Futures Tumble As Iran War Sends Oil, Gold And Dollar Sharply Higher

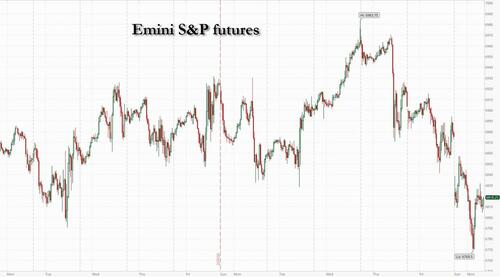

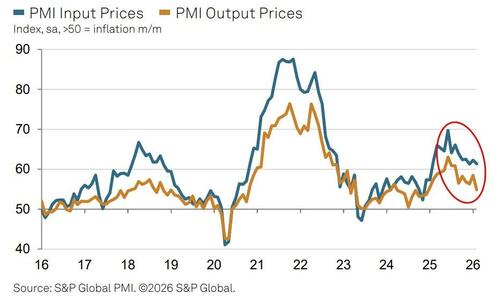

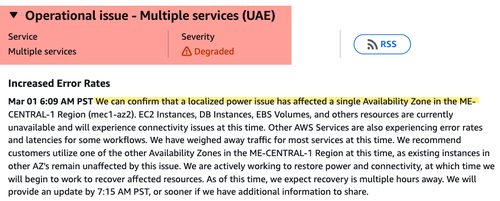

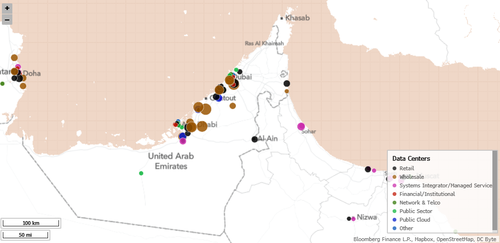

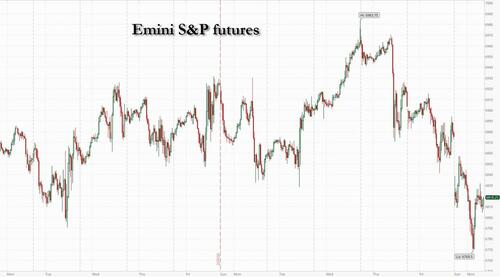

US equity futures and global stocks tumbled, the dollar and gold rallied and oil soared as military strikes intensified across the Middle East, sending oil to its biggest surge in four years and stoking concern that faster inflation could weigh on the global economy. AS of 8:10am ET, S&P 500 futures are down more than 1% - but off overnight lows - after the cash index fell nearly 1% over the previous two trading days; Nasdaq futures tumbled 1.5% with all Mag 7 stocks lower by more than 1% in premarket trading; Aerospace/Defense, Energy, and Gold Miners are the safety havens in equities and all are bid pre-mkt; PLTR +4% may help +Software/-Semis. In the latest war news, AMZN data centers were hit in Bahrain/UAE, as was a UK base in Cyprus; with Israel attacking Lebanon; both Israeli and Saudi indices opened higher before reversing lower due to escalation. After soaring 13% at the open, crude oil traded down to +4% and was now +7.5% after Saudi Aramco halted operations at its Ras Tanura refinery after a drone strike in the area. Bond yields are notably higher, rising +4-5bps with the USD bid against all major FX and DXY +57bp which would be its best day since Feb 2. Energy is unsurprisingly leading commodities higher with double-digit gains in gasoil, heating oil, and EU natgas. Gold, which is now at $5400, is leading silver ($94/oz) with platinum flat.

In premarket trading, energy and defense stocks rallied, with Exxon Mobil shares climbing 5.2% in early trading. British Airways owner IAG SA fell 5.4% amid a widespread disruption to flights in the Middle East. Mag 7 stocks all fall (Microsoft -0.8%, Apple -1%, Nvidia -1.3%, Meta -1.7%, Amazon -2.4%, Alphabet -2.6%, Tesla -2.1%)

- The Iran conflict is pushing shares of airlines and cruise operators lower, while energy stocks jump. Movers include American Airlines (AAL) -6% and Exxon (XOM) +4%.

- US banks and financials are pointing lower as risk off sentiment extends with military strikes intensifying across the Middle East. JPMorgan Chase (JPM) -2%, Wells Fargo (WFC) -1.7%.

- AES Corp. (AES) falls 16% after a consortium led by Global Infrastructure Partners and EQT agreed to buy the electric utility.

- Berkshire Hathaway (BRK/B) slips 1% after the conglomerate’s operating profits fell nearly 30% in Warren Buffett’s last quarter as CEO. Analysts note weakness in the company’s insurance businesses.

- EchoStar (SATS) declines 2% after the parent of Dish Network posted a net loss in the fourth quarter.

- Paramount Skydance (PSKY) rises 5% after Warner Bros. Discovery filed a join-statement following the market close on Friday announcing that they had entered into a definitive merger agreement.

- UniQure (QURE) tumbles 41% after US regulators said the company should conduct a pivotal study before getting approval of its gene therapy for Huntington’s disease, another example of the Trump administration slowing a treatment for a rare disease drug.

While markets are recoiling from the latest war in the Middle East, the strikes on Iran were heavily telegraphed and traders had built up meaningful hedging. Still, the conflict may be longer and wider than some expected. Trump said the bombing campaign against Iran will continue, perhaps for weeks. Iran fired missiles on Israel, US military bases and Persian Gulf countries including the financial hub of Dubai (there is a full summary of all the latest war news in the section below).

The war in Iran is adding to a list of headwinds for markets already on edge after fears over disruption from artificial intelligence and pressure in private credit have nearly erased this year’s gains in the S&P 500. Investors are now focused on how long the conflict will last and how far hostilities might spread, after President Donald Trump said the campaign could continue for weeks.

