America's Record Health Spending Explained In 5 Charts

Authored by Lawrence Wilson via The Epoch Times,

U.S. health care spending reached $5.3 trillion in 2024, according to recently released data from the Department of Health and Human Services.

That includes all health spending through federal and state health programs like Medicare and Medicaid, money paid by individuals to health insurers and providers, spending by employers, and payments made by insurance companies.

Here’s a look at the overall picture of America’s health spending and what that means for consumers and taxpayers.

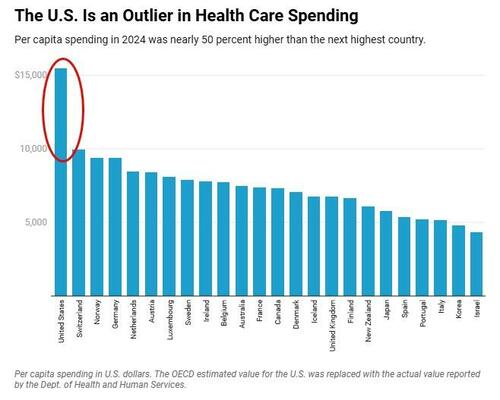

The United States spends more on health care than any nation in the world.

That’s true whether as a gross amount, a per-capita average of $15,474, or a share of the national economy, 18 percent.

And the amount keeps growing. Per capita health care spending has grown every year since 2000, rising at 77 percent higher than inflation.

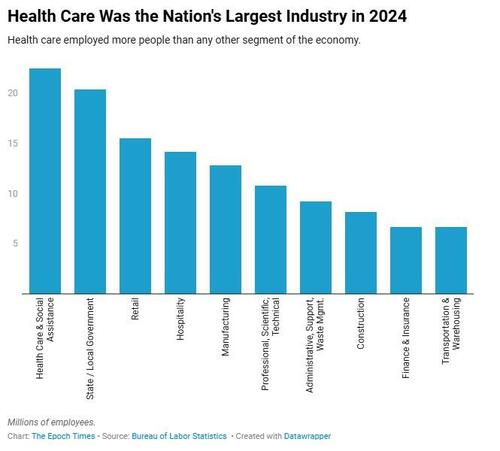

Health care is the largest industry in the United States by total spending and employment.

Health care, grouped with social services by the Bureau of Labor Statistics, employed more people than any other industry and was one of the fastest growing U.S. industries.

About $18 of every $100 spent in the United States went to pay for health care in 2024. That’s more than was spent on housing ($12), groceries ($5), national defense ($4), or cars ($3).

Health care spending rose 7.2 percent in 2024, but health care prices accounted for less than half of the increase.

Those prices rose 2.5 percent, which was below the overall inflation rate of 2.9 percent that year.

Most of the increase was due to increased cost or use of other goods and services, the increased demand for medical services, and changes in the population.

The overall demand for medical services increased and was the most significant reason for increased spending, according to the Department of Health and Human Services.

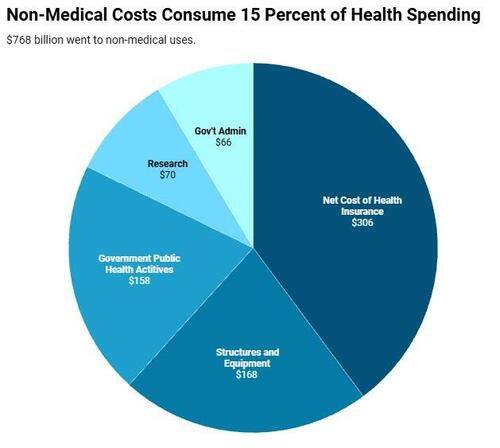

Americans spent $768 billion on non-medical expenses in 2024, about 15 percent of health care spending.

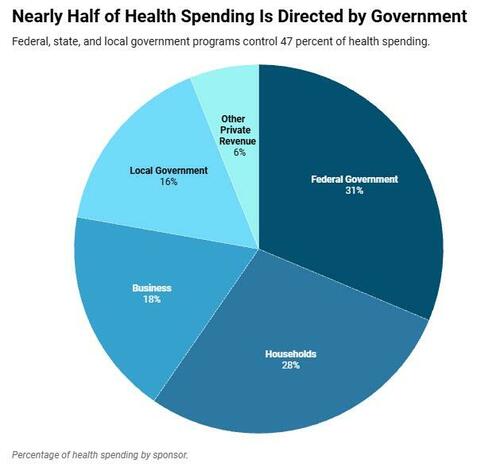

Most health care funding is provided by individuals through out-of-pocket payments, health insurance premiums, taxes used to fund government health care programs, or money paid by employers to health insurers in lieu of employee wages.

Most of the money flows through other hands, which include the federal government, state governments, and employers.

President Donald Trump and some Republicans in Congress have proposed placing more discretion for health care spending in the hands of consumers, for example by providing funded health savings accounts to individuals rather than paying subsidies directly to insurance companies.

Democrats, whose legislative and policy proposals generally favor controlling costs through increased regulation and subsidies, have so far opposed that idea.

Health care spending accounted for more than a quarter (27 percent) of all federal spending in 2024 and was the largest spending category.

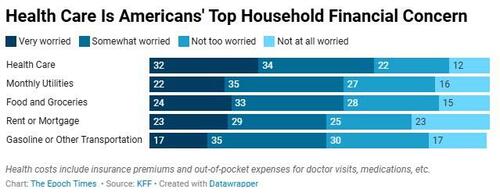

The cost of health care is the greatest financial worry for Americans, according to recent polling from health policy research group KFF.

Two-thirds of Americans (66 percent) said they worried about being able to afford insurance premiums and medical bills. Health expenses were a greater concern than paying for utilities, food, housing, and gas.

More than half (55 percent), said their health care costs had increased in the past year.

Tyler Durden Sun, 02/08/2026 - 17:30

A neighborhood near the train wreck where vinyl chloride from derailed tank cars was vented and burnt in East Palestine, Ohio, on Feb. 6, 2023. Gene J. Puskar/AP Photo

A neighborhood near the train wreck where vinyl chloride from derailed tank cars was vented and burnt in East Palestine, Ohio, on Feb. 6, 2023. Gene J. Puskar/AP Photo Fire from a burning train is seen from a farm in East Palestine, Ohio, on Feb. 3, 2023. Melissa Smith via AP

Fire from a burning train is seen from a farm in East Palestine, Ohio, on Feb. 3, 2023. Melissa Smith via AP

C-17, via USAF/X

C-17, via USAF/X Trucks line up next to the border wall before crossing to the United States at Otay commercial port in Tijuana, Mexico, on Jan. 22, 2025. Guillermo Arias/AFP via Getty Images

Trucks line up next to the border wall before crossing to the United States at Otay commercial port in Tijuana, Mexico, on Jan. 22, 2025. Guillermo Arias/AFP via Getty Images

Harvard University in Cambridge, Mass., on July 4, 2025. Learner Liu/The Epoch Times

Harvard University in Cambridge, Mass., on July 4, 2025. Learner Liu/The Epoch Times

David Veksler/Unsplash.com

David Veksler/Unsplash.com via The Export Practitioner

via The Export Practitioner

Recent comments