Is China Really Dumping US Treasuries?

Authored by Lance Roberts via RealInvestmentAdvice.com,

“China is dumping US Treasuries to get out of the dollar.” This claim has been circulating the mainstream feeds lately, with the narrative that the “end of the dollar is near,” or “the US will lose its funding base” and the “bond yields will surge.” But are those claims valid? Such is what we will explore in more detail.

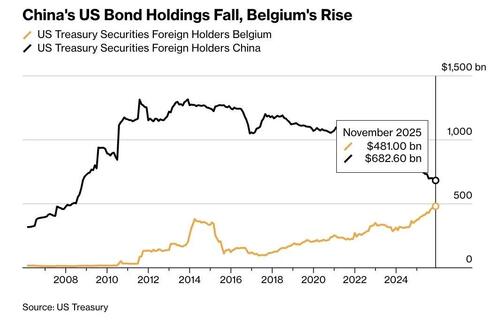

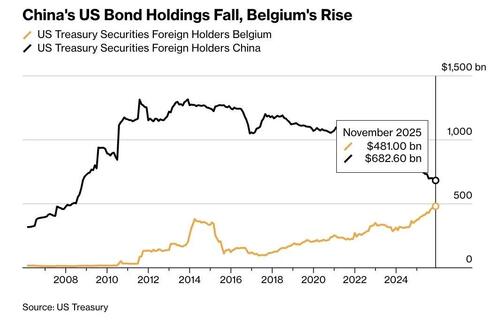

Let’s start with the chart that has everyone concerned. As shown, China’s holdings of US Treasury bonds have fallen from nearly $1.2 trillion to $600 billion, or a 50% decline. On the surface, you can certainly understand the reasons for concern, as the decline in holdings over the last decade supports a clean storyline.

However, the problem is the step between observation and conclusion. A lower line item for “China, Mainland” does not equal a forced sale, it does not prove intent, nor does it prove a structural exit. What it does show is a lack of understanding about the dynamics of reserve currency management, and, in the case of China, the need to protect those reserves.

Let’s start with the Treasury Department, which states that the holdings tables are built “primarily on the basis of custodial data.” That phrase matters. Custodial data records where securities are held for settlement and safekeeping. Critically, the custodian is not the same as the beneficial owner, and that distinction undermines the headline narrative.

The Treasury’s own FAQ is the most important in this particular narrative:

“If a Treasury security purchased by a foreign resident is held in a custodial account in a third country, the true country of ownership will not be reflected.”

Read that sentence again.

The system is designed to track where the bonds sit, not whose balance sheet carries the risk. This is crucially important when it comes to the narrative that China is dumping its bond holdings and moving away from the dollar.

For those jumping to that conclusion, they did not take the time to ask the right question: “Where did the custody shift to?” That question matters for investors because it changes the risk assessment. If China were liquidating, you would expect pressure across Treasury auctions, persistent stress on dealer balance sheets, and visible strain in dollar funding markets. While those episodes occur from time to time, often tied to Fed policy or risk shocks, there is no clear connection to the “China dumping” storyline.

A better way to approach the claim is to follow the settlement trail, which takes us to the Belgium and Luxembourg connection.

The Belgium and Luxembourg Connection

Over the last decade, geopolitical risk has been rising. Heavy sanctions have been imposed on Iran and Russia, assets frozen or seized, and political pressure brought to bear. If you are a country with significant US dollar reserves and face the risk of sanctions or seizure, what measures could you take to limit that risk? Here is a good example:

“Policymakers [in Beijing] are mindful of the precedent set in 2022, when the US and its allies froze about $300 billion of Russia’s central bank reserves after the invasion of Ukraine. The worry is that if tensions were to escalate, the US could — in an extreme scenario — restrict access to China’s state and privately held dollar assets in a similar fashion.” – Bloomberg

It is critical to understand the two main economic reasons that China buys and holds US Treasuries. The most important reason is that China wants its currency, the yuan, pegged to the dollar, a practice common among many countries since the Bretton Woods Conference in 1944. A dollar-pegged yuan helps keep down the cost of Chinese exports, particularly to the US, its largest customer, which the Chinese government believes makes it stronger in international markets. Secondly, dollar-pegging adds stability to the yuan because the dollar is still seen as the safest currency in the world. To conduct trade on a global scale, they hold their reserves in US Treasuries, gold, or the dollar itself.

However, just because China owns U.S. Treasuries does not mean it must have custodial holdings in the U.S. Look at the same holdings table and focus on Belgium and Luxembourg. In the November 2025 snapshot, Belgium shows about $481 billion in Treasury holdings, and Luxembourg shows about $425 billion. Those are massive totals for very small countries that are not building reserves at that scale.

