Germany's Intelligence Service Set To Expand Surveillance

Submitted by Thomas Kolbe

According to plans from the Federal Chancellery, Germany’s foreign intelligence service, the BND, is set to significantly expand its surveillance capabilities. The focus is particularly on internet communication transmitted from within Germany to abroad, which is to be included in the agency’s monitoring catalog going forward.

After months of heated debates over the expansion of the Brussels censorship apparatus under the Digital Services Act and EU chat control, attention to the EU Commission’s espionage activities has somewhat subsided. Now, a draft law from the Chancellery, obtained by WDR, NDR, and Süddeutsche Zeitung, is causing a stir.

The proposed expansion of BND powers makes one thing clear: German politics is moving in lockstep with the Brussels Commission—going all out against the privacy and communications of citizens, media, and government-critical organizations.

A Reminder of the NSA Scandal

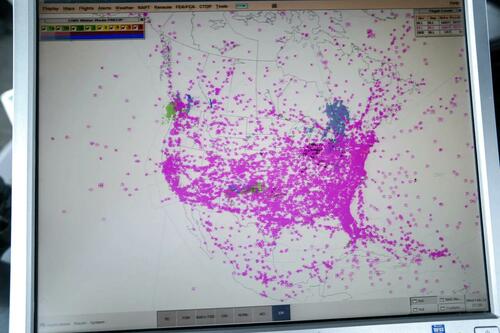

We recall the scandal over a decade ago involving the US National Security Agency (NSA). Whistleblower Edward Snowden exposed the agency’s operations. The NSA collected global telecommunications and internet data—including phone calls, emails, and online communications of millions of citizens—often without any criminal cause. Programs like PRISM, which allowed direct access to data from US tech companies, or X-Keyscore, which could monitor internet activity in real time, already showed how advanced state surveillance had become and what technical possibilities were available to government actors.

The leaked Chancellery document now shows where Germany is headed: the draft law follows almost the same principle. The BND would be allowed to monitor internet traffic from Germany to abroad, which was previously prohibited, capturing up to 30% of traffic. Internet communications would be stored for six months, this time including content—not just metadata—tracking connections between specific actors.

A Strategic Door Opener

The Chancellery’s approach to expanding BND powers is familiar: first, the door to the actual rule-breaking is opened. Safe spaces for journalists working for state media of authoritarian states are gradually eroded. Determinations of who counts as “authoritarian” will likely fall to an “ethics commission” subjected to the strict ethical rules of Merz’s Chancellery.

Soon, terms like “hate and incitement” or “anti-democratic activities,” as always cited in the fight against the opposition, come into play. In short: priority content revolves around the AfD circle. This also affects libertarian and conservative viewpoints opposing the climate-socialist complex or military sector expansion. Issues like a “Europe of regions” and resistance to the growing Brussels power complex will likely become part of the BND’s monitoring guidelines.

From this starting point, surveillance powers are gradually expanded—based on political urgency.

If foreign providers and platform operators are uncooperative, the BND could gain permission to legally hack and extract personal data and communications—even within Germany’s borders. It is a carte blanche for every “spy hat.” The social climate in Germany is visibly taking on the features of a digitalized DDR.

Digital Mass Surveillance

Chancellor Friedrich Merz’s draft goes far beyond previous EU-wide chat control attempts. Legal hacking of foreign systems, including Google, Meta, or Elon Musk’s platform X, is planned. The justification for this invasive policy is constructed as a strategic necessity: Germany’s IT infrastructure is increasingly threatened by hostile cyberattacks.

The BND is to play a key role and act more independently from US intelligence services. Germany aims to participate in the global intelligence network chessboard. In practice, surveillance is more likely to target its own citizens, as technical and personnel resources are insufficient to operate on an international level. The long retention and analysis periods make the direction clear: while French intelligence may store data for up to four years and the UK or Italy operate “as long as necessary,” German citizens are slowly losing privacy against an expanding bureaucratic state.

Cynical Politics and Opposition Oversight

For Green Party politician Konstantin von Notz, chair of the Parliamentary Control Panel for Intelligence (PKGr), the situation is clear: cybersecurity should be better funded but within strict legal frameworks.

At first glance, this sounds lawful but is systematically undermined by actual government actions—the proposed powers go far beyond necessary intelligence work. Brussels and Berlin’s political direction points precisely toward mass surveillance of digital communication. Platforms like X act as catalysts for opposition voices against Berlin and Brussels, criticizing Russia policy, the pandemic regime, and the growing bureaucratic apparatus. Here, clashes between state and opposition flare up.

Particularly distasteful is outsourcing monitoring to so-called “Trusted Flaggers” who report undesired content—creating a surveillance network reminiscent of DDR methods: opposition members face pressure, legal action, or loss of bank access—a social death by government command. In this context, expanding BND powers is a step toward interlinking multiple surveillance systems. The end of the secrecy of correspondence and anonymous digital communication seems sealed for EU citizens.

Repressive and Hypocritical

During the EU chat control debate, Germany initially publicly opposed indiscriminate surveillance to maintain appearances and give the impression of adhering to civil liberties traditions. Historically, libertarian forces in Germany successfully resisted state-driven data retention—proof of a healthy societal immune system.

Now, the BND is set to close this “informational” gap, initiated directly by the Chancellor. Merz theatrically portrays himself as a defender of freedom while leaving his party and coalition to ostentatiously oppose deep EU chat control.

Merz remained silent during year-end debates, fully aware that the next 180° turn had already been drafted into law. Now, with calculated cynicism, he positions Germany’s spy apparatus against its own citizens.

When the draft will enter parliament remains unclear. The Chancellery has provided no statements on this critical issue; it operates clandestinely. Germany of the 2020s still lacks effective societal “antibodies” against the growing state repression apparatus, possibly due to decades of media framing portraying the state as benevolent.

In summary: Germany has become a driving factor in both destructive climate policy and systematic erosion of civil rights in the EU—or perhaps always was, skillfully avoiding the appearance of being a malicious player in this unpleasant game.

Tyler Durden Mon, 01/12/2026 - 03:30

The U.S. embassy in Caracas on Jan. 9, 2026. Federico Parra/AFP via Getty Images

The U.S. embassy in Caracas on Jan. 9, 2026. Federico Parra/AFP via Getty Images

Greene visited “The View” in November amid the spat with Trump. Lou Rocco/ABC

Greene visited “The View” in November amid the spat with Trump. Lou Rocco/ABC

Recent comments