If You're Freaking Out About A Future Jobless AI Dystopia...

Amid an armada of dystopian futurists, projecting linear thoughts into a future of 'AI uber alles', Marc Andreessen stands as a beacon of potential utopian light, seeing a future that looks very different and very positive for young and old alike.

In a brief few minutes, the co-founder of Netscape and VC firm Andreessen Horowitz (a16z) believes instead that we are living through a unique (and most incredible) time in history with the rise of AI coming right as human civilization needs it...

"we're going to have AI and robots precisely when we actually need them [with populations shrinking] to keep the economy from actually shrinking."

Simply put, Andreessen says that fears of AI-driven mass job loss are overly simplistic.

After decades of unusually slow technological change and low job churn, AI could restore historical productivity levels (exemplified by the period from 1870-1930), sparking opportunity, innovation, and net job growth rather than displacement.

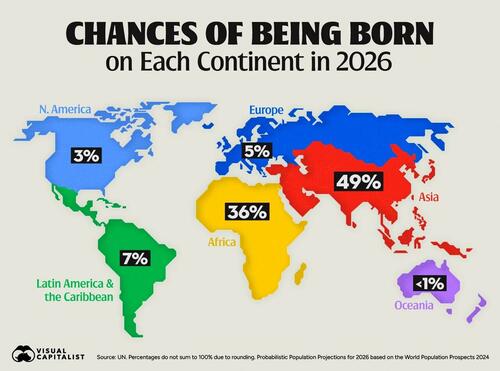

Declining populations and reduced immigration will make human labor increasingly valuable. AI's timing is "miraculous", Andreessen exclaims, preventing economic shrinkage from depopulation.

In even radical scenarios, explosive productivity leads to output gluts, collapsing prices, and massive real-wealth gains - equivalent to "giant raises" for everyone - while making safety-nets more affordable.

Whether incremental or transformative, Andreessen sees the outcome as fundamentally positive economic news.

"...there's all this concern among young people that their jobs are not going to be there for them. AI is replacing them..."

Andreessen replies (emphasis ours):

So the job-substitution/job-loss thing is very reductive. I think it's an overly simplistic model. And again it goes back to what I said at the very beginning which is we've actually been in a regime for 50 years of very slow technological change in the economy... like at half the rate of the previous era and a third the rate of like 100 years ago.

And so we're coming out of this kind of phase where we've had like almost no technological progress in the economy. We've had remarkably little job churn as a result of that relative to any historical period. And so even if AI triples productivity growth in the economy, which would like be a massively big deal, it would take us back to the same level of job churn that was happening between 1870 and 1930.

And if you go back and you read accounts of 1870 to 1930, people just thought the world was awash with opportunity. Right? At that rate of technological transformation, kids were able to develop new careers into new areas of the economy, building new kinds of products and services. A huge part of everything in our modern world today was kind of invented and proliferated during that period.

And so even if AI triples the pace of economic change in the economy, it's going to translate to a much higher rate of economic growth; it's going to translate to a much higher rate of job growth. And there will be some level of like task level and job level substitution that will take place but that will be swamped by the macro effects of economic growth and innovation that will happen and that then corresponding to that there will be hiring blooms quite honestly I think all over the place

And then again go back to the fact that this is all happening in the face of declining population growth and increasingly population shrinkage. So human workers in many, many, many countries over the next you know 10, 20, 30 years are going to be at more and more of a premium, literally because you're going to have shrinking population levels.

[While] we don't really want to get into you know politics particularly but it does feel like the world broadly is going to reverse course on the rates of immigration that we've had for the last 50 years. it seems to be kind of a broad-based thing happening - rise in nationalism, concerns about the rate of immigration - and immigration historically in countries like the US ha ebbed and flowed over time based on how the national mood shifts.

And so in a country like the US (or any country in Europe), if you combine declining population with less immigration, the remaining human workers are going to be at a premium not at a discount. And so I think that the combination of faster productivity growth, faster economic growth, and then slower population growth and less immigration - actually means there's going to be much less of this kind of dystopian/no-jobs thing. I just think it's probably totally off-base.

