Why Greenland Is At The Center Of A Shifting Global Order

Authored by Terri Wu via The Epoch Times (emphasis ours),

U.S. President Donald Trump’s pursuit of Greenland for national security purposes rankled allies ahead of the World Economic Forum in Davos, Switzerland, in January.

A drone view shows a general view of Nuuk, Greenland, on Jan. 15, 2026. REUTERS/Marko Djurica

A drone view shows a general view of Nuuk, Greenland, on Jan. 15, 2026. REUTERS/Marko Djurica

Trump’s threat of tariffs, coupled with his talk of possible military intervention to acquire the island, prompted sharp pushback from European countries. These tensions triggered talk of a “new world order” at Davos, with Canadian Prime Minister Mark Carney stating that the post-World War II world order is “in the midst of a rupture.”

But tensions eased soon after when the United States and NATO reached a framework deal on Greenland and Trump withdrew planned tariffs and ruled out the use of military action. High-level negotiations have continued between Washington and NATO and have begun between the United States, Denmark, and the semi-autonomous island.

Still, the Trump administration’s actions on Greenland represent a milestone event in a shifting world order, experts told The Epoch Times. As China and Russia look to deepen their strategic foothold in the Arctic and beyond, the United States is reasserting itself in the region.

Experts said they expect several years of turbulence before a new equilibrium emerges. When the dust settles in three to five years, they said, the United States is likely to retain its status as the dominant power, with China unlikely to secure material gains.

Despite China’s continued attempts to gain influence in Greenland and to deepen its operations with Russia in the Arctic Circle, experts said they suspect that reputational constraints and internal challenges will ultimately hamper the regime’s ability to achieve global primacy. At the same time, the United States will continue its world leadership role in a realigned position, they said.

A rare convergence of geopolitical factors has elevated Greenland’s strategic importance. Located in a region critical to U.S. homeland defense, the island is also situated between two emerging Arctic shipping routes that could significantly shorten global transit times. In addition, the territory is rich with natural resources, including rare earths.

Heightened Importance

Situated at the gateway to the Atlantic and Arctic oceans, Greenland has become central to U.S. homeland defense. That assessment is reflected in the new U.S. National Defense Strategy. Released on Jan. 23, it identifies Greenland as a “key terrain,” along with the Panama Canal and Gulf of America.

When Trump first mentioned purchasing Greenland in 2019, Alexander Gray was serving as a senior national security official at the White House. He said the president was “absolutely serious” then and is even more so now, given how he has prioritized the defense of the Western Hemisphere.

Geographically, Greenland is part of North America. Today, the United States has one military base—Pituffik Space Base, formerly known as Thule Air Base—in northwestern Greenland. That is down from 17 bases at the end of World War II.

The US military's Pituffik Space Base in Pituffik, Greenland, on March 28, 2025. Jim Watson - Pool/Getty Images

The US military's Pituffik Space Base in Pituffik, Greenland, on March 28, 2025. Jim Watson - Pool/Getty Images

During the Cold War, it played a critical role in the early detection of ballistic missiles to the continental United States. Military technology development makes that early-detection role even more critical, said Troy Bouffard, director of the Center for Arctic Security and Resilience at the University of Alaska–Fairbanks.

Conventional ballistic missiles first enter outer space and reenter the atmosphere, providing a predictable trajectory for tracking and ground interception. However, hypersonic cruise missiles are both maneuverable and can travel at altitudes below radar detection, making them much harder to track.

Russia and China likely have operational hypersonic cruise missiles, while those of the United States are still in development, according to a 2025 congressional research report.

“Pituffik would have an advantage of detecting anything first before anyone in quite a lot of the Arctic space,” Bouffard told The Epoch Times. “That’s critical to the entire missile defense enterprise of what will be North America’s Golden Dome.”

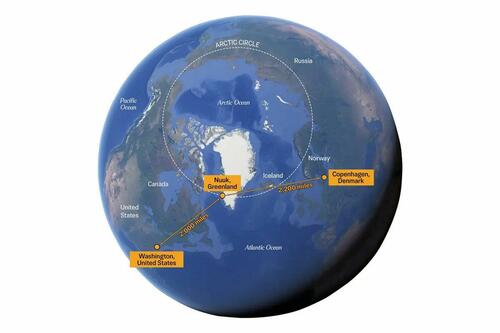

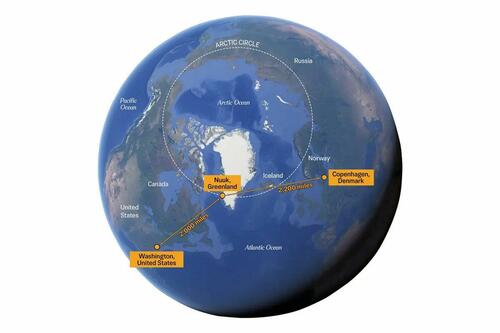

Greenland is part of North America. Its capital, Nuuk, is geographically closer to Washington, D.C., than to Copenhagen. Illustration by The Epoch Times, Google Earth