"The endgame remains highly uncertain, ranging from a relatively swift political exit to a broader regional spillover,” said Mathieu Racheter, head of equity strategy at Julius Baer. “In such a fog of war, markets tend to trade probabilities rather than shifting facts.”

The dollar strengthened as a spike in oil prices spurred traders to dial back bets on Fed rate cuts this year, with Bloomberg economists writing that changes to Fed policy are far from guaranteed, despite the war. The team’s risk scenario is for oil to raise to $108 a barrel, while a more temporary spike would keep the Fed on alert, but not trigger a shift in policy.

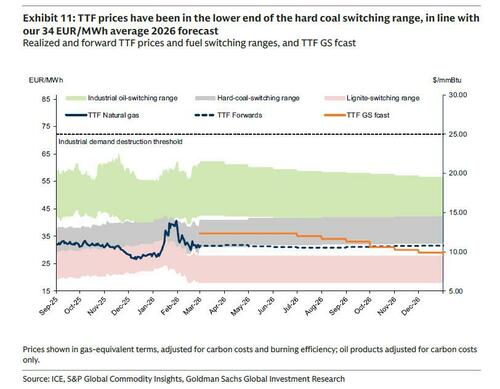

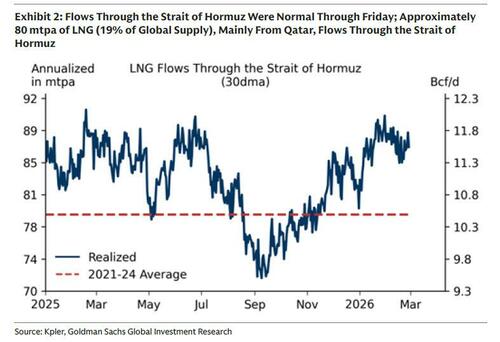

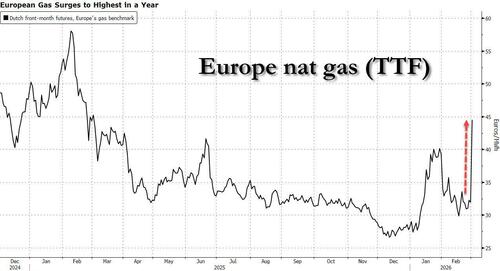

Meanwhile, Aramco halted operations at Saudi Arabia’s largest refinery after a drone strike in the area, Bloomberg reported. QatarEnergy’s decision to cease LNG production followed attacks on its Ras Laffan complex, sending European gas prices soaring.

“It is still very unclear what the duration of the conflict will be and more importantly, how the energy market reacts,” said Andrea Gabellone, head of global equities at KBC Securities. “One positive for the US is that the market has corrected since January, so we are not in overbought territory. It’s fair to say havens should continue to outperform.”

Strategists are coalescing around the view that a buying opportunity for US stocks may emerge. JPMorgan’s Mislav Matejka said the weekend’s events will naturally lead to risk-off in the short term, but investors with a 3/6/12-month time frame should use weakness to increase exposure. Morgan Stanley’s Mike Wilson agrees that the bullish view is intact for now, with a lasting spike in oil above $100 needed to impact the US equity outlook.

Still, geopolitical events underscore the need to diversify and hedge portfolios at a much faster pace over the next few months, according to today’s Taking Stock column. The impact on the stock market will be determined by its duration, Citigroup strategists said, as they presume a shorter-term impact.

Prashant Bhayani, chief investment officer for Asia at BNP Paribas Wealth Management, said the main questions traders are looking out for are how long the disruption lasts, developments in the Strait of Hormuz, any impact on oil infrastructure and whether Iran and the US can reach a negotiated settlement. “Most geopolitical events have limited long-term impact on asset markets,” Bhayani said. “There is already a premium in oil of circa $7-$10 before today’s trading. Only in an extended conflict, with oil prices over $100, would it materially impact the global economy.”

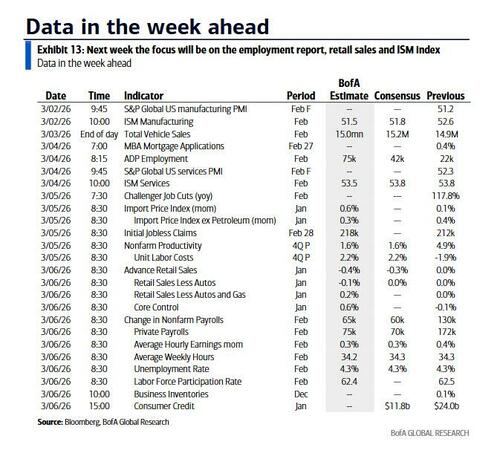

On the economic front, payrolls come back into focus later this week with the survey forecasting a more modest pace of hiring in February relative to the start of the year. January retail sales data is also due Friday, while the Fed’s Beige Book is released on Wednesday.

The Stoxx 600 has pared its fall, to 1.4%, although remains on course for its worst daily performance since November after conflict in the Middle East escalated over the weekend. Energy is the only sector in the green, while retail, travel and consumer product stocks fall the most. Here are some of the biggest movers on Monday:

- Shipping and logistics stocks are among the few gainers in European trading on Monday as conflict in the Middle East disrupts the Strait of Hormuz and Red Sea shipping routes.

- Energy stocks rise on back of an oil-price surge triggered by US and Israeli strikes against Iran. Morgan Stanley upgraded the sector to overweight, while JPMorgan upped its price targets on a slew of companies.

- Galp Energia shares rise as much as 9.6%, hitting their highest level since mid-2024, as rising Middle East tensions cause oil prices to surge.

- European defense stocks jump, with BAE Systems among those hitting record highs, as conflict in the Middle East spurs expectations of elevated security spending.

- Novo Nordisk shares fall as much as 5.7% and were downgraded to neutral from buy at Goldman Sachs after data last week showed its next-generation obesity drug CagriSema delivered less weight loss than Eli Lilly’s rival blockbuster.

