biggest boosts. South Korea’s Kospi index jumped as much as 3.8% closing at an all-time high, buoyed by the chip heavyweights. Japan’s Topix and Australia’s S&P/ASX 200 also climbed, while benchmarks fell in Hong Kong and Singapore. Nvidia’s results and outlook failed to impress investors amid concerns about an overheated AI economy, and some analysts also flagged concerns over competition. While the Korean memory makers gained, most Asian chip-related stocks slipped. Beyond tech, Asian markets largely shrugged off a US threat to raise global tariffs to 15% “where appropriate” in the coming days. The region’s stocks have been resilient this year, with the key MSCI APAC index up about 15%, far outpacing global peers.

Emerging-market stocks continued their outperformance, with MSCI’s gauge of EM equities up 15% in dollar terms this year. Rallies in memory chipmakers such as Samsung Electronics Co. and SK Hynix Inc. fueled gains on Thursday, pushing South Korea’s Kospi index up more than 50% in dollar terms so far in 2026.

A report from Citigroup Inc. found that money managers had added to long positions in emerging markets across Asia, Latin America, as well as Europe, the Middle East and Africa. They also favor emerging currencies against the dollar.

In FX, the yen is the best-performing G-10 currency, rising 0.2% against the greenback after some hawkish BOJ remarks.

In rates, treasuries are steady, with US 10-year yields near flat at 4.05% as US trading day begins, after plying narrow ranges during Asia session and European morning. US 10-year yield is near 4.05% with curve spreads likewise little changed. Gilts outperform as the pound weakens, with UK yields 1bp-2bp richer across maturities. This week’s Treasury auctions conclude with $44 billion 7-year notes at 1pm New York time; Wednesday’s 5-year sale tailed by 0.7bp

The Bloomberg Dollar Spot Index is little changed.

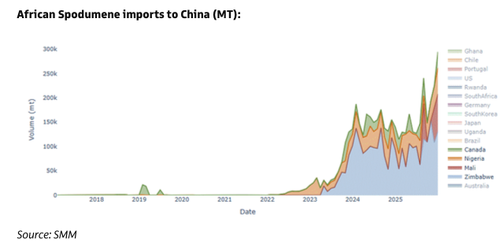

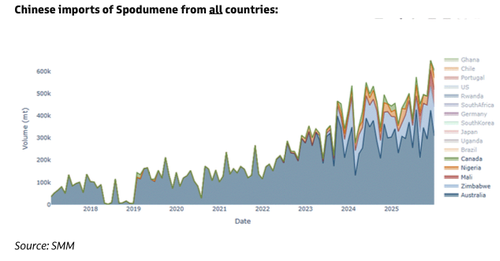

In commodities, US crude futures fall 1.6% to their lowest level this week as the US and Iran start a third round of nuclear talks in Geneva. Some major Middle Eastern producers have also been boosting exports, as concerns about a potential conflict in the region create uncertainty about future supply. Precious metals are mixed with silver down nearly 2% while gold is slightly higher. Lithium prices surged after Zimbabwe, one of the world’s top producers, suspended concentrate exports. Brent crude edged lower as nuclear talks take place between the US and Iran. Bitcoin falls 1%.

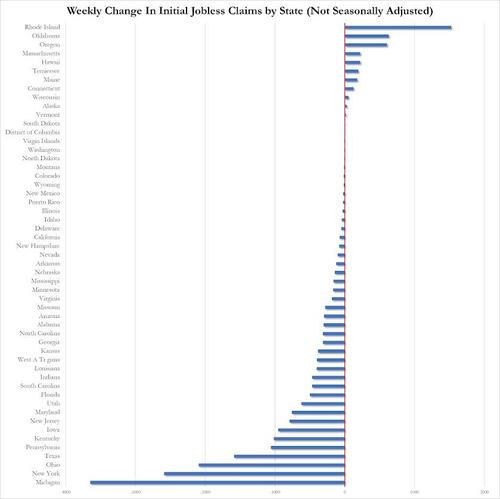

US economic data slate includes weekly jobless claims (8:30am) and February Kansas City Fed manufacturing activity (11am). Fed speakers scheduled for the session include Miran (8:45am), Bowman (10am) and Goolsbee (2:30pm)