Greenland is part of North America. Its capital, Nuuk, is geographically closer to Washington, D.C., than to Copenhagen. Illustration by The Epoch Times, Google Earth

He noted that when the Soviet Union fell, it significantly reduced its army but retained its strategic submarine forces.

“They kept that one up because it is still the most lethal weapon on the planet,” Bouffard said.

“They’re still going toe to toe with us. They may not be up in terms of sophistication, yet in terms of fifth- and sixth-gen technologies ... they’re never that far behind.”

According to the Danish Institute for International Studies, radar coverage over Greenland is insufficient to detect Russian aircraft, and NATO currently lacks the capacity to hunt submarines in the GIUK Gap—waters separating Greenland, Iceland, and the UK.

Arena of Competing Powers

The Arctic is perhaps one of the last few areas where China sees a relatively open field for amassing power, according to China expert Alexander Liao. And China has been active in the region for a decade.

Although it has no territory in the Arctic, China declared itself a “near-Arctic state” in its first-ever Arctic policy, released in 2018. Later in the same year, Beijing launched a Polar Silk Road program and linked it to the Belt and Road Initiative, a $1 trillion foreign policy platform that expands Beijing’s global economic and military footprint.

Since the end of the Cold War, the Arctic region has been characterized by the principle of “Arctic exceptionalism.” The political narrative proposed by the final leader of the Soviet Union, Mikhail Gorbachev, aims to leave the region to scientific cooperation and to insulate it from broader geopolitical rivalry.

A fishing village near Nuuk, Greenland, on May 4, 2025. John Fredricks/The Epoch Times

A fishing village near Nuuk, Greenland, on May 4, 2025. John Fredricks/The Epoch Times

That was largely how things went until Russia’s invasion of Ukraine broke the equilibrium in February 2022, Bouffard said. The war in Ukraine led to the first-ever whole-of-government Arctic strategy, issued by the White House eight months later.

In Gray’s view, Russia’s invasion of Ukraine was “an inflection point, in that the world order [was] basically reverting back to what it was prior to 1991.”

“The world has shifted back to great power competition because of [Russian President] Vladimir Putin and [Chinese leader] Xi Jinping,” he told The Epoch Times.

Short of launching a kinetic war, Xi has leveraged the global trade system through his industrial policy and military-civil fusion strategy.

Over the past decades, Beijing has monopolized the processing of rare earths, critical minerals essential for modern manufacturing and advanced weapon systems. The regime showed last year that it was not afraid to use its stranglehold over rare earths to retaliate against U.S. tariffs.

And the Arctic’s rich natural resources were an attraction. The 2022 U.S. National Strategy for the Arctic Region states that China doubled its investments in the region over the previous decade, with a focus on extracting critical minerals and its “dual-use research with intelligence or military applications.”

Specifically in Greenland, the Danish government blocked such projects by Chinese state-owned companies.

The year 2018 marked a shift in Nordic countries’ sentiment toward China, according to Andreas Forsby, senior researcher at the Danish Institute for International Studies.

Thanks to U.S. pressure and Nordic countries’ “second thoughts about inviting the Chinese into the Arctic region,“ he said, the Chinese were told “step by step” that they “were no longer welcome.”

Although China has taken what Forsby called a “tactical retreat” in Greenland, Gray said the Chinese regime will again see an opening if the island achieves its long-term goal of independence from Denmark.

When addressing the European Union Parliament on Jan. 26, NATO Secretary-General Mark Rutte also stressed the importance of allied efforts to curb Russian and Chinese military and economic influence in the Arctic.

According to Risk Intelligence, a Denmark-based consultancy, after the war in Ukraine began, China started constructing its own docks in the five most significant ports along Russia’s Arctic coastline—Murmansk, Sabetta, Arkhangelsk, Tiksi, and Uzden—while building Chinese railway lines in the area.