- European banks fall as war between the US and Iran triggered a broad-based selloff.

- European airlines stocks slump as conflict in the Middle East causes major disruptions at some of the world’s busiest airports. Analysts flag higher fuel costs and air space closures as factors likely to disrupt the sector.

- Informa shares sink as much as 11%, the biggest intraday drop since the Covid outbreak of 2020, as the events firm got swept up in the selloff of stocks exposed to the conflict in the Middle East.

- Oxford Nanopore shares drop as much as 18% after the British DNA-sequencing company cut its medium-term growth guidance, which analysts say will spark consensus downgrades.

- Luxury stocks fall as the escalating conflict in the Middle East creates a “highly uncertain backdrop” for the sector, according to Vontobel.

Earlier in the session, Asian stocks dropped for the first time in six days as the US-Israeli war against Iran prompted investors to reduce exposure to risk assets. The MSCI Asia Pacific Index slid as much as 1.8%, the most in a month, with financials and health-care the worst-performing sectors. A subgauge of energy shares climbed nearly 1% as oil rallied. Pakistani shares plunged the most on record after geopolitical tensions in the Middle East escalated, while benchmarks in Thailand, the Philippines and Hong Kong were leading declines in the region. Markets in South Korea were shut for a holiday. For Asian assets, the main risk from a prolonged Middle East conflict lies in a stronger dollar and higher oil prices, given that most economies in the region are net energy importers. A gauge of the greenback advanced on Monday and oil prices spiked before paring gains following a report that indicated at least one top official in Tehran sought to resume nuclear talks with the US. Japan’s Topix also dropped nearly 3% before paring declines, with bank stocks among the biggest losers.

The Hang Seng China Enterprises Index slumped 1.8% to enter a technical correction. A gauge of Chinese tech shares listed in the financial hub — which entered a bear market last month — shed 2.9%. The declines came as investors keenly awaited the start of China’s most important annual political meeting from Thursday, where top leaders are expected to set the growth target for 2026 and lay out economic priorities for the coming five years.

In FX, the dollar has pulled back from the highs. The Bloomberg Dollar Spot Index is up 0.5%. The Swedish krona is the weakest of the G-10 currencies, falling 0.9%. The Canadian dollar and Norwegian krone have been the most resilient.

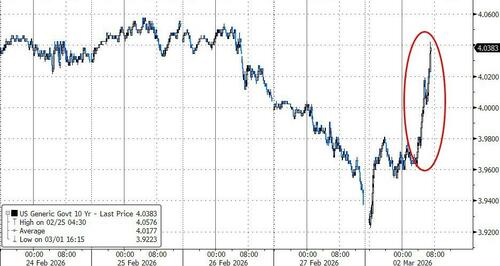

In rates, treasuries hold losses after erasing opening gains that were spurred by broadening Middle East warfare after the US struck Iran. The reversal suggested that traders chose to bet on the potential inflationary aspects of the US-Iran conflict rather than rush to safe havens which helped Friday’s rally into month-end. Adding to upside pressure on yields, US benchmark crude oil futures are up about 8% with tanker traffic through the Strait of Hormuz at a near standstill. US yields are 3bp to 4bp higher, keeping curve spreads within 1bp of Friday’s closing levels. 10-year is near 3.98% vs session low 3.922% reached shortly after the Asia open. European government bonds are also in the red with underperformance seen in shorter-dated maturities as traders trim bets on interest rate cuts by the Bank of England and European Central Bank.

For Geoff Yu, senior macro strategist at BNY, Monday’s rise in US yields came as no big surprise given the elevated levels at which bonds were trading. The 10-year rate was at 3.99%, five basis points higher for the day.

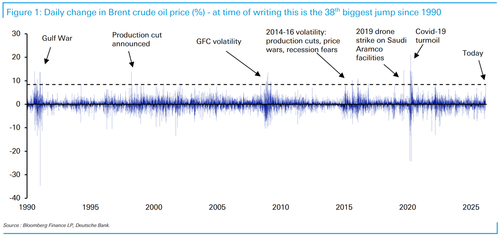

In commodities, WTI crude oil futures rose the most in four years, while Brent crude soared more than 7%, topping $80 a barrel as traders assess how quickly Hormuz traffic can normalize. In Europe, natural gas jumped as much as 28%, the biggest increase since August 2023 after Goldman warned that European natural gas prices could more than double if shipping through the Strait of Hormuz is halted for one month. Spot gold rises 2% and briefly topped $5,400/oz. Silver logs a slightly smaller gain. Bitcoin rises 0.8%.

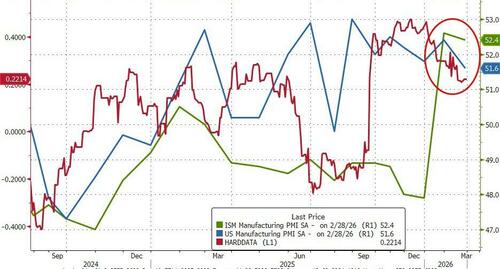

US economic data slate includes February final S&P Global US manufacturing PMI (9:45am) and February ISM manufacturing (10am); no Fed speakers are scheduled

Market snapshot

- S&P 500 mini -1%

- Nasdaq 100 mini -1.4%

- Russell 2000 mini -1.3%

- Stoxx Europe 600 -1.3%

- DAX -1.6%

- CAC 40 -1.5%

- 10-year Treasury yield +3 basis points at 3.96%

- VIX +3.4 points at 23.3

- Bloomberg Dollar Index +0.4% at 1192.78

- euro -0.6% at $1.1743

- WTI crude +7.4% at $72.01/barrel

Top Overnight News

- Donald Trump said the bombing campaign against Iran may last for weeks and called on the nation’s leaders to capitulate. Blasts were heard across several Gulf states as they intercepted missiles launched by Iran. Trump is pushing for an Iranian leadership change but told ABC his preferred candidates to lead Iran were killed in the initial US strike. BBG

- Iran is planning to name a new supreme leader within days after Saturday’s killing of Ayatollah Ali Khamenei. While Trump has urged Iranians to seize power from the regime, there’s no sign the US has laid the groundwork for an opposition movement. BBG

- The IDF bombed Lebanon after Hezbollah fired rockets and drones into Israel, opening a new front in a widening regional war. Lebanon ordered the militant group to disarm. BBG

- Chinese Foreign Minister Wang Yi called the killing of Khamenei “unacceptable,” complicating the planned summit between Trump and President Xi Jinping. Beijing said Washington gave it no advance warning of the attack, and added that they are in communication with the US about exchanges between their leaders. BBG

- China Foreign Ministry said they are in communication with the US about exchanges between their leaders.