In reality, Luxembourg and Belgium are “hosting custody” for China. Just for reference look at the chart of US Treasury holdings of China and Belgium. Over the same period, while China’s holdings fell by $600 billion, Belgiums rose by $500 billion.

This is why the Treasury’s FAQ points directly to this issue and calls out “major financial centers,” such as Luxembourg and Belgium, as the source of “custodial bias.” The chart below adjusts China’s treasury holdings for its “custodial” accounts, showing that its holdings of US Treasuries are essentially the same as in 2011.

This is not a conspiracy. It is plumbing. One of the primary reasons that China uses Belgium for custodial purposes, besides avoiding geopolitical risk, is that the Euroclear Bank is based there and sits at the center of cross-border settlement and collateral mobility. Clearstream’s international depository is based in Luxembourg and serves the same global institutional client base. When a central bank or a state institution wants to hold a large Treasury portfolio with flexible settlement and collateral options, these hubs help address operational challenges.

With this understanding, it should be clear that the “China is dumping bonds” narrative is incomplete. However, it is the problem that arises when individuals seeking to spin a narrative for headlines, clicks, or views focus on one line item and ignore the framework.

Brad Setser at the Council on Foreign Relations has repeatedly made the point that the reported data understate China’s dollar bond exposure due to offshore custodians and portfolio shifts across dollar instruments. In his words, “China isn’t shifting away from the dollar or dollar bonds.”

That leads to the next question: why would China shift custody at all?

Why Is China Using Other Countries to Buy and Hold Treasuries

We already touched on avoiding geopolitical risk, but there are four practical reasons for China to shift custodial holdings, none of which requires an exit from US bonds.

-

Settlement efficiency and scale: Large reserve portfolios require scale, operational redundancy, and deep settlement connectivity. European custody hubs provide that. Euroclear’s work on US Treasury DVP repo settlement is a signal of where institutions want improved collateral movement and repo settlement workflows. When the infrastructure improves, demand follows. Holding through a hub often reduces friction.

-

Collateral mobility and financing optionality: Treasuries are collateral. They are not only an investment. They are a financing tool. A portfolio held at a hub links more easily into repo markets, securities lending, and collateral transformation. That matters for institutions managing liquidity. If you want the option to raise dollars quickly against Treasury collateral, the custody venue matters.

-

Risk management after sanctions shocks: Following the freezing of Russian reserve assets in 2022, reserve managers began reassessing legal and operational exposures. The Financial Times has reported extensively on Euroclear’s central role in the custody of frozen Russian assets and the policy debates surrounding them. The lesson for global reserve managers is straightforward. Jurisdiction, legal perimeter, and operational touchpoints matter. Shifting custody and settlement routes is one response.

-

Data optics and portfolio composition: The Treasury table is widely quoted. It is also widely misunderstood. A shift from direct custody into a third country changes what the table shows. Some investors read the table as a loyalty scoreboard, but that interpretation is wrong. There is also a composition component. A holder can reduce Treasury holdings while raising exposure to other dollar assets, such as gold, agency debt or deposits, while staying inside the dollar system. That can reduce the “Treasuries only” line item without reducing dollar exposure.

So when you see “China, Mainland” drift lower, the right response is to think in layers: 1) Custody, 2) Instrument mix, 3) Funding and collateral function, and 4) Geopolitical risk management.

Put those together, and the incentive to use Belgium and Luxembourg is clear. The goal is not a panic move to “dedollarize” the US, which would harm the Chinese economy. Rather, it is to gain operational efficiency and optionality in a world where finance and politics collide more often.

Now step back and ask the investor question: What does this mean for you and your portfolio?

How Investors Should View US Treasury Bonds in Portfolios

Investors should treat Treasuries as a tool, not a referendum on geopolitics. However, it is critical to your portfolio outcome to understand the entire context of how the “financial plumbing” operates.

As such, investors should start with the role Treasuries play in global markets. US Treasuries:

-

Anchor dollar risk-free pricing.

-

Sit at the core of repo and collateral systems.

-

Serve as a settlement asset during stress.

Those functions do not disappear because one country adjusts custody venues.