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.2%

- Stoxx Europe 600 little changed

- DAX +0.1%, CAC 40 +0.8%

- 10-year Treasury yield little changed at 4.05%

- VIX +0.1 points at 18.01

- Bloomberg Dollar Index little changed at 1187.55

- euro -0.1% at $1.1796

- WTI crude -1.3% at $64.55/barrel

Top Overnight News

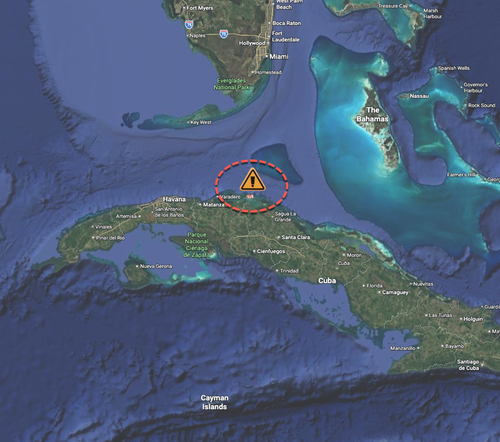

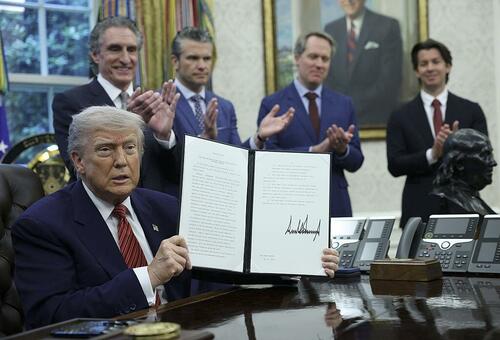

- The US and Iran kicked off nuclear talks in Geneva with days to go until Donald Trump’s deadline for a deal. Satellite images show Iran is already rebuilding nuclear facilities damaged by American and Israeli attacks last June. BBG

- The Pentagon asked two major defense contractors on Wednesday to provide an assessment of their reliance on Anthropic's AI model, Claude — a first step toward a potential designation of Anthropic as a "supply chain risk": Axios

- Iran’s atomic program hasn’t advanced significantly since the U.S. and Israel struck its three main nuclear sites last June, according to experts and diplomats, despite Washington’s top negotiator saying Tehran could make fissile material for a bomb within days. WSJ

- Pentagon officials and Hill lawmakers are increasingly warning that prolonged Iran strikes could stress U.S. military stockpiles to the brink and make the country more vulnerable. Politico

- The US will maintain high tariffs on China, at a range of 35% to 50%, according to USTR Jamieson Greer. Beijing warned it would take “all necessary measures” if new levies are imposed. BBG

- Suppliers to U.S. aerospace and semiconductor firms face worsening rare earth shortages, with two turning away some clients, industry insiders said, weeks before U.S. President Donald Trump is expected to meet his Chinese counterpart Xi Jinping for a summit in Beijing. RTRS

- With deflation now firmly in the rearview mirror, the path is clear for the Bank of Japan to raise interest rates sooner rather than later, said policy board member Hajime Takata. WSJ

- Christine Lagarde repeated that the ECB has succeeded in taming consumer prices, while cautioning that policymakers must watch elevated perceptions of inflation. BBG

- The UK’s top banks are resisting a regulatory initiative to boost lending by lowering their capital levels, people familiar said. BBG

- Nvidia CEO Jensen Huang said Wednesday markets have miscalculated the AI threat to software companies, hours after the chip behemoth issued an upbeat sales forecast on strong AI demand. Instead, he expects a broad swath of software firms to use agentic AI to develop their software and boost efficiency. CNBC

Trade/Tariffs

- German Chancellor Merz on his conversation with Chinese President Xi, said there are many challenges to overcome; Economic Minister will conduct a follow up visit.