"That is extremely interesting. So, what I'm hearing is you're not super worried about job loss. Is the key here that the timing kind of just works out, this population decrease, you know, like all these kind of have to line up for there not to be this massive job loss with AI?"

Andreessen replies (emphasis ours):

Yeah.

Well, look, if we didn't have AI, we'd be in a panic right now about what's going to happen to the economy. Right? Because what we what we'd be staring at is a future of depopulation and depopulation without new technology would just mean that the economy shrinks. Right?

So it would mean that the economy kind of itself kind of shrinks over time, the opportunity diminishes, and there are no new jobs, there are no new fields. There's no new source of consumer demand for spending on things. And so you would be very worried about going into period of severe decline or stagnation.

Essentially you'd be looking at these very dystopian scenarios of like an economy self-euthanizing over time.

So you'd be very worried about the opposite of what everybody thinks that they're worried about. The only reason we're not worried about that is because we now know that we have the technology that can substitute for the lack of population growth and also for the for the lack of immigration that's likely.

And so, I would say the timing has worked out miraculously well in the sense that we're going to have AI and robots precisely when we actually need them, to keep the economy from actually shrinking.

And that's just like a fundamentally good news story.

To get to the mass-job-loss thing that people are worried about, you'd have to look at like far, far, far higher rates of productivity growth. You'd have to look at rates of productivity growth that are 10, 20, 30, 50% a year - something like that - which are orders of magnitude higher than we've ever had in any economy in the history of the planet.

It's possible that we get that. I mean, look, I have my utopian temptation along with everybody else.

If AI radically transforms everything overnight, then maybe... let's play out the kind of utopian scenario.

You get to a much higher level of productivity growth.

You get to a much higher level of technological change.

Corresponding to that you'll have a massive economic boom.

You'll have massive growth in the economy and then corresponding with that you'll have a collapse in prices.

And so the price of goods and services that are affected by (or commoditized by) AI will collapse.

There'll be price deflation and then as a consequence of price deflation everything that people are buying today gets a lot cheaper and that's the equivalent of a gigantic increase in wealth right across the society.

This is actually worth talking about because people I think people get kind of sideways on this issue.

So if AI is going to transform the economy as much as the utopians or dystopians (or whatever kind) think that it will, the necessary economic calculation of what happens is massive productivity growth.

The consequence of massive productivity growth literally means mechanically more output requiring less input, right?

So you get more economic output for less input, right? So you're substituting in AI for human workers.

And as a consequence, you get like this massive boom in output with much lower input costs.

The result of that is you get lots of goods and services in all those affected sectors. The result of those gluts is you get collapsing prices, right?

The collapsing prices mean that the thing today that cost you $100 now cost you $10 and now cost you $1.

That's the equivalent of giving everybody a giant raise, right?

Because now they have all this additional spending power.

That additional spending power then translates to economic growth, right?

The development of new fields. Everybody's materially much better off very quickly. And then by the way, to the extent that you do have unemployment coming out the other side of that, it's now much cheaper to provide the kind of social safety net to prevent people from being immiserated, right?

Because the prices of all the goods and services that a welfare program has to pay from, they're all collapsing, right? And so the price of healthcare collapses, the price of housing collapses, the price of education collapses, the price of everything else collapses because of the incredible impact that AI is having.

And so in this kind of utopian/dystopian scenario that people have, there's no scenario in which everybody's just poor. In fact, it's quite the opposite.

Everybody gets a lot richer because prices collapse and then it's actually much easier to pay for the social safety net for the people who, for some reason, can't find a job.

And so, maybe we end up in that scenario.

I mean, the optimistic part of me says, yeah, maybe AI is that powerful and maybe the rest of the economy can actually change to accommodate that and maybe that'll happen.

But the result of that is going to be a much better news story than people think it's going to be.

Everything I've just described, by the way, is just a very straightforward extrapolation on very basic economics. I'm not making any like bold predictions in what I just said. This is just a straightforward mechanical process that plays itself out if you have higher rates of productivity growth, which are necessarily the results of higher rates of technological growth.

And so, to be clear, I think we're looking at a world that's not like radically transformed the way that maybe the utopians think that it will be or the dystopians think it will be.

I think it'll be more incremental.