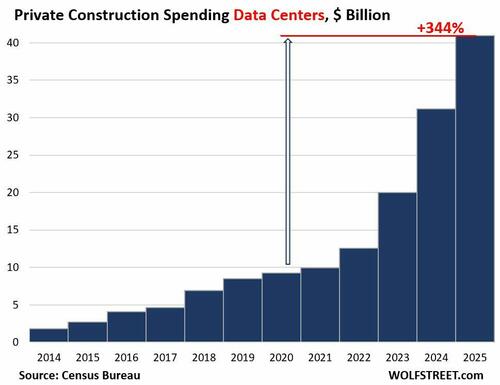

- Wealthy investors who ploughed hundreds of billions of dollars into private credit are pulling back, cutting off a key source of funds that investment giants including Blackstone, Blue Owl, and Ares Management have used to fuel their growth. New commitments to so called non traded business development companies slid 40% to $3.2bn in January compared with December. FT

- DeepSeek is set to release its latest large language model next week, more than a year since its last major release in a fresh test of China’s ambitions to challenge US rivals in AI.

- A gauge of manufacturing activity signaled continued improvement in some of Asia’s top exporting economies midway through the first quarter, as demand for the region’s goods defied a volatile global environment. WSJ

- Bank of Japan Deputy Governor Ryozo Himino said the central bank is expected to keep raising interest rates but gave no hints on the timing of the next hike, as the Middle East conflict heightened uncertainty over the economic outlook. RTRS

- Russian officials increasingly consider there’s no point to continue US-led peace talks with Ukraine unless Kyiv is willing to cede territory to reach a deal, according to people familiar with the negotiations. BBG

Iran War

- US and Israel launched a large-scale joint military operation against Iran on Saturday, 28th February, with explosions reported across Tehran shortly after 09:30 local time (06:00 GMT / 01:00 EST), and additional strikes were confirmed in Isfahan, Qom, Karaj and Kermanshah, while the Israeli military confirmed it launched an additional wave of strikes on Sunday morning, targeting Iran's ballistic missile and aerial defence systems.

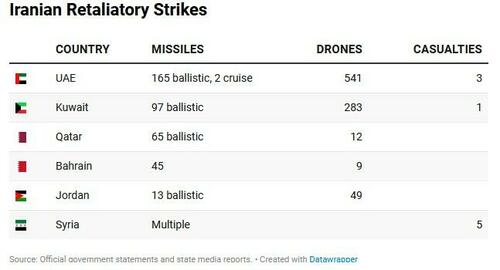

- Iran launched immediate retaliatory missile and drone attacks against Israel, and multiple US military installations across the Gulf and multiple Gulf states, including the UAE, Qatar, Kuwait and Bahrain. Iranian state television officially confirmed the death of Supreme Leader Ayatollah Ali Khamenei following Saturday’s US–Israeli “decapitation strike” on his secure residence and office compound in central Tehran. Furthermore, IRGC declared the Strait of Hormuz closed to international navigation until further notice, while major tanker operators and global trading houses have halted crude, fuel and LNG shipments through the waterway. IRGC also announced on Sunday that they hit 3 US and UK oil tankers with missiles in the Gulf and Strait of Hormuz.

- Iran launched a fresh wave of missile and drone attacks on Sunday, while Iranian sources stated that 27 US bases across the region were targeted, along with Israel’s military headquarters in Tel Aviv. It was also reported that Iran fired missiles towards British military bases in Cyprus and that rockets landed near British troops in Bahrain.

- Israeli Air Force launched a new wave of attacks on Iranian regime targets in Tehran early on Monday and bombarded Hezbollah strongholds in the southern suburb of Beirut, while Hezbollah fired rockets towards Northern Israel for the first time since the ceasefire agreement, and it was also reported that Hezbollah parliamentary bloc head Mohammed Raad was killed in an Israeli raid.

- US President Trump said the US military launched “major combat operations” in Iran with the objective of defending the American people by eliminating imminent threats from the Iranian regime. Trump said people in Iran should stay at home and that bombs will be dropping everywhere, while he called for Iranians to take over the government.

- US President Trump said that Iran’s Supreme Leader Khamenei had died, and he was informed that they destroyed and sank nine Iranian ships, as well as largely destroyed the naval headquarters. Trump separately commented that the military operations are ahead of schedule and that 48 leaders were killed in strikes on Iran, while he also stated that Iranian leaders want to talk and he has agreed to talk, but couldn’t say if it would happen soon, according to Atlantic Magazine and Daily Mail. Furthermore, Trump suggested that the fighting with Iran could go on for four weeks, while he also stated on Sunday that they have hit hundreds of targets in Iran under ‘Operation Epic Fury’ and combat operations will continue in full force until all objectives are complete.

- US President Trump said he could lift sanctions on Iran if its next leader proves pragmatic and that he had three very good choices for Iran's next leader, although he also commented that the people he considered for Iran's next leader died in the air attacks.

- US Secretary of War Hegseth is to hold a press conference at 08:00EST/13:00GMT. White House separately announced that US Secretary of State Rubio and Secretary of War Hegseth are to brief a full Congress on Tuesday.