Marie-Agnes Strack-Zimmermann, NATO Secretary General Mark Rutte and Chair of the Committee on Foreign Affairs of the European Parliament David McAllister arrive to address committees of the European Union Parliament about Greenland negotiations in Brussels, on Jan. 26, 2026. Omar Havana/Getty Images

Marie-Agnes Strack-Zimmermann, NATO Secretary General Mark Rutte and Chair of the Committee on Foreign Affairs of the European Parliament David McAllister arrive to address committees of the European Union Parliament about Greenland negotiations in Brussels, on Jan. 26, 2026. Omar Havana/Getty Images

A Shifting World Order

For now, it seems that the United States will have direct control over the land under its military bases in Greenland, according to a New York Post interview with Trump.

Rutte also said on Jan. 26 that negotiations will be carried out in two “workstreams”: one between the United States and NATO and one among the United States, Denmark, and Greenland. The second stream has begun, U.S. Secretary of State Marco Rubio said on Jan. 28.

Trump has said that more details will be negotiated in the coming weeks, after announcing on Jan. 21 that a framework had been discussed in Davos.

The Europeans got a “reality check” at the World Economic Forum, where the Greenland issue and surrounding tensions took center stage, said James Lewis, a former diplomat and a distinguished fellow at the Center for European Policy Analysis.

The old order was already breaking down, he said, and Trump accelerated the process.

“The rules-based international order never really worked; it worked as long as there weren’t any challenges to it,“ he told The Epoch Times. ”I think that’s what the Europeans have woken up to.

“They had this dream of a rules-based international order where lawyers were more important than guns, and that dream has gone.”

Similarly, Rutte said on Jan. 26 that it is time for Europe and Canada to shoulder more of their own defense.

Greenland was a “milestone” for the Europeans, Lewis said, noting that the transatlantic alliance has suffered a setback in trust that will linger after Trump’s term. However, he said, this was not a big win for China.

“China’s reputation makes it hard for it to take advantage of these changes,” he said.

Eventually, the Europeans will “let the Americans back in,” Lewis said, because defense is very expensive.

“They’d rather share the burden of the cost with the United States than go on their own,” he told The Epoch Times.

Although China aspires to “script the Sino-American relations and the world order,” he said, it is left in an odd place in terms of allegiances.

Liao said other countries use China as a card to negotiate with the United States. They knew that there was no long-term partnership potential with Beijing, he said, but they used engagement with Beijing as “strategic anesthesia” to alleviate the pain caused by Trump’s unpredictable approach.

According to Gray, the “brittle, paranoid political system” mired with internal turmoil—including the sacking of Zhang Youxia, Xi’s second-in-command in the military and a longtime family friend of Xi—makes it difficult for the regime to function in the long term.

Both Lewis and Liao said they think that the next three years of Trump’s presidency will be full of changes. Liao and Gray said they think that the new world order will take an initial form in roughly half a decade.

Liao said he sees Greenland as a milestone event in a broader reordering of power. The United States will lead, but in a new way, according to him.

Gray agrees. In his view, an emerging international order is coming into view.

“We’re beginning to see that it is a world in which the United States is the predominant power, but it is not the hyperpower,” he said.

“And there are multiple levels of polarity, and there are multiple groupings of powers.”

Daniel Holl contributed to this report.

Tyler Durden

Thu, 02/05/2026 - 23:25

Illustrative prior prisoner swap. There have been several throughout the 4-year long war.

Illustrative prior prisoner swap. There have been several throughout the 4-year long war.

A drone view shows a general view of Nuuk, Greenland, on Jan. 15, 2026. REUTERS/Marko Djurica

A drone view shows a general view of Nuuk, Greenland, on Jan. 15, 2026. REUTERS/Marko Djurica The US military's Pituffik Space Base in Pituffik, Greenland, on March 28, 2025. Jim Watson - Pool/Getty Images

The US military's Pituffik Space Base in Pituffik, Greenland, on March 28, 2025. Jim Watson - Pool/Getty Images Greenland is part of North America. Its capital, Nuuk, is geographically closer to Washington, D.C., than to Copenhagen. Illustration by The Epoch Times, Google Earth

Greenland is part of North America. Its capital, Nuuk, is geographically closer to Washington, D.C., than to Copenhagen. Illustration by The Epoch Times, Google Earth A fishing village near Nuuk, Greenland, on May 4, 2025. John Fredricks/The Epoch Times

A fishing village near Nuuk, Greenland, on May 4, 2025. John Fredricks/The Epoch Times Marie-Agnes Strack-Zimmermann, NATO Secretary General Mark Rutte and Chair of the Committee on Foreign Affairs of the European Parliament David McAllister arrive to address committees of the European Union Parliament about Greenland negotiations in Brussels, on Jan. 26, 2026. Omar Havana/Getty Images