- India's Trade Minister after hosting US Commerce Secretary Lutnick, said both parties engaged in "very fruitful" discussions to expand trade and economic partnership

A more detailed look at global markets courtesy of Newsquawk

APAC stocks are mostly positive as the majority of the region took its cue from gains on Wall Street, where tech led the advances and NVIDIA posted stronger-than-expected earnings after hours. ASX 200 mildly gained as the outperformance in tech, telecoms and healthcare offset the losses in energy and industrials, while better-than-expected private capex data also provided some encouragement. Nikkei 225 initially rallied to a fresh all-time high north of the 59,000 level but then pulled back from record levels as the yen gradually strengthened and after BoJ hawkish dissenter Takata called for gradually hiking rates. Hang Seng and Shanghai Comp were ultimately mixed with the Hong Kong benchmark the laggard amid weakness in tech, consumer discretionary and insurers, while the mainland was indecisive as price action was contained with very little in the way of fresh catalysts.

Top Asian News

- Japanese Coincident Index Final (Dec) 114.3 (Prev. 114.9).

- Japanese Leading Economic Index Final (Dec) 111 vs. Exp. 110.2 (Prev. 109.9).

- Australian Private Capital Expenditure for 2025-26 (AUD)(Estimate 5) 199.3B (Prev. 191.3B).

- Australian Private Capital Expenditure for 2026-27 (AUD)(Estimate 1) 158.4B.

- Australian Private Capital Expenditure QoQ (Q4) Q/Q 0.4% vs. Exp. 0.0% (Prev. 6.4%).

- New Zealand ANZ Activity Outlook (Feb) 52.6 (Prev. 51.6).

- New Zealand ANZ Business Confidence (Feb) 59.2 (Prev. 64.1).

European bourses (STOXX 600 +0.1%) are mixed, with France's CAC 40 (+0.4%) leading its peers while the IBEX 35 (-0.3%) lags. European sectors do not offer any additional bias. Financial Services (+1.3%) and Retail (+1.0%) top the sector list, while Basic Resources (-2.0%) suffer as silver prices fall. LSEG (+6.7%) supports the Financial sector, as the Co. unveiled a new GBP 3bln share buyback programme. For Retailing, Howden Joinery (+7.5%) released a positive FY report, with pretax profit rising annually. However, the boost in the Co.'s shares comes from the announcement of a GBP 100mln share buyback.

Top European News

- EU Consumer Confidence Final (Feb) -12.2 vs. Exp. -12.2 (Prev. -12.4).

- EU Consumer Inflation Expectations (Feb) 25.8 (Prev. 24.2, Rev. From 24.1).

- EU Economic Sentiment (Feb) 98.3 vs. Exp. 99.8 (Prev. 99.3, Rev. From 99.4, Low. 98.5, High. 100).

- EU Selling Price Expectations (Feb) 11.5 (Prev. 10.0).

- EU Services Sentiment (Feb) 5.0 vs. Exp. 7.5 (Prev. 7.2, Low. 6.8, High. 7.9).

- Italian Consumer Confidence (Feb) 97.4 vs. Exp. 97.2 (Prev. 96.8).

- Italian Business Confidence (Feb) 88.5 (Prev. 89.2).

- Swiss Non Farm Payrolls (Q4) 5.544 (Prev. 5.532).

- Swedish Consumer Confidence (Feb) 96.3 (Prev. 95.3).

FX

- DXY is modestly firmer after finding support around the 97.50 mark overnight before attempting to recoup some of yesterday's losses, with macro newsflow on the lighter side as US-Iran nuclear talks get underway. So far, Omani Foreign Minister said Iran and the US have welcomed proposals in the Geneva talks. On the data front, the Chicago Fed will release its labour market indicators; weekly jobless claims are seen at 215k from 206k; continuing claims (which coincide with the traditional BLS survey window for the February jobs report) are seen at 1.86mln from 1.869mln. DXY currently trades within a 97.49-97.72 range, vs Wednesday's 97.62-98.00 parameter.

- JPY is the current outperformer as USD/JPY continued to pull back overnight after climbing to its best levels in over two weeks, on Wednesday, following the Takaichi government's reflationist picks for the BoJ board. The pair was not helped by the lack of fresh drivers and the absence of tier-1 data from Japan, while there were comments from BoJ Governor Ueda, who reiterated the hiking bias, and hawkish dissenter Takata also stated that they must conduct further rate hikes in a gradual manner.