- US officials told Al Jazeera that the strikes on Iran are focused on military targets and will be far more extensive than the US strikes last June, while the US reported that three US service members died and five were seriously wounded amid the operations against Iran.

- Israeli PM Netanyahu said the US and Israel operations are to remove the existential threat from the Iranian regime, while Israeli officials characterised the action as a “pre-emptive strike” to prevent Iran from obtaining nuclear weapons. Israel ordered the shutdown of some natural gas fields as a security measure following the US-Israel strike on Iran, while it pre-approved a USD 2.9bln supplement to the defence budget to fund the war with Iran.

Trade/Tariffs

- India's Foreign Ministry announces that they have signed an uranium supply agreement with Canada.

- Singapore and South Korea are in talks to upgrade a free trade agreement.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly pressured as all focus centred on geopolitics following the US and Israeli strikes on Iran, which killed its Supreme Leader and dozens of officials, while Iran responded with retaliatory strikes against the US and allies, including several neighbours in the Gulf. ASX 200 was rangebound with weakness seen in tech, financial and airlines stocks as the latter got a double whammy from flight disruptions and higher fuel costs, while energy stocks benefitted from the surge in oil due to the Iran conflict.

Nikkei 225 fell beneath the 58,000 level as exporters suffered from the worsening geopolitical climate and disruption in the Strait of Hormuz, which the IRGC shut. Hang Seng and Shanghai Comp were mixed with heavy losses in Hong Kong due to tech weakness, while the mainland shrugged off early jitters and climbed ahead of the annual 'two sessions' in Beijing, where top officials are set to unveil economic strategies.

Top Asian News

- China overhauled a key micro credit program in which the focus is shifting to longer-term income support for rural households from a prior focus on poverty alleviation.

- Macau gaming revenue in February rose 4.5% Y/Y to MOP 20.6bln (exp. 1% growth).

- DeepSeek is to release the long-awaited DeepSeek 4 model in the week ahead.

European bourses (STOXX 600 -1.3%) are entirely in the red due to instability in the Middle East. In brief, the US-Israeli war with Iran has entered its third day, with all sides conducting large-scale airstrikes. Airspaces have been closed, oil refineries and tankers have been hit, and threats of further attacks continue (see "Iran Situation Report - Day 3" on the headline feed for more detailed analysis). The FTSE 100 (-1.0%) is being supported, albeit posting slight losses, helped by the major oil names (BP +1.8%, Shell +2.2%) as oil prices rise. The banking-heavy IBEX 35 (-2.2%) and FTSE MIB (-1.7%) have been hit the hardest on the prospect of increased war-risk claims.

From a sectoral perspective, Energy leads the pile, given the strength in underlying oil prices; Defence names are also stronger across the board, given the increased tensions; Rheinmetall +1.3%, BAE +5.2%, Leonardo +4.7%. One other key space of the market that has benefited is shipping names such as Maersk (+4.5%), Kuehne+Nagel (+0.4%), due to higher freight rates. US equity futures (ES -1.0%, NQ -1.4%, RTY -1.4%) have followed the global risk tone; in recent trade, contracts are attempting to rebound off worst levels, though remain significantly in the red. ASML (ASML NA) is planning to expand into advanced packaging for AI chips, and is exploring larger chip sizes and scanner systems

Top European News

- Top academics warned that planned cuts to physics and astronomy funding risk undermining a key government strategy to harness innovation to boost economic growth, according to FT.

FX

- DXY gains but trades off best levels as participants flock to the USD in light of the weekend geopolitics, with the initial US-Israel strike on Iran expanding throughout the Gulf and Middle East. Analysts at ING highlight three main channels that keep the USD in demand: 1) the US is less dependent on imported energy vs Europe and most of Asia. Higher energy hurts importers (EUR, JPY), whilst European Nat Gas opened up around 25%. 2) Markets are scaling back expectations for rate cuts from the Fed, with higher energy also proving headwinds for disinflation. A “bearish flattening” in the US yield curve (short-end yields rising) supports the dollar. 3) Higher energy and reduced Fed easing expectations could reverse capital flows into EM, which would further support the USD. DXY is around the middle of a 97.768-98.566 range after hitting highs around an hour after the European cash open.

- GBP is the worst performer amid the RAF base in Cyprus being struck by an Iranian drone. The UK has confirmed it is not participating in offensive operations but is permitting defensive use of bases. GBP/USD slipped from a 1.3456 peak to a 1.3314 trough.

- EUR has been hit by the aforementioned surge in energy prices, with EUR/USD slumping from near 1.1800 to lows of 1.1698 before trimming losses at the time of writing. ING suggests EUR/USD could slide back toward the 1.1575–1.1600 area if escalation continues.

- JPY and CHF are softer despite their haven appeals, with the USD sought after given its reduced dependency on energy imports. USD/JPY is +0.6% in a 156.04-157.25 range. USD/CHF trades +0.5% in a 0.7668-0.7742 parameter.

- Antipodeans also post losses amid their high-beta properties and sensitivity to risk. AUD/USD resides in a 0.7032-0.7117 range and NZD/USD in a 0.5928-0.5995 band.

Fixed Income

- USTs opened higher, then jumped to a session high of 114-12, before quickly paring much of the upside as the APAC session progressed. The narrative quickly shifted from “haven” related upside, to traders assessing and then pricing in the inflationary impacts of the closure of the Strait of Hormuz. This impacts both: a) energy prices, b) prices of goods which are subject to longer trading routes, as shipping giants avoid the chokepoint. From a central banking perspective, inflationary pressures could see policymakers shift hawkishly – though, Danske Bank suggested that the Fed is unlikely to trigger speculations of near-term policy shifts following the rise in energy prices. Geopols aside, the US ISM manufacturing survey for February is expected to be little changed at 52.3 (from 52.6). The Atlanta Fed will update its GDPnow tracking estimate, which is currently modelling growth of 3.0% in Q1. Later in the session, the Fed will publish its Senior Loan Officer Survey. USTs currently trade around 113-23 within a 113-22+ to 114-12 range.