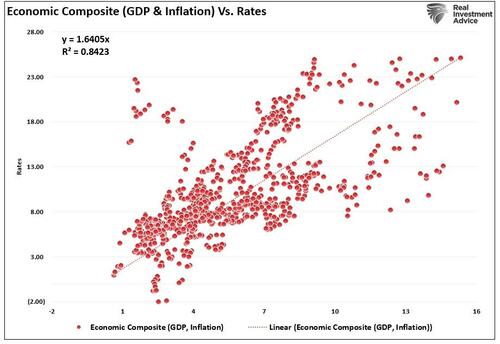

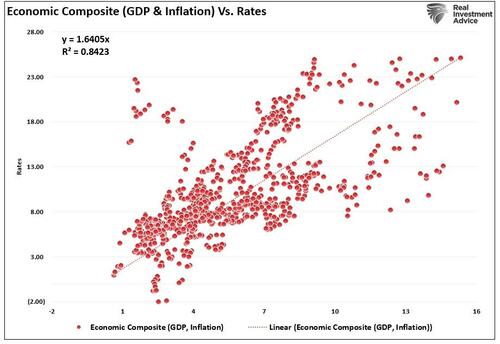

Secondly, focus on the real drivers of Treasury returns. The return of US Treasuries is driven by expectations for economic growth and inflation over time. Federal Reserve policy drives the front end of the interest rate curve. Economic growth and inflation drive the long end. The chart shows a strong correlation between the composite of GDP, inflation, and interest rates. Those factors matter more than headlines about one foreign holder.

Next, as an investor, you should build your Treasury investment exposure based on objectives, rather than narratives. If you need:

-

Liquidity and drawdown control hold more short to intermediate-term Treasuries, which often serve as portfolio ballast during equity stress.

-

Income with controlled volatility, a ladder across the front-to-intermediate curve, helps manage reinvestment risk.

-

To adjust for inflation uncertainty, blend nominal Treasuries with TIPS.

Lastly, avoid the common mistake of basing bond decisions on some misguided narrative. However, US Treasuries are not risk-free in price. As such, investors must focus on the risks that matter for their bond holdings.

-

Duration risk

-

Inflation risk

-

Policy risk

The “China dumping” narrative is not a risk worth worrying about.

Focus on what matters by aligning duration and inflation sensitivity with your time horizon and risk tolerance. Treat headlines as noise, and Treasuries as a portfolio instrument built for cash flow, liquidity, and risk control. If you do that, you will be much better off.

Tyler Durden

Mon, 02/23/2026 - 17:40

United States Chairman of the Joint Chiefs of Staff Dan Caine, via AP

United States Chairman of the Joint Chiefs of Staff Dan Caine, via AP

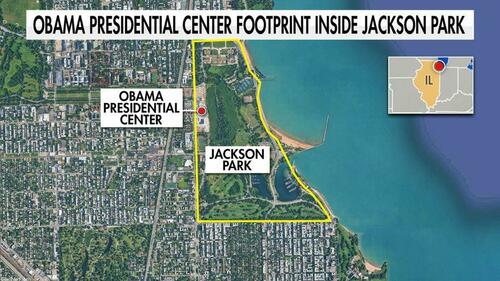

Former President Barack Obama is pictured next to construction of the Obama Presidential Center in Chicago, a project facing delays, soaring costs and mounting scrutiny over its finances. (Scott Olson/Getty Images; Reuters/Vincent Alban) via Fox News

Former President Barack Obama is pictured next to construction of the Obama Presidential Center in Chicago, a project facing delays, soaring costs and mounting scrutiny over its finances. (Scott Olson/Getty Images; Reuters/Vincent Alban) via Fox News A map graphic shows the footprint of the Obama Presidential Center inside Jackson Park on Chicago’s South Side along Lake Michigan. (Fox News)

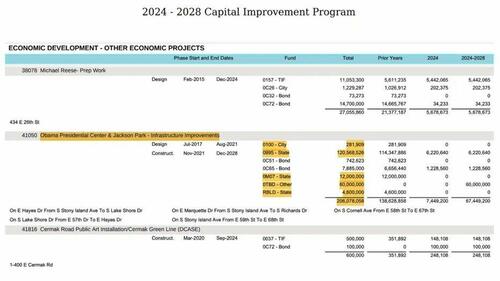

A map graphic shows the footprint of the Obama Presidential Center inside Jackson Park on Chicago’s South Side along Lake Michigan. (Fox News) Chicago’s 2024–2028 Capital Improvement Program lists $206,078,058 for "Obama Presidential Center & Jackson Park – Infrastructure Improvements," with most funding labeled as state sources. (City of Chicago Capital Improvement Program)

Chicago’s 2024–2028 Capital Improvement Program lists $206,078,058 for "Obama Presidential Center & Jackson Park – Infrastructure Improvements," with most funding labeled as state sources. (City of Chicago Capital Improvement Program)

Tehran Times

Tehran Times

Recent comments