- GBP takes a breather after advancing in tandem with high-beta FX. Newsflow for the UK has been on the lighter side, with price action fitting with the subdued/cautious tone. UK focus will likely be on the Gorton and Denton by-election: analysts suggest that a heavy defeat for the ruling Labour Party could trigger volatility in Sterling. Some suggest a loss in what has been a safe Labour seat for nearly 100 years could re-ignite speculation regarding UK PM Starmer's leadership.

- Antipodeans are subdued following the recent outperformance that was facilitated by their high-beta statuses. Overnight, quarterly capex data from Australia topped forecasts, which feeds into next week's GDP release.

Central Banks

- ECB's Lagarde said we continue to expect inflation to stabilise at the 2% target in the medium term, will continue to follow data-dependent and meeting-by-meeting approach.

- BoJ's Governor Ueda said basic stance is to continue hiking interest rates if the likelihood of our economic, price forecasts materialising heightens, according to Yomiuri. Underlying inflation has not yet fully reached 2% and policy will be guided to get underlying inflation to around 2%, while avoiding it exceeding 2% on a sustained basis.

- BoJ's Takata said no preset pace for rate hikes and future moves depend on economic environment and data.

- BoJ Board Member Takata said fears of Japan's economy returning to deflation have been dispelled and believes it's necessary to move the BoJ's focus more to upswing in prices. Proposed a rate hike in January on the view that BoJ must continue adjusting real interest rates, which remain significantly lower than the rates seen overseas.

- Bank of Korea keeps base rate unchanged at 2.50%, as expected. Raises 2026 GDP growth forecast to 2.0% from 1.8% sees 2027 growth at 1.8%. Raises 2026 CPI forecast to 2.2% from 2.1% and sees 2027 CPI at 2%.

- BoK said rate decision was unanimous and median projections show base rate is seen at 2.5% in six months. Said the Bank will make policy decisions supporting a recovery in economic growth. Growth momentum is to remain favourable. Strong chip exports supporting growth.

- BoK Governor Rhee said no board member expects rates to be increased in three months time, also noted that US tariff ruling is to have a limited impact on exports for now.

Fixed Income

- USTs are flat and currently holding within a 113-04+ to 113-09 range. Really not much driving things for US paper this morning, and this has been reflected by the lacklustre price action. After-market on Wednesday, saw the release of stronger-than-expected NVIDIA earnings, with the name a touch firmer pre-market – but had little follow through from a sentiment perspective. On the data front, the Chicago Fed will release its labour market indicators; weekly jobless claims are seen at 215k from 206k; continuing claims (which coincide with the traditional BLS survey window for the Feb jobs report) are seen at 1.86mln from 1.869mln. From a geopolitical perspective, US-Iran talks have reportedly begun in Geneva. A breakdown in talks could spur some haven inflows in USTs, given the increased likelihood of a US strike on Iran.

- Bunds follow the sideways action across global peers, and hold within a 129.57 to 129.69 range. Lack of catalysts for German paper this morning, with commentary from ECB President Lagarde also failing to spur action. She reiterated the usual data-dependent and meeting-by-meeting approach.

- Gilts ditto peers. Currently flat and within a narrow 92.82-92.90 range. Markets were expecting some remarks via BoE’s Lombardelli, though nothing thus far. UK focus will likely be on the Gorton and Denton by-election, with some analysts suggesting that a Labour loss, in what has been a safe seat for nearly 100 years, could re-ignite speculation regarding UK PM Starmer's leadership. Hence, this could weigh on Gilts in the short-term.

- Italy sells EUR 6.5bln vs exp. EUR 5.5-6.5bln 2.85% 2031 and 3.45% 2036 BTP & EUR 2.5bln vs exp. EUR 2.0-2.5bln 1.468% 2035 CCTeu.

- Abu Dhabi is set to issue two benchmark USD bonds, Bloomberg reported. 5-year note offered at a spread +50bps over USTs. 10-year note offered at a spread +55bps over USTs.

- UK government debt sales are anticipated to decline for the first time in four years as large banks forecast GBP 247bln of gilt issuances in the approaching fiscal year amid Chancellor Reeves seeks to rein in borrowing, according to FT.