- Bunds moving in-line with peers and currently trading around 130.05 to 130.53 range. Price action is similar to the above, initial haven flows buoyed German paper, before markets began factoring in inflationary impacts. Danske expect short-term widening Schatz spreads, but the bank highlights that safe-haven inflows are often short-lived and modest.

- Gilts are underperforming, and trades lower by around 30 ticks within a 93.31 to 93.57 range. Underperformance, which perhaps can be explained given that the region is a net-importer of oil, and as such has long been considered highly vulnerable to energy volatility. Elsewhere, ahead of this week’s UK Spring Statement, Chancellor Reeves has received a GBP 22bln windfall as tax receipts outperformed forecasts, according to Bloomberg; analysis of official data showed stronger than expected self-assessed income tax and sales levy revenues, alongside lower debt-interest spending, contributing to the improvement in the public finances.

Commodities

- Crude futures surged at the reopen in reaction to the geopolitical escalation in the Middle East owing to the strikes against Iran and the killing of its Supreme Leader, as well as its retaliation against the US and several neighbours in the Gulf, while it also announced the closure of the Strait of Hormuz. (Newsquawk analysis available on the feed). However, prices waned off their opening highs as Brent returned to beneath the USD 80/bbl and WTI briefly retreated to below 70/bbl levels before recovering, with Brent May'26 currently within USD 74.54-80.82/bbl (+6.2% at the time of writing) and WTI Apr'26 within USD 71.88-75.33/bbl (+7.3% at the time of writing).

- Spot gold rallied on a haven bid amid the weekend geopolitics (Newsquawk analysis available on the feed) but then mildly pulled back after stalling just shy of the USD 5,400/oz level in APAC trade, before mounting the level to a USD 5,419.15/oz peak. Spot silver hit a USD 92.42/oz peak from a USD 92.02/oz trough.

- Copper futures ultimately weakened overnight but trades flat in European hours, in choppy trade amid the mostly negative risk appetite in the region, with all focus on geopolitics. 3M LME copper resides in a narrow USD 13,249.60-13,444/t range at the time of writing.

- OPEC+ is to resume oil output increases, in which it will add 206k bpd in April. It had been previously reported over the weekend that OPEC+ could consider a larger production hike of as much as 441k bpd following the strike on Iran.

- IRGC declared the Strait of Hormuz closed to international navigation until further notice, while major tanker operators and global trading houses have halted crude, fuel and LNG shipments through the waterway. Furthermore, analysts warned of a potential Brent crude move above USD 100/bbl if the blockade persists.

- Oil facilities of regional countries are not Iran's targets, via Mehr.

- Chevron (CVX) said it was instructed by Israel's Ministry of Energy to temporarily shut-in production at the Leviathan gas production platform.

- Middle East crude benchmark Dubai's premium rises to around USD 5.90/bbl, the highest since 2022, sources say.

- IAEA Director General Grossi said we have no indication that any of Iran's nuclear installations have been damaged or hit. The situation is very concerning, cannot rule out a possible radiological release with serious consequences. No elevation of radiation levels above the usual background levels have been detected so far in countries neighbouring Iran.

- Saudi Energy Ministry says limited fire at Aramco's Ras Tanura refinery, no impact on supplies.

- The limited fire at Ras Tanura refinery was due to shrapnel falling during an interception operation, Al Hadath reported.

Central Banks

- BoJ Deputy Governor Himino said to raise rates if economic outlook is met, adds the goal is to maintain price stability by avoiding excessive inflation and deflation, thereby supporting sustainable economic growth. said:Impact of rate hikes has been limited so far.

- SNB states that in view of the international situation, we are more prepared to intervene in the FX market.

- Swiss Sight Deposits (w/e Mar 1). Domestic Banks CHF 440.5bln (prev. 440.6bln), Total CHF 459.8bln (prev. 457.6bln).

Geopolitics: Middle East

- Israeli military says it has begun additional strikes on Tehran.

- Qatar Defence Ministry says it intercepted two Iranian drones, which targeted energy facilties; one drone headed towards QatarEnergy's Raf Laffan facility

- "Israel army said there is no reason for Lebanon ground invasion for now", via Al Arabiya citing AFP.

- Israel's IDF said "We are discussing the option of carrying out a ground operation inside Lebanon", via Al Jazeera.

- Iran's ambassador to the IAEA said Israel and the US attacked Iranian nuclear facilities on Sunday.

- Iran's Larijani said they will not negotiate with the US.

- Iran's Secretary of the Supreme National Security Council Larijani said US President Trump has brought chaos to the region with "false whims" and is now worried of more casualties among US forces. Trump is sacrificing American soldiers for Israel's quest for power.

- Iran warns that those responsible for killing Supreme Leader Khamenei will face consequences.

- US President Trump said he could lift sanctions on Iran if its next leader proves pragmatic, according to New York Times. said:He had three very good choices for next Iran leader.

- US President Trump said the people he considered for Iran's next leader died in the air attacks, according to ABC News.

- US President Trump said Iran does not want to go quite far enough and it's too bad and are not happy with Iran negotiation.

- US Secretary of State Rubio designating Iran as state sponsor of wrongful detention; Iran must stop taking hostages; will consider other measures if Iran does not stop.

- US State Department said no American should travel to Iran for any reason and reiterate their call for Americans who are currently in Iran to leave immediately.

- Hezbollah reportedly fires rockets towards Northern Israel for the first time since the ceasefire agreement, according to Israel Broadcasting Corporation.

- Omani Foreign Minister said "The single most important achievement, I believe, is the agreement that Iran will never, ever have a nuclear material that will create a bomb...", according to CBS interviewing Albusaidi. "

Geopolitics: Ukraine

- Ukraine President Zelensky says long war in Iran may impact air defence for Ukraine.