Marie-Agnes Strack-Zimmermann, NATO Secretary General Mark Rutte and Chair of the Committee on Foreign Affairs of the European Parliament David McAllister arrive to address committees of the European Union Parliament about Greenland negotiations in Brussels, on Jan. 26, 2026. Omar Havana/Getty Images A U.S. Marine eats a military field ration during a field exercise at Combined Arms Training Center Camp Fuji, Japan, on Dec. 11, 2025. Lance Cpl. Weston Brown/U.S. Marine Corps via DVIDS

A U.S. Marine eats a military field ration during a field exercise at Combined Arms Training Center Camp Fuji, Japan, on Dec. 11, 2025. Lance Cpl. Weston Brown/U.S. Marine Corps via DVIDS Tractor spreading Round-Up (glyphosate) on wheat straw with a spraying machine in Normandy, France, September 2007. Leitenberger Photography/Shutterstock

Tractor spreading Round-Up (glyphosate) on wheat straw with a spraying machine in Normandy, France, September 2007. Leitenberger Photography/Shutterstock Chow hall employees and a Marine officer serve food to Marines and sailors during the 241st Navy Birthday Meal held at Marine Corps Air Station New River, on Oct. 13, 2016. Cpl. Melodie Snarr/U.S. Marine Corps via DVIDS

Chow hall employees and a Marine officer serve food to Marines and sailors during the 241st Navy Birthday Meal held at Marine Corps Air Station New River, on Oct. 13, 2016. Cpl. Melodie Snarr/U.S. Marine Corps via DVIDS

Vink Fan/Shutterstock

Vink Fan/Shutterstock

via AFP

via AFP An FBI press office employee approaches the Fulton County Election Hub and Operation Center in Union City, Ga., on Jan. 28, 2026. Arvin Temka/Atlanta Journal-Constitution via AP

An FBI press office employee approaches the Fulton County Election Hub and Operation Center in Union City, Ga., on Jan. 28, 2026. Arvin Temka/Atlanta Journal-Constitution via AP

DOJ

DOJ

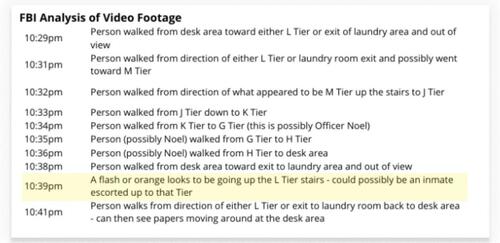

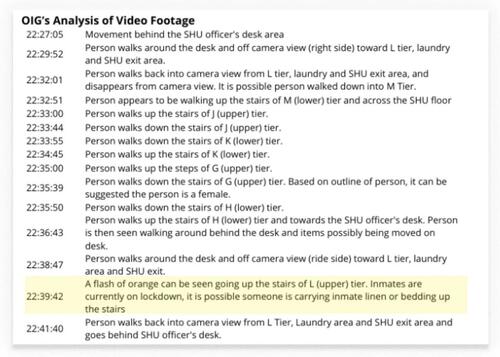

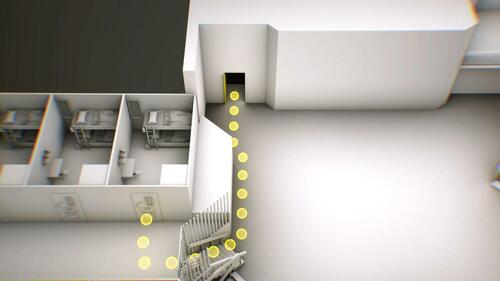

This illustration shows a path from the entrance to the Special Housing Unit common area to the stairs leading up to Epstein's cell. Only a narrow portion of the staircase could be seen in video released by federal officials. CBS News

This illustration shows a path from the entrance to the Special Housing Unit common area to the stairs leading up to Epstein's cell. Only a narrow portion of the staircase could be seen in video released by federal officials. CBS News

The Nike logo above the entrance to a store in Miami Beach, Fla., on Dec. 21, 2021. Joe Raedle/Getty Images

The Nike logo above the entrance to a store in Miami Beach, Fla., on Dec. 21, 2021. Joe Raedle/Getty Images The U.S. Capitol building in Washington on Feb. 4, 2026. Madalina Kilroy/The Epoch Times

The U.S. Capitol building in Washington on Feb. 4, 2026. Madalina Kilroy/The Epoch Times United Nations: A photograph of the 1971 Licorne nuclear test, which was conducted in French Polynesia in the Pacific Ocean.

United Nations: A photograph of the 1971 Licorne nuclear test, which was conducted in French Polynesia in the Pacific Ocean.

Recent comments