Commodities

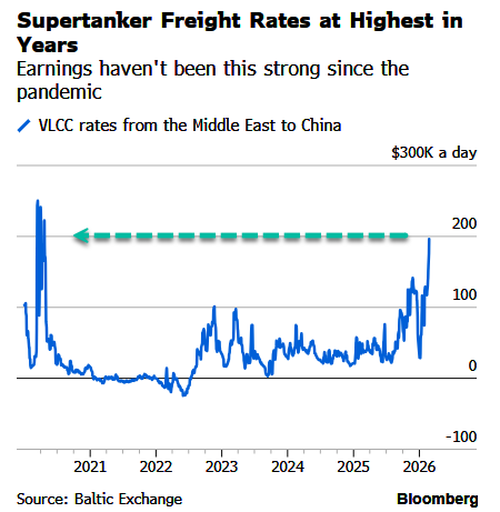

- Crude benchmarks traded lower on the commencement of the US-Iran talks in Geneva. As updates from that meeting got announce, WTI and Brent dipped to fresh session lows and now trade off by around 1.5% and 1.3% respectively. Two main takeaways from the meeting, including the Omani Foreign Minister suggesting that Iran and the US have welcomed proposals in the Geneva talks. Elsewhere, Al Jazeera reported that the “Iranian negotiating delegation meets IAEA director” – this would be necessary for a market-friendly sustainable deal. Brent May’26 is now shy of USD 70.00/bbl, with the low currently a moving a target at the time of writing.

- Precious metals are trading mixed this morning, with spot gold trading firmer and silver lower. XAU and XAG trades within a narrow range of USD 5155.59-5205.58/oz and USD 86.33-90.34/oz, respectively.

- Base metals are lower this morning, tracking headwind from its largest buyer, China, which saw mixed to weak sentiment, pinning down price action for base metals. Sentiment in Europe has done little to shake off sentiment in the base metal complex, with European equities trading mixed this morning. 3M LME copper trades within the lower range of USD 13.23-13.35k/t.

- Nordic countries investigate a threat to the region's energy infrastructure, according to TV4 citing sources. “According to the threat, the actor may strike in the near future,” says an informant.

Geopolitics: Middle East

- Omani Foreign Minister says Iran and the US have welcomed proposals in the Geneva talks.

- "Iranian negotiating delegation meets IAEA director at the headquarters of the negotiations in Geneva", via Al Jazeera.

- Omani mediator in Geneva said that US and Iran are open to new and creative ideas, AFP reported.

- Iran's Foreign Ministry spokesperson said the country will move to the nuclear negotiation site in half an hour, our negotiating team has reasonable amount of flexibility in the US nuclear talks in Geneva.

- "Reported in Iran that the Omani foreign minister, who is in Geneva, conveyed to the American side the Iranian proposal for an agreement.", according to journalist Kais.

- White House officials reportedly argue it would be best if Israel makes the first move regarding striking Iran, according to POLITICO.

- US Secretary of State Rubio said Iran poses a grave threat and seeks nuclear capability, adds talks on Thursday will focus on the nuclear programme and that Iran also poses a conventional weapons threat designed to target the US.

- US VP Vance said we see evidence that Iran is trying to build a nuclear weapon.

Geopolitics: Ukraine

- Russian Foreign Minister says they do not have a deadline for reaching a Ukraine settlement, but does confirm they are working to resolving them.

Geopolitics: Other

- South Korea's presidential office states it will continue working towards peaceful coexistence with North Korea, according to News1.

- US Secretary of State Rubio said the US will investigate a deadly speedboat shooting off Cuba after the Cuban Interior Ministry reported its forces killed four people who allegedly opened fire from a Florida-tagged vessel.