- Russia is said to consider a halt in peace talks unless Ukraine cedes land. Talks planned for the week ahead will be decisive on whether or not the sides can agree on terms to end the war, while Russia will likely walk away if Ukrainian President Zelensky fails to make the concession.

- A fuel terminal in Russia's Novorossiysk is on fire, according to local authorities.

US Event Calendar

- 9:45 am: United States Feb F S&P Global US Manufacturing PMI, est. 51.35, prior 51.2

- 10:00 am: United States Feb ISM Manufacturing, est. 51.5, prior 52.6

- 10:00 am: United States Feb ISM Prices Paid, est. 60, prior 59

DB's Jim Reid concludes the overnight wrap

Those who read my EMR on Friday will appreciate that frantic emails around a major international conflict were an interesting additional challenge to try to squeeze into a packed weekend of “daddy childcare”. By now, there is little point in recapping much of the news around the strikes on Iran, so instead we’ll jump straight into the latest market reaction.

As regular readers will know from the work we have shared from DB's Binky Chadha, the negative market impact of notable geopolitical events is usually measured in only days and weeks, and you could argue that the market has increasingly realised this and now reacts less to big geopolitical events than it may have done a few years ago. However, one persistent risk is always a prolonged impact on the oil price. As such, that is the main market to watch today and for the duration of this episode. How firmly, or officially closed, the Strait of Hormuz remains will probably play a big part in this.

So far, Brent is about +7% higher at $77.60/bbl as I type this morning, having briefly been as high as $82 as trading in Asia opened. The spike comes as tanker traffic via the Strait of Hormuz has largely stopped with Iran having attacked three oil tankers over the weekend, though Iran’s foreign minister said on Sunday that Iran was not seeking to close the strait. There is a view that ahead of the mid-terms, the US administration will do what they can to ensure Iran struggles to block the Strait for long. Investors will also be watching the extent of damage to Iran’s oil export facilities.

Meanwhile, OPEC+ yesterday announced a supply increase of 206k barrels a day in April, following an increase of 137k a day in December. This is a decent rise, but it would not change the bigger picture if there were a sizeable disruption to oil flows.

With most markets closed over the weekend, Bitcoin served as a barometer of sentiment and immediately dropped around -4% when news of the attacks broke early London time on Saturday morning. From these lows, it rebounded around 7% through Saturday and into Sunday as mounting speculation that Supreme Leader Khamenei had been killed was confirmed. This raised hopes of a decisive operation with an obvious ending. As things stand, Bitcoin is about -2% down off these highs, but still +2% above where we were just before the strikes.

Market sentiment bounced shortly after the Asia open amid some more encouraging reporting. According to the New York Times, Trump said that he was open to lifting sanctions on Iran if its new leadership was pragmatic though he also said that the US could keep up its campaign against Iran for “four to five weeks”. Meanwhile, the Wall Street Journal reported that Ali Larijani, the secretary of Iran's Supreme National Security Council who’s seen as leading Iran’s current effort, made a fresh push to resume nuclear talks with Washington via Omani mediators. However Larijani has poured some cold water on this on X, stating that “We will not negotiate with the United States.” This has taken oil off its lows for the session.

With the US unlikely to put boots on the ground, it’s not clear if full regime change is achievable and its outcome would be highly unpredictable, which naturally leaves questions of whether a negotiated resolution can still be found. At the same time, we’ve seen a widening of the conflict to Lebanon overnight, with Israel striking targets in the country after Hezbollah fired rockets into Israel.

So that all leaves global markets with a clear but not extreme risk-off reaction this morning. S&P 500 futures are down -0.81% from Friday’s close, with those on the STOXX 50 down a larger -1.47%. Note that Europe is more negatively exposed to higher energy prices, including also possible disruptions to LNG shipments from the Gulf. Meanwhile, in Asia, the Hang Seng (-1.59%) and the Nikkei (-1.51%) are among the worst performers, also affected by declines in technology stocks. The Shanghai Comp has turned positive (+0.33%). In FX, the dollar index is +0.29% higher, while the Swiss Franc is the best performing G10 currency amid the safe-haven demand. And gold is +1.41% higher. For Treasuries, yields initially opened a touch lower amid the safe-haven bid but this has quickly reversed this morning with the 10yr +2.8bps higher at 3.97%, after ending last week at post-2024 lows. So overall fairly measured response in Asia to the weekend events.

Outside the obvious and huge attention on the Middle East, the key focus this week will be on the US jobs report on Friday, retail sales on the same day, the ISM indices (today and Wednesday), and the Fed’s Beige Book, also due on Wednesday. European releases will include inflation data tomorrow and the ECB’s accounts of their February meeting on Thursday. Various global PMIs are also out this week.

In politics, highlights include the Two Sessions in China as well as the Spring Statement in the UK. Earnings reports will be due from Costco and Broadcom.

Delving deeper into the US data, the most important release in the week ahead is Friday’s February employment report. Our economists forecast headline payroll growth of 30k, down from 130k previously, with private payrolls rising by 50k after January’s unusually strong 172k gain. The moderation largely reflects payback from outsized hiring last month in private education and health services and construction, where job gains more than doubled their six month averages. Elsewhere in the establishment survey, our economists expect average hourly earnings to rise 0.4% month over month, unchanged from January, while the average workweek remains steady at 34.3 hours.

The household survey adds an additional layer of uncertainty this month, as the BLS implements its delayed annual population controls. Our economists forecast the unemployment rate at 4.3%, though risks around this estimate are elevated in both directions. January data will also be revised using the new controls, and attention will be focused on whether these adjustments meaningfully alter unemployment rates across demographic groups, particularly among younger cohorts, where concerns around entry level hiring remain heightened.

Friday also brings January retail sales, where weather related weakness in auto sales is likely to weigh on the headline figure. Our economists expect headline sales to decline 0.6%, with sales excluding autos down 0.1%, partly reflecting lower gasoline prices. That said, retail control sales are forecast to rebound by 0.3%, pointing to a firmer underlying pace of goods consumption. Tax refunds should provide additional support to spending in coming months, with the average refund running meaningfully higher than a year ago.