But I think that incremental shift is overwhelmingly going to be a good news process. And then even if it's much faster, it's also going to be a good news process. It'll just be a good news process in the other way that I described.

Tyler Durden

Sat, 02/28/2026 - 20:20

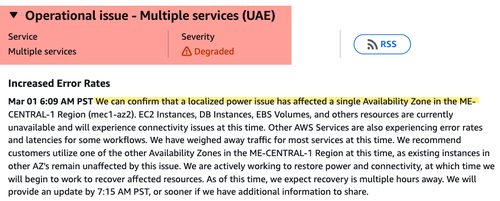

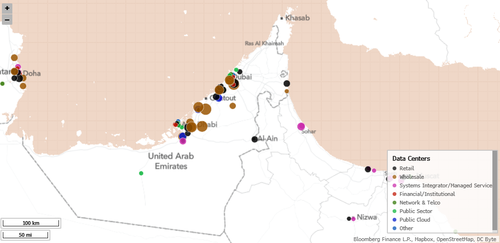

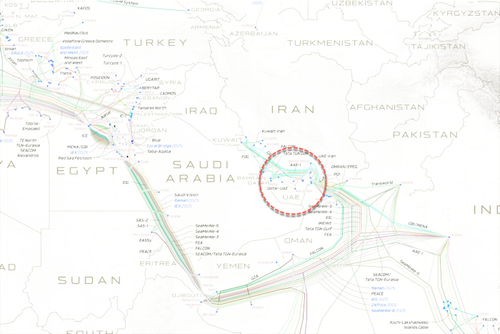

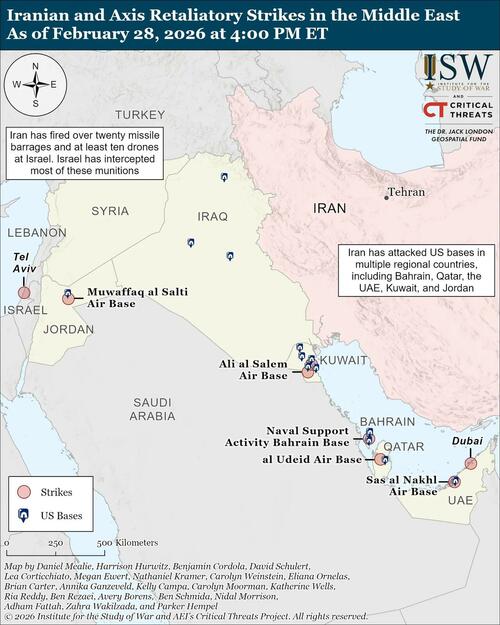

Explosions at Dubai International Airport following Iranian strike.

Explosions at Dubai International Airport following Iranian strike.

A U.S.-made F-16V fighter jet taxis on the runway at an airforce base during the annual Han Kuang military drills in Hualien, Taiwan, on July 23, 2024. Sam Yeh/AFP via Getty Images

A U.S.-made F-16V fighter jet taxis on the runway at an airforce base during the annual Han Kuang military drills in Hualien, Taiwan, on July 23, 2024. Sam Yeh/AFP via Getty Images An aerial view of vehicles awaiting their export at a port in Nanjing, eastern Jiangsu Province, China, on Dec. 9, 2025. AFP via Getty Images

An aerial view of vehicles awaiting their export at a port in Nanjing, eastern Jiangsu Province, China, on Dec. 9, 2025. AFP via Getty Images

Michelle Bowman, vice chair for supervision of the Federal Reserve Board, in Washington on July 22, 2025. Ken Cedeno/Reuters

Michelle Bowman, vice chair for supervision of the Federal Reserve Board, in Washington on July 22, 2025. Ken Cedeno/Reuters Homes for sale in Maryland on Nov. 12, 2023. Madalina Vasiliu/The Epoch Times

Homes for sale in Maryland on Nov. 12, 2023. Madalina Vasiliu/The Epoch Times

Video posted on pro-government Telegram accounts shows Iranians searching through a destroyed school in Minab, via Telegram

Video posted on pro-government Telegram accounts shows Iranians searching through a destroyed school in Minab, via Telegram

Recent comments