US Event Calendar

- 8:30 am: United States Feb 21 Initial Jobless Claims, est. 216k, prior 206k

- 8:30 am: United States Feb 14 Continuing Claims, est. 1858k, prior 1869k

- 8:45 am: United States Fed’s Miran on Fox Business

- 10:00 am: United States Fed’s Bowman Testifies Before Senate Banking on Regulation

- 2:30 pm: United States Fed’s Goolsbee Appears on Fox News

DB's Jim Reid concludes the overnight wrap

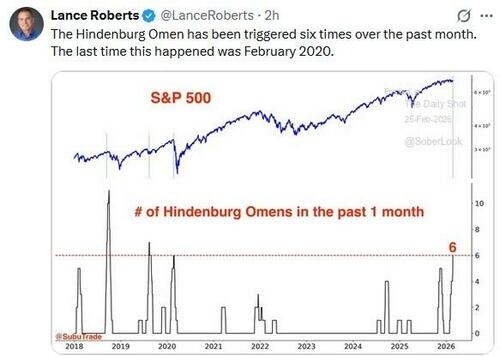

After 4 months of non-stop rain, we had a mini heatwave in London yesterday. I hope you've survived the highs of 16 degrees Celsius if you were in the UK and parts of Europe. Even before this "heatwave", I've been on maximum strength hay fever tablets for weeks now as it's unfortunately that time of year for me again. There were no streaming eyes for the markets yesterday though as we saw another decent session, with the S&P 500 (+0.81%) closing within half a percent of its record high last month, whilst the STOXX 600 (+0.69%) hit a new all-time high. That was primarily driven by easing fears around AI, which meant that software and other tech stocks continued their rebound from Monday’s sell-off. Indeed, software stocks in the S&P were up +3.05% on the day, and the VIX index (-1.62pts) fell to a two-week low of 17.93pts. But the recovery in risk appetite was clear more broadly, with Bitcoin (+7.65%) bouncing back to $68,945, whilst US IG and HY spreads tightened back in from their YTD highs.

The tech mood did fade a bit after the US close though even as Nvidia’s results delivered a stronger-than-expected revenue guidance for the current quarter ($78bn s $72.8bn est.). The initially positive reaction faded as the company’s conference call offered limited detail on the revenue outlook, leaving the chipmaker’s shares little changed by the end of extended trading. So perhaps a sign of investors’ increased anxiety over AI valuations, even as the world’s most valuable company delivered a remarkable 73% year-over-year revenue growth with 75% gross margins. Meanwhile, we saw mediocre results from Salesforce, whose guidance for $46bn of revenue in the current year just about met analysts’ expectations but failed to assuage lingering worries over the outlook for software revenues. The company’s shares fell by about -4.5 % in extended trading. This has left futures on the NASDAQ down -0.34% overnight, with those on the S&P 500 a more modest -0.20% lower.

Ahead of those results, it had been a decent session on both sides of the Atlantic, with Nvidia (+1.41%) itself up to a 3-month high. That came alongside a broader recovery in the tech space, with the NASDAQ (+1.26%) and the Magnificent 7 (+1.53%) both advancing, alongside Europe’s STOXX Technology index (+1.48%). There wasn’t a single headline driving that, but the rebound came amidst growing scepticism about the scenario painted by Citrini Research, which outlined a situation where US unemployment reached double digits by mid-2028. Indeed, as Adrian and I outlined in our Tuesday note (link here), even our own AI tool said it was “a work of persuasive, emotional rhetoric”, with a reliance on emotional framing to create a sense of alarm.

Yesterday’s equity gains were also helped by some of the other names that had slumped following the Citrini paper, such as Doordash (+5.28%) and Capital One (+4.70%). Blue Owl (+5.78%) recovered for a second day from Monday’s two-and-a-half year low, with an improved credit market mood also seeing US IG and HY credit spreads narrow by -1bp and -4bps from YTD highs. However, the breadth of equity gains was narrower than on Tuesday, with the equal-weighted S&P essentially unchanged (+0.03%). The S&P homebuilder index (-3.69%) was a notable laggard, weighed on by underwhelming earnings from home improvement retailer Lowe’s (-5.59%) and the absence of new housing measures in President Trump’s State of the Union address the previous evening.