Ahead of Friday, several other releases will help set the tone. Our economists expect today’s manufacturing ISM to edge up to 53.1 from 52.6. Wednesday brings the ADP employment report, forecast at 50k (though seasonals might push it higher), alongside the non manufacturing ISM, seen at 54.0.

Other notable data include February unit motor vehicle sales tomorrow, which our economists expect at 15.1 million, potentially restrained again by adverse weather. Thursday’s preliminary Q4 productivity and unit labour cost figures are forecast at 1.3% and 2.2%, respectively.

Moving to Europe, the focus will continue to be on inflation, with February prints due for the Eurozone and Italy tomorrow, Switzerland on Wednesday, and Sweden on Thursday. ECB speakers will include President Lagarde today, and the central bank will release the accounts of its February meeting on Thursday.

In the UK, attention will be on the Spring Statement delivered by the Chancellor tomorrow, and our UK economist previews it here. There will also be the February DMP survey from the BoE on Thursday.

Over in Asia, the spotlight will be on China’s annual Two Sessions starting Wednesday (running through March 11), followed by the National People’s Congress session opening on Thursday, with the 15th Five Year Plan expected. Elsewhere, data highlights will include the February PMIs, both the official and private gauges, in China on Wednesday.

In Japan, our Chief Japan economist highlights the Shunto wage demands due on Thursday as the most anticipated event next week and expects wage demands this year to come in at 6.0%. There will also be the Financial Statements Statistics of Corporations (MoF survey) for Q4 on Tuesday, as well as the February consumer sentiment index on Wednesday. For more detail and forecasts, see our Chief Japan economist’s week ahead for the country here.

Earnings will include tech firms Broadcom, CrowdStrike and Marvell. US consumer firms will continue to be in focus, with reports from Costco and Target.

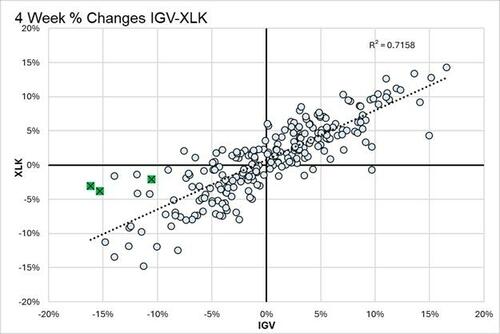

Looking back at last week, which now feels like a long time ago, the main theme was the ongoing AI disruption narrative, which continued to affect a range of assets. In part, this reflected the now infamous memo from Citrini Research, which outlined a hypothetical scenario in which AI adoption drove the US unemployment rate into double digits by mid 2028. We also had Nvidia’s earnings, which once again failed to deliver the kind of positive surprise markets had grown used to in 2023–24, even as they beat analysts’ estimates. Against this backdrop, the S&P 500 fell -0.44% (-0.43% on Friday), with the Magnificent 7 down -1.80% (-1.41% on Friday). The Philadelphia Semiconductor Index fell -1.96% (-1.21% on Friday), ending a run of 10 consecutive weekly gains.

Performance outside the US was notably stronger. The STOXX 600 posted a fifth consecutive weekly gain of +0.52% (+0.11% on Friday), closing at a record high. In Japan, the Nikkei rose +3.56% (+0.16% on Friday) to also hit a new record, taking its year to date gains to +16.91%.

The biggest news on Friday was rising concern about a possible US strike against Iran, which added further upward pressure on oil prices. Brent crude ended the week up +1.00% (+2.45% on Friday) at a seven month high of $72.48/bbl. It was also another strong week for precious metals, with gold prices up +3.36% (+1.81%) in their fourth consecutive weekly gain, and both are obviously seeing significant action again this morning.

Finally, in fixed income, sovereign bonds benefited from the broader caution. Ten year Treasury yields fell -14.4bps last week (-6.4bps on Friday) to 3.94%, their lowest level since October 2024. In Europe there were similar moves, with 10 year Bund yields down -9.4bps last week (-4.7bps on Friday) to 2.64%, marking their biggest weekly decline since April last year around the Liberation Day turmoil. Credit spreads widened on both sides of the Atlantic, with US high yield up +21bps (+9bps on Friday) and US investment grade up +7bps (+2bps on Friday), their biggest weekly widening since the Liberation Day tariffs. In Europe, high yield widened +13bps (+5bps on Friday), while investment grade widened +5bps (+3bps on Friday).

Tyler Durden

Mon, 03/02/2026 - 08:39

Dr. Marty Makary, FDA commissioner. (Andrew Harnik/Getty Images)

Dr. Marty Makary, FDA commissioner. (Andrew Harnik/Getty Images)

A 14-year-old boy poses at his home near Gosford as he looks at social media on his mobile phone in New South Wales, Australia, on Oct. 24, 2025. David Gray/AFP via Getty Images

A 14-year-old boy poses at his home near Gosford as he looks at social media on his mobile phone in New South Wales, Australia, on Oct. 24, 2025. David Gray/AFP via Getty Images A plume of smoke rises from a reported Iranian strike in the industrial district of Doha on March 1, 2026. Mahmud Hams/AFP via Getty Images

A plume of smoke rises from a reported Iranian strike in the industrial district of Doha on March 1, 2026. Mahmud Hams/AFP via Getty Images

Britain's Prime Minister Keir Starmer makes a statement from Downing Street in central London on Feb. 28, 2026, following the U.S. and Israeli strikes on Iran. Jonathan Brady/POOL/AFP via Getty Images

Britain's Prime Minister Keir Starmer makes a statement from Downing Street in central London on Feb. 28, 2026, following the U.S. and Israeli strikes on Iran. Jonathan Brady/POOL/AFP via Getty Images

Recent comments