Still, the growing optimism on the near-term outlook (and diminishing fears of mass unemployment) led to a clear risk-on move for several asset classes. A notable feature yesterday was that investors kept dialling back the likelihood of an H1 rate cut. The odds of a cut by the June meeting (the first with a new Chair) fell beneath 50% for the first time this year to end the day at 48%, suggesting more doubt about an immediate rate cut by Kevin Warsh, particularly now core PCE is back to 3.0%. And with investors pricing out rate cuts, that meant US Treasuries struggled across the curve. So the 2yr yield (+0.9bps) was up to 3.47%, whilst the 10yr yield (+2.3bps) rose to 4.05%. The moves in the belly and at the long-end also weren’t helped by a soft 5yr auction that saw $70bn of bonds issued +0.7bps above the pre-sale yield, with primary dealer take up rising to its highest since last March. So some signs of a softening in Treasury demand after the recent rally, with a 7yr auction today the next test. Having said that, yields have edged back down just shy of a basis point this morning across the curve.

Earlier in Europe, sovereign bonds had put in a stronger performance, with a fresh tightening in sovereign bond spreads too. So yields on 10yr Italian BTPs (-0.6bps) hit their lowest since December 2024, and those on French OATs (-1.2bps) fell to their lowest since July. By contrast, 10yr bund yields (+0.1bps) were steady, but that also meant France’s 10yr spread over Germany fell to just 55bps, the tightest since Macron called the snap legislative election back in June 2024.

Looking forward, UK politics will be back in the spotlight today, as a by-election is taking place in the Greater Manchester seat of Gorton and Denton. That’s a significant one, because the governing Labour Party won it convincingly at the general election in 2024 but opinion polls suggest they could lose it today, which would put Prime Minister Starmer’s position under growing pressure. That matters for gilt markets because of concerns about a new PM easing the fiscal rules and borrowing more. So there’s been a clear pattern of gilt sell-offs when questions around Starmer’s survival have resurfaced, and today’s vote represents another moment where that could happen.

Asian equity markets continue to rise overnight with the KOSPI (+3.11%) again leading the way, and again achieving another record high, primarily driven by chipmakers Samsung and SK Hynix. It's just over a percentage point shy of +50% YTD before the end of February! Elsewhere, Japanese stocks are also at fresh record highs, with the Nikkei (+0.10%) and the Topix (+0.94%) continuing to build on gains from the previous session as investors have adjusted their expectations regarding further interest rate increases by the Bank of Japan. The S&P/ASX 200 (+0.50%) is also performing well, reaching a record high due to ongoing strength in mining and banking shares. Conversely, mainland Chinese equities are experiencing slight declines, with the CSI (-0.17%) and the Shanghai Composite (-0.08%) both dipping marginally, taking a moment to consolidate after significant rallies in the last two sessions. The Hang Seng (-0.81%) is also in negative territory as local technology stocks have retreated after gains earlier this week.

In monetary policy action, the Bank of Korea (BOK) kept its benchmark interest rate unchanged at 2.50% while signalling that policy would stay unchanged for the next six months as a chip boom in exports and steady inflation allow policymakers more time to assess financial stability risks. Meanwhile, the central bank raised its growth forecast for 2026 to 2.0% from a previous estimate of 1.8% citing stronger-than-expected chip exports. Following the decision, yields on the policy-sensitive 3yr government bonds fell -4.6bps to trade at 3.12% as we go to print.

Over on the tariff front, there hasn’t been much in the way of concrete news, but we did get a few comments from US Trade Representative Greer on the path forward yesterday. He said that President Trump would raise the current 10% rate to 15% “where appropriate”, and when it came to the deals already agreed, he said they wanted “to give continuity and be able to be in a position where we can honor the deals”. So that suggested that a country like the UK, which agreed a 10% tariff deal with the US last year, might not be affected by a rise in the global rate to 15%. That had been a concern earlier in the week, as the new global rate had raised fears of fresh retaliation, with the EU already having paused ratification of the deal they agreed with the US last year.

Looking at the day ahead now, data releases include the US weekly initial jobless claims, the Euro Area M3 money supply for January, and the European Commission’s economic sentiment indicator for the Euro Area in February. From central banks, we’ll hear from ECB President Lagarde and the ECB’s Dolenc, along with the Fed’s Bowman and the BoE’s Lombardelli. Finally in the UK, there’s a parliamentary by-election in Gorton and Denton.

Tyler Durden

Thu, 02/26/2026 - 08:40

Presidents Putin and Cyril Ramaphosa, via TASS.

Presidents Putin and Cyril Ramaphosa, via TASS.

Getty Images

Getty Images

Recent comments